What are the past 25 years returns for SIP in Sensex? This important number will help us to know what the future of Sensex will look like.

Sensex represents the top 30 companies in BSE (Bombay Stock Exchange). SIP in Sensex for past 25 years has given Rs. 20.6 Lakh on Rs. 1000 SIP, Rs. 40.13 Lakh on Rs. 2000 SIP and Rs. 1 crore on Rs. 5000 SIP. So now you know in order to accumulate Rs. 1 crore in next 25 years, you can invest Rs. 5000 via SIP in good mutual funds.

Note that above are the past returns and it does not guarantee future returns. Still it is a good factor to see how mutual funds have performed in the past. It is always better to see the list of stocks listed in the mutual funds before investing in them.

SIP in Sensex Returns Calculation Video

Watch more Videos on YouTube Channel

Is there any Sensex Index fund?

Yes there are many Sensex index mutual funds you can invest in. Below are some of the popular ones:

- HDFC Index Fund – Sensex Plan

- ICICI Pru BSE Sensex Index Fund

- LIC MF BSE Sensex Index Fund

- Tata BSE Sensex Index Fund

- Nippon India Index Fund – Sensex Plan

All above mutual funds represent the Sensex plan (top 30 companies) in India. You can invest in one of them to get returns similar to Sensex index over time.

ALSO READ: Best Mutual Funds to Invest via SIP

What is the best way to invest in Sensex?

Investing via Sensex mutual funds is the way way to invest in Sensex. Already you can see the list of Sensex mutual funds above from which you can choose one to invest over long term using SIP (Systematic Investment Plan).

SIP is the best way to invest in mutual funds. You can also use below SIP calculator to know what returns you can expect over specific time period.

How to invest in Sensex mutual funds?

If you are investing via SIP in any mutual fund, you can follow simple steps to invest in Sensex mutual funds.

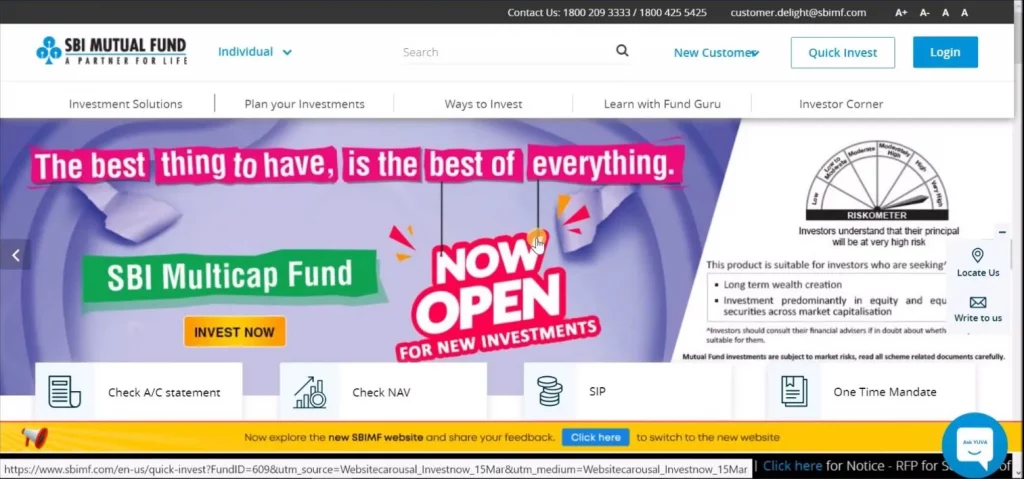

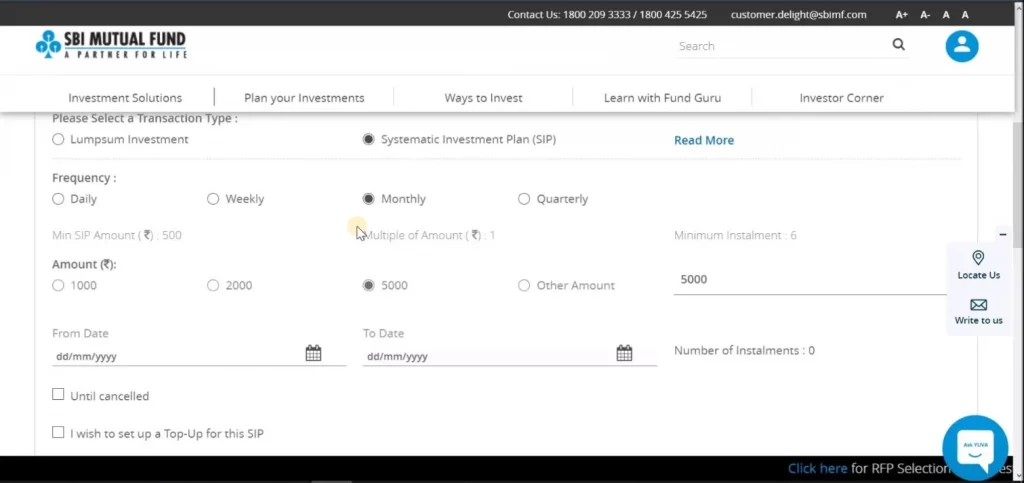

Below is the example of investing via SIP online using SBI mutual fund official website:

- Go to SBI Mutual Fund website. Below is the page that will be displayed

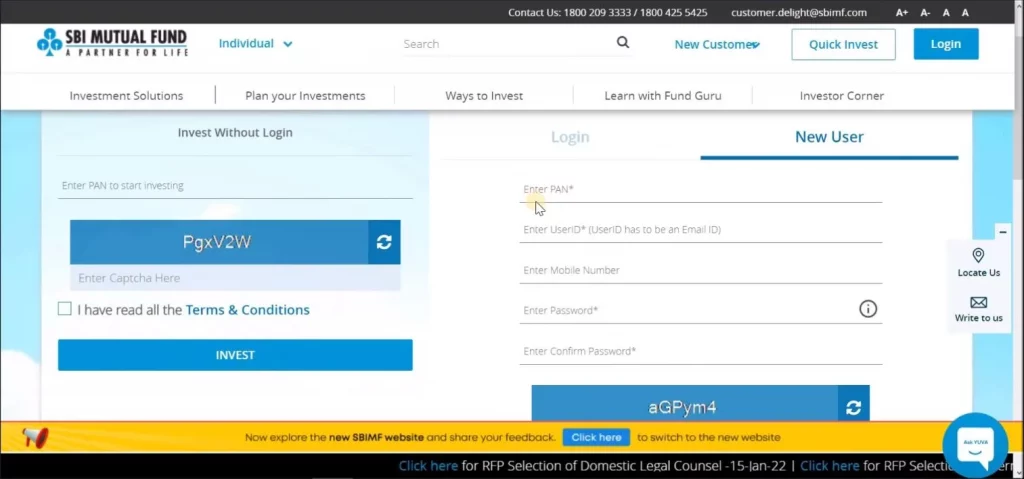

2. Register on SBI Mutual Fund website by providing PAN, email ID, mobile number and password to be used

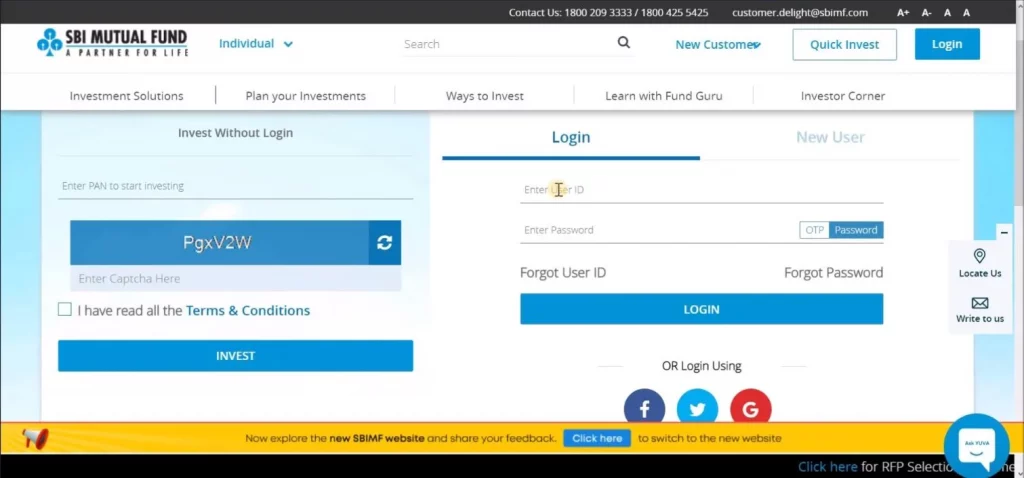

3. Login using your email ID and password

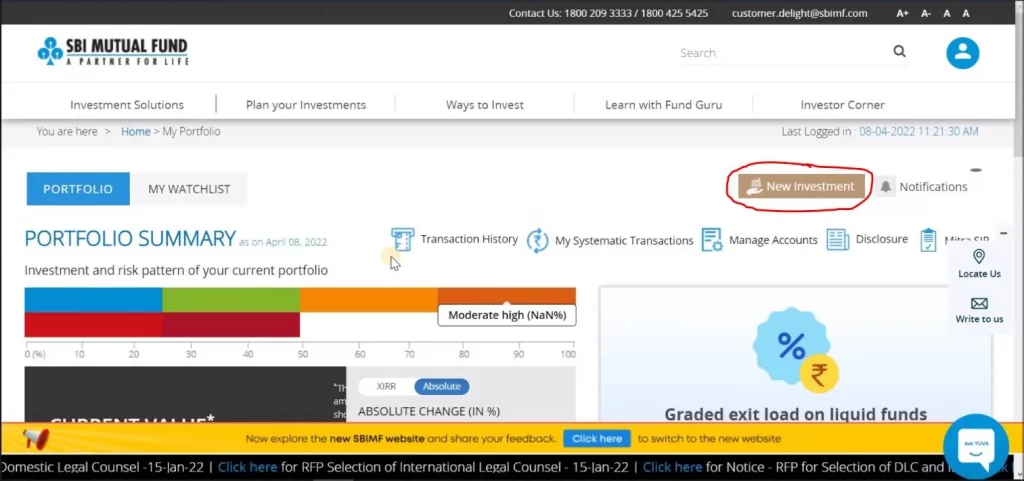

Click on “New Investment”

5. Select folio number and provide other SIP details

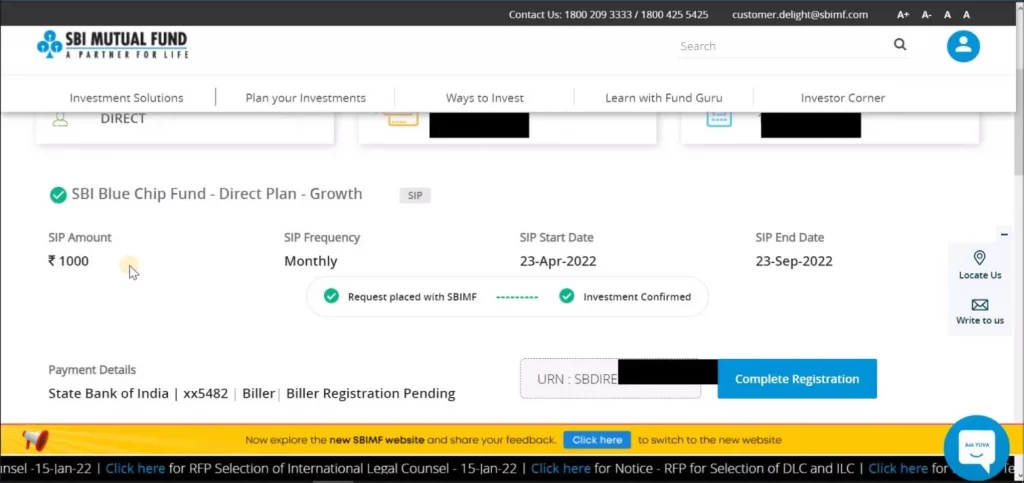

6. Submit and check confirmation details

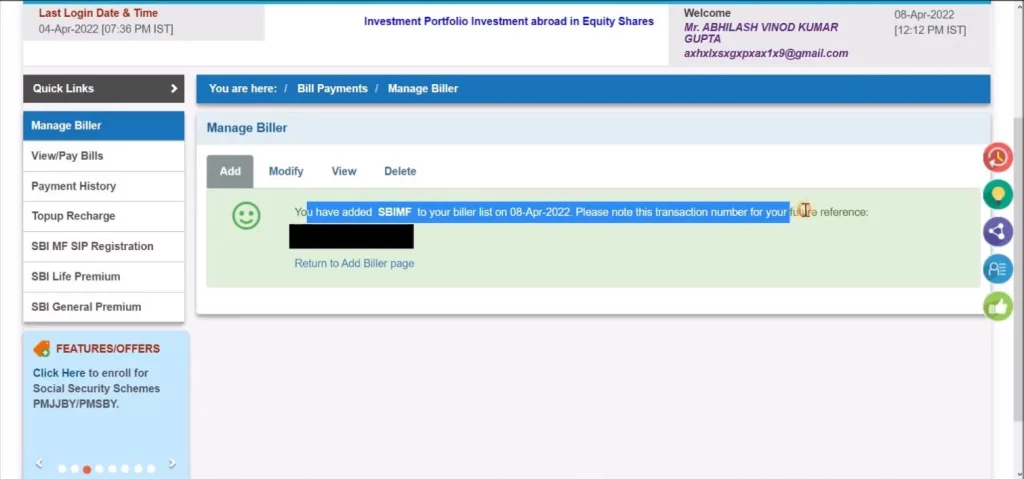

7. Register URN (unique registration number) on bank’s internet banking website

So above are all the steps you need to perform to start SIP in SBI mutual fund. Similar process can be followed to invest in SIP via any other mutual fund website and internet banking based on your bank.

You can also watch the video explaining all the steps in below video:

How to Invest in Mutual Funds via SIP Online Video

Watch more Videos on YouTube Channel

SIP in Sensex Returns Calculation

Let us now see the returns calculation when we invest via SIP in Sensex.

We will take 3 examples of SIP Rs. 1000, Rs. 2000 and Rs. 5000 over past 25 years.

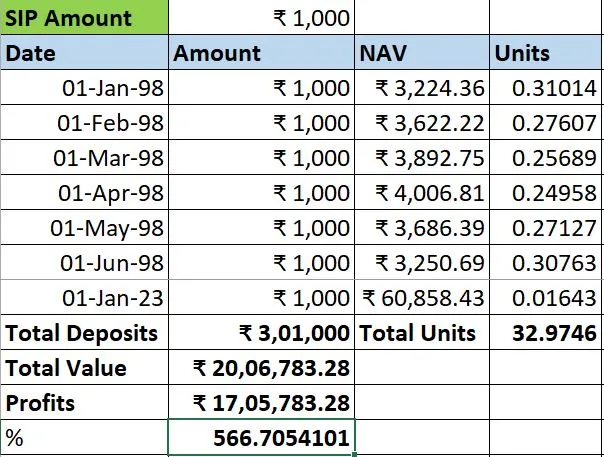

₹1000 SIP in Sensex

If you would have invested Rs. 1000 via SIP in Sensex mutual fund, consistently for past 25 years, below are some stats:

- Total Deposits via SIP: ₹ 3,01,000

- Tenure = 25 Years

- Maturity Amount = ₹ 20,06,783

- Profits = ₹ 17,05,783

- Total Units = 32.97461

- Absolute Returns % = 566.70%

Below is the screenshot of the calculations in Excel from the video at the top of this article:

You can also download the SIP Excel Calculator to check returns in offline mode.

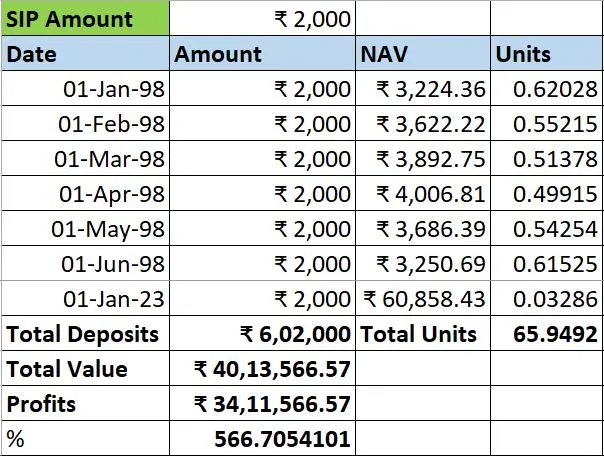

₹2000 SIP in Sensex

If you would have invested Rs. 2000 via SIP in Sensex mutual fund, consistently for past 25 years, below are some stats:

- Total Deposits via SIP: ₹ 6,02,000

- Tenure = 25 Years

- Maturity Amount = ₹ 40,13,566

- Profits = ₹ 34,11,566

- Absolute Returns % = 566.70%

- Total Units = 65.94923

Below is the screenshot of the calculations in Excel from the video at the top of this article:

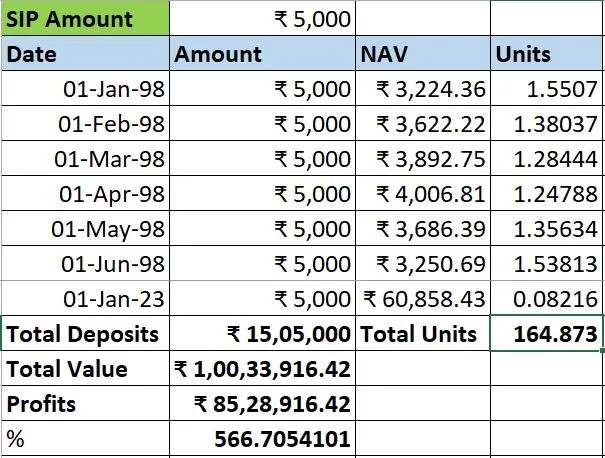

₹5000 SIP in Sensex

If you would have invested Rs. 5000 via SIP in Sensex mutual fund, consistently for past 25 years, below are some stats:

- Total Deposits via SIP: ₹ 15,05,000

- Tenure = 25 Years

- Maturity Amount = ₹ 1,00,33,916

- Profits = ₹ 85,28,916

- Total Units = 164.8731

- Absolute Returns % = 566.70%

Below is the screenshot of the calculations in Excel from the video at the top of this article:

So as seen above, you must have achieved Rs. 1 crore goal just by investing Rs. 5000 via SIP consistently over past 25 years.

You can also use the step up SIP option to increase your investment amount and achieve your goal before time.

ALSO READ: Rs. 2000 SIP vs Step up SIP Returns Calculation

Is it good to invest in Sensex?

It is absolutely good to invest in Sensex since you are investing in top 30 companies in India. Even if couple of big companies are not performing for any time period, other companies will help you to gain profits over long term.

Also, based on the market capitalization, top 30 companies are selected. When any company’s market cap is reduced in such a way that it is not in top 30 list, it will be replaced by another company that deserves to be in top 30 list.

So you are ensured that you are investing in top companies only.

Is SIP available for stock market?

Yes many brokers allow you to invest via SIP in stock markets. This helps you to invest specific amount every month in your favorite stocks to achieve your financial goals.

ALSO READ: Compounding in Stock Market with Calculations

Conclusion

So based on above stats and videos, you can easily start investing via SIP in Sensex and achieve your financial goals systematically. Continue your SIP investments and make lump sum investment when market goes down to achieve the best from the market fluctuations.

Make sure that you are not trying to time the market as no one can predict the market’s next move. You aim must be to give time to the market and invest for long term.

Some more Reading

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.