With the growing Home Loan Interest rates in almost all banks and financial institutions, it is very important to know how your Home Loan Interest amount is Calculated with variable rates. In this article we will see what is variable home loan rates, fixed vs variable rates in home loans and how you can save home loan interest amount you pay in the form of EMI.

Variable Home Loan Interest rates can be good when interest rates decreases with time, but can also prove to be more expensive when interest rates are increasing due to change in repo rate by RBI. By default, most banks and financial institutions provide you variable interest rate home loans. Also the adjustable rate home loans provide you with the option of home loan prepayments to allow you to close your loan before time. This option is either missing or comes with a penalty with fixed home loan rates.

- Floating Interest Rate Home Loan Calculation Video

- What is a variable home loan rate?

- Fixed Rate Home Loan Features

- Variable Rate Home Loan Features

- What happens when Home Loan Interest Rate varies?

- Can you pay off a variable loan early?

- Fixed vs Variable Rates Home Loan

- Home Loan with Variable Rates Calculation Examples

- Download Home Loan EMI Excel Calculator

- How to Save Home Loan Interest?

- Do variable rates ever go down?

- Fixed vs Variable rate home loans Which is Better?

- Conclusion

Floating Interest Rate Home Loan Calculation Video

What is a variable home loan rate?

Variable Home Loan interest rate also called Adjustable Rate Home Loan (ARHL) also called Floating rate Home Loan, is the type of home loan in which interest rates changes over time, specifically based on the change in repo rate by RBI (Reserve Bank of India).

Recently we have seen home loan interest rate increased by 2% within a short period of time. This will mostly impact the home loan buyers with variable interest rates, as their interest rate will be also increased on reset dates.

This will indirectly increase the amount of interest amount you pay in the form of EMI.

Every month EMI that you pay contains 2 components: Principal Amount and Interest Amount. The Interest amount gets affected with the increase or decrease in interest rate, whereas the EMI will be kept same when interest rate varies.

And when interest amount increases, your home loan tenure will also increase.

ALSO READ: Why Home Loan Tenure Increases

Fixed Rate Home Loan Features

Below are some features of Fixed Rate Home Loan:

- Interest rate on your home loan remains fixed throughout the loan tenure

- Fixed rates are slightly higher than variable rates

- If you are comfortable with the mentioned interest rates, and are reasonably sure that interest rates will rise in future, opt for a fixed rate home loan

- There is a prepayment penalty in case of fixed rate home loans

Variable Rate Home Loan Features

Below are some features of Variable Rate Home Loan:

- Interest rate on your home loan changes based on change in the lender’s benchmark rate

- Variable rates are slightly lower than fixed rates

- If you are unsure about where interest rates are heading, opt for a floating rate home loan

- There is no prepayment penalty in case of floating rate home loans and you can close loan before time and without paying penalty

ALSO READ: Home Loan Prepayment Reduce EMI or Tenure

What happens when Home Loan Interest Rate varies?

There are multiple things happening when your home loan interest rate increases:

- You interest amount portion in EMI increases

- Since your EMI needs to be kept same, the loan tenure increases when interest amount increases

- You have to pay your loan EMI for longer tenure

- The principal amount portion in your EMI decreases

Can you pay off a variable loan early?

Yes, you are allowed to make home loan prepayments in variable rate home loan to pay off your loan early and before time. This option is either missing or comes with a penalty to be paid in fixed rate home loan.

Fixed vs Variable Rates Home Loan

Let’s discuss about the various features of Fixed and Variable home loan interest rates. Below is the table showing the differences in both options:

| Fixed Rate Home Loan | Variable Rate Home Loan |

|---|---|

| Interest rate on your home loan remains fixed throughout the loan tenure | Interest rate on your home loan changes based on change in the lender’s benchmark rate |

| Fixed rates are slightly higher than variable rates | Variable rates are slightly lower than fixed rates |

| If you are comfortable with the mentioned interest rates, and are reasonably sure that interest rates will rise in future, opt for a fixed rate home loan | If you are unsure about where interest rates are heading, opt for a floating rate home loan |

| There is a prepayment penalty in case of fixed rate home loans | There is no prepayment penalty in case of floating rate home loans |

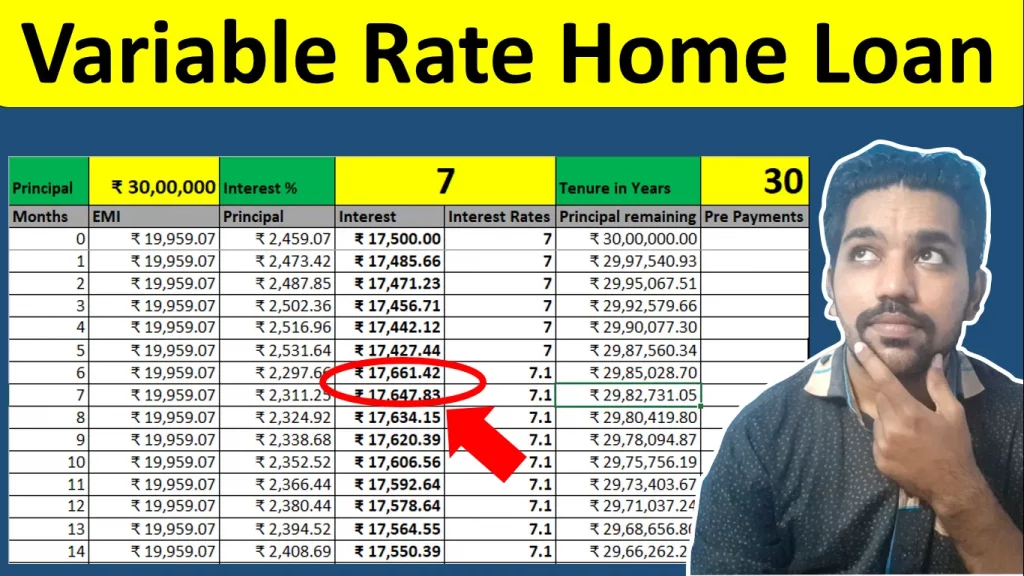

Home Loan with Variable Rates Calculation Examples

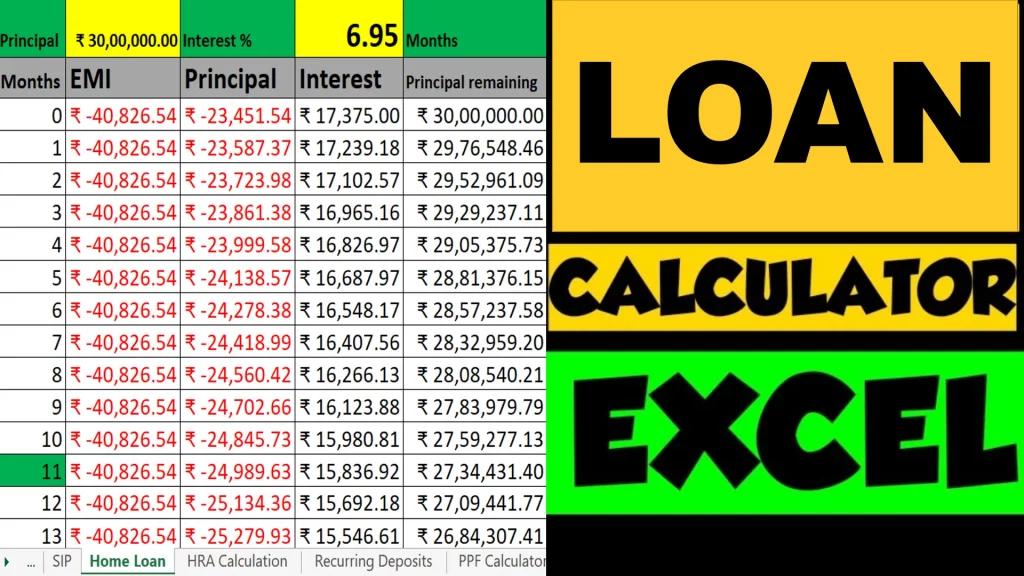

We will be using the excel calculator to check how change in interest rates will impact the total interest amount you pay in your home loan.

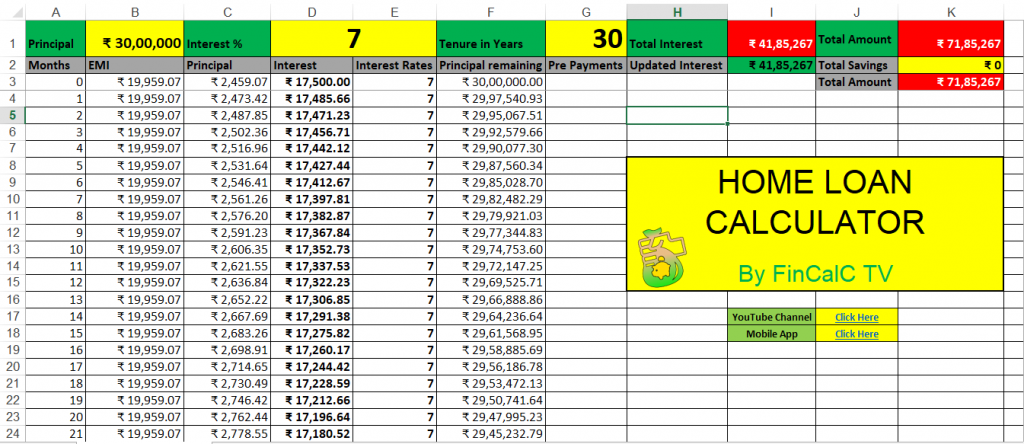

Let’s say for example, you take:

Home Loan = Rs. 30 Lacs

Interest rate = 7% per annum

Tenure = 30 Years

Below is the screenshot of excel calculation:

Total interest you pay in 30 years is Rs. 41,85,267 on a Rs. 30 Lacs loan with 30 years tenure and 7% interest rate fixed throughout tenure.

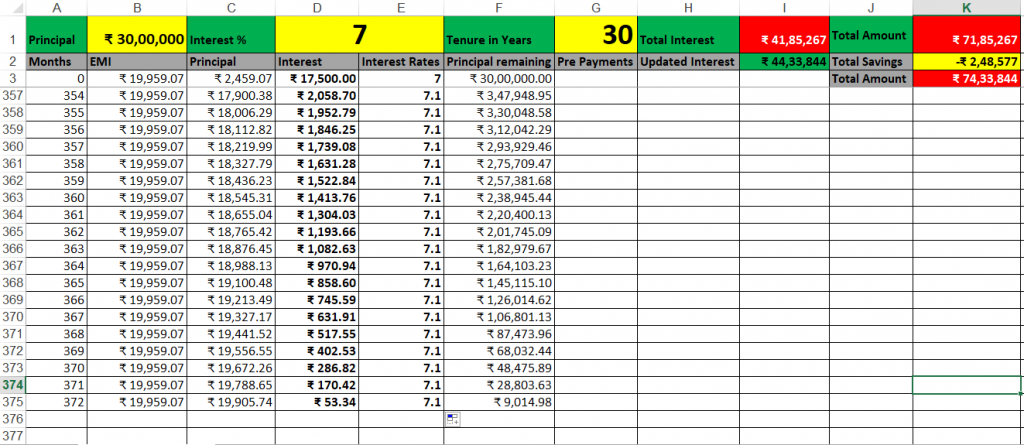

Now what if the interest rate is increased to 7.10% after 6 months? Below is the screenshot of calculation if interest rate is increased to 7.10% from 7th month onwards:

As seen above, total interest you pay now is Rs. 44,33,844, which got increased by Rs. 2,48,577 due to 0.10% increase in interest rate from 7th month onwards.

To make matter more worse, interest rates have increased by almost 2% in last 12 months on home loans (as of 2022), so you can imagine how exponentially the interest amounts will increase if you have an existing home loan. Current home loan interest rates are in the range 8.5% to 9.5% per annum

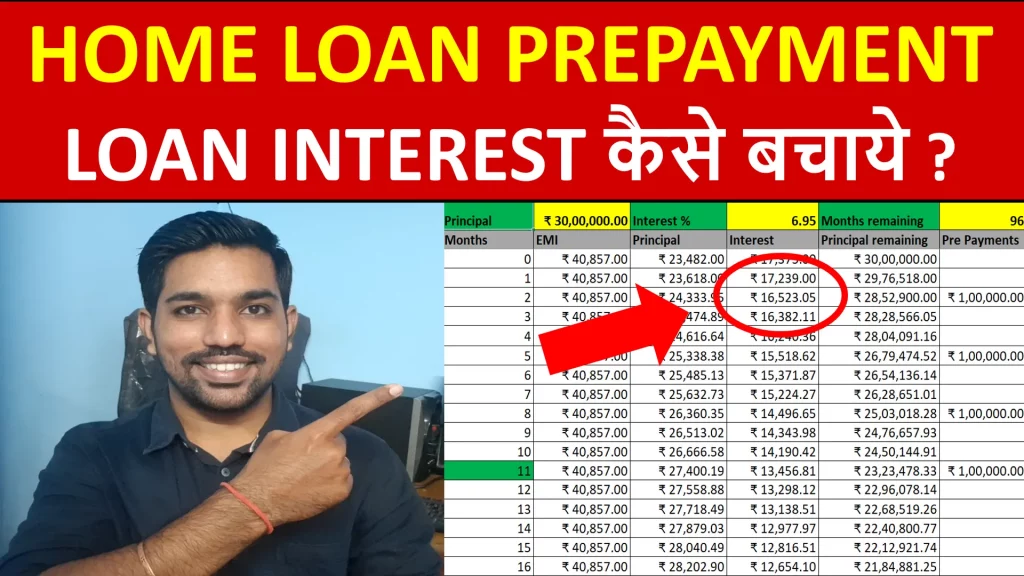

But not to worry, you can keep the loan tenure low and make loan prepayments to have less impact of such interest rate increases.

Watch the video at the start of this article to see more examples and impacts on home loan interest rates change.

Download Home Loan EMI Excel Calculator

Click below button to download Home Loan EMI Excel calculator:

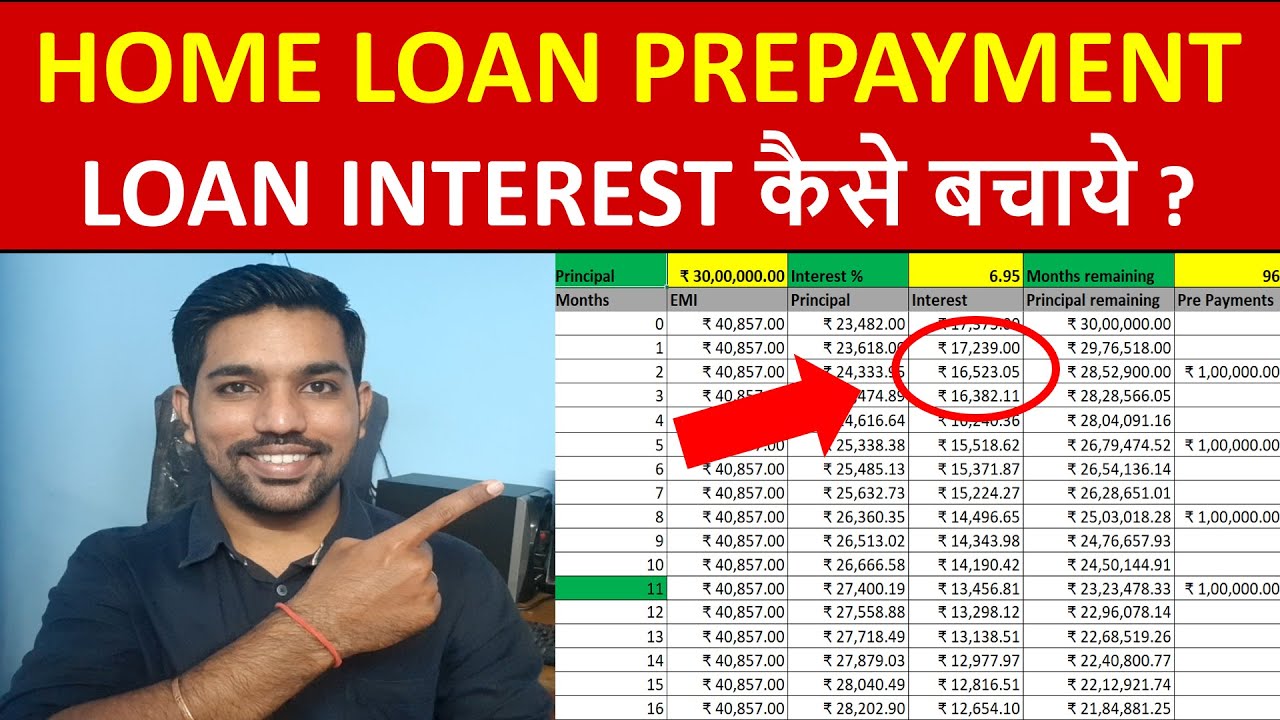

How to Save Home Loan Interest?

You can save home loan interest amounts by following certain rules:

- Keep your home loan tenure as low as possible

- Go for low interest rates home loan

- Choose variable or floating rates home loan so that you can make prepayments

- Making Home loan prepayments will help to save loan interest by reducing the outstanding principal amount on your loan.

Home Loan Prepayment Video

Do variable rates ever go down?

Yes, in case the government want to promote home buying than one of the best ways for them is to reduce the home loan interest rates, which happened during Covid 19 in the year 2019 and 2020. So yes having variable rate home loan can also give you this advantage of rates going down, but the frequency is less compared to rates going up!

Fixed vs Variable rate home loans Which is Better?

- Choose variable rate home loan if:

- You expect interest rates to fall

- You are unsure about interest rate movements

- You want some savings on your interest cost in the near term

- Choose fixed rate home loan if:

- You are comfortable with the EMI you are committing to pay

- You expect interest rates to rise

- If interest rates have come down and you wish to lock in at that rate

Conclusion

If you already have variable rate home loan, it is better to make periodic prepayments to reduce your loan interest and close your home loan as soon as possible, to reduce the impact of interest rate increase.

And if your are looking to buy new house on home loan, assess all your benefits you might get on fixed and variable home loan rates and choose accordingly. There is no one best option for all of us so decide based on your own situation and close your loan debt asap to enjoy your life debt free.

Some more Reading:

- 7 Home Loan Mistakes to avoid

- Home Loan Tax Benefits

- Buy vs Rent a House with Excel Calculations

- How to Invest in SIP Online

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

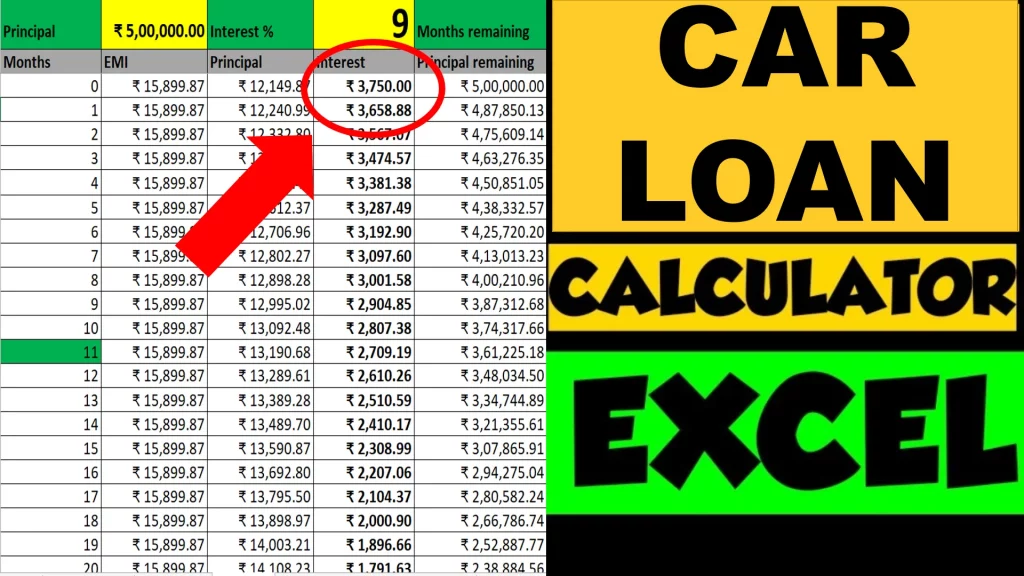

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

Not able to download excel file of Home loan calculator.

issue is solved now, please check. thanks for informing

Not able to download excel file of Home loan calculator.

sent on your email ID. Please check

not able to download

download is working. please try again