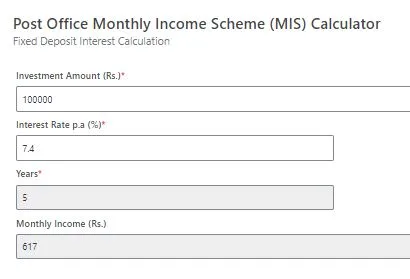

Post Office Monthly Income Scheme (MIS) Calculator helps you to know the monthly income you can get in this monthly income scheme of Post office.

If you have lump sum amount and looking for fixed monthly income scheme, Post Office Monthly Income Scheme (MIS) is the best scheme for you to get regular monthly income.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this Post Office Monthly Income Scheme (MIS) Calculator with your friends and help them know the fixed monthly income they can get.

ALSO READ: Latest Interest Rates in Post Office Schemes

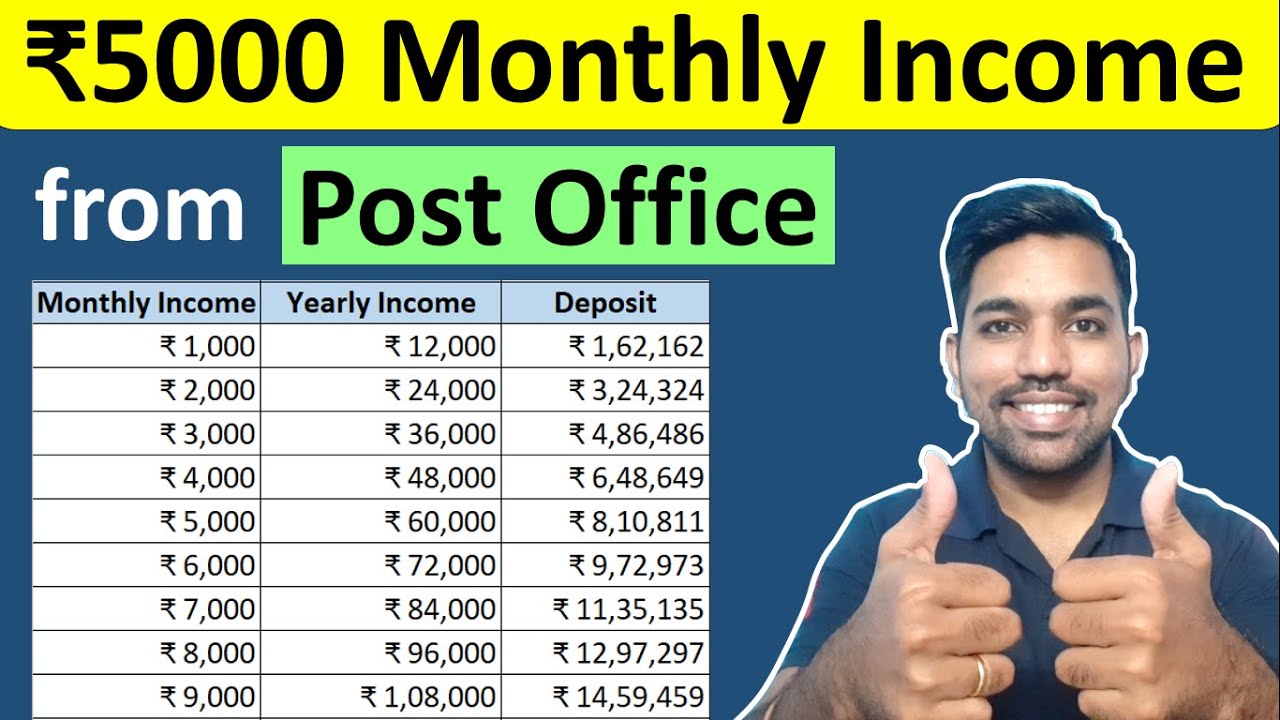

- Rs. 5000 Monthly Income from Post Office Scheme Video

- What is Post Office Monthly Income Scheme (MIS)?

- Post Office Monthly Income Scheme (MIS) Interest Rate 2025

- How the Post Office MIS Calculator can help you?

- Eligibility to open Post Office Monthly Income Scheme (MIS)

- Deposit limits in Post Office MIS Scheme

- Interest Calculation in Post Office Monthly Income Scheme?

- Pre mature closure of Post Office MIS

- Maturity of Post Office Monthly Income Scheme

- Conclusion

- Frequently Asked Questions

Rs. 5000 Monthly Income from Post Office Scheme Video

Watch more Videos on YouTube Channel

What is Post Office Monthly Income Scheme (MIS)?

- Post Office Monthly Income Scheme or Post Office MIS is a fixed income scheme that gives regular payout every month on your deposits

- This is a Post office scheme for those looking for decent returns on their lump sum investment

- The tenure for Post Office MIS Scheme is 5 years, which means your money will be locked in for 5 years.

- You can deposit minimum of Rs. 1000 and maximum of Rs. 9 Lakh in Single account and Rs. 15 Lakh in joint account of this scheme

- The current interest rate in Post Office Monthly Income Scheme is 7.4% for April to June 2025 quarter

- This interest rate is reviewed by government of India every quarter

- The interest on which you open Post Office Monthly Income Scheme will be fixed throughout 5 years of your tenure

ALSO READ: Latest Post Office Interest Rates

Post Office Monthly Income Scheme (MIS) Interest Rate 2025

- The interest rate you will get in Post Office Monthly Income Scheme is 7.4% for April to June 2025 quarter

- It is important to note that this interest rate will be reviewed every quarter by government of India

How the Post Office MIS Calculator can help you?

- The above Post Office MIS Calculator can help you to calculate the monthly income you can get in this scheme

- Let’s say for example you deposit Rs. 1 Lakh in this scheme and current interest rate is 7.4% per annum, this will pay you Rs. 617 every month

- Below is the screenshot of the calculations

Eligibility to open Post Office Monthly Income Scheme (MIS)

You can open the Post Office Monthly Income Scheme if:

- You are an adult

- Open joint account (up to 3 adults)

- A guardian on behalf of minor

- A minor of age above 10 years on his / her own name

If any of the above conditions are satisfied, you are eligible to open Post Office Monthly Income Scheme Account.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

Deposit limits in Post Office MIS Scheme

- While opening the Post Office MIS Scheme, minimum deposit is Rs. 1000.

- Maximum deposit you can make is Rs. 9 Lakh for single account and Rs. 15 lakh for joint account

- The interest earned will be equally distributed in case of joint accounts

- The deposits made above Rs. 1000 should be in multiple of Rs. 1000

Interest Calculation in Post Office Monthly Income Scheme?

You can easily calculate the monthly income you can earn in Post Office Monthly Income Scheme using above calculator.

- The monthly interest will be paid to you on completion of month after opening the account and will continue every month thereafter

- If the interest earned is not claimed, no additional interest will be earned in this case

- If excess amount is deposited, the additional amount will be refunded back and will only earn interest based on Post Office Savings Account Interest rate

- Interest can be drawn via auto credit feature in your Post Office savings account

ALSO Read: Rs. 1000 PPF Interest Calculation for 15 Years

Pre mature closure of Post Office MIS

- You cannot withdraw any amount before 1 year of opening the Post Office MIS Account

- If MIS account is closed after 1 year and before 3 years, 2% of your principal amount (deposits made) will be deducted and remaining amount will be paid back

- If MIS account is closed after 3 years and before 5 years, 1% of your principal amount (deposits made) will be deducted and remaining amount will be paid back

- You can fill the pre mature closure form and submit along with passbook in post office to close the account pre maturely

ALSO READ: Rs. 10,000 Fixed Deposits Interest Calculation

Maturity of Post Office Monthly Income Scheme

- Your Post Office Monthly Income Scheme account will mature after 5 years of opening the account

- After completion of 5 years, you can submit the application along with passbook in post office

- You principal amount will be credited to your savings account

- In case of death of account holder before 5 years, the nominee will be paid the principal amount immediately

Conclusion

So Post Office Monthly Income Scheme is one of the best fixed income scheme that pays you regular payout. You earn interest amount every month your your principal amount you deposit in MIS account.

Use above Post Office MIS calculator to know the monthly income you can get.

Comment below your queries if you have any.

Some more Reading

- PPF Account Benefits

- Rs. 1000 Sukanya Samriddhi Yojana Interest Calculation

- PPF vs Mutual Funds Which is Better

- Post Office Schemes with High Returns

Frequently Asked Questions

Is Post Office MIS Interest rate fixed?

Yes Post Office MIS Interest rate is fixed for the tenure of 5 years after opening the MIS account. Note that interest rates in MIS account is reviewed every quarter by government of India

Is Post Office MIS Interest taxable?

Yes the monthly income you get in Post Office MIS account is taxable. The interest earned will be added to your income and taxed as per the income tax slab rates.

Which scheme is best for monthly income in post office?

Post Office Monthly Income Scheme is best scheme for monthly income in post office. Currently the interest rate is 7.4% per year for April to June 2025 quarter which is decent returns provided it is guaranteed

Where can I invest to get monthly income?

Post Office Monthly Income Scheme is best scheme to invest to get monthly income. Use above calculator to know the monthly income from this scheme

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.