One of the most asked questions is How can I calculate my income tax? This article will help you answer this question.

It depends on your Income. You have to check the Tax bracket you belong to, based on the Old Tax Regime and New Tax Regime mentioned below. For example, if your income is 8 Lakh, based on Old Tax Regime, you belong to 20% tax bracket and based on New Tax Regime, you belong to 10% Tax Bracket. According to the tax bracket, your income tax will be calculated. After calculations, you have the option to choose between Old Tax Regime or New Tax Regime to pay your income tax.

| Income | Old Tax Regime | Income | New Tax Regime |

|---|---|---|---|

| Rs. 0 to Rs. 2.5 Lacs | 0% | Rs. 0 to Rs. 3 Lacs | 0% |

| Rs. 2.5 Lacs to Rs. 5 Lacs | 5% | Rs. 3 to Rs. 7 Lacs | 5% |

| Rs. 5 Lacs to Rs. 10 Lacs | 20% | Rs. 7 to Rs. 10 Lacs | 10% |

| more than 10 Lacs | 30% | Rs. 10 to Rs. 12 Lacs | 15% |

| Rs. 12 to Rs. 15 Lacs | 20% | ||

| more than 15 Lacs | 30% |

Here are the steps to calculate your Income Tax

- Identify the tax bracket you belong to, based on above Income Tax Slab Rates table

- Calculate your taxable income on which income tax will be calculated

- Calculate income tax based on each slab rate, up to your taxable income

- Add income tax from each slab to get intermediate total income tax

- Calculate 4% cess on this intermediate total income tax

- Add this cess amount to reach total income tax

- Perform above steps with both – Old Tax Regime and New Tax Regime

- Choose between Old or New Tax Regime to pay your income tax. Choose the one that helps you pay less income tax

Note: Difference between Old and New Tax Regime is that New Tax Regime has lower tax rates compared to Old Tax Regime. Also, in Old Tax Regime you will be able to claim investment options as deductions to save your income tax which is not possible in New Tax Regime.

Let’s take few examples below. For simplicity we have considered that you are a salaried employee and only have standard deduction = Rs. 50,000 as the deduction option in Old Tax Regime based on income tax calculation for FY 2024-25. Standard deduction is also applicable for new tax regime in FY 2024-25.

How much tax do I pay on 10 lakh salary?

So for Salary = 10 Lakh in FY 2024-25, with standard deduction = Rs. 50,000 in old tax regime and Rs. 75,000 in new tax regime, your taxable income will be:

- Taxable Income (Old Tax Regime ) = Rs. 9.5 Lakh

- Taxable Income (New Tax Regime ) = Rs. 9.25 Lakh

And you belong to 20% tax bracket in Old Tax Regime and 15% Tax bracket in New Tax Regime. Below is the table of your income tax calculation:

| Items | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income | Rs. 10,00,000 | Rs. 10,00,000 |

| Standard Deduction | Rs. 50,000 | Rs. 75,000 |

| Taxable Income | Rs. 9,50,000 | Rs. 9,25,000 |

| 5% Slab | Rs. 12,500 | Rs. 20,000 |

| 10% Slab | Rs. 0 | Rs. 22,500 |

| 15% Slab | Rs. 0 | Rs. 0 |

| 20% Slab | Rs. 90,000 | Rs. 0 |

| Income Tax | Rs. 1,02,500 | Rs. 42,500 |

| Cess (4%) | Rs. 4,100 | Rs. 1,700 |

| Total Income Tax | Rs. 1,06,600 | Rs. 44,200 |

Based on above calculations, it is better to choose new tax regime to pay less tax compared to old tax regime. You can also make use of investments or deduction options to save income tax with old tax regime.

How 5% Income Tax is Calculated in above slab?

5% tax rate is applicable on income between Rs. 2.5 Lacs to Rs. 5 Lacs based on above Income Tax Slab Rate table. So 5% tax will be applicable on this difference of Rs. 2.5 Lacs, which will be Rs. 12,500. Similar calculation is done with other slab rates as well.

For example, 20% slab rate is applicable on income between Rs. 5 lacs to Rs. 9.5 Lacs based on Old Tax Regime in above example. So 20% tax is applicable on difference of Rs. 4.5 Lacs which is Rs. 90,000. And this is the way your income tax is calculated for FY 2024-25.

ALSO READ: 6 Tax Saving Options to pay Zero Income Tax with Rs. 11 Lakh Salary

Note that cess of 4% is applied after adding income tax from different slabs, which is added to get your total income tax to be paid or tax liability. Watch below video on income tax calculation using excel.

Income Tax Calculation FY 2024-25 Video

How much tax do I pay on 14 lakhs?

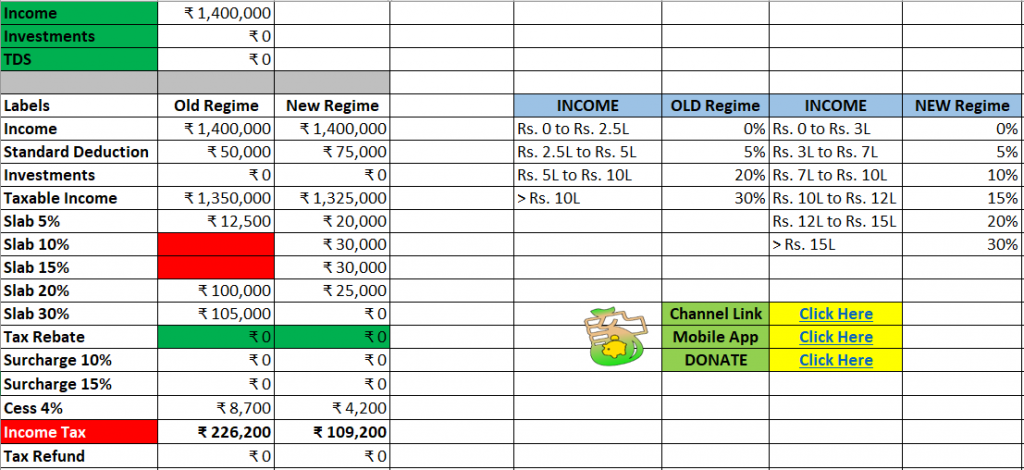

Let’s take another example of Rs. 14 Lakhs salary with standard deduction = Rs. 50,000 in old tax regime and Rs. 75,000 in new tax regime. This belongs to 30% tax bracket with old tax regime and 20% tax bracket with new tax regime.

- Taxable Income (Old Tax Regime ) = Rs. 13.5 Lakh

- Taxable Income (New Tax Regime ) = Rs. 13.25 Lakh

| Items | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income | Rs. 14,00,000 | Rs. 14,00,000 |

| Standard Deduction | Rs. 50,000 | Rs. 75,000 |

| Taxable Income | Rs. 13,50,000 | Rs. 13,25,000 |

| 5% Slab | Rs. 12,500 | Rs. 20,000 |

| 10% Slab | Rs. 0 | Rs. 30,000 |

| 15% Slab | Rs. 0 | Rs. 30,000 |

| 20% Slab | Rs. 1,00,000 | Rs. 25,000 |

| 30% Slab | Rs. 1,05,000 | Rs. 0 |

| Income Tax | Rs. 2,17,500 | Rs. 1,05,000 |

| Cess (4%) | Rs. 8,700 | Rs. 4,200 |

| Total Income Tax | Rs. 2,26,200 | Rs. 1,09,200 |

Above is the calculation for various slab rates on Rs. 14 Lakh salary. It is better to choose new tax regime in above case as you will be paying less income tax with new tax regime.

Above calculations can be seen in the excel screenshot here:

Click below button to download the income tax excel calculator:

How much tax should I pay for 8 lakhs?

Another example of Rs. 8 Lakh salary, with standard deduction = Rs. 50,000 in old regime and Rs. 75,000 in new tax regime. You’ll belong to 20% tax bracket with Old Tax Regime and 10% Tax bracket with New Tax Regime.

- Taxable Income (Old Tax Regime ) = Rs. 7.5 Lakh

- Taxable Income (New Tax Regime ) = Rs. 7.25 Lakh

| Items | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income | Rs. 8,00,000 | Rs. 8,00,000 |

| Standard Deduction | Rs. 50,000 | Rs. 75,000 |

| Taxable Income | Rs. 7,50,000 | Rs. 7,25,000 |

| 5% Slab | Rs. 12,500 | Rs. 20,000 |

| 10% Slab | Rs. 0 | Rs. 2,500 |

| 15% Slab | Rs. 0 | Rs. 0 |

| 20% Slab | Rs. 50,000 | Rs. 0 |

| Income Tax | Rs. 62,500 | Rs. 22,500 |

| Cess (4%) | Rs. 2,500 | Rs. 900 |

| Total Income Tax | Rs. 65,000 | Rs. 23,400 |

Again, here as well it is better to choose new tax regime since you’ll be paying less income tax with no other investments or deductions available apart from standard deduction if you are not making any other investments.

Tax Rebate under Section 87A

Based on Tax Rebate under Section 87A, you don’t have to pay any income tax with old tax regime when your taxable income is below Rs. 5 lakh, and no income tax with new tax regime if your taxable income is below Rs. 7 lakh in FY 2024-25.

Watch below video to know more about tax rebate 87A with calculation examples:

Watch more Videos on YouTube Channel

Some more Reading:

- Marginal Relief in New Tax Regime

- Old vs New Tax Regime Which is Better?

- SIP Returns Calculation with Excel Calculator

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.