In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income.

TDS full form is Tax Deduction at source, which is deducted every month from your salary as part of your income tax. Based on your income, your income tax is calculated and this income tax amount is not to be paid as a lump sum amount, but is deducted by your employer every month in a financial year starting from April to March of next year.

This deduction of income tax from your salary every month is called TDS on Salary. Depending on how much investments you make in order to claim deductions to reduce your taxable income, TDS on Salary will be calculated accordingly every month.

Note: You can find the TDS on Salary Excel Calculator at the bottom of this article

TDS on Salary Calculator Video

Watch above video to understand TDS on Salary calculation using excel and various examples including salary increments in a financial year due to bonuses or job switch.

Use Income Tax Calculator to calculate your income tax:

Why TDS is deducted from Salary

So based on your income, your income tax is calculated. This income tax need to be paid by you and government cannot wait for the financial year end for you to file your ITR (Income Tax Return) to pay your income tax during filing process.

This paying of income tax based on your income for financial year is covered under Section 192 of the Income Tax Act.

So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Based on employees income, and using income tax calculator, employees income tax is calculated and accordingly it is divided into remaining months of the financial year.

In many cases, you as employee, might provide various investment deductions that you want to claim like Employee Provident Fund, Public Provident Fund or investments in ELSS (Equity linked saving saving), you can inform about these deductions to your employer based on which your taxable income is adjusted and income tax is calculated accordingly.

Usually, most of the employers have this cycle of taking the estimated investments between the April to December months and taking the Actual investment amounts during January to March months so that income tax can be calculated accordingly and paid within the financial year based on your tax liability.

And in this way, in order to pay your income tax for a financial year, TDS is deducted from your salary every month in a financial year.

How to Calculate TDS on Salary

It is very important to understand that how TDS is calculated and deducted from your salary to avoid any surprises on your salary credit day!

Let’s understand this with the help of example.

Example 1

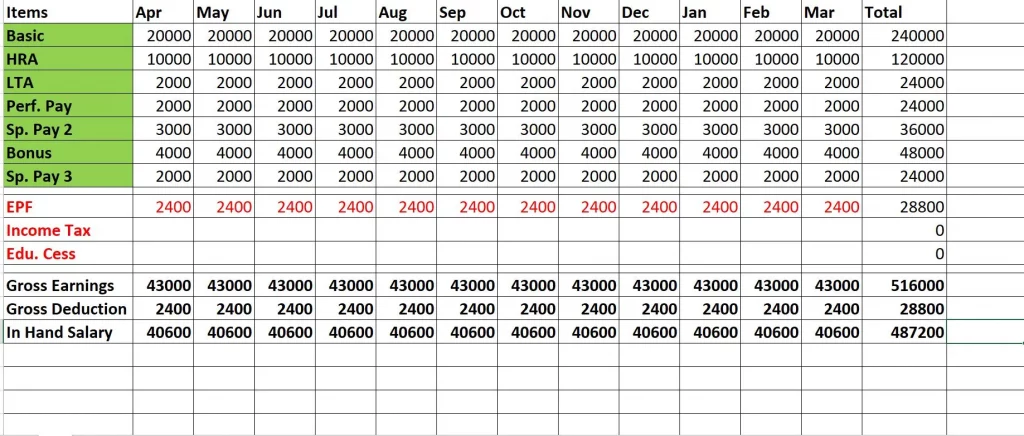

Let’s say your Basic Salary is Rs. 20,000, and you also get other allowances and deductions according to below data:

You can use your own salary payslip to know these numbers.

As seen in above image, your monthly gross earnings after adding all salary components is Rs. 43,000 and gross deductions is Rs. 2,400, which makes your in hand salary as Rs. 40,600.

ALSO READ: How to Calculate Income Tax using Salary Payslip

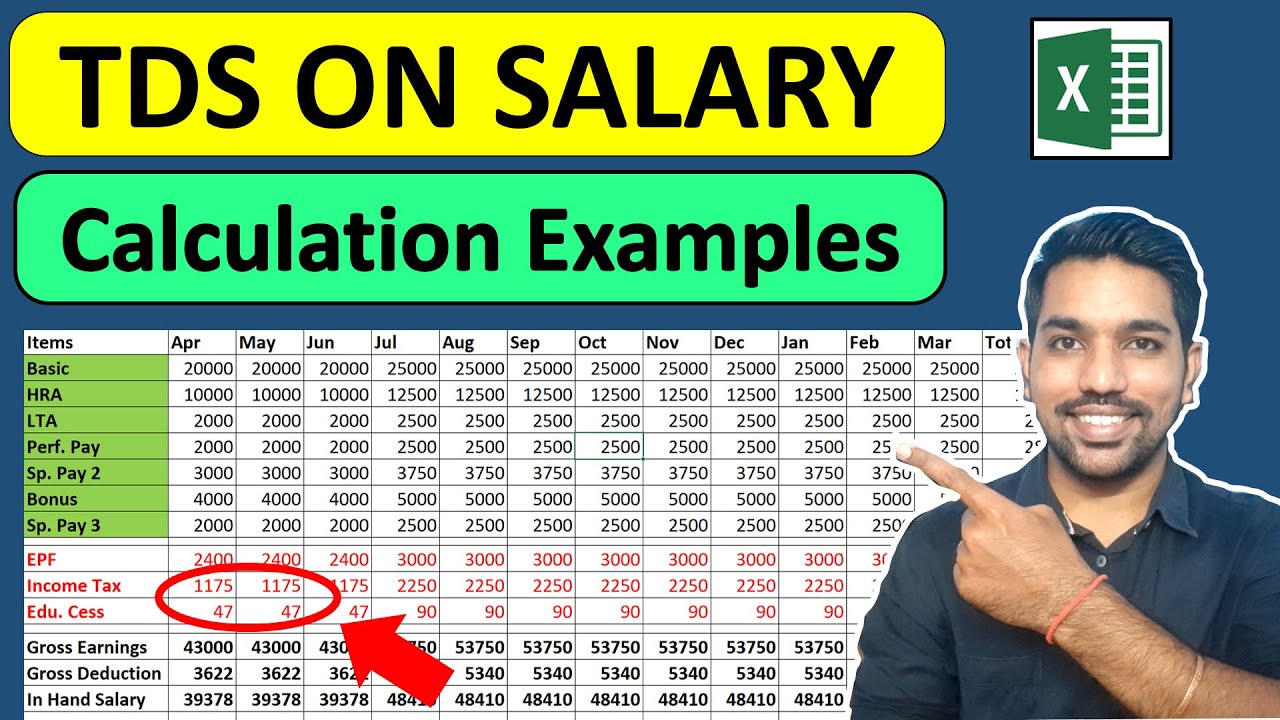

Now we find out how much will be your annual Salary based on this existing data by projecting these numbers up to March month of next year. Below is the data that is projected for complete financial year:

So as seen above, the gross earnings for financial year is Rs. 5,16,000, out of which gross deduction is Rs. 28,800 and your in hand salary is Rs. 4,87,200.

Now standard deduction of Rs. 50,000 will be also considered for FY 2022-23 since the income is for salaried employee, which makes taxable income as Rs. 4,37,200. This makes your income tax = Rs. 0 due to tax rebate u/s 87A. For more information, watch this video on income tax calculation.

Let’s take another example where you’ll be liable to pay income tax.

Example 2

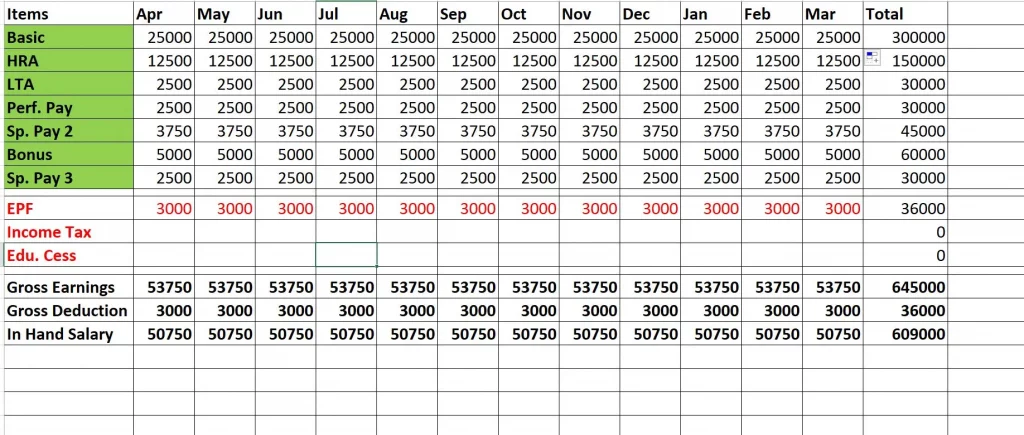

Let’s say your Basic Salary is Rs. 25,000, and you also get other allowances and deductions according to below data:

So your annual gross earnings is Rs. 6,45,000, annual gross deductions (without income tax) is Rs. 36,000 and annual in hand salary is Rs. 6,09,000.

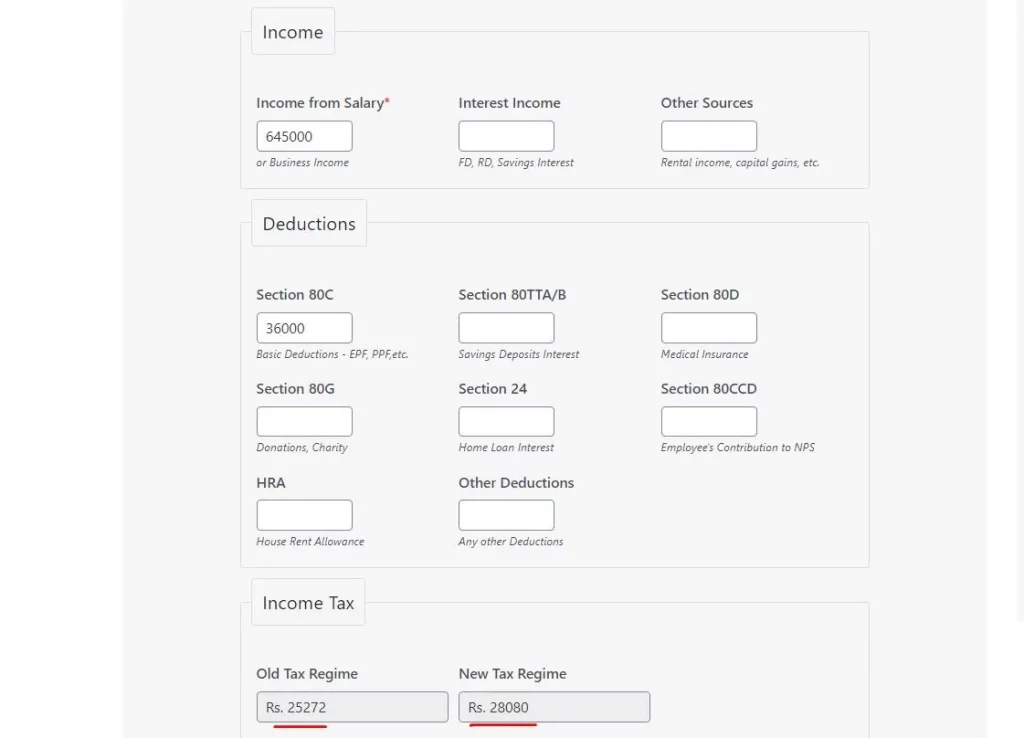

Let us put this gross earnings and gross deductions data in our income tax calculator to calculate income tax as below:

So we get income tax based on Old Tax Regime as Rs. 25,272 and based on New Tax Regime as Rs. 28,080, considering taxable income of Rs. 5,59,000 and Rs. 6,45,000 respectively. (Applying Rs. 86,000 as deductions in Old Tax Regime for EPF = Rs. 36,000 and Standard Deduction = Rs. 50,000 respectively).

Now if we assume that we choose Old Tax Regime to calculate our income tax since we’ll be paying less taxes considering deductions, we’ll be paying Rs. 25,272 / 12 = Rs. 2,106 as income tax every month. Which will be divided as Rs. 2,025 as income tax and Rs. 81 as education cess (4% of income tax) every month.

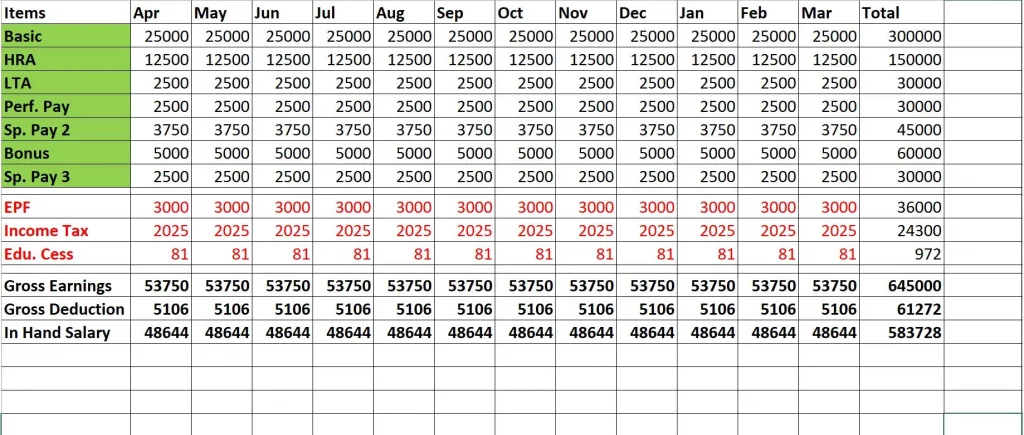

Let’s put this income tax and education cess data in our excel:

As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. 24,300 + Rs. 972 = Rs. 25,272 as income tax that you have to pay. Notice that your in hand salary is reduced to Rs. 48,644 due to deduction of income tax and education cess amounts every month.

And this is how your every month approximate TDS on salary is calculated and deducted using the calculator in excel. Also, you have to consider other deduction options in case you make investment in tax saving options.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

TDS on Salary Increment Example

Let us now understand how TDS will be calculated and deducted based on the the salary increments you get due to job switch, promotion or bonus in a financial year.

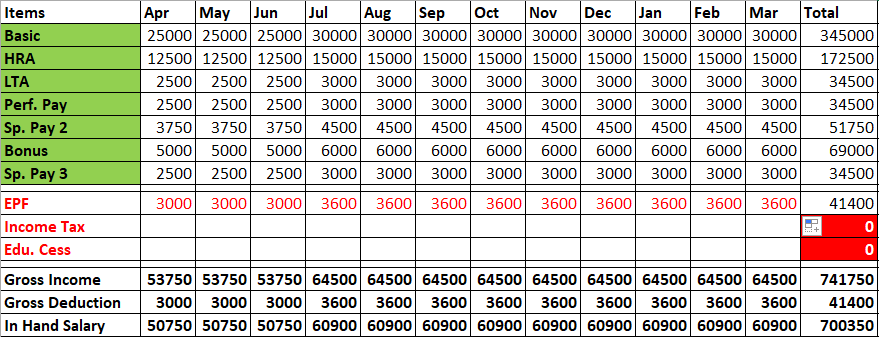

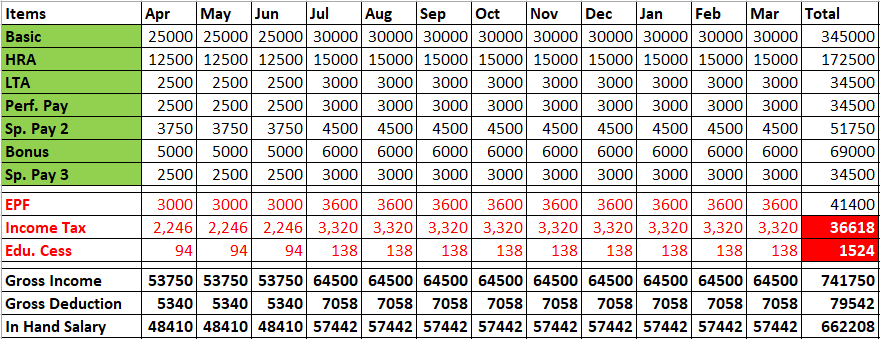

Considering same example above of starting with Basic Salary + Da of Rs. 25,000 in April to May quarter, and let’s say your Basic Salary is increased to Rs. 30,000 for the period of July to March du to your promotion.

Below is the table for calculation of your gross income:

So your annual gross earnings is Rs. 7,41,750, annual gross deductions (without income tax) is Rs. 41,400 and annual in hand salary is Rs. 7,00,350.

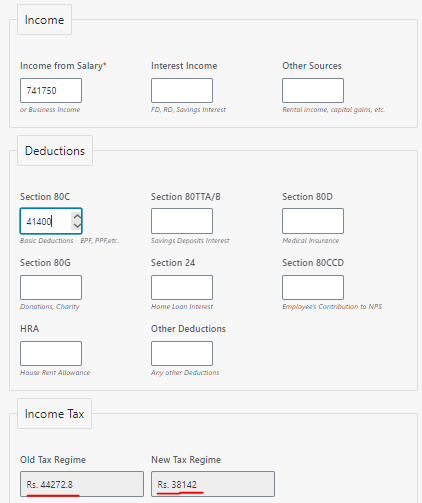

Let us put this gross earnings and gross deductions data in our income tax calculator to calculate income tax as below:

So we get income tax based on Old Tax Regime as Rs. 44,273 and based on New Tax Regime as Rs. 38,142, considering taxable income of Rs. 6,50,350 and Rs. 7,41,750 respectively. (Applying Rs. 91,400 as deductions in Old Tax Regime for EPF = Rs. 41,400 and Standard Deduction = Rs. 50,000 respectively).

Now if we assume that we choose New Tax Regime to calculate our income tax since we’ll be paying less taxes considering deductions, what will be the every month TDS deduction under Section 192?

In this case due to salary increment, for April to May period, income tax will be considered using Rs. 25,000 basic salary and for July to March period, income tax will be calculated based on Rs. 30,000 basic salary.

This will make the income tax for this period as:

- April to May period = Rs. 2340 per month (for 3 months)

- July to March period = Rs. 3458 per month (for 9 months)

If we add all these numbers of income tax per month, we get total income tax of Rs. 38,142 according to new tax regime that we already found previously.

Let’s put this income tax and education cess data in our excel:

Note that these are approximate figures on monthly basis. But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192.

Download TDS on Salary Calculator in Excel

In case you want to Download this excel and check your own numbers, you can download from above link.

ALSO READ: Download Income Tax Calculator FY 2022-23

Conclusion

It is very important to know how TDS on Salary will be calculated using this calculator in excel so that you can plan the investments accordingly.

Also, you can assess your income and investments and find ways to save income tax with Old tax regime if that helps you to pay less income tax in the financial year. Share this post with your friends to let them know about the TDS deduction calculation on their salary.

Some more Reading

- Old vs New Tax Regime Calculator in Excel

- Income Tax Brackets in India

- How to File ITR on Salary with Form 16

- New Tax Regime Benefits

Frequently Asked Questions

Is TDS applicable on 30000 salary?

TDS is applicable on all salary that exceeds Rs. 5 Lakh in a financial year. Above this income you are liable to pay tax and hence TDS will be deducted from your salary before it is credited to your bank account based on Section 192 of IT Act.

Who is eligible for TDS on salary?

All individuals in India whose income is taxable and are liable to pay income tax are eligible for TDS on salary.

How is 192 TDS calculated on salary?

Using the income tax calculator, we can calculate the total tax liability based on our total income and investments (Deductions). This total income tax is then divided into the number of months remaining in the financial year, which will give us the monthly income tax and cess of 4% to be deducted from our in hand salary before it gets credited to our bank account.

The TDS deducted in this way is transferred to Government’s account as income tax paid by individual.

What is the TDS for 30000 salary?

TDS for 30000 salary will be Rs. 0, that’s because the annual income will be Rs. 3,60,000 and since the taxable income is below Rs. 5 Lakh in financial year, we get tax rebate under section 87A (Rs. 12,500 max), due to which our calculated tax of Rs. 5,500 (5% tax slab) gets cancelled, so Rs. 0 Income tax.

What is the TDS for 45000 salary?

According to Old Tax Regime, TDS will be zero because the taxable income will be Rs. 4,90,000 after deducting Rs. 50,000 standard deduction if you are salaried employee, but if you opt for new tax regime, than TDS for 45000 salary will be approximately Rs. 1400 per month. You should select Old Tax Regime in this case!

Is it compulsory to deduct TDS on salary?

Yes according to Section 192 of the IT ACT, you are liable to pay income tax to government based on your income and deduction levels. This income tax will be paid in the form of TDS on salary.

SHOW your Support!

Found this Helpful? DONATE any amount to see more useful Content. Scan below QR code using any UPI App!

UPI ID: abhilashgupta8149-1@okhdfcbank

Verify that you are “Paying Abhilash Gupta” before making the transaction so that it reaches me. It makes my Day 🙂

Thank you for Donating. Stay Tuned!

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2023-24 and previous FY 2022-23

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.