This Income Tax Calculator FY 2024-25 and NEW FY 2025-26 helps you in Income Tax Calculation for new FY 2025-26 and FY 2024-25 (AY 2025-26), with the help of Old Tax Regime and New Tax Regime. This calculator can also be used as New Tax Regime Calculator. You can Download Income Tax Calculator 2025-26 Excel to know your Tax Liability.

It also helps you to know which tax regime is better for you – Old or New tax regime, so that you pay less income tax based on your income and investments.

Get complete Tax break up with Excel Calculator:

Download our Android App FinCalC to see Slab-wise details of your Income Tax Calculation

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this Free Income Tax Calculator 2024-25 with your friends and family members and help them in Tax Calculation!

- Download our Android App FinCalC to see Slab-wise details of your Income Tax Calculation

- What is Income Tax Calculator?

- Overview

- Income Tax Calculation 2024-25 Video

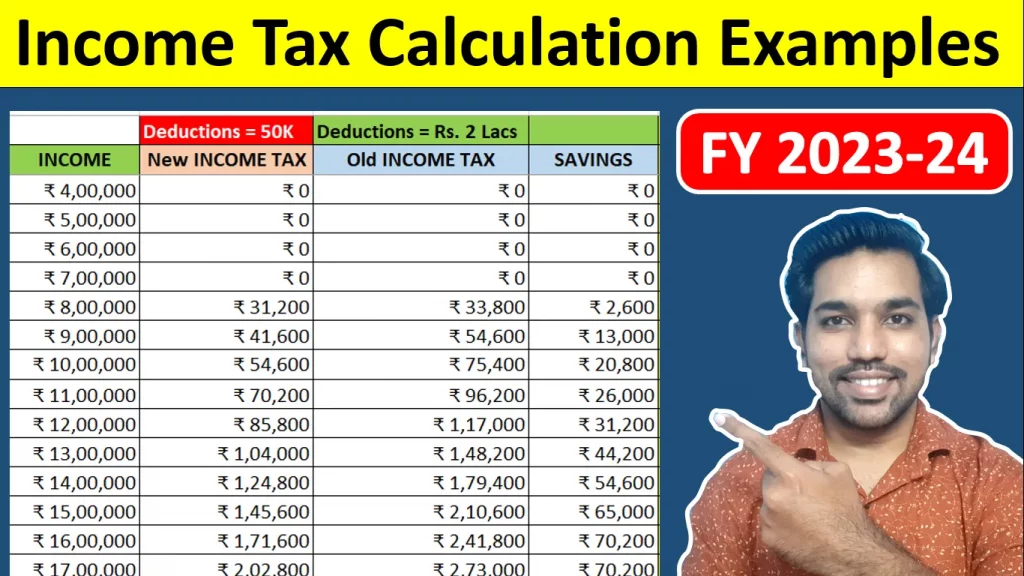

- Income Tax Calculation Examples 2025-26

- How to use this Income Tax Calculator?

- Old vs New Tax regime Slab Rates

- How to Calculate Income Tax Examples

- How Income Tax is Calculated for Salaried Employees?

- How to Save Income Tax

- Old vs new Tax Regime – Which is Better for You?

- Income Tax Calculator Android App

- Frequently Asked Questions (FAQs)

- What is the maximum non-taxable income limit?

- Does everyone have to file their income tax returns?

- How to Save Income Tax in FY 2024-25?

- Can I save Income Tax using New Income Tax Slab Rates?

- Why Income Tax is Rs. 0 on Income up to Rs. 5 Lacs?

- Is Tax Rebate u/s 87a applicable to both old and new slab rates?

- What is the standard deduction amount for FY 2024-25?

- Is interest earned in Savings Account Taxable?

- Some more reading:

What is Income Tax Calculator?

This Income Tax calculator 2024-25 and 2025-26 is a Free Tax Calculator that helps you in calculating Income Tax based on your Income. You are liable to pay Income Tax to government based on your Income, so this calculator will help you calculate your Income Tax so that you don’t get any surprises and plan accordingly.

Overview

- In FY 2024-25 and FY 2025-26, there are 2 tax regimes – Old Tax Regime and New Tax Regime

- When you have certain income, you have to pay income tax on your income you generate in a FY (Financial Year), which is between April month to March month of next year. April 2024 to March 2025 in this case

- During this period, you need to pay income tax on total income you earn in the FY

- Now, based on the 2 tax regimes, you will reach 2 figures of income tax. You can plan and decide which one you should choose to pay less income tax.

- Old Tax Regime – This regime has slab rates that are unchanged from a long time. It allows you to have some investment options to help you save income tax by deducting the investment amounts under various sections

- New Tax Regime – This regime was introduced in Budget 2020 and has slightly reduced tax slab rates. This regime was introduced to help you lower the burden of income tax you were paying in previous years using Old tax regime. But new tax regime does not allow any deductions (except Standard Deduction in FY 2024-25) to be claimed if you make any investments, to save more income tax. You pay tax on entire amount you earn in FY.

Below are the Income Tax Calculations videos for FY 2024-25 and FY 2025-26

Income Tax Calculation 2024-25 Video

Income Tax Calculation Examples 2025-26

How to use this Income Tax Calculator?

- Select the “Financial Year” you want to calculate Income Tax for

- Choose your “Age“

- Select whether you are a Salaried employee, own Business or a Pensioner for Standard Deduction availability

- Provide your yearly Income in “Income” Section along with Interest earned and other income

- Provide “Deductions or Investments” you have made or will be making in selected Financial Year. Read this article to know various Deduction options to Save Income Tax

Old vs New Tax regime Slab Rates

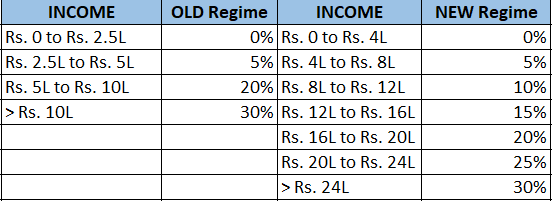

Below are the Old and New Tax Slab Rates for FY 2025-26 – age below 60 Years:

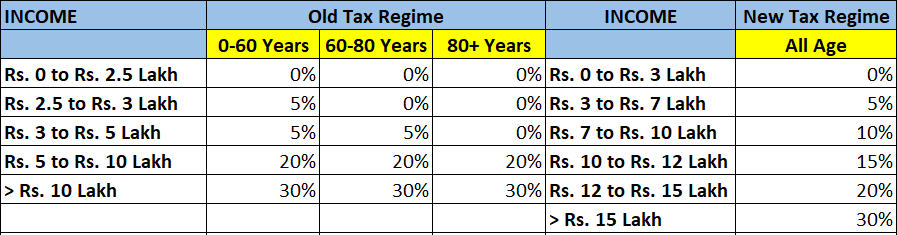

Below are the Old and New Tax Slab Rates for all Age groups FY 2024-25:

The New Tax Slab Rates are same for all age groups.

For Age between 60 – 80 years, 5% slab is for income between Rs. 3,00,000 to Rs. 5,00,000 under Old Slab Rates.

For Age above 80 years, 5% slab rate is not applicable in Old Slab Rate. So people in this age group can belong to only 20% or 30% Slab Rate.

How to Calculate Income Tax Examples

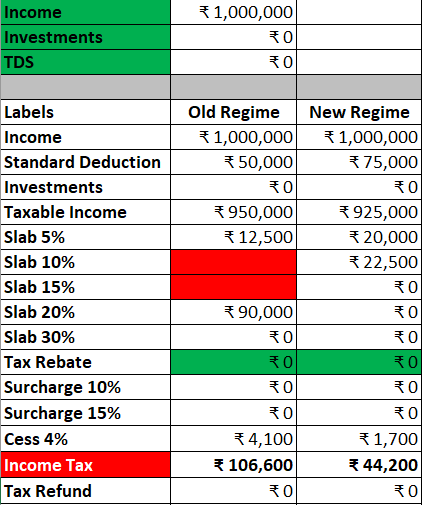

Let’s take example of income = Rs. 10 Lakh in FY (April 2024-March 2025)

Tax Calculation with Old Tax Regime

Since income = Rs. 10 Lacs, taxable income will be Rs. 9.5 lakh after including standard deduction of Rs. 50,000 , based on old slab rates – you pay 0% tax on income between Rs. 0 to Rs. 2.5 Lacs, 5% tax on income between Rs. 2.5 Lacs to Rs. 5 Lacs and 20% tax on income between Rs. 5 Lacs to Rs. 9.5 Lacs. So below is the calculation:

0% Tax (Rs. 0 – Rs. 2.5 Lacs) = Rs. 0

5% Tax (Rs. 2.5 Lacs to Rs. 5 Lacs) = Rs. 12,500 (on Rs. 2.5 Lacs difference)

20% Tax (Rs. 5 Lacs to Rs. 9.5 Lacs) = Rs. 90,000 (on Rs. 4.5 Lacs difference)

This makes your intermediate tax as Rs. 1,02,500. Now an additional 4% cess is applicable on this amount which is Rs. 4,100, which makes your total income tax based on Old Tax Regime = Rs. 1,06,600

| Income Brackets | Old Tax Regime Slabs | Income Tax |

|---|---|---|

| Rs. 0 – Rs. 2.5 Lacs | 0% | Rs. 0 |

| Rs. 2.5 Lacs – Rs. 5 Lacs | 5% | Rs. 12,500 |

| Rs. 5 Lacs – Rs. 8 Lacs | 20% | Rs. 90,000 |

| Cess | 4% (on Rs. 1,02,500) | Rs. 4,100 |

| Total Income Tax | Rs. 1,06,600 |

In above calculation, we have considered Standard Deduction of Rs. 50,000 which must be applied if you are Salaried employee or pensioner. You can also make more investments to save income tax under various sections with old tax regime. Various tax saving options are mentioned below in this article.

Let us now see income tax calculation using New Tax Regime

Tax Calculation with New Tax Regime

With same example of income = Rs. 10 Lacs, taxable income will be Rs. 9.25 lakh after considering standard deduction of Rs. 75,000 and based on new slab rates – you pay 0% tax on income between Rs. 0 to Rs. 3 Lacs, 5% tax on income between Rs. 3 Lacs to Rs. 7 Lacs and 10% tax on income between Rs. 7 Lacs to Rs. 9.25 Lacs. So below is the calculation:

0% Tax (Rs. 0 – Rs. 3 Lacs) = Rs. 0

5% Tax (Rs. 3 Lacs to Rs. 7 Lacs) = Rs. 20,000 (on Rs. 4 Lacs difference)

10% Tax (Rs. 7 Lacs to Rs. 9.25 Lacs) = Rs. 22,500 (on Rs. 2.25 Lacs difference)

This makes your intermediate tax as Rs. 42,500. Now an additional 4% cess is applicable on this amount which is Rs. 1,700, which makes your total income tax based on New Tax Regime = Rs. 44,200.

| Income Brackets | New Tax Regime Slabs | Income Tax |

|---|---|---|

| Rs. 0 – Rs. 3 Lacs | 0% | Rs. 0 |

| Rs. 3 Lacs – Rs. 7 Lacs | 5% | Rs. 20,000 |

| Rs. 7 – Rs. 9.25 Lacs | 10% | Rs. 22,500 |

| Cess | 4% (on Rs. 42,500) | Rs. 1,700 |

| Total Income Tax | Rs. 44,200 |

In this case, you pay less income tax with new tax regime. We have considered standard deduction of Rs. 75,000 in our example, which will be applicable in New tax regime as well from FY 2024-25 if you are salaried employee or pensioner.

How Income Tax is Calculated for Salaried Employees?

Below video explains how you can calculate Income Tax if you are a Salaried Employee and how to calculate your Taxable Income which will be taxed based on slabs you belong to

ALSO READ: How to Save Tax on Salary above Rs. 7 Lakh

How to Save Income Tax

As seen above, standard deduction helps you save income tax based on old tax regime. Do we have any other options to save more Income Tax? Yes, we do.

But remember that these options are applicable only when you choose old tax regime to calculate and save income tax. Below are some of the options you can use to save income tax:

Section 80C

We have below investment options to save income tax under Section 80C, maximum Rs. 1.5 Lacs can be claimed in this section:

- Employee Provident Fund

- Public Provident Fund

- 5 Year Fixed Deposits

- Equity Linked Saving Schemes, etc.

Section 80CCD(1B)

Section 80CCD includes NPS (National Pension Scheme) and allows maximum of Rs. 50,000 to be claimed in a financial year to save income tax.

Section 10(13A)

Section 10(13A) includes HRA (House rent allowance) that you receive in your salary. This will be allowed to be claimed if you stay in rented accommodation. Know more about HRA Exemption calculation here.

Section 80D

Section 80D includes medical insurance for which maximum amount is Rs. 25,000 for non-senior citizens and Rs. 50,000 for senior citizens. It also allows to claim deduction for your parent’s medical insurance as well.

More options to save income tax in this video:

Old vs new Tax Regime – Which is Better for You?

To answer this question, selecting between old and new tax regime depends on person to person. The selection depends on your total income and investments (if any). Every individual is having different incomes in a Financial Year.

As we saw in above Income Tax slab rates, if your income is in the range of Rs. 5 Lacs to Rs. 12 Lacs, you can opt for Old Income Tax Slab rate, make some Tax saving investments and Save Income Tax.

But if your income is above Rs. 12 Lacs, there is not much option to save maximum income tax. Even after making investments with maximum limits in different sections, you’ll still be paying more taxes with old tax regime compared to new tax regime.

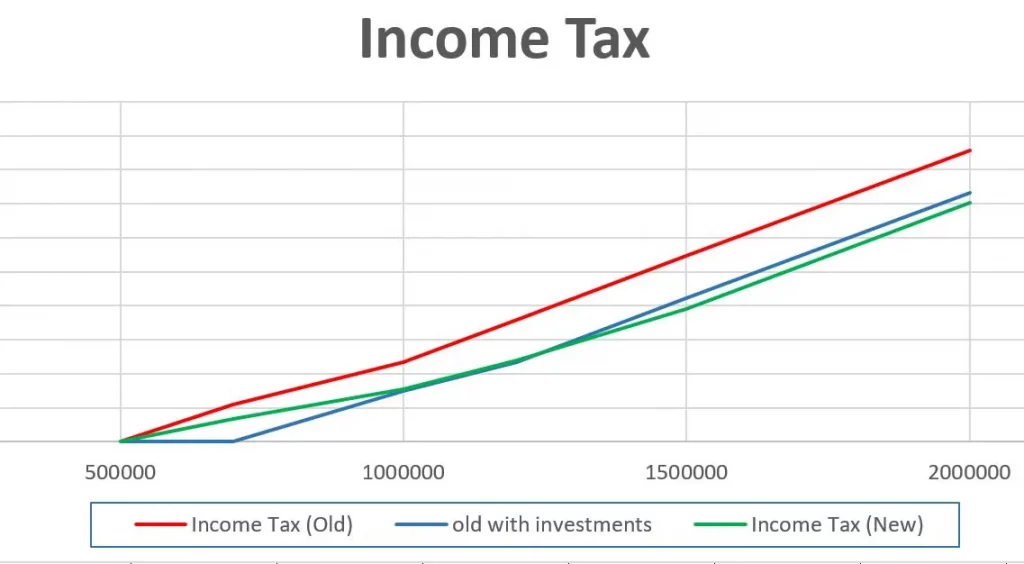

Below is the graph showing the comparison of income vs income tax:

As seen above, green line depicts income tax with new tax regime, which is low when your income moves greater than 12 Lacs. Blue line (old regime with investments) is still above green line which shows that even after investments you’ll more more income tax with old slab rates compared to new slab rates.

So you should make your investments according to your total income and based on the calculations of income tax in both regimes. Choose the one that helps you pay less income tax.

Income Tax Calculator Android App

I have made a Free Android App “FinCalC” that will help you to calculate income tax and see slab wise details. You can easily calculate your income tax on your mobile device and plan your investments accordingly. Below are some of the features of Android App:

- Calculate Income Tax for new FY 2023-24 and previous FY 2022-23

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Frequently Asked Questions (FAQs)

What is the maximum non-taxable income limit?

The maximum limit of non-taxable income for an individual is set at Rs 2.5 lakh. However, you can also get a rebate of Rs 12,500 under section 87A if you have a total income of less than Rs 5 lacs for FY 2024-25. If you have tax saving investments under section 80C of up to Rs 1.5 lakh then you will not have to pay any taxes till Rs 6.5 lakhs for age up to 60 years.

Does everyone have to file their income tax returns?

If the income of an individual is below the basic exemption limit then he is not required to file income tax returns. Though those who have income less than Rs 2.5 Lakh and want to claim an income tax refund can only claim the refund by filing an ITR. Otherwise, it is mandatory to file income tax returns in any other case.

How to Save Income Tax in FY 2024-25?

You can save income tax in FY 2024-25 by opting for Old Income Tax Slab Rates and making required Tax saving investments. You can watch this video to know what are the Tax Saving instruments you can use to Save Income Tax.

Can I save Income Tax using New Income Tax Slab Rates?

No, you cannot claim any deductions for your investments you make using New Income Tax Slab Rates for FY 2024-25. Only Standard Deduction of Rs. 75,000 and employer contribution in NPS under Section 80CCD2 can be claimed for FY 2024-25 with new tax regime.

Why Income Tax is Rs. 0 on Income up to Rs. 5 Lacs?

In case your Net Taxable Income is up to Rs. 5 Lacs, you get Tax Rebate of maximum Rs. 12,500 under Section 87a which cancels your income tax of Rs. 12,500 on income of Rs. 5 Lacs, thus making your Total Income Tax = Rs. 0. This Tax Rebate u/s 87a is applicable to both Old and New Slab Rates.

Is Tax Rebate u/s 87a applicable to both old and new slab rates?

Yes. Tax Rebate with old tax regime is applicable when taxable income is below 5 lakh and with new tax regime when taxable income is below Rs. 7 lakh for FY 2024-25

What is the standard deduction amount for FY 2024-25?

Standard Deduction applicable for FY 2024-25 is Rs. 50,000 in old tax regime and Rs. 75,000 in new tax regime for salaried employees.

Is interest earned in Savings Account Taxable?

Yes. But you can claim maximum of Rs. 10,000 in FY 2024-25 under Section 80TTA for interest earned in your savings account using old tax slab rates (Rs. 50,000 for senior citizens under Section 80TTB). Again, this is not applicable in New Tax Slab Rates. Any amount above Rs. 10,000 as interest in your savings account will be taxable even using old tax slab rates.

Some more reading:

- How to File ITR (Income Tax Return) on Salary

- Senior Citizen Income Tax Calculation

- What is Standard Deduction?

- TDS Calculation on Salary

- Calculate Income Tax using Payslip [Example]

- HRA Exemption Calculation

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

Disclaimer: Every effort is made to show accurate results in this calculator. The user have to carefully provide required details in this calculator to reach accuracy. It is also advised to seek professional help before taking any actions based on above calculations. We are not liable for any losses in case actions are taken solely based on above calculations.