It is very important to plan for the financial stability of your loved ones and family members in case of untimely demise. When you check the various types of Life Insurance, it includes Term life insurance, ULIPs (Unit Linked Insurance Plan), Traditional Plans and Pension Insurance Plans. The main reason why term life insurance is better is that – It Provides High Coverage amount and Minimum Premiums to be paid. For example, you can get Rs. 50 Lakh life cover with just Rs. 6000 yearly premium with term life insurance.

Term Life Insurance is the pure life insurance that provides life cover for the insured. In case of sudden death of the bread earner of family, term life insurance will provide sum assured to the family members to help in pending home loan, car loan or any other debt to be repaid, or else can be used for financial stability of you loved ones.

Even though term life insurance does not provide any survival benefit, the extra premiums that might you might have to pay in money back plans, can be invested in mutual funds or stock market on your own to reap better returns while getting high coverage amount with term life insurance.

What Is the Difference Between Term Insurance and Money Back Plans?

- Money Back Plans combine life cover with savings. They offer periodic payouts during the policy term and a maturity benefit if you survive.

Term Insurance vs Money Back Plan: Detailed Comparison

| Feature | Term Life Insurance | Money Back Plan |

| Purpose | Pure life cover | Life cover + savings |

| Premium | Low | High |

| Death Benefit | Full sum assured | Full sum assured (even after payouts) |

| Survival Benefit | None (unless ROP option) | Periodic payouts + maturity benefit |

| Returns | None | Guaranteed returns + bonuses (if declared) |

| Cash Value | No | Yes |

| Surrender Value | No | Available after certain period |

| Tax Benefits | 80C & 10(10D) | Same as term plans |

| Flexibility | High (customizable with riders) | Moderate |

| Ideal For | Pure protection seekers | Insurance + savings seekers |

ALSO READ: What is ULIP (Unit Linked Insurance Plan)

Benefits of Term Life Insurance

Simplicity & Purpose

- Term life insurance is straightforward and serves single purpose: to provide a lump-sum payout to your loved ones in case of your death during the policy term

- On the other hand, money back plans are a combination of insurance and savings, often leading to confusion about their primary purpose

- The complexity of money back plans can make it difficult to understand the actual returns and benefits, which is not the case with term life insurance

Affordability

- This is mainly because term life insurance focuses only on providing death benefit and doesn’t involve complex investment components

- If your goal is to secure a good amount of death benefit without stressing on your finances, term life insurance offers a cost-effective solution

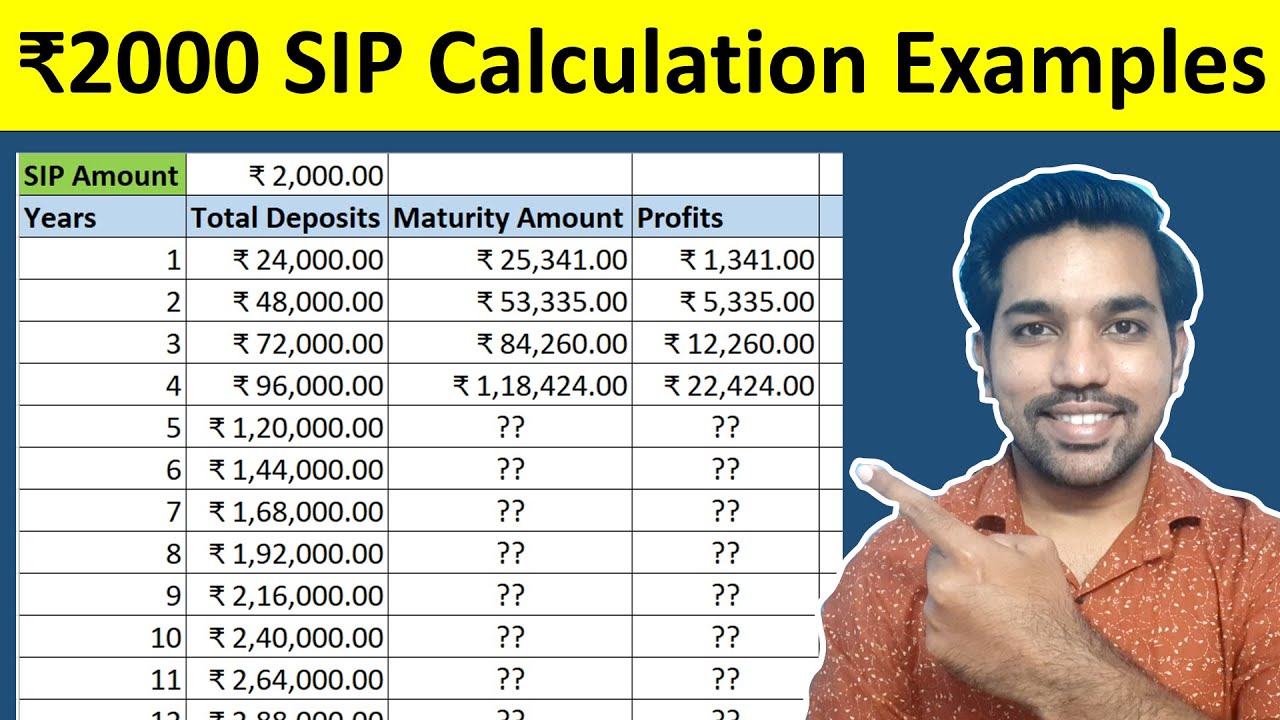

- For your investments, you can start a SIP in order to grow your money

ALSO READ: Rs. 5000 SIP Returns in Sensex for 25 Years

Higher Coverage Amounts

- This is crucial for ensuring that your beneficiaries and loved ones are adequately protected in case of your unfortunate demise

- Money back plans tend to have lower coverage amounts due to the savings component, which can compromise the financial security of your beneficiaries

- So Term insurance provides you high coverage amount and low savings, money back plans provide low coverage amount and medium savings. This is why term insurance is called pure form or life insurance

Investment Flexibility

- One of the important points of money back plans is the savings or investment component they offer

- This makes us to opt for money back plans since we are getting something out of it in case of survival of the policyholder

- However, it is important to note that the investment returns from these plans are often modest compared to other investment options available in the market

- You can invest elsewhere in mutual funds or stocks to get more returns than money back plans

Watch below video to know Rs. 2000 SIP Returns for next 15 Years:

Watch more Videos on YouTube Channel

Term Customization

- Term life insurance policies offer flexibility in choosing the policy term

- You can choose any time of period starting from current age for the policy to be active

- Select term that aligns with your financial conditions, such as your loans or your children’s education

- This ensures that your loved ones are protected during the most critical years

- Money back plans generally come with fixed terms and may not offer the same level of customization to suit your specific needs

No Maturity Benefit Concerns

- Money back plans often come with maturity benefits where you receive periodic payouts during the policy term

- While this may seem attractive, it’s important to identify that the payout amounts might not match the actual inflation rate or investment returns

Why Term Insurance Is a Smarter Choice

- High Coverage: Protect your family’s lifestyle, debts, and future goals

- Simplicity: No complex returns or bonus calculations

Real-Life Example using Term Insurance

| Scenario | Term Insurance Plan | Money Back Plan |

| Age | 30 years | 30 years |

| Sum Assured | ₹1 crore | ₹10 lakh |

| Policy Term | 30 years | 20 years |

| Annual Premium | ₹6,000 | ₹40,000 |

| Death Benefit | ₹1 crore | ₹10 lakh |

| Survival Benefit | None | ₹2 lakh every 5 years + maturity |

Verdict: Term insurance offers 10× coverage at 1/6th the cost

Who Should Choose Term Insurance?

- Primary earning members

- Young professionals with dependents

- People with loans (home, education, personal)

- Those seeking maximum coverage at minimum cost

Conclusion

So these are some of the advantages and benefits of Term Life Insurance. It provides you high coverage amount with lower premiums to be paid. The Death benefit is also not related to market fluctuations.

Money back plans offer low coverage and medium investment returns which can be replaced with Term Insurance and investments in mutual funds or stocks on your own.

You also get the option of return with premium in term insurance, but this also defies the purpose of pure term insurance since it provides you with less coverage amount with little higher premium amount that cannot beat inflation when you get your premium amount back.

In case you need assistance or guidance in buying the best Life Insurance for you, please Fill this Form to get more information.

Some more Reading:

- Rs. 2000 SIP vs Step up SIP Returns

- Top 6 PPF Account Benefits

- Mutual Fund Calculator – 10 Years Returns Calculation

Frequently Asked Questions

1. Why is term insurance cheaper than money back plans?

Because it offers pure protection without savings or investment components.

2. Do I get any money back if I survive the term?

Not in regular term plans. You can opt for Return of Premium (ROP) plans for survival benefit.

3. Is money back plan better for long-term savings?

Not necessarily. Returns are lower than mutual funds or ULIPs and premiums are higher.

4. Can I add riders to term insurance?

Yes. Popular riders include critical illness, accidental death, and waiver of premium.

5. Which plan offers better tax benefits?

Both offer similar tax benefits under Section 80C and 10(10D).

6. Is term insurance suitable for young people?

Yes. Premiums are lowest when bought early, and coverage can be high.

7. What happens if I stop paying premiums?

Your policy may lapse. Some plans offer a grace period or revival option.

8. Can I convert my term plan to a money back plan later? No. These are fundamentally different products with different structures

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.