Section 80C to 80U includes multiple tax saving options with old tax regime that can help you to reduce your tax liability. Majority of these options are available with old tax regime, since new tax regime has reduced tax slab rates. Starting from Employee Provident Fund (EPF), 5 Year Fixed Deposits, Equity Linked Saving Schemes, to saving account interest exemption and donations, you have several options to save income tax.

Let us understand Section 80C to 80U in more detail.

Section 80C

- Section 80C of income tax act includes many tax saving options such as EPF (Employee Provident Fund), PPF (Public Provident Fund), NSC (National Saving Certificate), Tax Saving 5 years FD, SCSS (Senior Citizen Saving Scheme), etc.

- The limit under section 80C is Rs. 1.5 Lakh in a financial year and these deductions can be claimed only with Old Tax Regime

- New Tax Regime does not allow any deductions to be claimed, so make sure you choose Old Tax Regime to claim section 80C deductions

Below is the full list of deductions available under Section 80C of income tax act:

| Scheme Name | Tenure | Returns |

|---|---|---|

| Employee Provident Fund | Retirement | 8.15% |

| Public Provident Fund (PPF) | 15 Years | 7.10% |

| National Saving Certificate (NSC) | 5 Years | 7.70% |

| Tax Saving 5 years FD from Banks | 5 Years | 7.5% |

| 5 years Post Office Time Deposit (POTD) | 5 Years | 7.5% |

| Senior Citizen Saving Scheme (SCSS) | 5 Years | 8.2% |

| Life Insurance Premium (Term / ULIP) | Flexible | 8-10% |

| National Pension Scheme (NPS) (80CCD1B) | Retirement | 10-12% |

| Equity Linked Savings Scheme (ELSS) | 3 Years | 10-12% |

| Tuition fee for 2 children | NA | NA |

| Stamp duty and registration cost of the House | NA | NA |

| Home Loan Principal Payment | Flexible | NA |

| Sukanya Samriddhi Yojana | 21 Years | 8.2% |

Section 80CCD

Section 80CCD of Income Tax Act helps us to contribute towards National Pension Scheme (NPS) or Atal Pension Yojana (APY) and claim deductions to save income tax.

This section is further divided in more subsections:

- 80CCD(1) – Individual’s contribution to NPS or APY from Income

- 80CCD(2) – Employer’s contribution to NPS on behalf of Employee

While 80CCD(1) can be claimed by employee and self employed individuals, 80CCD(2) can only be claimed by employees.

Below are the deduction limits under Section 80CCD:

| Sections | Description | Deduction Limits |

|---|---|---|

| 80CCD(1) | Employee Contributions to NPS or APY up to 10% of Basic Salary + DA | Rs. 1,50,000 |

| 80CCD(1B) | Self Contribution to NPS or APY above the limits of Section 80CCD(1) | Rs. 50,000 |

| 80CCD(2) | Employer’s Contribution to NPS or APY | up to 10% Basic Salary + DA |

So based on above table, total Deductions with Section 80CCD will be Rs. 2,00,000 that can be claimed in financial year with employee’s contribution – Rs. 1,50,000 with 80CCD(1) which is part of Section 80C and Rs. 50,000 with Section 80CCD(1B).

How to Invest in NPS Online – Video

Watch more Videos on YouTube Channel

Section 80CCC

- Section 80CCC of Income Tax Act allows us to claim deduction for insurance premiums paid, if the policy provides us the pension plan

- The money spent on this life insurance policy must be spent either to buy a new policy or renew the existing ongoing policy. The premium amount paid can be claimed in a financial year

- Section 80CCC has a limit of Rs. 1.5 Lakh in financial year and is part of Section 80C

- So you cannot claim 80C and 80CCC amounts separately

- Note that any bonus or income from this pension or annuity plan will not be considered as deduction in this section

- Also, Section 80CCC is available only with Old Tax Regime. New Tax regime will not allow this deduction

Section 80D

- Section 80D of income tax act includes deductions or exemptions that can be claimed with Old Tax Regime for Medical Insurance Premiums and Preventive Health Check ups

- Medical insurance helps you to avoid uncertain medical or hospitalizations expenses that can occur anytime as an emergency

- You must have medical insurance for your family members to avoid such uncertain expenses, in case your emergency funds are not sufficient

- The insurance company provides you with required medical aid in case of expenses occurring due to hospitalization of insured person. To get this benefit, you need to have medical insurance for that person for which you pay premiums regularly.

- This payment of premiums can be claimed as deduction or exemption every year under Section 80D with below mentioned limits

| Insured | Age below 60 Years | Age above 60 Years |

|---|---|---|

| Self, Spouse and Children | Rs. 25,000 | Rs. 50,000 |

| Parents | Rs. 25,000 | Rs. 50,000 |

| Maximum Deductions | Rs. 50,000 | Rs. 1,00,000 |

| Preventive Healthcare Expenses | Rs. 5000 | Rs. 5000 |

Section 80DD

- Section 80DD of income tax act allows us to save income tax by claiming deduction for expenses occurred to take care of disabled person in your family

- Differently abled person can be your spouse, children , parents, brother or sister

- Only resident Indians can claim this deduction, who can be an Individual tax payer or HUF (Hindu Undivided family)

- If differently abled person is claiming the deduction for self than Section 80U is the correct section to claim such deductions

- And if the person has claimed Section 80U deduction for self, one cannot claim same deduction again under Section 80DD. Section 80U is for physical disability of self and Section 80DD is for physical disability of dependent family member

- It is important to note that while claiming 80DD, the differently abled person must be a dependent person for the tax payer

- You can only claim this deduction with Old Tax Regime. New Tax Regime does not allow this deduction to be claimed

Section 80DDB

- Section 80DDB of income tax act allows you to claim deduction against the medical expenses occurred for specific diseases.

- This section is different from the medical insurance premiums paid under Section 80D. In 80D, you pay the insurance premiums and that amount can be claimed in financial year

- Where as under 80DDB, you can claim the expenses occurred for medical treatment in hospital, irrespective of whether you have taken medical insurance or not

- If treatment is done for non senior citizen than the limit under Section 80DDB is Rs. 40,000 else for senior citizen treatment, the limit is Rs. 1 lakh in a financial year.

- Note that you can claim 80DDB deduction only under Old Tax Regime

Section 80E

- Section 80E of Income Tax Act allows us to claim Interest amount of Education Loan that is taken for higher studies

- In order to promote higher studies by individuals of India, government provides tax benefits if you take Education Loan for higher studies.

- You can take Education loan for self, spouse or children, or any student for whom you are the legal guardian and claim tax benefits on such education loan

- Only Interest amount from EMI can be claimed as deduction under Section 80E. This Section does not allow principal amount to be claimed as deduction

- You can claim the deduction up to 8 years starting from the year when you started repaying the loan amount

- There is no maximum limit to be claimed in a financial year, so you can claim the entire interest amount of loan EMI paid by you in a financial year to save income tax.

- If your loan tenure is more than 8 years, then you can claim the interest amounts paid in Emi only for 8 years and not beyond 8 years of interest on your education loan.

- You can use the Home Loan EMI calculator to check Loan EMI. It works for Education Loan EMI calculation as well.

- This deduction can be claimed with Old Tax Regime. New Tax Regime does not allow this deduction.

Section 80EE

- Section 80EE of Income Tax Act allows Tax deduction on Home Loan Interest Amount

- So if you have taken a home loan to buy your first house, you can claim this deduction

- Maximum of Rs. 50,000 can be claimed as interest amount in a financial year based on this Section mentioned in Income Tax Act

- You can claim both Section 24 (maximum limit of Rs. 2 Lakh) and Section 80EE (Rs. 50,000) in same financial year, if you don’t have any other property in your name

- If you have multiple properties, than you cannot claim 80EE, but can claim Section 24

- This section is only applicable to individual, HUF (Hindu Undivided Family) is not eligible to claim this deduction

Section 80EEA

- Section 80EEA of income tax act helps in saving income tax with old tax regime on home loan interest amount paid in a financial year

- This section has a maximum limit of Rs. 1.5 lakh that can be claimed as deduction if you pay home loan interest amount

- 80EEA was introduced to promote home buying in FY 2019, which is the extension of Section 80EE (limit of Rs. 50,000)

- This deduction is not applicable for home loan principal amount in EMI that you pay every month

- Home loan Principal amount, stamp duty and registration amounts can be claimed in Section 80C with a maximum limit of Rs. 1.5 Lakh in financial year with old tax regime

Section 80G

- Section 80G of income tax act allows you to claim tax deduction if you make donations in a financial year

- These donations can be made to specific institutions in order to be claimed with old tax regime.

- An individual, company or firm, HUF or NRI can claim this deduction to save income tax

- Based on the relief fund or charitable institution, the deduction can be claimed as 100% or 50% of amount, with or without upper limit restrictions

Section 80GG

- Section 80GG of Income Tax Act allows us to claim house rent amount paid in a financial year to save income tax

- If you receive HRA (House Rent Allowance) in your Salary payslip, than you should claim HRA instead of using Section 80GG

- But if you don’t receive HRA component in your salary payslip, you can use Section 80GG, if you stay in rented accommodation

- Condition to claim Tax Deduction in this section is: you must not own any property in same city. Also you cannot claim both – HRA received from employer and Section 80GG deduction

- This section is applicable to both salaried employees and self employed as well. So if you are a business owner, you can still claim deduction under Section 80GG if staying on rent, provided you are no carrying out any business in rented accommodation

- You can also stay with your parents, who are having property in their name, pay monthly rent to them and have a rental agreement as well to claim Section 80GG deduction. The income received by your parents will be taxable in their hands

- Maximum limit of Section 80GG is Rs. 60,000 in a financial year. If the rent amount goes above Rs. 1 Lakh in financial year, than you need to provide PAN number of landlord

Section 80GGB

- Section 80GGB of income tax act allows Indian Company to donate or contribute to political party or electoral trust in India for development purpose

- This donation can help the Indian companies to save income tax

- For Individuals, the donations and contributions to political parties or electoral trust can be claimed under Section 80GGC to save income tax

- Note that there is no maximum limit to be claimed under 80GGB and 100% of the amount donated can be claimed as deduction from gross income

- The political party receiving the donation must be a registered political party under the Section 29A of the Representation of the People Act

- An electoral trust is a non-profit company

- Electoral trust can receive contributions from companies and then reallocate it to the registered political parties

- Individuals can make donations to other organizations under Section 80G to claim deductions with old tax regime

Section 80GGC

- Section 80GGC of income tax act allows an Individual tax payer to claim deduction against donation paid to political party or electoral trust in India

- This donation can help the Individuals to save income tax

- For Indian Companies, the donations and contributions to political parties or electoral trust can be claimed under Section 80GGB to save income tax

- Note that there is no maximum limit to be claimed under 80GGC and 100% of the amount donated can be claimed as deduction from gross income

- However you can only donate maximum of what you earn in a financial year, that is your gross total income. So your donations that can be claimed cannot be more than your gross total income

- The political party receiving the donation must be a registered political party under the Section 29A of the Representation of the People Act

- An electoral trust is a non-profit company

- Electoral trust can receive contributions from companies and then reallocate it to the registered political parties

- Individuals can make donations to other organizations under Section 80G to claim deductions with old tax regime as well

Section 80RRB

- Section 80RRB of income tax act allows you to claim deduction on income earned from patent royalty

- If you have written a book or created an art or music, inventions, and have the legal right as the author (patent), anyone using such material and paying for using it will be received by you since you are the author

- Such income earned in financial year can be claimed as deduction with old tax regime due to your exceptional work that will be used within and outside the country of India

- Since Indians are known to have some of the best innovative minds, we Indians are encouraged to create such exceptional materials and have them patented to receive non taxable income, anytime it is used by someone else

- This source of income is called Royalty Income or Royalty Payments

- Royalty is an amount paid to a person by another party or person against the usage of certain work produced by the recipient

- Maximum limit of Section 80RRB deduction is Rs. 3 lakh in a financial year or the amount received by you in that year, whichever is less

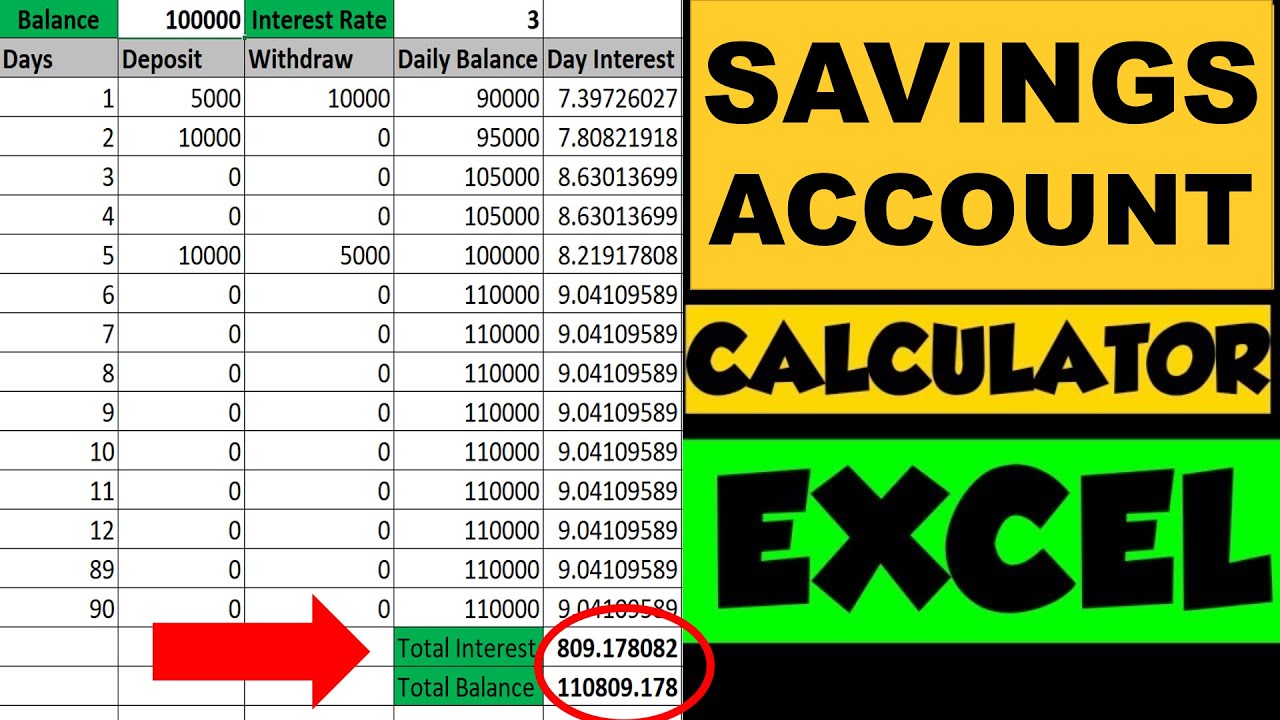

Section 80TTA

- Section 80TTA of Income Tax Act, 1961 allows us to claim deduction related to Savings Account Interest Amount that we earn every quarter.

- Since this is one of the component of “Income from other sources” while filing ITR (Income Tax Return), we need to pay tax on this income.

- But we also get the relief while paying income tax on this interest amount – we can claim maximum Rs. 10,000 in a financial year with old tax regime, if your age is below 60 years.

- For Senior Citizens, we have separate deduction – Section 80TTB that allows maximum of Rs. 50,000 to be claimed in a financial year.

Savings Account Interest Calculation Video

Section 80TTB

- Section 80TTB of Income Tax Act, was introduced to provide tax benefits for senior citizens on their interest incomes from deposits

- This deduction include deposits such as Savings Account Interest, Fixed Deposits, Recurring Deposits and other such deposits in Banks and Post offices

- Maximum of Rs. 50,000 can be claimed in this deduction if your age is 60 years or above any time during the financial year

- This deduction helps senior citizens with some financial cushion during their old age when they might have deposits as the only source of income

- While 80TTB is applicable for senior citizens (60 years and above) and Super senior citizens as well, but if you are a non senior citizen of age less than 60 years than you can claim on savings account interest amount under Section 80TTA

- While in 80TTA, only savings account interest can be claimed, 80TTB for senior citizens allow fixed deposits and recurring deposits interest to be claimed as well

- It is important to note that 80TTB can be claimed only with Old Tax Regime

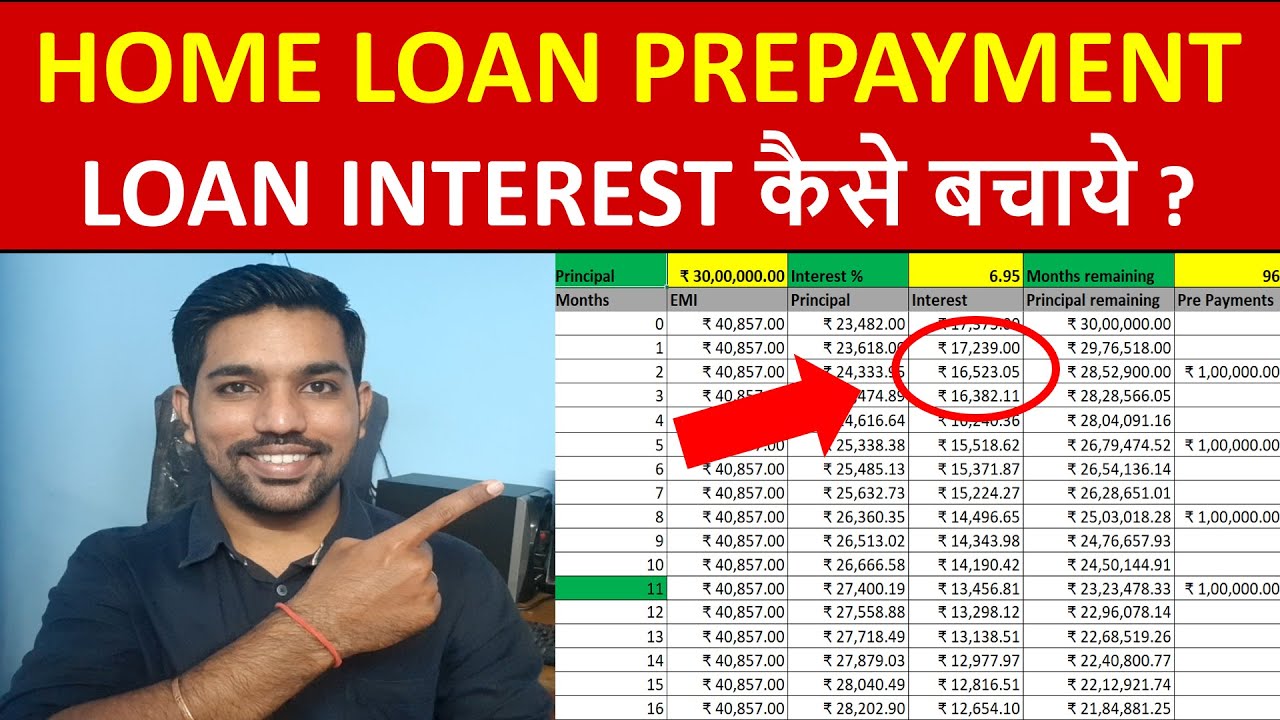

Section 24

- Section 24 of Income Tax Act allows you to claim deductions in case of Income from House Property

- If the property is bought on Home Loan and you are paying EMI (Equated Monthly Installment), you are eligible to claim deductions against your Home Loan EMI

- Section 80C allows the deduction of Principal amount in your Loan EMI

- Section 24 allows deduction of Interest amount in your Loan EMI

- If the property is self occupied (you stay with your family), than Rs. 2 lakh or the total interest paid in home loan (whichever is lower), can be claimed in a financial year. This is the case when you buy a property. Incase you are taking loan for reconstruction or repair purpose of existing property, than maximum Rs. 30,000 can be claimed in this section

- If the property is let out, the entire interest amount paid by you in a financial year can be claimed under Section 24

Home Loan EMI Calculation and Prepayments Video

Section 80U

- Section 80U of income tax act allows you to claim tax deduction if you are physically disabled

- You must be certified as a person with physical disability by appropriate medical authority

- Section 80U is different from Section 80DDB – where medical expenses occurred for specific disease is claimed

- Only Individuals can claim this deduction in Section 80U

- Also, you must be an Indian Resident to claim this deduction

- The appropriate medical authority can fill the Form 10-IA that can help you to claim Section 80U Tax Deduction

- Maximum limits that can be claimed is Rs. 75,000 and Rs. 1,25,000 based on your disability percentage

Conclusion

So above is the list of Section 80C to 80U deductions that can help you to save income tax with old tax regime, Please note that new tax regime does not allow majority of the deduction options mentioned above, so ensure that you select old tax regime while calculating your income tax.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.