One of the most searched question on internet and my YouTube Channel is How to Calculate Income Tax for FY 2022-23. Though I have created a Free Income Tax Calculator here and also an Android App that helps to calculate Income Tax, we will see all steps to calculate Income Tax in this article.

Income Tax Calculation process involves following steps:

- Calculate your Taxable Income

- Identify your Tax Bracket

- Choose between Old and New Tax Regime

- Calculate Income Tax based on Tax Regime

You can also watch below video to know Income Tax Calculation using 3 ways: online calculator, Excel calculator and the Android App on your phone.

How to Calculate Income Tax FY 2022-23 Video

Now Income Tax Calculation involves some steps that we will go in depth one by one.

Calculate your Taxable Income

This step is very important. Many of us get confused whether we should calculate income tax on in hand salary or gross salary?

To answer this question, we have to consider gross salary every month, including the PF contributions (deductions). Using the every month gross salary, we have to reduce other Investment options / deductions to reach taxable income.

What is Taxable Income?

Taxable Income is the income on which we have to calculate our income tax. Not entire monthly income is taxable. So for example:

- If we stay on rent and claim HRA, than HRA component in salary slip is not taxable

- EPF contributions made every month can be used to save income tax, as that amount is not taxable

- More Investment options belonging to Section 80 can be made further to make our income non taxable

Now since you have understood the definition of Taxable Income, let’s see an example to calculate Taxable Income with a salary payslip example.

Taxable Income Example

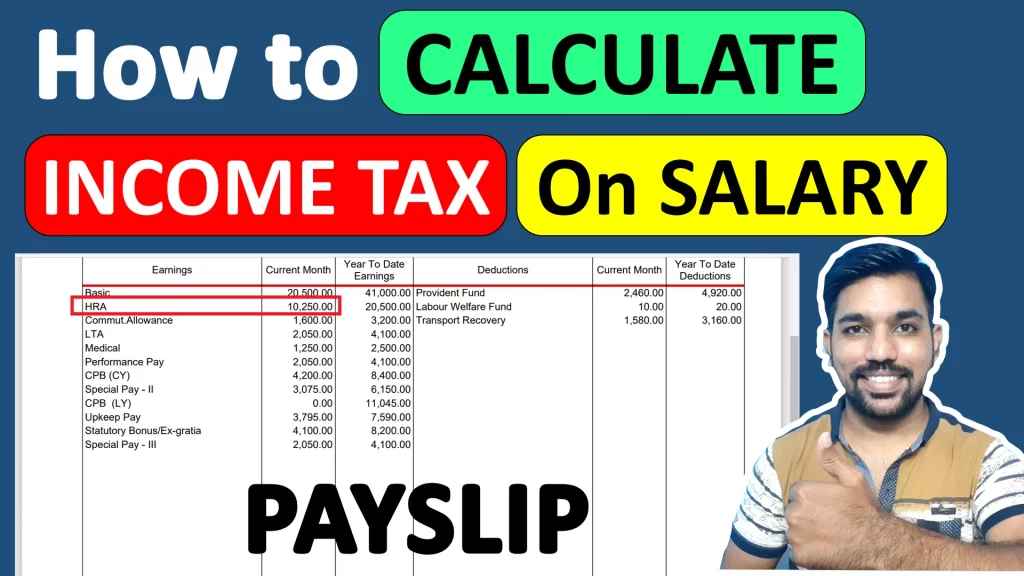

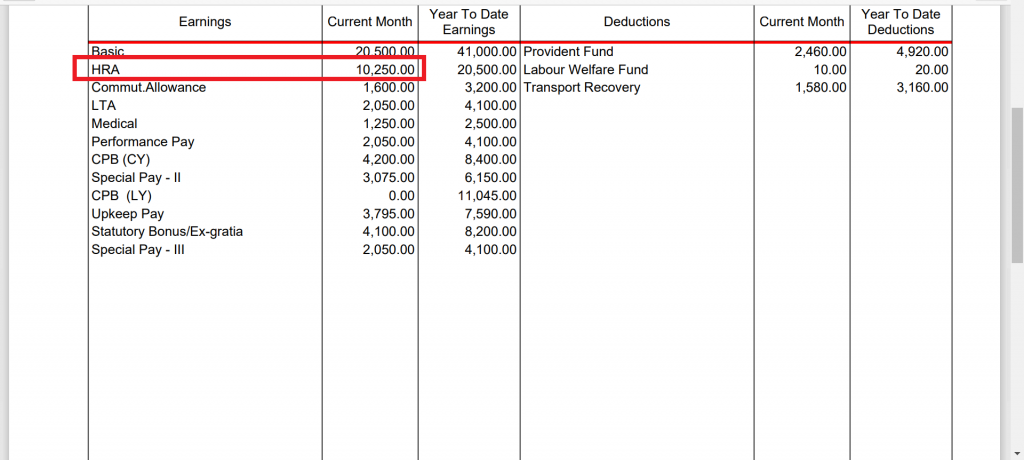

Below is the screenshot of a salary payslip:

As seen in above salary payslip, below are some numbers to focus on:

- Total Monthly Income = Rs. 58,970 (Adding all earnings and deductions)

- Total Monthly In Hand Income = Rs. 54,920 (Left hand side)

- Total Monthly Deductions = Rs. 4050 (Right hand side)

So the formula to calculate monthly in hand income is:

In hand Income = Total monthly income – Monthly Deductions

We also have to consider Standard Deduction of Rs. 50,000 which will be applicable to only Salaried Employees and Pensioners under Old Tax Regime.

Standard Deduction is not applicable in New Tax Regime.

Now, how much of this total income is taxable?

The answer to this question is different for different salaried employees and are as follows:

- Provident Fund Contribution need to be removed from Gross Income and mentioned in Section 80C, so your updated Taxable Income becomes Rs. 56,510 (Rs. 58,970 – Rs. 2460)

- Transport recovery (and Labour welfare) in above case is the type of your expenses and cannot be deducted to save income tax

- So if there are no more deductions, your taxable income per month will be Rs. 56,510

- But if you stay on rent and get HRA = Rs. 10,250, you can claim some amount using HRA calculator here. So if your monthly rent is Rs. 10,000, you are eligible to claim Rs. 7950 per month, which can be reduced from monthly taxable income to reach Rs. 48,560 (Rs. 56,510 – Rs. 7950)

So we have reached Taxable Income of Rs. 48,560 per month, which will be Rs. 5,82,720 in a financial year if the income and deductions remains same.

Here we have not considered salary increments or bonuses which need to be added accordingly in the Taxable Income.

Identify your Tax Bracket

Since now we have seen the calculation of taxable income using a salary payslip, it is time to identify our Tax Bracket.

Based on our income every year, our income tax will be calculated. And also we need to choose between Old Tax Regime and New Tax Regime to calculate income tax that we will see later in this article.

Previously we used to identify the income tax bracket based on income in following ways:

- If Income between Rs. 2.5 Lacs to Rs. 5 Lacs, then 5% Tax Bracket

- If Income between Rs. 5 Lacs to Rs. 10 Lacs, then 20% Tax Bracket

- If Income above Rs. 10 Lacs, then 30% Tax Bracket

Above procedure is applicable only for Old Tax Regime.

But couple of years ago, a New Tax regime with Reduced Tax Slab rates were introduced due to which we can belong to different Tax Bracket based on our Income.

And following is the way to identify the Tax Bracket in New Tax Regime:

- If Income between Rs. 2.5 Lacs to Rs. 5 Lacs, then 5% Tax Bracket

- If Income between Rs. 5 Lacs to Rs. 7.5 Lacs, then 10% Tax Bracket

- If Income between Rs. 7.5 Lacs to Rs. 10 Lacs, then 15% Tax Bracket

- If Income between Rs. 10 Lacs to Rs. 12.5 Lacs, then 20% Tax Bracket

- If Income between Rs. 12.5 Lacs to Rs. 15 Lacs, then 25% Tax Bracket

- If Income above Rs. 15 Lacs, then 30% Tax Bracket

This introduction to more income tax slabs have helped individuals save a lot of income tax due to reduced Tax Slab Rates.

But there is a condition with New Tax Regime: We cannot claim any Investment options or deductions with New Tax Regime. So New Tax Regime does not allow us to reduce our taxable income to save income tax.

But we can claim deductions to save income tax in Old Tax Regime.

So these are certain differences between Old Tax Regime and New Tax Regime.

Now which one you should choose?

Depends on your Income and deductions you make in a financial year. Let’s understand this more.

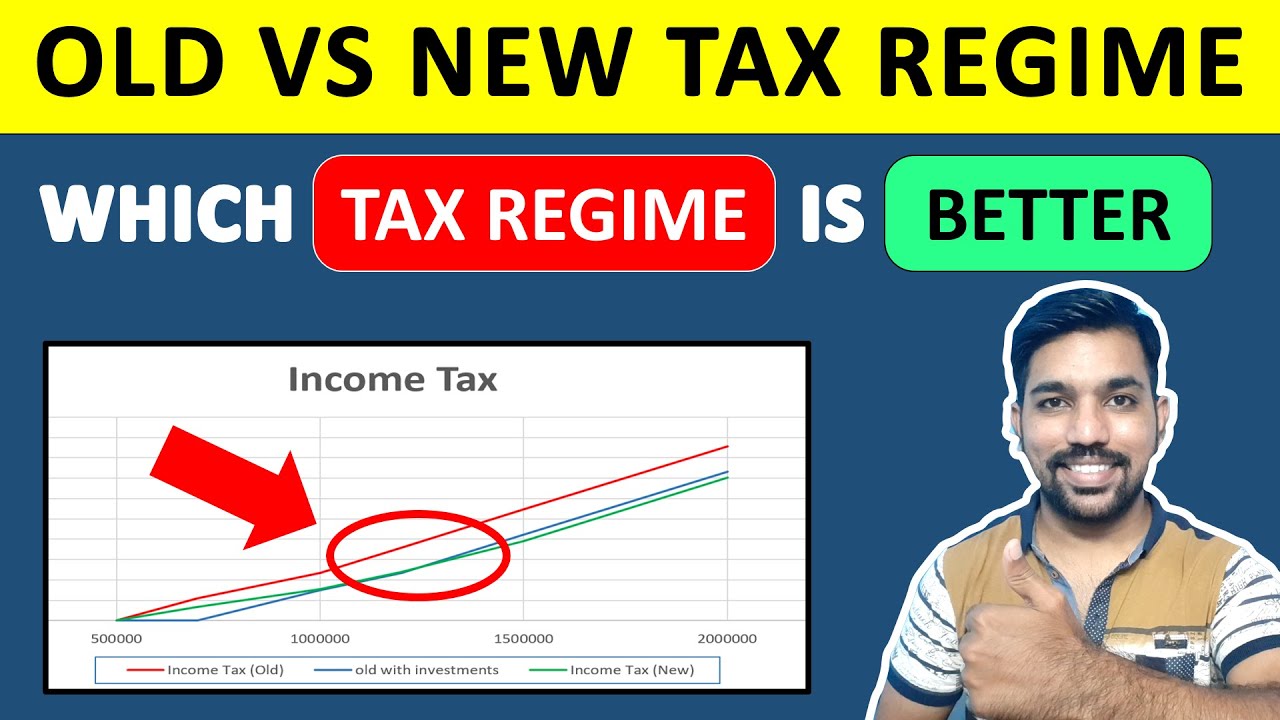

Choose between Old and New Tax Regime

We have the option to choose between Old Tax Regime or New Tax Regime. And we should choose the one that will make us pay less income tax.

While calculating income tax we realized a threshold value of Rs. 15 Lacs.

So if your annual income (gross income) is more than Rs. 15 Lacs, it’s better to choose New Tax Regime to calculate income tax.

Otherwise, it is better to use various investment options and deductions to reduce your taxable income (if below Rs. 15 Lacs), and pay less income Tax with Old Tax Regime.

I have explained this in a good statistical way in this below video, so check this out.

Which Tax Regime is Better? – Video

Calculate Income Tax based on Tax Regime

Now this is interesting step to Calculate your Income Tax.

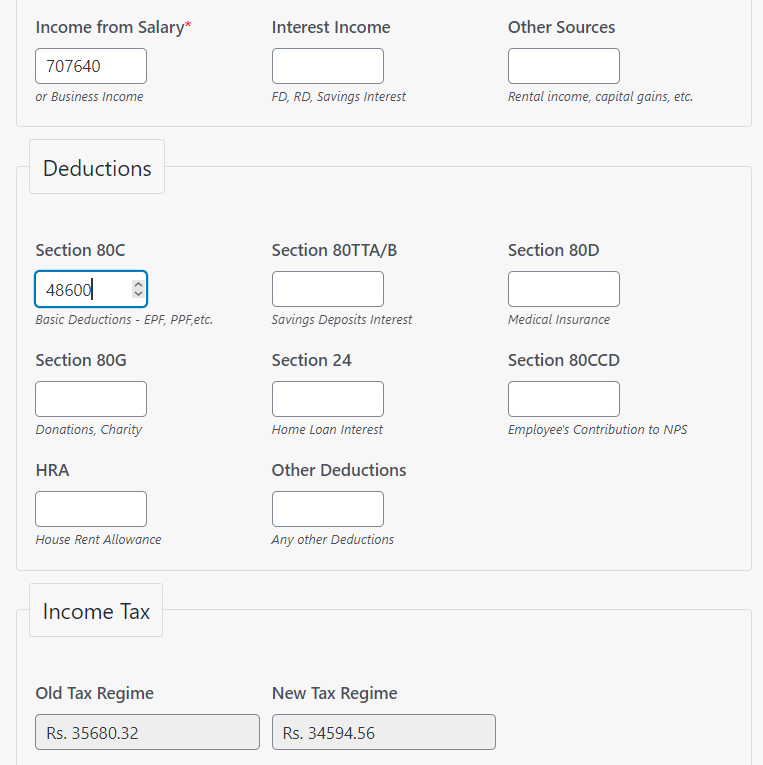

Based on above example, we have a total yearly income = Rs. 7,07,640 and total yearly deductions as Rs. 48,600 – only considering Provident Fund as Deductions for now.

We can calculate income tax in 3 ways:

- Using Online Calculator I have made

- Using Excel Calculator which you can download from below section

- Downloading Income Tax Calculator Android App

For simplicity, let’s use the online calculator with below details:

- Annual Gross Income = Rs. 7,07,640

- Annual Deductions = Rs. 48,600 + Rs. 50,000 (Std. Deduction) = Rs. 98,600

Income Tax based on above details will be:

- Old Tax Regime = Rs. 35,680

- New Tax Regime = Rs. 34,595

Below is the screenshot using Income Tax Calculator:

Let’s understand more on how this income tax is calculated.

How Income Tax is Calculated with Different Slabs

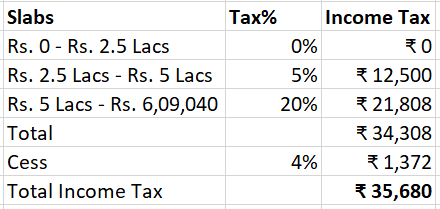

- First, we calculate Taxable Income for both Regimes:

Old Regime = Rs. 7,07,640 – Rs. 98,600 = Rs. 6,09,040

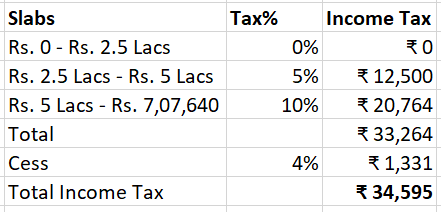

New Tax Regime = Rs. 7,07,640 (No deductions allowed) - Next, we have to calculate income tax based on different tax slabs of both regimes

- First let’s calculate income tax with Old Tax Regime:

- As seen above, we also have to pay 4% Education cess on the total Tax to reach our Total Income Tax.

- Next, let’s calculate Income Tax based on New Tax Regime:

- So as seen above in both Tax Regimes, we pay Rs. 35,680 (Old Tax Regime) or Rs. 34,595 (New Tax Regime)

- In this example it’s better to opt for New Tax Regime as we will be paying less Income Tax!

But as I mentioned above, you can use more deduction options in Old Tax Regime to save your Income Tax.

Also, you can watch below video to pay Zero Income Tax.

How to Pay Zero Income Tax Video

In case you want to calculate income tax using excel, as I have showed you with the video on top of this article, your can download the income tax excel calculator from below section.

Download Income Tax Calculator in Excel

Please fill below details to download Income Tax Excel Calculator:

Some more Reading:

- Senior Citizen Income Tax Calculator [Excel]

- How to Claim HRA when living with Parents

- Calculate Income Tax on Salary

- All Deductions in Section 80

Frequently Asked questions

How much Tax do you pay on 10 Lakh Salary?

Based on the income tax calculator, you pay Rs. 1,06,600 as tax with Old Tax Regime or Rs. 78,000 as tax with New Tax Regime. It’s better to use New Tax Regime to pay income tax here.

What is Tax Rebate u/s 87A?

Tax Rebate u/s 87A will be applicable to us only when our taxable income is below Rs. 5 Lacs in a financial year. According to tax rebate u/s 87A, we get tax rebate of maximum Rs. 12,500.

This tax rebate will cancel the income tax for our income between Rs. 2.5 Lacs to Rs. 5 Lacs. Interestingly, Tax Rebate u/s 87A will be applicable on both Old and New Tax Regime.

With New Tax Regime, you cannot use deductions whereas with Old Tax Regime, we can use deductions to reach taxable income below Rs. 5 Lacs.

Which Tax Regime you should choose?

Based on our analysis, we should choose new Tax Regime if income is above Rs. 15 Lacs and Old Tax Regime if income is below Rs. 15 Lacs.

If you want to make use of standard deduction and other deductions, we should use Old Tax Regime, provided you pay less income tax with Old Tax Regime compared to New Tax Regime.

What is the best method to calculate Income Tax?

You can use the FinCalC online income tax calculator to easily calculate income tax.

Other ways are to use the excel calculator and android app on your phone.

What is Standard Deduction? How to claim it?

Standard Deduction is a flat deduction of Rs. 50,000 available for salaried employees and pensioners.

While calculating income tax with Old Tax Regime, standard deduction of Rs. 50,000 will be automatically applied in the online income tax calculator and android app. In excel we have to provide it separately under investments options.

Please note that standard deduction is not applicable in new tax regime.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.