Old vs New Tax Regime Calculator Excel can be easily downloaded using below button. This income tax calculator in excel will help you to calculate income tax based on old and new tax regime for FY 2025-26 and FY 2026-27. Note that you don’t have to pay any income tax up to 12 Lakh income with new tax regime in FY 2025-26 and FY 2026-27, due to tax rebate 87A.

How Old vs New Tax Regime Calculator in Excel Works?

You can simply provide below inputs to calculate tax based on old and new tax regime:

- Annual Income

- Investments

- Select option of Salaried Yes or No, for Standard Deduction applicability

Based on Income and Investments, the income tax will be calculated using old and new tax regime. Investments will be used to save income tax as per old tax regime. Also, you get tax rebate under section 87A with taxable income up to 5 lakh with old regime and up to 12 Lakh with new tax regime.

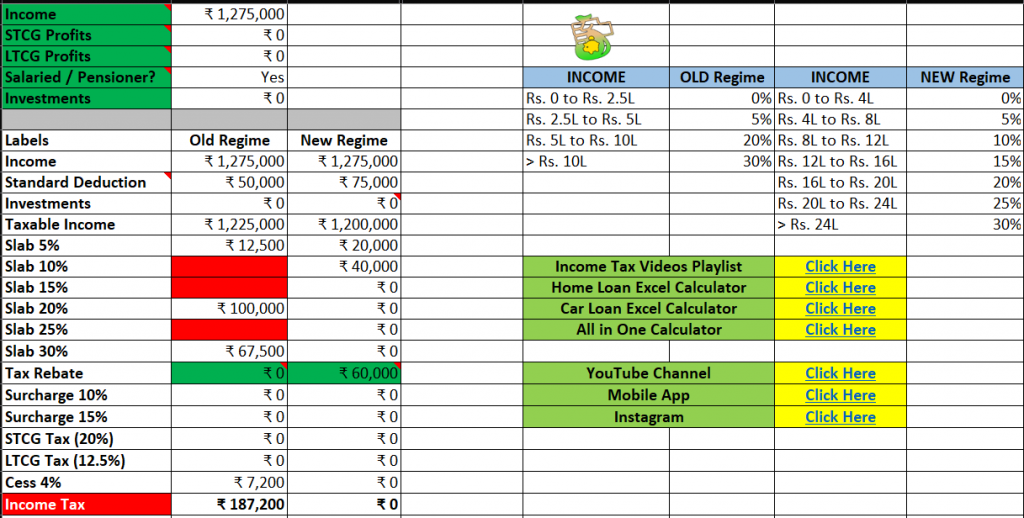

Below is the screenshot of Old vs New Tax Regime Calculator in Excel:

Above screenshot is taken from the Income Tax Calculator for FY 2025-26 in excel. The example is taken for Rs. 12.75 Lakh income, in which case, the salaried employee will get Rs. 75,000 as Standard Deduction, which means the taxable income will be 12 lakh and the net income tax will be Rs. 0.

You get maximum Tax rebate of Rs. 60,000 with new tax regime in FY 2025-26. Note that this rebate is not applicable for STCG and LTCG profits that you make in FY 2025-26.

Old vs New Tax Regime Calculator in Excel Video

Watch more Videos on YouTube Channel

Income Tax Slabs for Age Below 60 Years

Since there are 2 tax regimes for you to select, both regimes have different slab rates based on age groups.

Old Tax Regime

If your age is below 60 years in FY 2025-26, below are the Tax slab rates for you based on Old Tax Regime:

| Income | Tax Slab Rates (Old Tax Regime) |

|---|---|

| Rs. 0 – Rs. 2.5 Lakh | 0% |

| Rs. 2.5 Lakh – Rs. 5 Lakh | 5% |

| Rs. 5 Lakh – Rs. 10 Lakh | 20% |

| Rs. 10 Lakh or above | 30% |

Let us now see the reduced tax slab rates, that is New Tax Regime for age up to 60 years:

New Tax Regime

| Income | Tax Slab Rates (New Tax Regime) |

|---|---|

| Rs. 0 – Rs. 4 Lakh | 0% |

| Rs. 4 Lakh – Rs. 8 Lakh | 5% |

| Rs. 8 Lakh – Rs. 12 Lakh | 10% |

| Rs. 12 Lakh – Rs. 16 Lakh | 15% |

| Rs. 16 Lakh – Rs. 20 Lakh | 20% |

| Rs. 20 Lakh – Rs. 24 Lakh | 25% |

| Rs. 24 Lakh or above | 30% |

So New Tax regime has reduced tax slab rates compared to old tax regime. But you will not get any deduction options to save income tax in new tax regime.

Given that the slab rates with both regimes, the Old vs New Tax Regime Calculator in Excel (provided above) becomes very important to use and compare the income tax.

Let us now understand the Tax slabs for senior citizens in India.

Income Tax Slabs for Senior Citizens

If your age is 60 years and less than 80 years in FY 2025-26, below are the Tax slab rates for you based on Old Tax Regime:

Old Tax Regime

| Income | Tax Slab Rates (Old Tax Regime) |

|---|---|

| Rs. 0 – Rs. 3 Lakh | 0% |

| Rs. 3 Lakh – Rs. 5 Lakh | 5% |

| Rs. 5 Lakh – Rs. 10 Lakh | 20% |

| Rs. 10 Lakh or above | 30% |

As seen above, here the basic exemption limit for senior citizens is Rs. 3 Lakh of income, up to which no income tax need to be paid.

Let us now see the reduced tax slab rates, that is New Tax Regime for Senior Citizens:

New Tax Regime

| Income | Tax Slab Rates (New Tax Regime) |

|---|---|

| Rs. 0 – Rs. 4 Lakh | 0% |

| Rs. 4 Lakh – Rs. 8 Lakh | 5% |

| Rs. 8 Lakh – Rs. 12 Lakh | 10% |

| Rs. 12 Lakh – Rs. 16 Lakh | 15% |

| Rs. 16 Lakh – Rs. 20 Lakh | 20% |

| Rs. 20 Lakh – Rs. 24 Lakh | 25% |

| Rs. 24 Lakh or above | 30% |

As mentioned above, the tax slab rates in new tax regime is same for all age groups irrespective of whether you are a senior citizen or non senior citizen.

Given that the slab rates with both regimes for senior citizens, the Old vs New Tax Regime Calculator in Excel becomes very important to use and compare the income tax.

Let us now see Income Tax Slabs for Super Senior Citizens

Income Tax Slabs for Super Senior Citizens

If your age is 80 years or above in FY 2025-26, below are the Tax slab rates for you based on Old Tax Regime:

Old Tax Regime

| Income | Tax Slab Rates (Old Tax Regime) |

|---|---|

| Rs. 0 – Rs. 5 Lakh | 0% |

| Rs. 5 Lakh – Rs. 10 Lakh | 20% |

| Rs. 10 Lakh or above | 30% |

Super senior citizens in India get extra exemption limit of up to Rs. 5 Lakh in a financial year, on which they don’t need to pay any income tax. This may be due to most of the super senior citizens are already retired by this time.

But still, if you are following your passion and generating good revenue out of it, you need to pay tax! So, Above 5 Lakh of income, the slab rates are same on the income as compared to other citizens.

Let us now see the reduced tax slab rates, that is New Tax Regime for Super Senior Citizens:

New Tax Regime

| Income | Tax Slab Rates (New Tax Regime) |

|---|---|

| Rs. 0 – Rs. 4 Lakh | 0% |

| Rs. 4 Lakh – Rs. 8 Lakh | 5% |

| Rs. 8 Lakh – Rs. 12 Lakh | 10% |

| Rs. 12 Lakh – Rs. 16 Lakh | 15% |

| Rs. 16 Lakh – Rs. 20 Lakh | 20% |

| Rs. 20 Lakh – Rs. 24 Lakh | 25% |

| Rs. 24 Lakh or above | 30% |

So the tax slab rates in new tax regime is same for super senior citizens as well.

So these are the Income Tax Slabs in India for FY 2025-26 in Old and New Tax Regimes. If any of your friends is confused about the Tax slab rates in India than share this article with them!

ALSO READ: New Tax Regime Benefits (Section 115 BAC)

Let us now understand features of both Tax Regimes:

Features of Old Tax Regime

Despite introduction of New Tax Regime in Budget 2020, many Indians still opt for Old Tax Regime due to it’s various features that include:

- Deductions available for tax payers to save income tax.

- Flat Deduction, also called Standard Deduction is available to salaried employees and pensioners with Old Tax Regime

- You can invest in various investment options like Provident Fund, Public Provident Fund, ELSS (Equity Linked Saving Schemes), 5 year fixed deposits and many other under Section 80C to claim deductions up to Rs. 1.5 Lakh in FY 2025-26

- Apart from above deductions, there are many other deductions available to you as an individual to save income tax with Old Tax Regime

- The only disadvantage is the tax slab rates are higher in Old Tax regime compared to New Tax Regime.

Let us now see the features of new tax regime.

Features of New Tax Regime

- New tax regime has reduced tax slab rates compared to Old tax regime as seen above

- New regime slab rates are same for all age groups, unlike old tax regime which depends on your age

- Few deductions are allowed in new tax regime that are mentioned below

- You get is Tax rebate under Section 87A, in which case if your taxable income is 12 lakh or less in a financial year, you don’t need to pay any tax with tax rebate under section 87A (Maximum Rs. 60,000 rebate with new and old tax regime)

Deductions Allowed in New Tax Regime

- Standard Deduction of Rs. 75,000 available for salaried employees

- Deduction for employer’s contribution in NPS Account under Section 80CCD(2)

- Home Loan Interest amount under Section 24 in case of let-out property

- Deduction of amount paid or deposited in Agniveer Corpus Fund under Section 80CCH(2)

- Transport allowance can be claimed in case of specially-abled person

- Conveyance allowance for employees received to meet conveyance expenditures

- Compensation received for cost of travel or tour

- Daily Allowance received as compensation for cost of living in some other place compared to regular place of working

- Gifts up to Rs. 5000

- Exemption on voluntary retirement 10(10C), gratuity u/s 10(10) and Leave encashment u/s 10(10AA)

You can also use this online income tax calculator to calculate income tax:

Also read this article on Income Tax Calculation in India with Examples to know more about how your income tax is calculated with Old and New Tax Regimes.

Which Tax Regime is Better for you?

Now very important question is – which tax regime is better for you? Should you select Old or New Tax regime while ITR (Income Tax Return) Filing?

With the changes mentioned in Budget 2025, no income tax up to 12 lakh with new tax regime, so if your income is within 12 lakh in FY 2025-26, you pay ZERO Income Tax.

On other hand, with income up to 5 lakh, you pay zero income tax with old tax regime.

So new tax regime seems to be better when income is within 12 lakh in 2025-26. And even if the income is above 12 lakh, let’s say 15 lakh, you won’t be able to claim maximum deductions to save income tax with old tax regime.

Can you change Tax Regime from Old to New or vice versa?

Yes this is allowed while you file your ITR (Income Tax Return).

Filing income tax return is a process to confirm your actual incomes and investments during the financial year and you can select the tax regime for FY while filing the returns.

In some cases, if your are salaried employee, chances are that you have already committed to your employer that you want to select a particular tax regime, and in your Form 16, same tax regime will be displayed as selected by you.

In this case also, while filing ITR, you can change the tax regime and choose the one appropriate for you using which you have to pay less income tax.

Conclusion

So you can easily download the old vs new tax regime calculator in excel by using the link at the start of this article. We have covered many other queries in this article and if you are confused about the selection between Old and New Tax Regime, you can always use this excel calculator or the online income tax calculator to check which tax regime will help you to pay less income tax.

Remember that few deductions are allowed in new tax regime, but you will get all the deduction options available in old tax regime at the expense of high tax slab rates.

Tax Rebate under section 87A is applicable with both old and new regime, provided your taxable income is less than 5 Lakh and 12 lakh in a financial year with old and new tax regime respectively.

Some more Reading:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.