I get many queries on my YouTube Channel regarding how mutual funds work, is there any Mutual Fund Returns Calculator in Excel, what is expense ratio, what is NAV, how mutual fund NAV is calculated, what are the best mutual funds and how to select best mutual fund based on goals.

Mutual funds are funds that invest in set of companies to maximize investor’s returns. The amount you invest helps you buy units of mutual funds based on NAV (Net Asset Value), which is the price of a single unit of a mutual fund. You accumulate mutual fund units over a period of time based on your goals and sell them off with a NAV value that provides you good returns. Also, every mutual fund has a fund manager that tries to maximize your returns by selecting good stocks to invest your money in. We will see all these with the help of examples.

Also, you can find the Mutual Fund Returns Excel Calculator Download link at the bottom of this article.

- Mutual Fund Returns Calculator Video using Excel

- What are Mutual Funds

- What is NAV (Net Asset Value) of Mutual Fund

- How Mutual Funds Work

- What is Expense Ratio

- Lump sum vs SIP Investment

- Mutual Fund Categories

- Types of Mutual Funds

- Things to remember before investing in Mutual Fund

- Some more Videos

- DOWNLOAD MUTUAL FUND RETURN EXCEL CALCULATOR

- Conclusion

Mutual Fund Returns Calculator Video using Excel

What are Mutual Funds

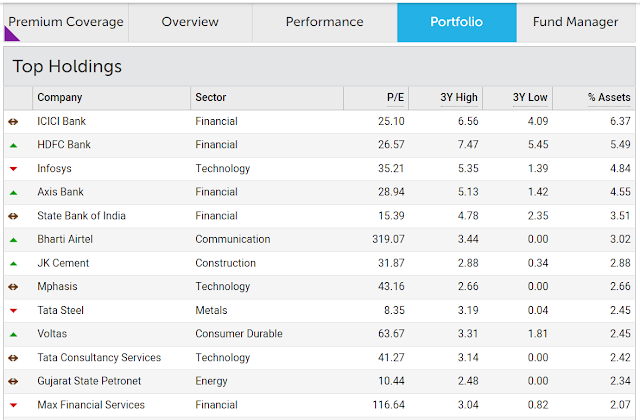

- Unlike stocks investing, mutual funds invests your money in multiple companies thus reducing the risks

- Every mutual fund is assigned a Fund Manager who manages that mutual fund

- Fund manager is responsible to select percentage of stocks to invest your money in, to give you better returns

- Unlike stocks investing, you need not have to worry about selecting and monitoring stock performances while investing in mutual funds. Fund manager does the job for you

- Below is the screenshot of the portfolio (list of stocks) of one the popular mutual funds in India

What is NAV (Net Asset Value) of Mutual Fund

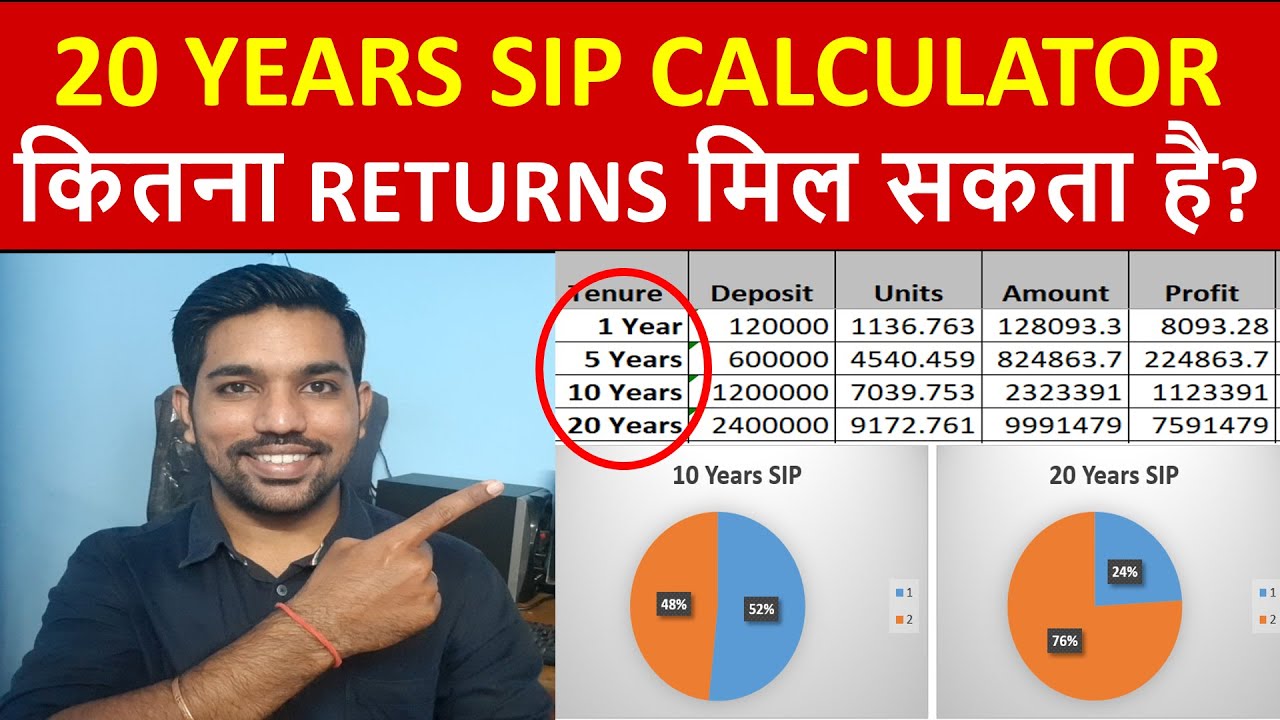

ALSO READ: 20 Years SIP Returns Calculation in Excel

How Mutual Funds Work

- Mutual Fund Returns Calculator will help you see all these numbers in action.

Always remember to invest in mutual funds with a goal in mind. Goal must be time specific and realistic. Some goal examples can be to buy a new car, to save for child’s education or to accumulate retirement fund.

You can find the Mutual Fund Returns Calculator at the bottom of this article.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

What is Expense Ratio

Expense ratio is a small percentage taken by AMC (Asset Management Company) to manage your funds. You need not have to pay additionally as a part of Expense Ratio.

Expense Ratio amount is recovered from your profits that you make. Usually, expense ratio of regular mutual funds are high compared to those of direct mutual funds. You can get details of expense ratio of every fund on the mutual fund page.

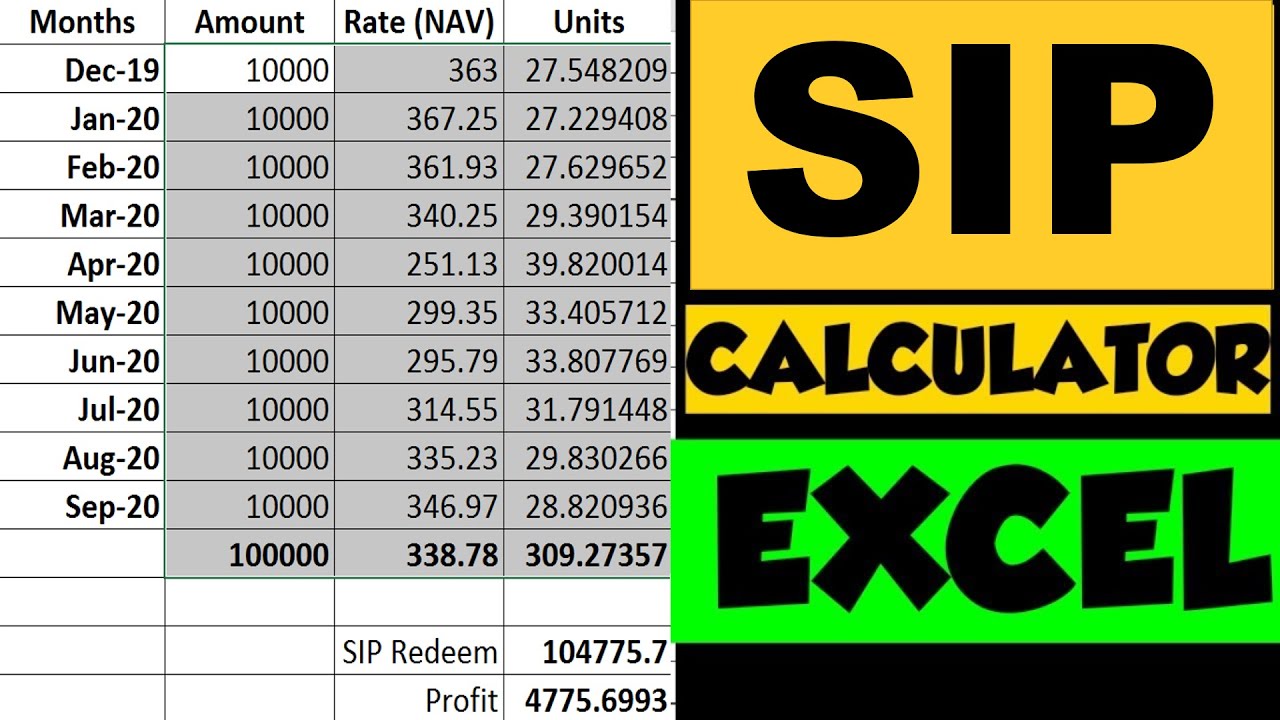

SIP Returns Calculator Excel

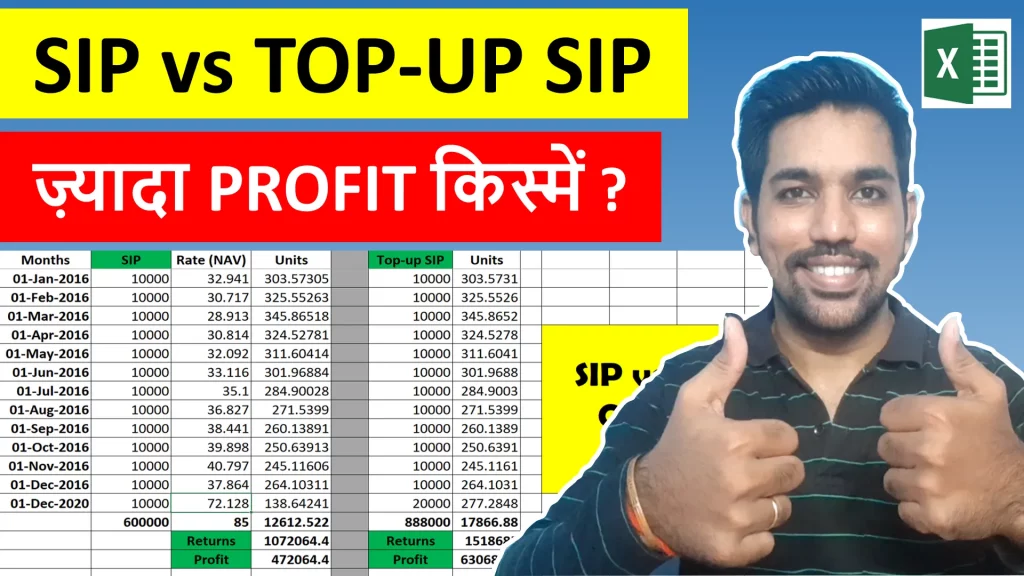

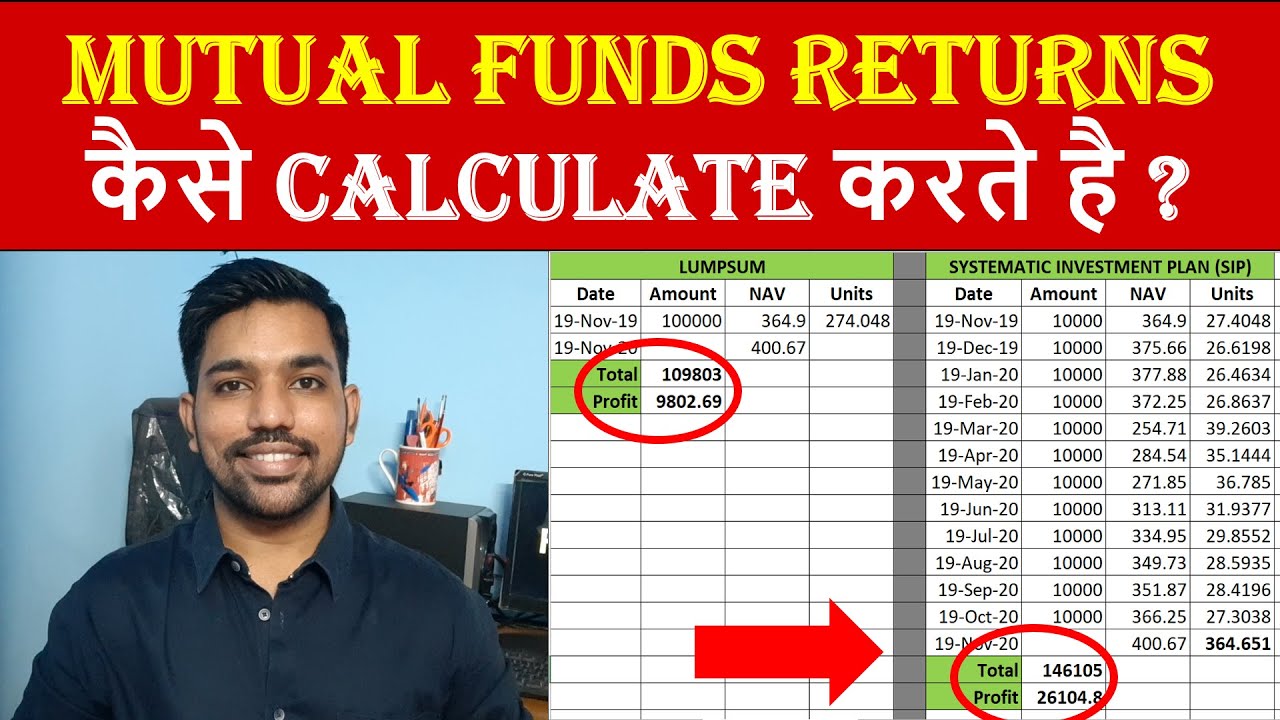

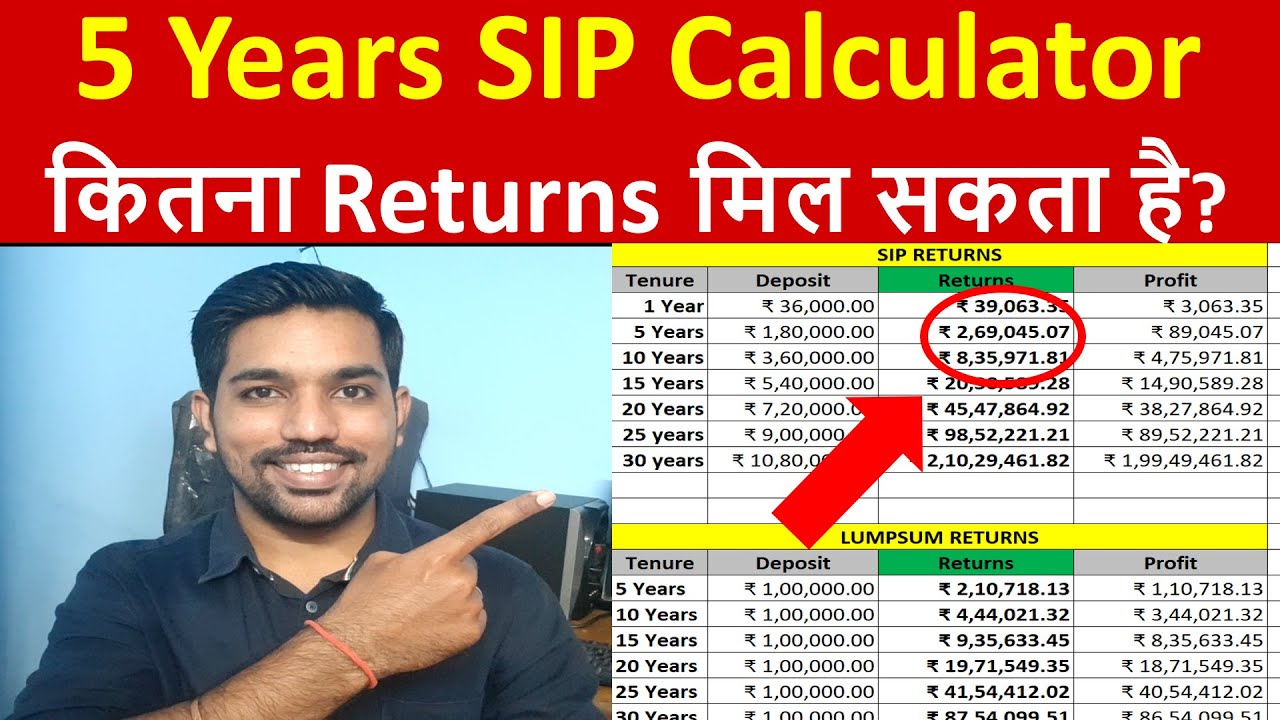

Lump sum vs SIP Investment

- Lump sum Investing: You deposit a one time amount as a lump sum investment in mutual fund

- SIP Investing: You deposit a fixed amount regularly every month which is called SIP (Systematic Investment Planning)

- When we see returns, lump sum investing will give you more returns compared to SIP, but lump sum investing also has high risk compared to SIP

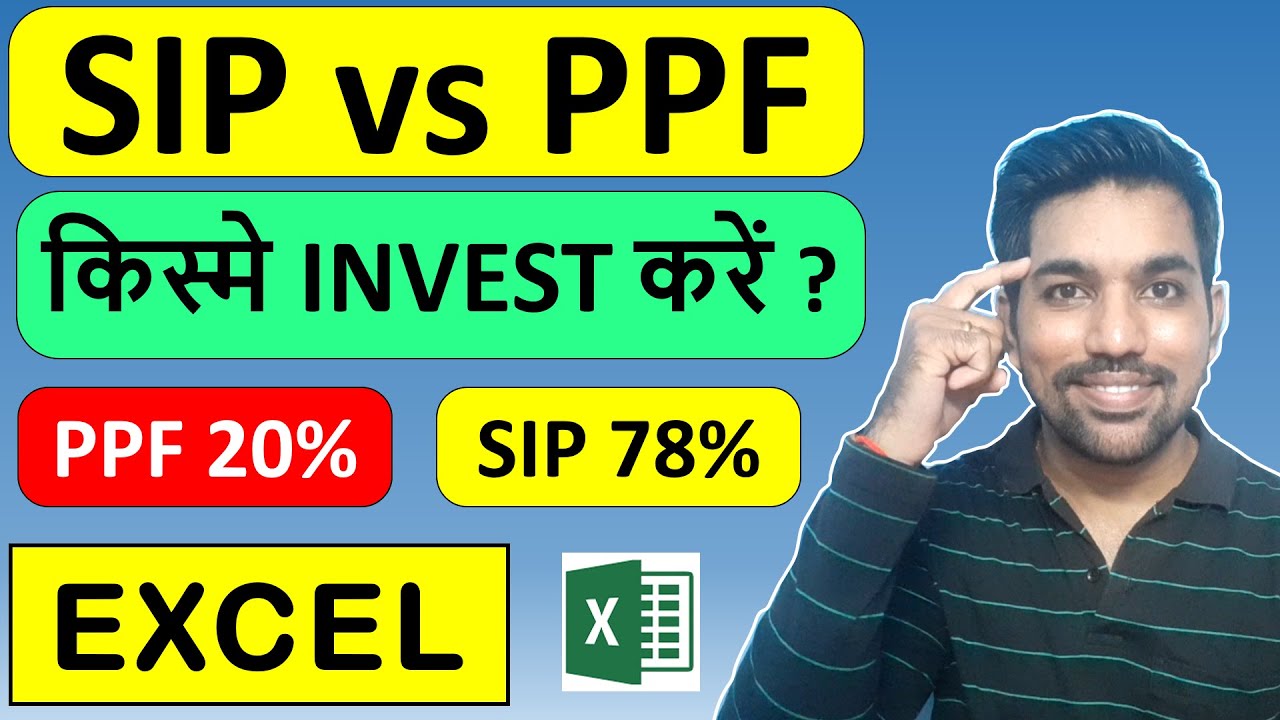

ALSO READ: SIP vs Lumpsum Investments in Mutual Fund

Mutual Fund Categories

- Every mutual fund has 2 categories: Regular and Direct

- Both regular and direct mutual fund have almost same set of stocks under their portfolio

- Expense Ratio: Expense ratio of regular mutual fund is high compared to direct mutual fund

- Returns: Direct mutual fund gives you higher returns compared to regular mutual fund

- You should go for direct mutual fund to get better returns

ALSO READ: Rs. 1000 SIP Returns Calculation for 15 Years

Types of Mutual Funds

- There are 3 types of mutual funds: Equity, Debt and Hybrid mutual funds

- Debt mutual fund: Mutual funds that invest in bonds or instruments. They have low risk and low returns

- Hybrid mutual fund: Mutual funds that invest in a combination of Equity and Debt instruments. They have medium risk and medium returns

- Based on your risk appetite and your goals, you can choose between above categories of mutual funds

ALSO READ: Taxation on Short Term Capital Gains (STCG Tax)

Things to remember before investing in Mutual Fund

- While you are searching for a good mutual fund, you should see how the fund has performed in past

- You should also see the expense ratio of the fund and how much money is invested in the fund which is called AUM (Asset under management). Lower the expense ratio of the fund, more returns you’ll receive

- You should only invest in Direct mutual funds for better returns which also have low expense ratio compared to their regular fund counterpart

- Remember to link your mutual funds investments with goals. And once your goal is achieved, you can stop investing and reap the benefits

- Never book losses in mutual funds. If the market is down, wait for the market to come up so that you are in profit

- It is always better to divide your money and invest via SIP (Systematic Investment Planning) compared to investing as lump sum.

Never try to time the market to get best returns. - If someone says they can maximize your returns and ask you to lend them your money, just run away and never look back

Some more Videos

DOWNLOAD MUTUAL FUND RETURN EXCEL CALCULATOR

Click below button to download Mutual Fund Returns Calculator

Conclusion

You can start investing with a small amount of Rs. 500 and gradually increase this amount with time as your income increases. SIP (Systematic Investment Plan) is on of the best ways to invest in mutual funds.

Also lumpsum investing in mutual funds in between during bear market will help you accumulate good number of mutual fund units and give better profits over long term.

Always remember to link a goal with every investment in mutual fund and when the goal is achieved, redeem the mutual fund units and live a better life with such personal finance planning!

Some more Reading:

- How to Start SIP Online (SBI Demo)

- Rs. 2000 SIP Returns Calculation

- SIP vs Step up SIP Returns Calculation on Rs. 2000

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.