Below EPF Calculator helps you to know how much interest you get in your provident fund account based on your every month PF deductions. Latest EPF Interest rate for FY 2024-25 is 8.25%.

Employer contributions are divided into EPF and EPS accounts and only 3.67% of employer contribution goes to EPF for which you get interest!

Download EPF EXCEL Calculator from here

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this Free EPF (Employee Provident Fund) Calculator with your friends and family members and help them in EPF Interest Calculation and total accumulated corpus!

What is EPF?

The Employees Provident Fund (EPF) is a savings scheme introduced under the Employees Provident Fund and Miscellaneous Act, 1952. It is administered and managed by the Central Board of Trustees that consists of representatives from three parties, namely, the government, the employers and the employees.

The Employees Provident Fund Organization (EPFO) assists this board in its activities. EPFO works under the direct jurisdiction of the government and is managed through the Ministry of Labor and Employment.

EPF scheme aims at promoting savings to be used post-retirement by various employees all over the country. Employees Provident Fund or EPF is a collection of funds contributed by the employer and their employee regularly on a monthly basis. The employer and employee contribute 12% each of the employee’s salary (basic + dearness allowance) to the EPF. These contributions earn a fixed level of interest set by the EPFO. The amount of interest to be received on the deposit along with the total accumulated amount is totally tax-free, i.e. the employee may withdraw the entire fund without worrying about paying any kind of tax on it, if total years of service is more than 5 years.

The accrued amount may also be withdrawn by the nominee or the legal heir of the employee post his death or can be withdrawn by the employee himself post-resignation.

Dearness Allowance: This amount is added to the employee’s basic salary due to rising. This allowance is different in different states. It is a relief given to employees to tackle ill-effects of inflation.

ALSO READ: Home Loan with Variable Interest Rates

What is EPF Interest Rate?

Currently for FY 2024-25, interest rate in Employee Provident Fund (EPF) is 8.25%

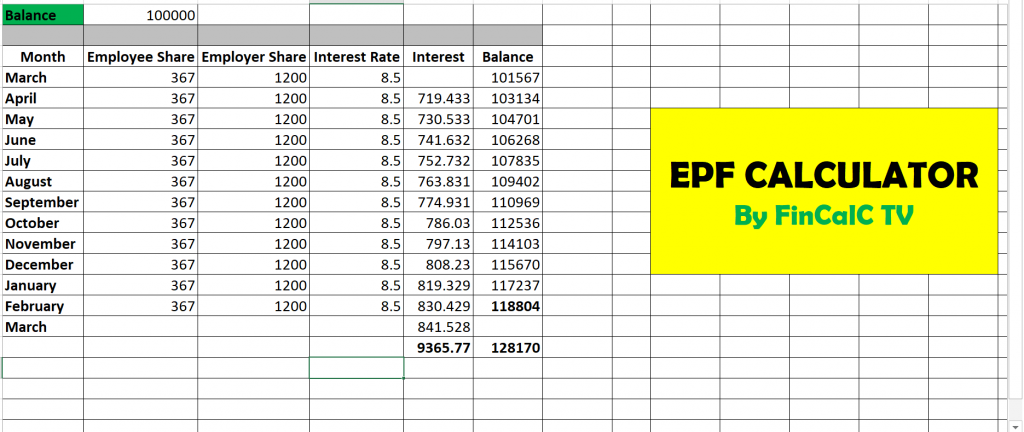

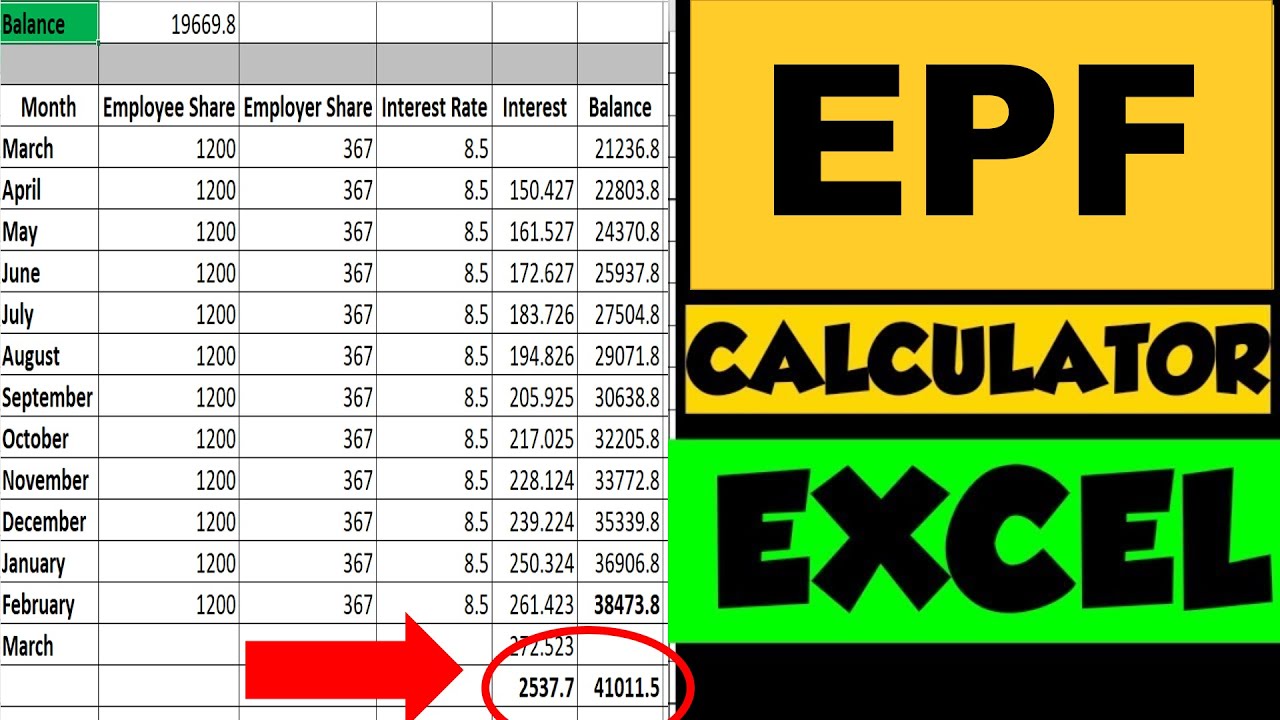

How is EPF Calculated?

The interest extended on EPF schemes is calculated each month and is calculated by dividing the rate per annum by 12.

Such a method helps to calculate the specific interest that is offered to member employees for a given month.

Example

If the rate of interest is 8.10% p.a. the rate for each month would be (8.10/12) %, i.e. 0.675%.

Now, 12% of an individual’s salary is directed towards their EPF account.

Assuming that the salary of an individual is Rs. 15,000 per month:

12% of Rs. 15,000 would accrue Rs. 1800 by month-end which would be transferred to the individual’s EPF account.

Now, employers contribute 3.67% towards their EPF account, while 8.33% is contributed towards their EPS account.

The contribution towards EPF account would be 3.67% of Rs. 15,000 = Rs. 550 (Employer’s contribution)

The total contribution towards the EPF account would stand at Rs. (1800+550) = Rs.2350

The interest accrued in one month would be Rs. 2350 x 0.675% = Rs. 16.64

It is to be noted that the interest accrued in a given month would only be credited to the account at the end of a current financial year.

Another important point to note is EPF compounding frequency is annual. This means you will get more interest on the interest gained in previous Financial years.

EPF Interest Calculation Excel Video

How much PF will I get on 15000 salary?

Based on above calculator, if your monthly Basic pay + DA is Rs. 15,000, employee’s monthly contribution will be Rs. 1,800 and employer’s monthly contribution will be Rs. 551.

And based on your current age and retirement age in above calculator, you can get the total funds accumulated in your EPF Account.

Benefits of EPF?

The employees provident fund scheme extends an array of benefits towards the EPF employee members. It inculcates a sense of financial stability and security in them.

Here is a list of benefits that an EPF employee member can avail through the said scheme:

- Capital appreciation: The PF online scheme offers a pre-fixed interest on the deposit held with the EPF India. Additionally, rewards extended at maturity further ensure growth in the employees’ funds and accelerate capital appreciation.

- Corpus for Retirement: Around 8.33% of an employer’s contribution is directed towards the Employee Pension Scheme. In the long run, the sum deposited towards the employee provident fund helps to build a healthy retirement corpus. Such a corpus would extend a sense of financial security and independence to them after retirement.

- Emergency Corpus: Uncertainties are a part of life. Therefore, being financially prepared to face such unwarranted situations is the best an individual can do deal with exigencies. An EPF fund acts as an emergency corpus when an individual requires emergency funds.

- Tax-saving: Under Section 80C of the Indian Income Tax Act, employee’s contribution towards their PF account is deemed eligible for tax exemption. Moreover, earnings generated through EPF scheme are exempted from taxes. Such exemption can be availed up to a limit of Rs. 1.5 Lakh.

The tax benefits applicable to the Employees Provident Fund scheme ensure higher earnings to the members. It further improves savings and an individual’s purchasing power in the long-term. - Easy premature withdrawal: Members of EPF India are entitled to avail benefits of partial withdrawal. Individuals can withdraw funds from their PF account to meet their specific requirements like pursuing higher education, constructing a house, bearing wedding expenses or for availing medical treatment.

ALSO READ: Section 80C Tax Saving Options

Is the EPF calculator free to use?

Yes, EPF calculator is completely free to use as many times as you want. You can also use other calculators here

How to Check EPF Passbook?

All contributions made by a member and his employer are mentioned in the EPF passbook. The passbook also contains other important details such as establishment ID and name, member ID and name, office name, employee’s share, employer’s share, EPS contribution, etc.

The member can download the EPF passbook online by visiting the EPF website.

ALSO READ: EPF Explained in Detail with Excel Calculations

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.