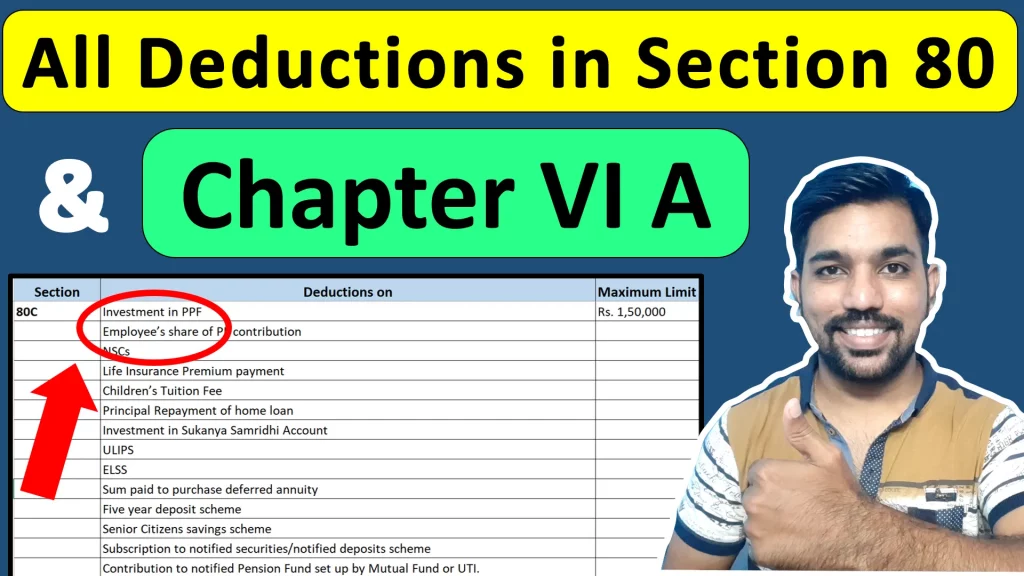

This article helps us go through the list of deductions in 80C, 80CCC, 80CCD and other deductions belonging to Chapter VI A (or Chapter 6 A). These deductions helps us in reducing our taxable income thus reducing the Income Tax we pay every financial year. It is very important among individuals that are salaried employees or businessmen.

Deductions in 80C includes Provident Fund, Public Provident Fund, 5 year Fixed Deposits, ELSS, Life insurance premiums, etc. which will hep reduce your income tax according to Old Tax Regime. Section 80C allows maximum of Rs. 1.5 Lacs in FY to be claimed. Apart from these options, you can also invest in NPS (National Pension Scheme) which allows additional deduction of Rs. 50,000 under Section 80CCD(1B). Home loan and house rent also allows you to use deductions to save income tax.

Let’s see all the options with their maximum limits. Note that these options are available for FY 2021-22 and FY 2022-23 as well.

- All Deductions in Section 80C, 80CCC, 80CCD, 80D in Hindi (Chapter VI A) Video

- What is Income Tax Deduction?

- Who can claim Income Tax Deductions?

- Benefits of using Income Tax Deductions?

- List of Deductions in 80C & other Sections

- Frequently Asked Questions

- How is 80C Calculated?

- Can you claim Deduction in 80C and 80CCC separately?

- Which option in Section 80C has minimum lock in period?

- Is NPS under 80C or 80CCD?

- What is the difference between 80CCD1 and 80CCD 1B?

- What is Savings Account Section 80TTA or 80TTB?

- Is Recurring Deposit deducted in 80C?

- Fixed Deposits can be deducted in 80C to save income tax?

- Can you claim Stamp duty and registration amounts on Land purchase?

All Deductions in Section 80C, 80CCC, 80CCD, 80D in Hindi (Chapter VI A) Video

Above video shows you the list of deductions you can claim to save income tax based on your investments or expenses incurred in a financial year.

What is Income Tax Deduction?

Income Tax Deductions are options that either belong to investments made or expenses incurred, which can be used to reduce your taxable income by reducing total deduction amount from your total income in a financial year.

These deductions are categorized into various sections based on the schemes that we invest in. Some of them include Section 80C, Section 80CCD, Section 80D, etc.

We will see all these options below. You can also use online income tax calculator to calculate your income tax:

Who can claim Income Tax Deductions?

Individuals that are either salaried employees or even business man can claim the deductions to save income tax.

Mostly the deductions are popular among salaried employees who try to maximize their deduction options available in order to save maximum income tax. This may be because salaried employees don’t deal much in cash transactions and their entire income is tracked via online transactions.

Moreover, salaried employees also have to pay advance income tax or TDS (Tax deducted at source) based on the projected salary credits in their bank account in a financial year.

This is the reason why it is important for salaried employees to mention their investment options to their employers so that Tax can be deducted accordingly. The process includes mentioning estimated investment deductions in the month of April, and then providing actual investments receipts in the month of December so that the actual advance tax can be paid accordingly.

Later, we can also file ITR (Income Tax Return), in order to claim any additional tax deducted from our salary if the Tax we already paid is greater than the actual income tax we have to pay.

ALSO READ: How to Calculate Income Tax in FY 2022-23

Benefits of using Income Tax Deductions?

There are many benefits of using Income Tax Deductions:

- Use Deductions to save income tax according to Old Tax Regime. We’ll see examples below

- Save the investment amount for future by investing in long term schemes

- Deductions helps you save for long term and helps you take the benefit of compounding – A method to earn interest on already earned interest amount

Let’s understand income tax saving using deductions with the help of Example:

| Particulars | Tax Amount After Deduction | Tax Amount without Deduction |

|---|---|---|

| Gross Income | Rs. 15,00,000 | Rs. 15,00,000 |

| Income Tax Deductions | Rs. 1,50,000 | Rs. 0 |

| Net Taxable Income | Rs. 13,50,000 | Rs. 15,00,000 |

| Income Tax (Old Regime) | Rs. 2,26,200 | Rs. 2,73,000 |

| Tax Saving = Rs. 46,800 |

As seen above, for gross income of Rs. 15 lacs in a financial year, if you make Income tax deductions of let’s say Rs. 1.5 Lacs, which is allowed as deduction in 80C schemes, you’ll be able to save income tax of Rs. 46,800.

The number of income tax saving increases when your gross income increases with time. Also, these deductions made helps you in saving in various schemes that would compound over time and may be help you to retire as well! Thus giving you a win-win deal.

Watch below video on some Tax saving options for salaried employee:

Let us now see the list of deductions in various sections along with their maximum limits.

List of Deductions in 80C & other Sections

| Sections | Deduction Options | Maximum Amount |

|---|---|---|

| Section 80C | Investment in PPF Employee’s share of PF contribution NSCs Life Insurance Premium payment Children’s Tuition Fee Principal Repayment of home loan Investment in Sukanya Samridhi Account ULIPS ELSS Sum paid to purchase deferred annuity Five year deposit scheme Senior Citizens savings scheme Subscription to notified securities/notified deposits scheme Contribution to notified Pension Fund set up by Mutual Fund or UTI. Subscription to Home Loan Account scheme of the National Housing Bank Subscription to deposit scheme of a public sector or company engaged in providing housing finance Contribution to notified annuity Plan of LIC Subscription to equity shares/ debentures of an approved eligible issue Subscription to notified bonds of NABARD | Rs. 1,50,000 |

| Section 80CCC | For amount deposited in annuity plan of LIC or any other insurer for a pension from a fund referred to in Section 10(23AAB) | Included in above |

| Section 80CCD(1) | Employee’s contribution to NPS account (maximum up to Rs 1,50,000) | Included in above |

| Section 80CCD(2) | Employer’s contribution to NPS account | Maximum up to 10% of salary |

| Section 80CCD(1B) | Additional contribution to NPS | Rs. 50,000 |

| Section 80TTA | Interest Income from Savings account | Maximum up to Rs. 10,000 |

| Section 80TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to Rs. 50,000 |

| Section 80GG | For rent paid when HRA is not received from employer | Maximum up to Rs. 60,000 |

| Section 10 | HRA exemption if HRA received from employer | Calculated using this method |

| Section 80E | Interest on education loan | Interest paid for a period of 8 years. No Maximum Limit |

| Section 80EE | Interest on home loan for first time home owners | Rs 50,000 |

| Section 24 | Interest paid on home loan | Rs. 2,00,000 |

| Section 80EEA | Interest paid on home loan (on loan before 31st march 2022) | Rs. 1,50,000 |

| Section 80D | Medical Insurance – Self, spouse, children Medical Insurance – Parents more than 60 years old | Non Senior = Rs. 25,000 Senior Citizen = Rs. 50,000 |

| Section 80DD | Medical treatment for handicapped dependent | Maximum up to Rs. 1,25,000 |

| Section 80DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD | Maximum up to Rs. 1,00,000 |

| Section 80U | Self-suffering from disability | Maximum up to Rs. 1,25,000 |

| Section 80GGC | Contribution by individuals to political parties | Amount contributed (not allowed in cash) |

| Section 80RRB | Deductions on Income by way of Royalty of a Patent | Maximum up to Rs. 3,00,000 |

| Standard Deduction | Flat deduction for Salaried Employees and Pensioners | Rs. 50,000 |

| Section 80G | Income Tax Deduction on Donations | 50% or 100% based on relief funds and organizations |

So above is the list of deductions in 80C and other Chapter VI A with details and maximum limits allowed for exemption in income tax calculation.

Standard Deduction is a flat deductions of Rs. 50,000 applicable for salaried employees and pensioners. So, you directly subtract this amount from your gross total income to calculate your income tax.

Let us now see few queries related to these deductions.

Frequently Asked Questions

How is 80C Calculated?

Total Deductions in 80C includes sum of the investments amount made in above mentioned 80C schemes along with Section 80CCC and 80CCD investments. The maximum limit is Rs. 1.5 lacs under Section 80C in a financial year. And additional amount of Rs. 50,000 under Section 80CCD(1B) with NPS – National Pension Scheme

Can you claim Deduction in 80C and 80CCC separately?

Not separately, but a total of Rs. 1.5 Lacs can be claimed after combining amounts from both Section. Only Section 80CCD(1B) for NPS investment allows to claim additional Rs. 50,000 apart from Rs. 1.5 Lacs in Section 80C.

Which option in Section 80C has minimum lock in period?

ELSS or Equity Linked Saving Scheme is the option that helps you to save income tax under Section 80C with minimum lock in period which is just 3 years. Watch Best ELSS Mutual funds to invest here in this video.

Is NPS under 80C or 80CCD?

NPS full form is National Pension scheme and falls under Section 80CCD(1B) with maximum investment limit of Rs. 50,000, which is apart from Rs. 1.5 Lacs under Section 80C

What is the difference between 80CCD1 and 80CCD 1B?

Section 80CCD(1) is employee’s contribution towards NPS in case the amount is deducted from employee’s salary on regular basis, whereas, to promote NPS scheme, additional Rs. 50,000 can also be claimed as deduction under Section 80CCD(1B), if you separately invest in NPS on your own. Watch this video to see how NPS contributions can be done online:

What is Savings Account Section 80TTA or 80TTB?

Interest earned on Savings Account every quarter is taxable. But up to Rs. 10,000 interest amount is exempted from income tax. Interest above Rs. 10,000 is taxable in a financial year. So while filing ITR, you can mention Interest amount of maximum up to Rs. 10,000 under Section 80TTA which will be exempted from income tax if your age is below 60 years. For senior citizens, with age above 60 years, Section 80TTB is applicable with maximum limit of Rs. 50,000 in a financial year which includes post office interest amount as well.

Is Recurring Deposit deducted in 80C?

No. Recurring deposits does not belong to section 80C and the deposits cannot be claimed. Moreover, recurring deposit does not help us in saving income tax.

Fixed Deposits can be deducted in 80C to save income tax?

Yes. Special type of fixed deposits – 5 year fixed deposits helps us in saving income tax by claiming deduction in 80C, up to Rs. 1.5 Lacs in a financial year. Also, you cannot break the 5 year fixed deposit (tax saving deposits) and liquidate before the completion of 5 years.

Can you claim Stamp duty and registration amounts on Land purchase?

No. Stamp duty amount cannot be claimed on a land purchase. Stamp duty and registrations amounts can be claimed on purchase of flats in the same financial year.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Some more reading:

Home Loan EMI Calculation & Prepayment using Excel

HRA Exemption Calculation with Examples

Income Tax on SIP Maturity or Redemption

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.