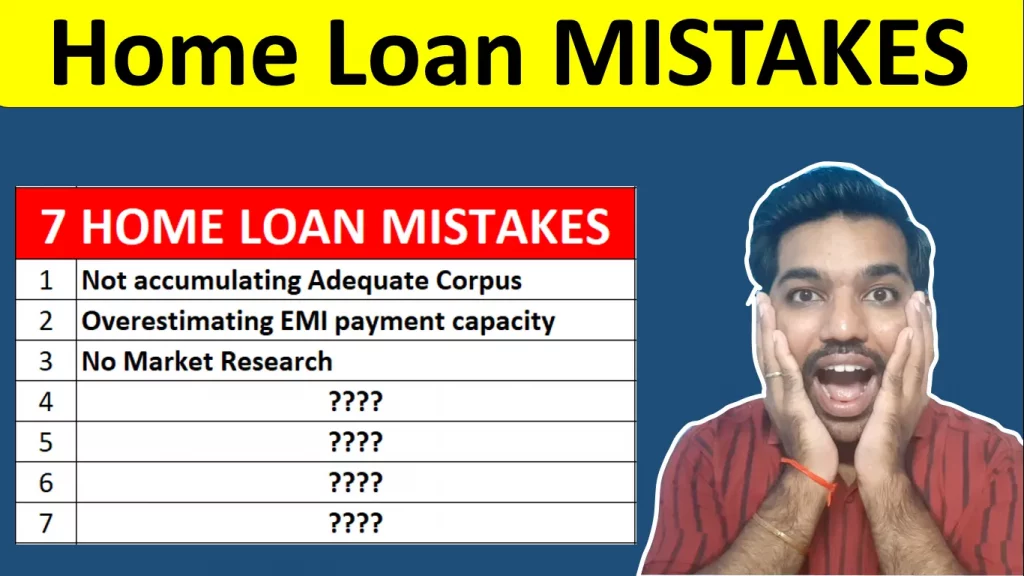

Home Loan is one of the popular ways to buy your dream home. But did you know that you can be a victim if you don’t avoid some home loan mistakes? What are the things you should know and avoid while taking or availing home loan?

Below are the Home Loan Mistakes You Should Avoid

- Not accumulating Adequate Corpus

- Overestimating EMI payment capacity

- No Market Research

- Taking Loan with high tenure

- Not reviewing Credit Score

- Using Emergency Fund

- Not doing Loan Prepayments

- Below are the Home Loan Mistakes You Should Avoid

- Video on Home Loan Mistakes You Should Avoid

- 1. Not accumulating Adequate Corpus

- 2. Overestimating EMI payment capacity

- 3. No Market Research

- 4. Taking Loan with high tenure

- 5. Not reviewing Credit Score

- 6. Using Emergency Fund

- 7. Not doing Loan Prepayments

- Conclusion

Video on Home Loan Mistakes You Should Avoid

Watch more Videos on YouTube Channel

Let us understand all these points one at a time.

1. Not accumulating Adequate Corpus

Before you think about buying your dream home, you must know that you can take home loan with a maximum amount of 90% of the property cost. Meaning at least 10% of the property cost must be paid by you before you expect Bank to give you home loan.

The exact percentage depends on the bank and on your income level as well which will be accessed before your home loan is approved

For example, in case you are buying a property of let’s see Rs. 50 Lakhs, you must at least pay the down payment of Rs. 5 Lakhs. Apart from this, you should be aware about the charges related to other paper work, such as processing fees, stamp duty, registration cost of property, etc.

This means, you should plan for the down payment that you are going to make while buying your dream home and considering other costs as well before taking home loan.

So try to accumulate enough corpus before you approach the bank for Home Loan.

ALSO READ: Home Loan Interest Deduction under Section 24

2. Overestimating EMI payment capacity

Ideally, banks will assess your income and will propose you to keep your total monthly EMIs (Every month installment) within 50% of your monthly income. Here your total EMIs will include all loans you have currently such as car loan, personal loan, bike loan, etc.

So for example, let’s say your monthly income is Rs. 50,000, you can take home loan with EMI of maximum Rs. 25,000. Accordingly, your tenure will be set, Considering you don’t have any other existing loan.

But as you know, lower the EMI, higher will be your tenure and more interest you’ll be paying while your EMIs are deducted automatically from your bank account.

But you cannot do much in this case as your income will be assessed by bank before giving you home loan.

In above example, if your expenses is Rs. 30,000, than don’t try to set your EMI as 25,000 as you will run out of money at the end of the month and will rely on the last day of month to get your salary.

It would be wise to either reduce your expenses, or keep your EMI low – at a level that you can afford every month.

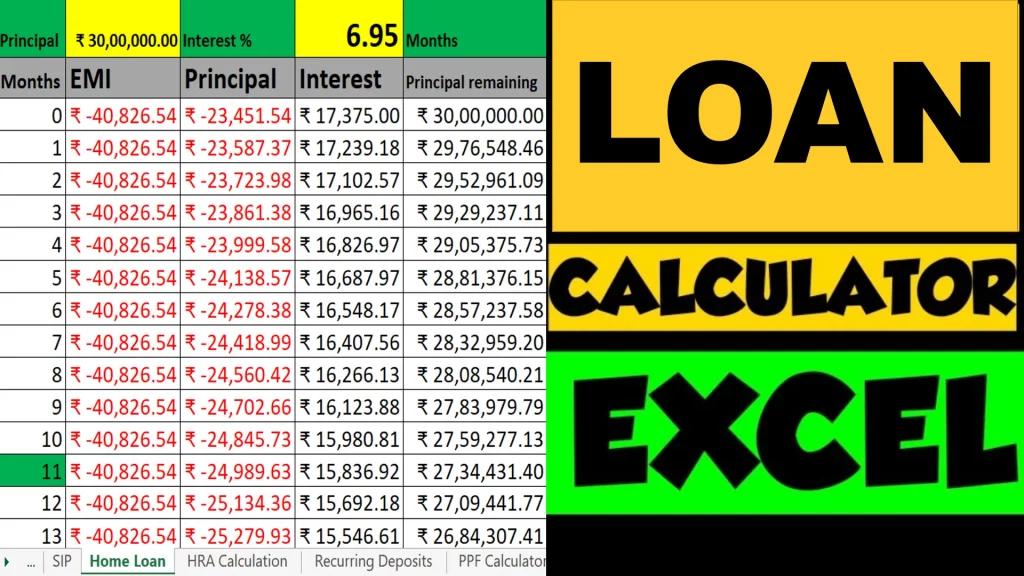

Use below Home loan calculator to calculate your home loan EMI and plan accordingly:

3. No Market Research

Lack of market research or no market research at all will be against you on long term. That’s because you might pay back the loan amount with high interest rate or with high processing fees.

While doing market research, you should look for a bank or financial institution that will:

- Give you home loan with low interest rate

- Floating interest rate is better compared to fixed interest rate (due to prepayment opportunities)

- Have a lawyer that will check the property documents correctly

- Give you loan with less processing fees and must have a good name

So all the market research and comparison of different banks or financial institutions is important to be on safe side and save some extra money, that would help you close your loan as soon as possible.

Why Floating home loan interest rate is useful? Because you get the opportunity to prepay the loan amount with floating interest rate without any additional condition

With fixed interest rate, there are certain conditions like you cannot prepay the loan amount for certain initial months, or you have to pay penalty while making loan prepayments. It depends on bank to bank.

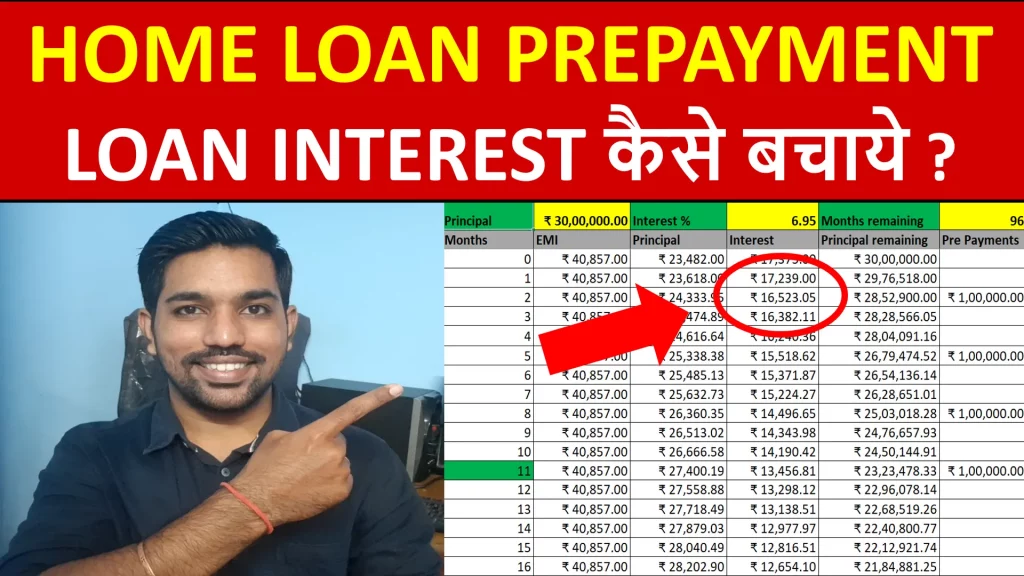

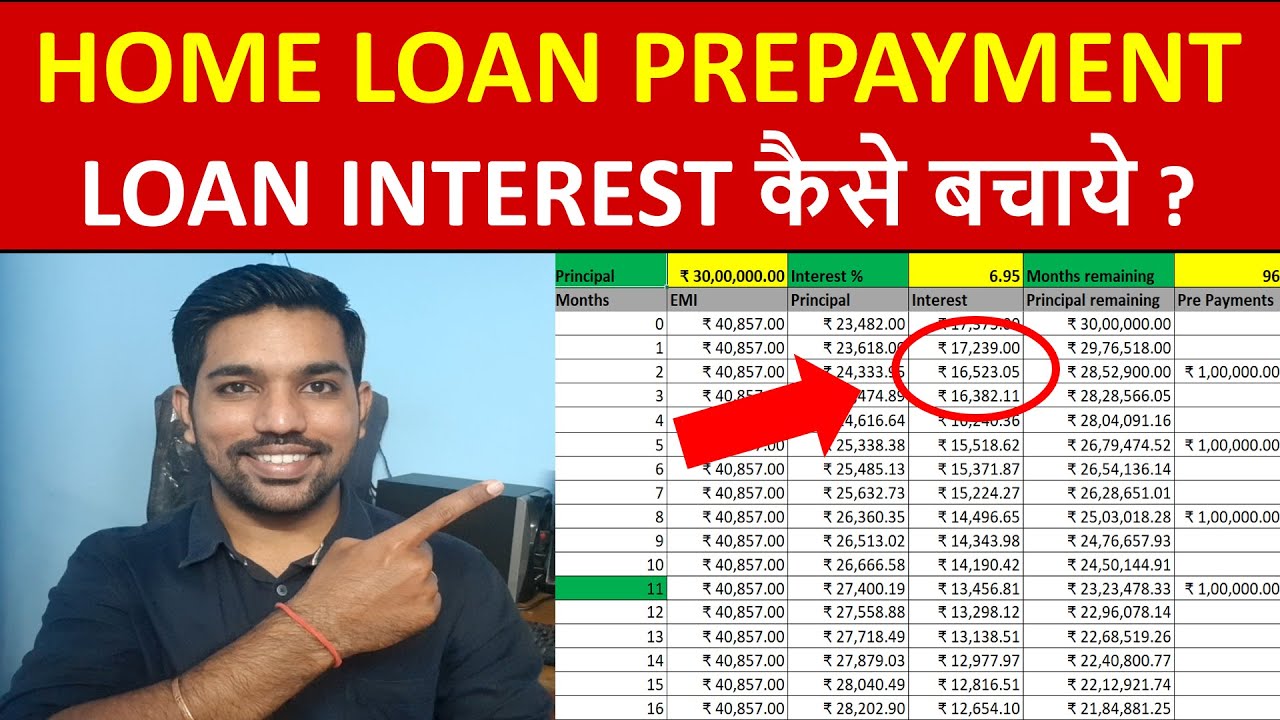

Home Loan Prepayment is a way to save interest amount in your home loan and either you close your loan before time or you can reduce the EMI amount as well.

Read more on Home Loan Prepayment in below article.

ALSO READ: Home Loan Prepayment with Calculation Examples in Excel

4. Taking Loan with high tenure

As mentioned above, higher the tenure you keep, more interest amount you will be paying.

For example, using our home loan calculator, for loan of Rs. 30 Lakhs and tenure of 15 years, you’ll pay total interest of Rs. 21.6 Lakhs (EMI = Rs. 28,670).

But if you reduce the tenure to 10 years in same example, you pay total interest of Rs. 13.6 Lakhs (EMI = Rs. 36,398).

So you save approximately Rs. 8 Lakhs on interest amount, by paying slightly higher EMI and with reduced tenure. This will also give you an advantage by closing the loan soon.

So go for low tenure and fix the EMI based on your affordability.

5. Not reviewing Credit Score

It is very important to review your credit score, which is one of the home loan mistakes that people do frequently.

You credit score must be above 750, to get hassle free loan from any bank.

Financial Institutions or banks check your credit score before lending you loans. This credit score is a factor that proves whether they can trusts you on getting bank’s money back.

If you don’t pay your EMIs on time, your credit score is reduced, but if you pay all debts on time, it increases your credit score and also increases your chances of getting home loan easily.

ALSO READ: Credit Card vs Debit Card Differences

6. Using Emergency Fund

This is important. Your emergency fund is for emergency purpose and not to finance for your dream home.

Emergencies are categorized as unexpected hospitalization or any other situation when you need the money. During such bad times, it is not good to ask your relatives or friends for money.

Instead you should rely on your own emergency fund and avoid using it to finance your house.

7. Not doing Loan Prepayments

Last but not the least, if you have some extra money, you can make loan prepayments to save loan interest amounts.

Home loan prepayments is a way to pay extra to reduce your principal outstanding balance. This will help you save on home loan interest amount that you might pay without making loan prepayment.

Watch below video on Home Loan Prepayment with Example:

Also you can watch this video on Home Loan Prepayment to reduce EMI or tenure with comparison in both scenarios.

So you should make loan prepayments periodically, if you have extra money during your loan tenure and save home loan interest amount.

Conclusion

So these were some of the home loan mistakes that we should avoid. Try to close your home loan as soon as possible instead of keeping it for the next 15 – 20 years.

Live your life tension free rather than thinking about the loan EMIs to be paid by avoiding above mentioned mistakes in home loan. Being debt free is one the of best feelings one can have.

Some more Reading:

- Home Loan Calculation Examples

- Tax Benefits in Home Loan

- Buy vs Rent a House comparison with calculations

- Reduce EMI or Tenure during loan prepayment?

- Section 80C Deductions List

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

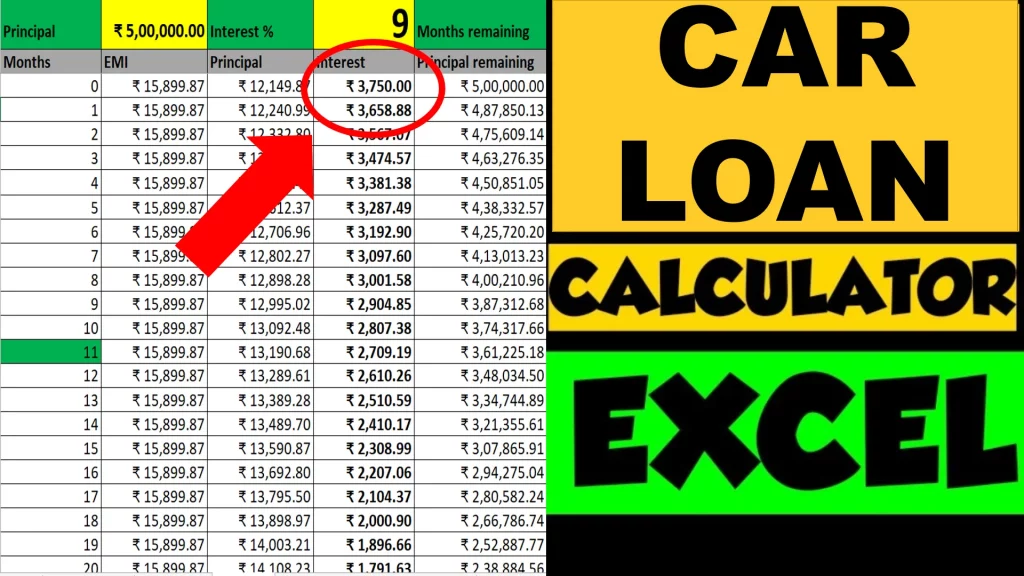

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.