Is Standard Deduction in new tax regime available? How much standard deduction is available for salaried and pensioners? What will be the impact of this standard deduction on your income tax calculation purpose? We will address all these queries in this article.

In Budget 2024, Standard Deduction in New Tax Regime was updated that will be applicable from FY 2024-25 onwards. According to this Standard Deduction, you get flat deduction of Rs. 75,000 while calculating income tax for FY 2024-25 with new tax regime. You also get this deduction in old tax regime with limit of Rs. 50,000 for salaried employees. Note that this standard deduction is only available to salaried and pensioners in both tax regimes.

- Standard Deduction in New Tax Regime Video

- What Exemptions are allowed in new tax regime?

- How much tax to pay in new tax regime?

- Can we claim standard deduction in new tax regime?

- Is Standard Deduction Applicable in Old Tax Regime?

- Standard Deduction part of Section 80C?

- Is Standard Deduction Applicable for pensioners?

- Standard Deduction Benefits

- Is standard deduction available for businessman?

- Old vs New Tax Regime Which is Better – Video

- Conclusion

Standard Deduction in New Tax Regime Video

Watch more Videos on YouTube Channel

What Exemptions are allowed in new tax regime?

We have already covered Benefits of New Tax Regime in detail.

Below are the exemptions available in New Tax Regime:

Exemptions and Deductions available in New Tax Regime

- Standard Deduction of Rs. 75,000 is available from FY 2024-25 onwards

- Transport allowance can be claimed in case of specially-abled person

- Conveyance allowance for employees received to meet conveyance expenditures

- Compensation received for cost of travel or tour

- Daily Allowance received as compensation for cost of living in some other place compared to regular place of working

- Deduction for employer’s contribution in NPS Account under Section 80CCD(2)

And below are the exemptions not available in New tax regime:

Exemptions and Deductions NOT available in New Tax Regime

- Investments included in Section 80C such as Provident Fund, Public Provident Fund, Life Insurance Premiums, 5 year Fixed Deposits, Equity Linked Saving Savings, etc. are not available in New Tax Regime

- NPS (National Pension Scheme) under Section 80CCD(1B) which allows maximum of Rs. 50,000 deduction is not available in New Tax Regime

- All other Deductions available under Chapter VI A is not available under New Tax Regime

How much tax to pay in new tax regime?

It depends on your income and investments made as to how much income tax you are supposed to pay.

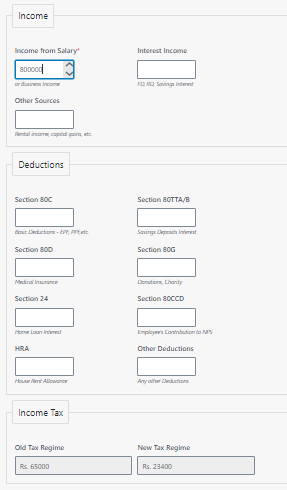

Let’ s take an example, so let’s say your income is Rs. 8 lakh in FY 2024-25 and you do not make any investments.

So below is the income tax based on old and new tax regime using the income tax calculator:

As seen above, with old regime you have to pay Rs. 65,000 income tax and with new regime your tax liability is Rs. 23,400. Note that standard deduction of Rs. 50,000 and Rs. 75,000 in old regime and new regime is automatically applied in this case since we selected salaried option as seen above, which makes taxable income = Rs. 7.5 lakh with old tax regime and Rs. 7.25 lakh with new tax regime.

So using above numbers, it’s better you select new tax regime that helps you to pay less tax compared to old tax regime. But you can save income tax under old tax regime by using various deduction options.

You can also download income tax calculator in excel to see slab wise details.

ALSO WATCH: Old vs New Tax Regime 2024-25 Comparison

Can we claim standard deduction in new tax regime?

Yes we can claim standard deduction of Rs. 75,000 in new tax regime from FY 2024-25 onwards that will be applicable from AY 2025-26.

This standard deduction is applicable to only salaried employees and pensioners. Businessman will not get this deduction while calculating their income tax.

Standard deduction of Rs. 50,000 is available in old tax regime with other deductions options to save income tax.

Is Standard Deduction Applicable in Old Tax Regime?

Yes Standard Deduction is applicable in Old tax regime right from when it was introduced in Budget 2020. Transport Allowance and medical reimbursement has been replaced by standard deduction of Rs. 50,000.

From FY 2023-24, Standard Deduction will be applicable in both old tax regime and new tax regime.

Standard Deduction part of Section 80C?

No, Standard Deduction is not a part of Section 80C Deductions. You get flat deduction of Rs. 50,000 or Rs. 75,000 (with old or new tax regime respectively), separately apart from Rs. 1.5 lakh limit under Section 80C investment options.

Is Standard Deduction Applicable for pensioners?

Yes Standard Deduction is applicable for pensioners who get monthly pension. The deduction is Rs. 50,000 which needs to be subtracted from yearly pension before calculating income tax for pensioners.

Standard Deduction Benefits

Standard deduction helps you to save income tax with both old and new regime.

Let’s take an example of income = 10 lakh in FY 2024-25. If you are businessman, below is the income tax:

| Businessman | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income | Rs. 10,00,000 | Rs. 10,00,000 |

| Standard Deduction | Rs. 0 | Rs. 0 |

| Income Tax | Rs. 1,17,000 | Rs. 52,000 |

Now let us see the income tax calculation for salaried employees and pensioners with same income and standard deduction of Rs. 50,000 and Rs. 75,000 in old and new tax regimes

| Salaried / Pensioner | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income | Rs. 10,00,000 | Rs. 10,00,000 |

| Standard Deduction | Rs. 50,000 | Rs. 75,000 |

| Income Tax | Rs. 1,06,600 | Rs. 44,200 |

So as seen above, you save Rs. 10,400 with old tax regime and Rs. 7,800 with new tax regime, just be applying standard deduction of Rs. 50,000 and Rs. 75,000 respectively. This is the main benefit of this standard deduction available for salaried and pensioners in both old and new tax regime.

With Old Tax Regime, you get more deduction and exemption options as well.

ALSO READ: How to Save Income Tax on Salary above 5 lakh

Is standard deduction available for businessman?

No, standard deduction is not available for Businessman in any tax regime.

Old vs New Tax Regime Which is Better – Video

Conclusion

So applying standard deduction becomes very important to save income tax if you are salaried employee or pensioner. This will help you to reduce your tax liability with old and new tax regime.

You get Rs. 50,000 as standard deduction with old tax regime and Rs. 75,000 with new tax regime if you are salaried employee in FY 2024-25. For businessman, there is not standard deduction applied.

Some more Reading:

- Senior Citizen Income Tax Calculation

- Change between New to Old Regime or vice versa

- New Tax Regime Benefits

- How to calculate income tax on salary

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.