In previous article related to home loan, we have seen how home loan EMI can be calculated, 2 components of EMI (principal and interest amounts), how to save home loan interest using prepayments. In this article, we will focus on home loan tax benefits calculator, what are the income tax benefits on home loan, section 80C and section 24 limit to save income tax using home loan, how to find principal and interest components to claim deduction amounts, section 80EEA to claim additional interest amounts, income tax benefits on under construction property, stamp duty and registration amounts, joint home loan tax benefits and many more queries.

When you pay home loan EMI, as per FY 2024-25 you can avail Rs. 1.5 Lacs principal amount under Section 80C, Rs. 2 Lacs interest amount under Section 24 and additional Rs. 1.5 Lacs interest amount under Section 80EEA. These sections will be applicable only when we use Old Tax Regime to calculate income tax. Home loan prepayment amount can also be claimed under Section 80C since it is part of principal amount of home loan.

We can easily find the principal and interest amounts to be claimed in FY using the excel calculator provided at the bottom of this article. While your property is under construction, you cannot claim interest amounts you pay until the property is fully constructed. After construction, pre construction interest can be claimed in 5 equal installments. Stamp duty and registration amounts can be claimed as deductions in the same year these amounts are paid. Also, you can avail all benefits separately in case you have taken joint home loan and are the co owners of the property.

- Home Loan Tax Benefits Table

- Home Loan Tax Benefits Calculator Video

- Section 80C – Income Tax benefit on Home Loan Principal

- Section 24 – Income Tax benefit on Home Loan Interest

- Home Loan EMI Calculation Method

- Principal amount to be claimed in Section 80C

- Interest amount to be claimed in Section 24

- Home Loan Prepayment to save loan interest

- Tax Benefits on under construction property

- Stamp Duty and registration amounts exemption

- Section 80EEA – Income Tax benefit on Home Loan Interest

- Joint Home loan Tax benefits

- DOWNLOAD HOME LOAN EXCEL CALCULATOR

- SHOW your Support!

- Income Tax Calculator App – FinCalC

Home Loan Tax Benefits Table

Below table shows the home loan tax benefits summary. Note that the amount can be claimed only under Old Tax Regime which allows deductions to be claimed in order to save income tax.

| Sections | Deduction Amount (FY) |

|---|---|

| Section 80C (Principal) | Rs. 1.5 Lacs |

| Section 24 (Interest) | Rs. 2 Lacs |

| Section 80EEA (Interest) | Rs. 1.5 Lacs |

Home Loan Tax Benefits Calculator Video

Section 80C – Income Tax benefit on Home Loan Principal

- There are 2 components of Home Loan EMI – Principal Amount and Interest Amount

- Both the amounts can be claimed up to a certain limit in a financial year to save income tax

- Principal Amount paid as part of your EMI (Equated monthly installment) can be claimed under Section 80C

- Section 80C has a maximum deduction limit of Rs. 1.5 Lacs in a financial year. Which means a maximum of Rs. 1.5 Lacs can be claimed as deduction in FY using Old Tax Regime

- Important: You can claim deduction under section 80C only when choosing Old Tax Regime. New Tax Regime does not allow any investment option to claim deduction in case you want to save income tax

- Condition: While you can claim principal amount of EMI under Section 80C, you should not sell the property bought within 5 years to take advantage of this section. In case you sell the property bought within 5 years of purchase, the amount you claimed in previous FY under section 80C will be added to your income in the year you sell the property, and will be taxed based on your Tax bracket and Tax regime selected

- For example, if you bought property in FY 2018-19 and have been claiming Rs. 1 Lac in FY 2018-19 and FY 2019-20 under Section 80C. Now, let’s say you sell this property in FY 2020-21, then the amounts claimed in previous financial years (Rs. 2 Lacs) will be added in your income in FY 2020-21 and will be taxed accordingly.

Section 24 – Income Tax benefit on Home Loan Interest

- Similar to Section 80C where you can claim loan principal amount every year, Section 24 allows you to claim loan interest amount every year

- Maximum amount that can be claimed in Section 24 in Rs. 2 Lacs in FY

- Important: You can claim deduction under section 24 only when choosing Old Tax Regime. New Tax Regime does not allow any investment option to claim deduction in case you want to save income tax

- The interest amount you pay every year against your loan depends on your total loan amount, interest rate and loan tenure

Watch below video to understand Loan principal amount and interest amount calculation in EMI:

Home Loan EMI Calculation Method

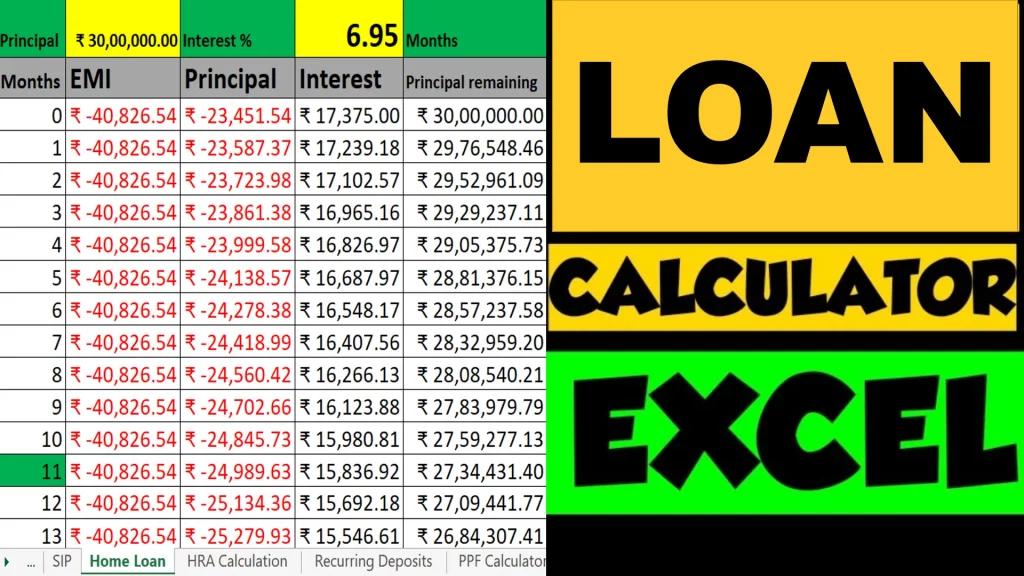

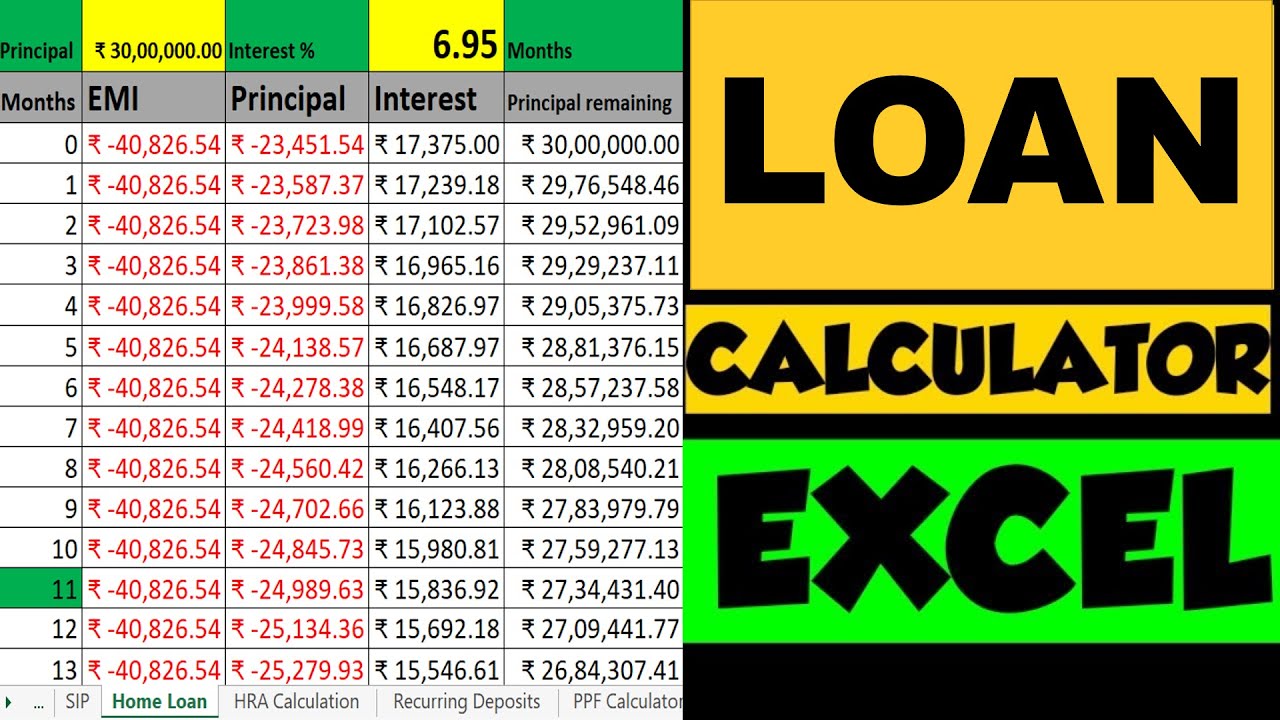

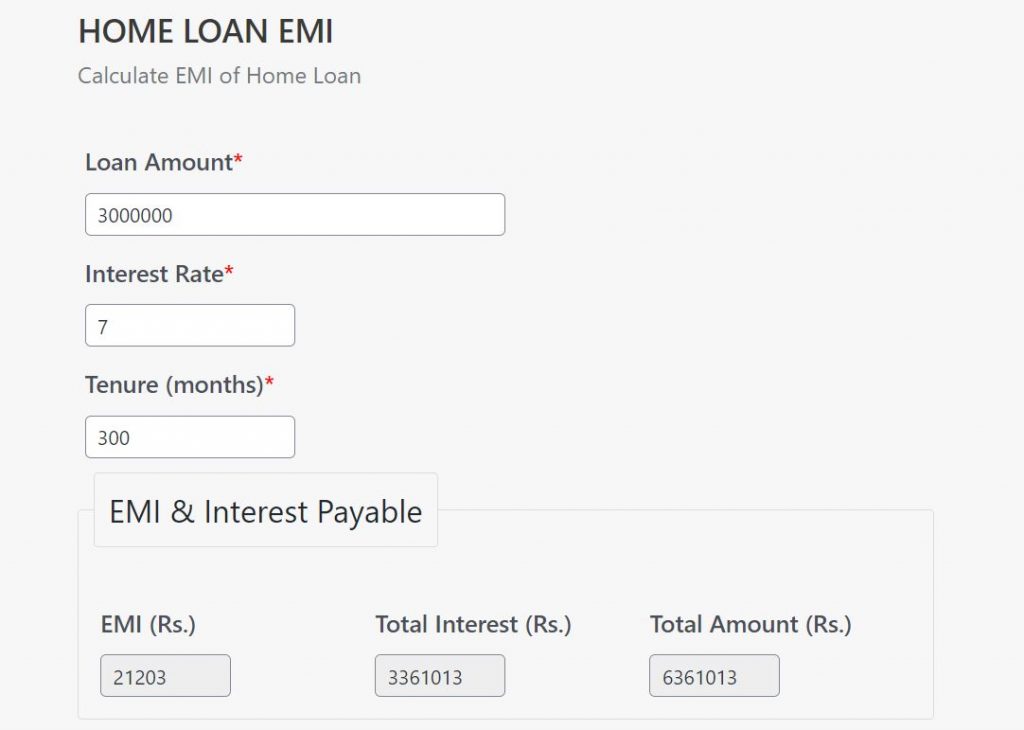

We can easily calculate Home Loan EMI using calculators available online. Below is another Home Loan calculator I have made for you in case you want to check your Home Loan EMI

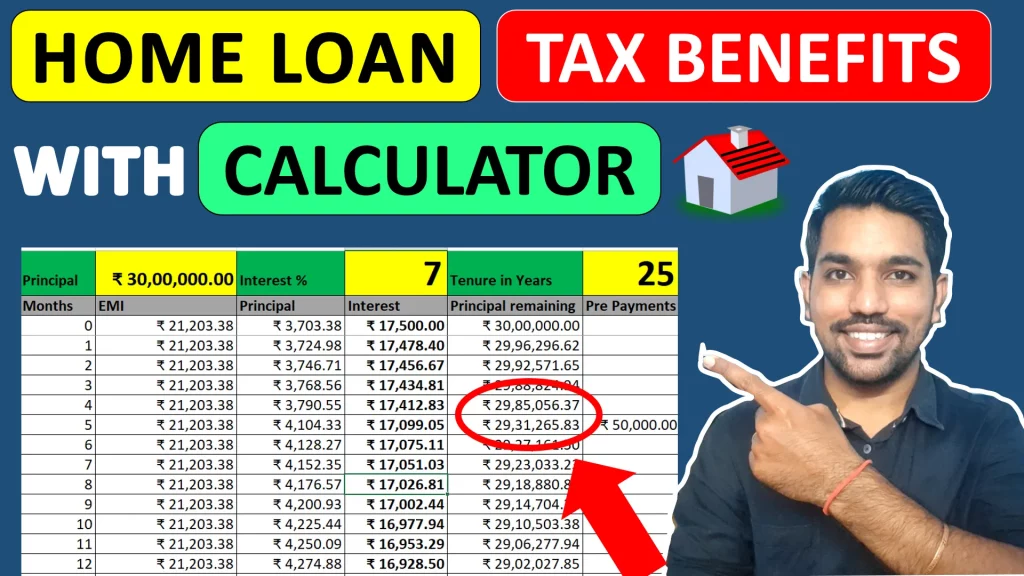

Here is how calculation looks like for Loan amount of Rs. 30 Lacs, with 7% yearly interest rate and 25 years tenure:

Another way to calculate your loan EMI is the use PMT function in excel. PMT function in excel takes below parameters to calculate your loan EMI:

- Interest Rate (rate / 12 / 100)

- Number of months

- Loan Principal value (amount of loan taken)

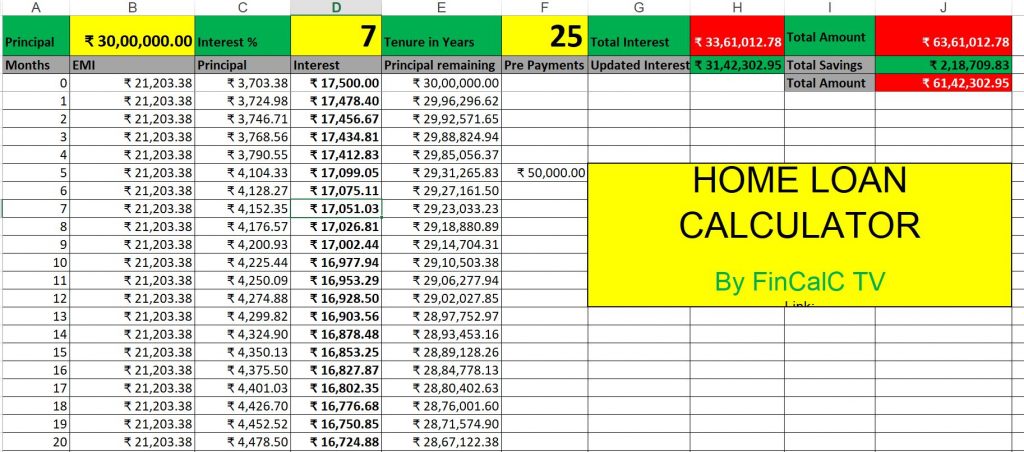

For example, if you have taken Loan of Rs. 30 Lacs, with 7% yearly interest rate and 25 years tenure, below is how excel calculator can be used to calculate loan EMI with principal and interest amounts:

ALSO READ: Buy or Rent a House?

Principal amount to be claimed in Section 80C

Home loan tax benefits calculator in excel can be used to calculate principal amount to be claimed. Steps to calculate principal amounts of your EMI in a FY is very simple. This is required to claim principal amount under section 80C.

- As shown in first video on this article, we first compute the EMI amount of the loan using excel

- From this EMI amount, we calculate interest paid for a month using the current outstanding loan amount and interest rate. This gives us the amount we can claim under section 24

- Now the remaining portion is principal amount. So we subtract interest amount calculated from EMI amount (EMI – interest amount), to find principal amount for that month

- We follow above steps for the months between April to march and add all principal amounts to be claimed under section 80C

- Note: Maximum of Rs. 1.5 Lacs only can be claimed in a Financial year while adding all principal amounts

Below is the screenshot for calculation of principal amount from EMI:

Interest amount to be claimed in Section 24

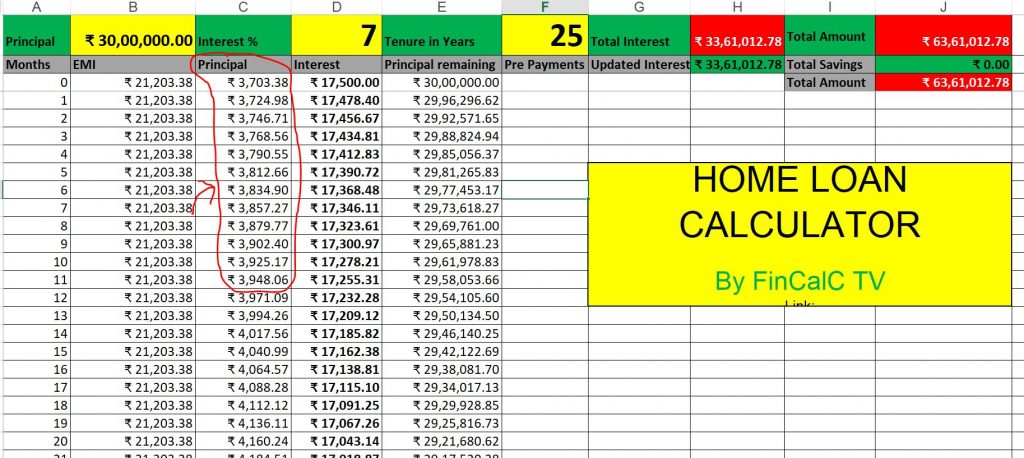

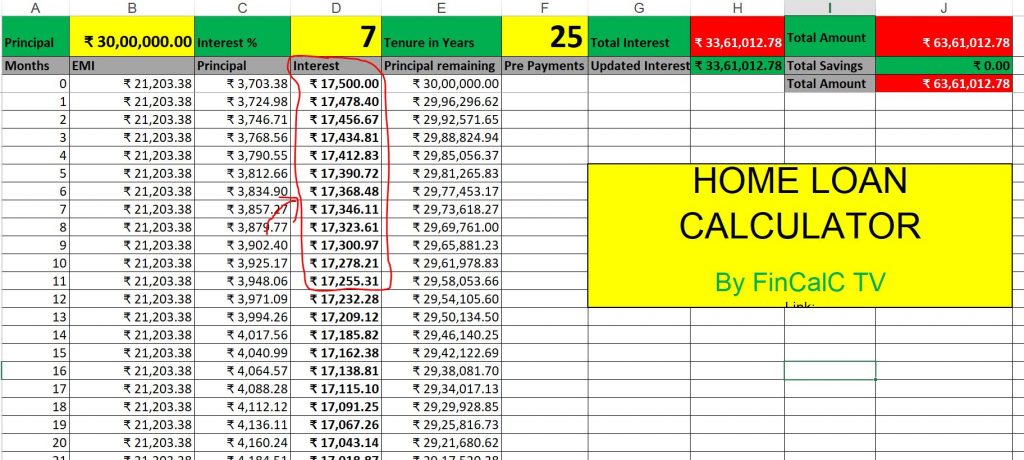

Home loan tax benefits calculator in excel can be used to calculate interest amount to be claimed. Below are the steps to calculate interest amounts to be claimed under section 24

- As shown in first video on this article, we first compute the EMI amount of the loan using excel

- From this EMI amount, we calculate interest paid for a month using the current outstanding loan amount and interest rate. This gives us the amount we can claim under section 24

- Now the remaining portion is principal amount. So we subtract interest amount calculated from EMI amount (EMI – interest amount), to find principal amount for that month

- We follow above steps for the months between April to march and add all interest amounts to be claimed under section 24

- Note: Maximum of Rs. 2 Lacs only can be claimed in a Financial year while adding all interest amounts

Below is the screenshot for calculation of principal amount from EMI:

Use this: Income Tax Calculator

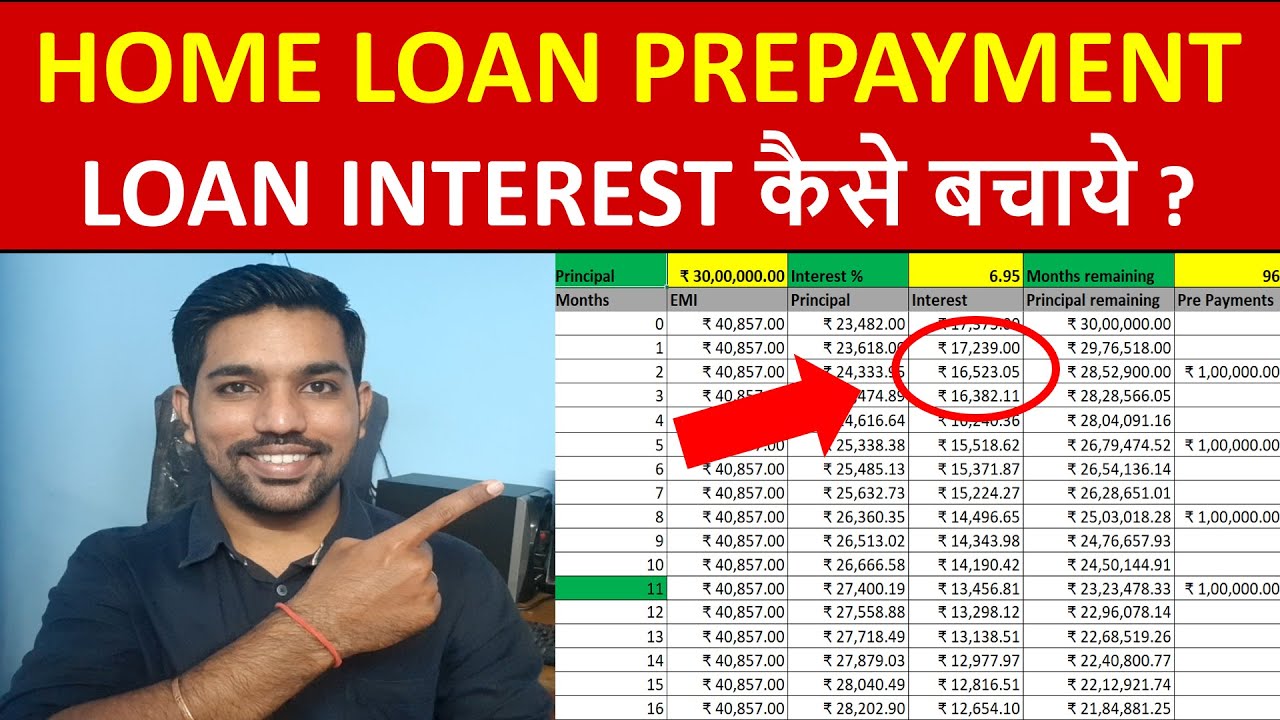

Home Loan Prepayment to save loan interest

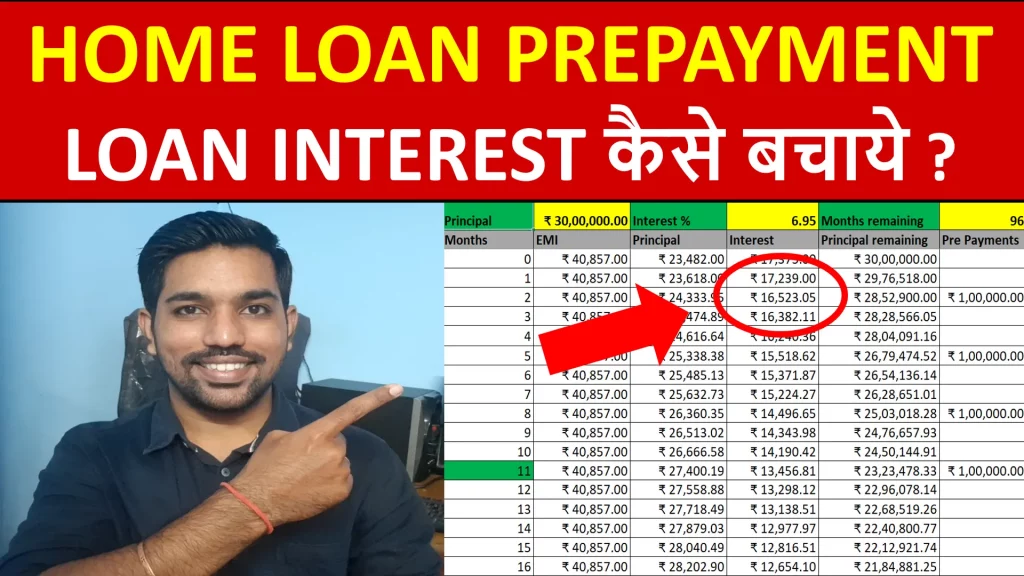

Apart from paying EMI every month, you can also make home loan prepayments to close your loan before time. Loan prepayment is a way to reduce your outstanding loan principal amount in order to close your loan as soon as possible. This also helps save your home loan interest amounts.

How do you plan for making prepayments? It needs some planning with your finances and little bit of savings every month. While making prepayments has the biggest advantage of saving home loan interest that you would be paying otherwise, it is best to regularly make loan prepayments during the start of your loan.

We have seen in above screenshots and examples that principal amount is lowest and interest amounts are highest initially. So maximum of the interest amounts you will be paying throughout your loan tenure will be taken from you during the initial months of your loan.

So, if you can save regularly every month and make prepayments every 4-6 months against your loan amount remaining, you can save a lot of loan interest amounts!

I have already explained you about how home loan prepayment helps you save loan interest amount here. You can also watch this video to understand the calculation in more details with examples:

While making home loan prepayment, you have the option to either reduce EMI or loan tenure. Which one you should choose?

Reduce EMI or Tenure?

It is seen using loan prepayment reduce emi or tenure examples here, that reducing tenure while making loan prepayments is the better option compared to reducing EMI.

If you can afford the same EMI until your loan is closed and keep making prepayments regularly, your loan tenure will be reduced every time and loan will be closed before time. And as you know, “Time is Money“, this will help you to achieve your other financial goals instead of paying your loan EMI for longer tenure.

This saying is true as well. The longer your loan tenure, the longer you’ll keep paying EMIs, which will still have interest amounts in it. This can be avoided by closing the loan soon by reducing tenure.

ALSO READ: Home Loan Prepayment Reduce EMI or Tenure?

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

Tax Benefits on under construction property

Many have questions about saving taxes on under construction properties. Let’s look what you should know:

- You cannot claim loan interest amounts while your property is still under construction, but you have the chance to do so after construction completion!

- After construction is completed, you can claim the deductions in a normal way as above

- But the interest you already paid before construction can be claimed after property construction completion. The interest you paid already is called pre construction interest

- You can claim pre construction interest amount after property construction is completed in 5 equal installments. Let’s understand this with the help of example

Pre construction interest exemption example

Let’s say you bought under construction property in FY 2018-19 for which construction is completed in FY 2020-21. And below are the details of principal and interest amounts paid by you:

| Items | FY 2018-19 | FY 2019-20 | FY 2020-21 |

|---|---|---|---|

| Principal Amount | Rs. 1,80,000 | Rs. 2,40,000 | Rs. 1,68,000 |

| Interest Amount | Rs. 90,000 | Rs. 1,20,000 | Rs. 72,000 |

| Total | Rs. 2,70,000 | Rs. 3,60,000 | Rs. 2,40,000 |

As seen above, you pay total interest of Rs. 2,10,000 (Rs. 90,000 + Rs. 1,20,000) in FY 2018-19 and FY 2019-20 before the construction is completed. Since construction is completed in FY 2020-21, interest paid in previous financial years is called pre construction interest, which is total of Rs. 2,10,000.

This pre construction interest can be paid in 5 equal installments as Rs. 42,000 (Rs. 2,10,000 / 5) from FY 2020-21 onwards. In this way you can claim a total of Rs. 1,14,000 (Rs. 72,000 + Rs. 42,000) as interest amounts in section 24 in FY 2020-21.

In this way you can claim the pre construction interest amount paid after property construction is completed.

Stamp Duty and registration amounts exemption

- Stamp Duty and Registration is the fees you pay to government when you buy a house.

- This is usually 4%-6% of your property value depending on location

- The amount you pay as stamp duty and registration can be claimed under section 80C similar to EMI principal amount

- You should claim this amount in the financial year in which you buy the property

- Maximum of Rs. 1.5 Lacs can be claimed as deduction while claiming stamp duty and registration amount

Section 80EEA – Income Tax benefit on Home Loan Interest

Section 80EEA was introduced in Budget 2019 in order to promote home buying among Indians. Section 80EEA provides additional Rs. 1.5 Lacs deduction of interest amount in a financial year apart from Rs. 2 Lacs in Section 24.

This provides you a total of Rs. 3.5 Lacs deduction of loan interest amount together in Section 24 and Section 80EEA.

Conditions to use Section 80EEA:

- Stamp value of property must be less than Rs. 45 Lacs

- Loan must be sanctioned between 1st April 2019 to 31st March 2022

- You must be a first time home buyer

Joint Home loan Tax benefits

It is very good when you contribute together with your spouse towards closing your home loan. In this case we are referring to joint home loan which provides additional benefits to both the co-owners of the property. Following are some of the benefits:

- Stamp duty and registration cost in some states are less when one of the co-owners is a female

- Both the owners can claim Rs. 1.5 Lacs as principal amount separately under Section 80C to save income tax if both are paying EMIs

- Both owners can claim Rs. 2 Lacs of interest amount under Section 24 provided EMIs or repayments are deducted from their respective amounts

- Both partners help each other by supporting themselves financially

- Income tax is saved as a family by considering above points

DOWNLOAD HOME LOAN EXCEL CALCULATOR

Use above download link to download home loan excel calculator to calculate the amount you can claim under Section 80C, Section 24 and Section 80EEA for your principal and interest amounts.

SHOW your Support!

Found this Helpful? DONATE any amount to see more useful Content. Scan below QR code using any UPI App!

UPI ID: abhilashgupta8149-1@okhdfcbank

Verify that you are “Paying Abhilash Gupta” before making the transaction so that it reaches me. It makes my Day 🙂

Thank you for Donating. Stay Tuned!

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2023-24 and previous FY 2022-23

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.