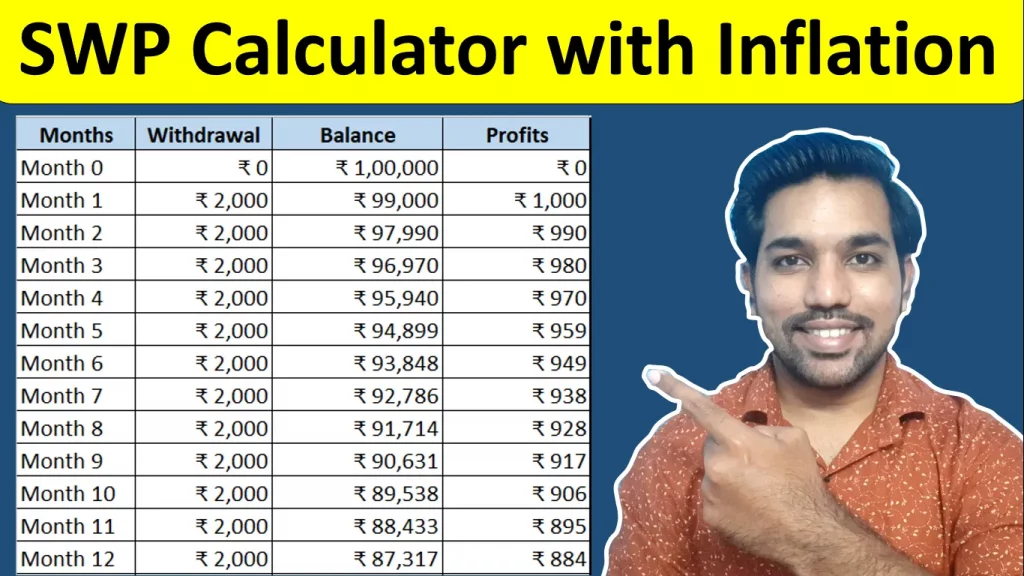

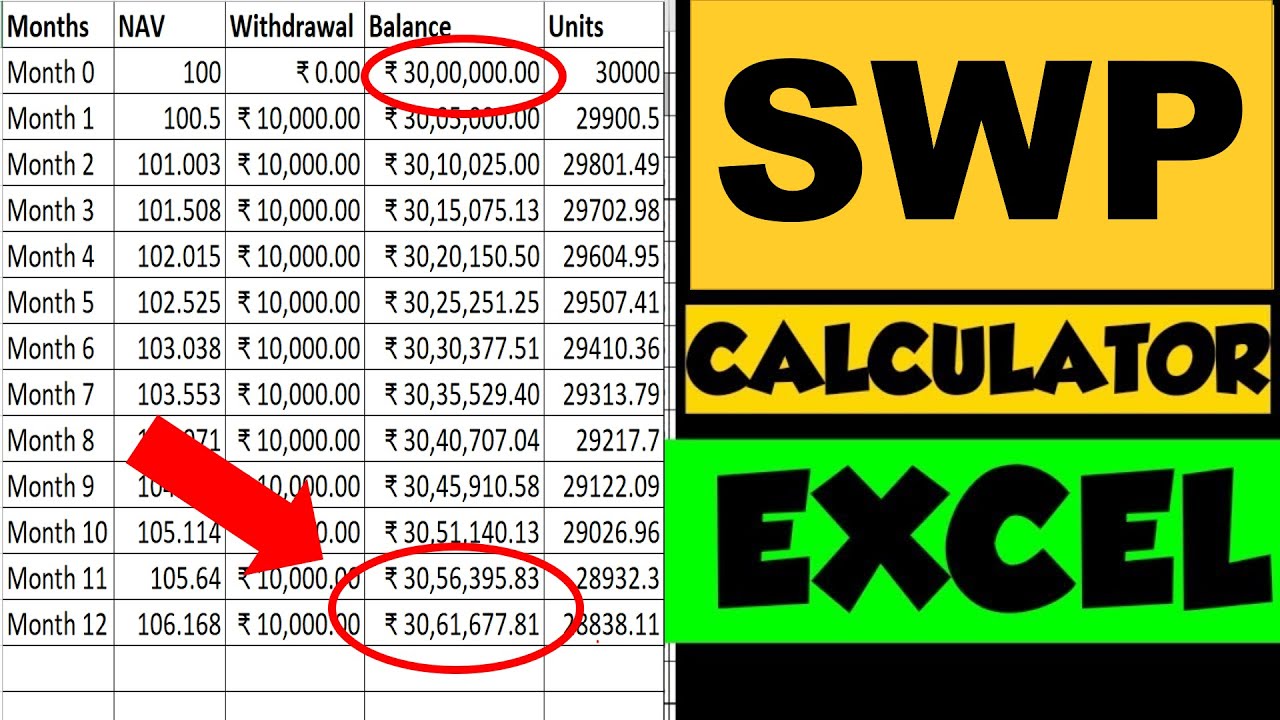

SWP Calculator with Inflation helps you to know how much amount you can withdraw every month while keeping your balance above your deposit.

In SWP, we invest lump sum amount that is accumulated, and withdraw specific amount every month to meet our expenses. While doing so, the balance in the mutual fund that we invest in, gives us returns based on market conditions.

Get details of Monthly Income using SWP with Excel Calculator:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this SWP calculator with your friends and family members so that they can calculate the returns they can get via Systematic Withdrawal Plan while enjoying the benefits of mutual fund returns.

ALSO READ: Types of Mutual Funds in India

What is SWP?

- SWP or Systematic Withdrawal Plan is a method to withdraw consistently every month from a mutual fund that you want to invest in

- Basically, it is the reverse of SIP. In SIP (Systematic Investment Plan), you invest some amount every month to accumulate desired corpus by the end of tenure

- In SWP, you can keep the same accumulated amount in that mutual fund (or other mutual fund) and withdraw consistently every month, while the accumulated units in mutual fund earns you more profits

- SWP helps you to earn regular income after your retirement to meet your needs.

- It is similar to Post Office Monthly Income Scheme Plan, in which you earn regular income based on fixed interest rate

- The only difference is in Post Office, the interest rate is known, where as in SWP, returns from mutual funds are not known. But over long term, market usually gives better returns if invested in good mutual funds

- You can provide the expected returns in your mutual fund in above calculator, after adjusting inflation, and know the every month withdrawal amount and remaining amount after specific time period

ALSO READ: Rs. 1000 in Mutual Funds for 1 to 15 Years

SWP Calculation in Excel Video

Watch more Videos on YouTube Channel

How SWP works?

- As mentioned above, for your accumulated balance in mutual fund, you get returns based on fund performance

- You can select the amount you want to withdraw every month from this mutual fund

- Higher the withdrawal amount, it is more likely that your fund balance will come close to zero if every month returns are not more than the withdrawal amount

- It is advised to keep the withdrawal amount based on your needs and less than the returns provided, so that your balance in mutual fund is maintained at same level

Let us take an example for SWP calculation:

SWP Example 1

Mutual Fund Balance = Rs. 20,00,000

Expected returns = 12%, which means average monthly returns = 1% (after adjusting with inflation)

Withdrawal amount = Rs. 15,000

So for above data, below is the table showing returns, balance and withdrawal amounts for first five months:

| Months | Balance | Profits (1% per month) | Withdrawal | Updated Balance |

|---|---|---|---|---|

| 1 | ₹ 20,00,000 | ₹ 20,000 | ₹ 15,000 | ₹ 20,05,000 |

| 2 | ₹ 20,05,000 | ₹ 20,050 | ₹ 15,000 | ₹ 20,10,050 |

| 3 | ₹ 20,10,050 | ₹ 20,100 | ₹ 15,000 | ₹ 20,15,151 |

| 4 | ₹ 20,15,151 | ₹ 20,151 | ₹ 15,000 | ₹ 20,20,302 |

| 5 | ₹ 20,20,302 | ₹ 20,203 | ₹ 15,000 | ₹ 20,25,505 |

So as seen above, the updated balance is increasing with time since the withdrawal amount is set based on the needs and your monthly expenses, that are lower than the returns you are getting from market.

Note that mutual fund returns are volatile in nature and is not consistent on short term. But for long term it gives returns around 10-15% if investing for more than 5 years. For simplicity in calculation purpose, we have considered 1% monthly average returns from market.

Let us take another example where withdrawal amount is more than the returns you get from mutual fund.

Example 2

Mutual Fund Balance = Rs. 20,00,000

Expected returns = 12%, which means average monthly returns = 1% (after adjusting with inflation)

Withdrawal amount = Rs. 30,000

Below is the table showing returns, updated balance and withdrawal amounts for first five months:

| Months | Balance | Profits (1% per month) | Withdrawal | Updated Balance |

|---|---|---|---|---|

| 1 | ₹ 20,00,000 | ₹ 20,000 | ₹ 30,000 | ₹ 19,90,000 |

| 2 | ₹ 19,90,000 | ₹ 19,900 | ₹ 30,000 | ₹ 19,79,900 |

| 3 | ₹ 19,79,900 | ₹ 19,799 | ₹ 30,000 | ₹ 19,69,699 |

| 4 | ₹ 19,69,699 | ₹ 19,697 | ₹ 30,000 | ₹ 19,59,396 |

| 5 | ₹ 19,59,396 | ₹ 19,594 | ₹ 30,000 | ₹ 19,48,990 |

So here’s another example where withdrawal amount is higher than the monthly returns we get from mutual funds.

If you notice the Updated Balance column, the value is decreasing with time, that’s because we have set the withdrawal amount higher than the returns we are getting from mutual funds.

So try to keep your withdrawal amount below the expected returns from market to keep your balance either same or increasing.

You don’t want to end up your balance after withdrawal high amounts every month. And if your monthly expenses are really high, than the accumulated balance need to be increased to meet your needs.

ALSO READ: Power of Compounding in Stock Market

Which SWP is best for 5 years?

There are no such separate mutual funds that are specifically best for SWP or Systematic Withdrawal Plan.

You can read about some Best Mutual Funds to know more about them. These are not recommendations but might give you some idea as to how mutual funds can be selected.

Is SWP better than FD?

SWP (Systematic Withdrawal Plan) and FD (Fixed deposits) are 2 different schemes for different purposes.

Here we will consider the Fixed Deposits that give quarterly returns (payout) and not the fixed deposits that accumulate interest over time to earn more interest (compounding).

Below are some differences in SWP and FD:

| SWP (Systematic Withdrawal Plan) | FD (Fixed Deposits) |

|---|---|

| SWP must be started with long term goals in mind | FD must be started to achieve short term goals |

| Good returns of 10-15% over long term | Interest rates can range between 6.5 to 7.5% based on the tenure selected |

| For those who can take little risk after retirement, can go for SWP over 7-10 years for better returns | Those who don’t want to take risk and are happy with around 1.75% returns every quarter on the deposits can go for FD |

| SWP withdrawal is on monthly basis | FD interest payout is on quarterly basis |

| You have to pay income tax on the withdrawal amount every FY | FD interest are also taxable if your income is above basic exemption limit |

So it depends on your goal and risk appetite whether you want to opt for SWP (Systematic Withdrawal Plan) or FD (Fixed Deposits).

What is SWP formula?

As seen in above calculations, SWP formula is very simple.

Based on the monthly interest rate (expected) and current Balance, the returns in mutual funds are calculated, and desired withdrawal amount is removed.

Below is the formula:

Monthly Profits = Monthly expected returns * Balance / 100Using above formula, for Rs. 20 Lakh amount, 1% monthly return, you get profit of Rs. 20,000 for a month. Out of this, the withdrawal amount is Rs. 15,000, so remaining Rs. 5000 is additional returns on top of your existing balance of Rs. 20 Lakh.

This calculation is repeated every month until the maturity period or when balance becomes less than withdrawal amount.

What is the risk in SWP?

The risk in SWP is same as that in any mutual fund. In short term, Equity mutual funds can be highly risky if you are expecting some moderate returns. But over long term, we have seen historically that good mutual funds give 10% to 15% annual returns.

Some small cap mutual funds have also give more than 15% returns every year if returns are averaged over 7-10 years of period.

Conclusion

So SWP is a good option to get monthly income after you have accumulated sufficient amount in mutual funds. It is similar to Post Office Monthly Income Scheme in which you get regular income based on fixed interest rate.

You should plan carefully while investing in mutual funds to use SWP. If not selected properly, the mutual funds can eat your principal amount with increasing inflation every year.

Some more Reading:

- Rs. 5000 SIP Returns in Mutual Funds

- PPF vs Mutual Funds Which is Better

- Types of Life Insurance in India

- Mutual Fund Calculator – With 10 Years Returns Calculation

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.