Cash Flow Statement (CFS) is one of the important financial statements which summarizes the cash coming in and going out. This statement details about the cash amount generated from various activities such as operating activities, investing activities and financing activities. Cash Flow Statement is a valuable statement for business owners to check which section is draining more cash and the major source of cash coming in, also it helps the creditors to check if the business is managing cash in efficient way and the net cash flow is positive to decide whether to grant business loan.

Let us understand more about Cash Flow Statement in detail.

What is Cash Flow Statement?

- Cash Flow Statement is an important financial statement that summarizes the cash inflows and outflows

- When cash inflow (cash coming in) is greater than cash outflow (cash going out), the net cash flow is positive which is a good sign of company’s financial health

- This statement complements the other two financial statements that are income statement and balance sheet

- This Statement consists of 3 sections – Operating Activities, Investing Activities and Financial Activities. We will see all these sections in detail below

- Most business follow accrual accounting, in which case the future revenue is recorded in the income statement but since it is not received as cash, it is not recorded in CFS. Thus it is important to understand this difference between income statement and cash flow numbers while analyzing the company’s business

- Thus the cash flow statement is the king of all statements which cannot be manipulated since it has to record the actual cash generated by business

ALSO READ: Top 6 Financial Ratios to Select Stocks

Components of Cash Flow Statement

Let us now understand the various components or sections of cash flow statement:

Cash from Operating Activities

Operating Activities are the activities which include the actual selling of products or services by the company, and the cash generated from such activities are included in operating activities. Various items in cash from operating activities are mentioned below:

- Sale of Goods and services

- Interest Payments

- Income Tax Payments

- Salary paid to employees

- Supplier payments

- Rent Payments

- Other payments made as part of operating activities

Cash from operating activities must be the major porting of the CFS for a business, since this is the daily work of an organization.

Cash from Investing Activities

Investing activities include Property, Plan and Equipment (PPE), which are assets for the company that are used to produce goods or services. Many times businesses want to expand with the help of new land, property, and new equipment and the cash used to buy all these assets are recorded in cash from investing activities.

These actions are investments in company in order to grow business in future, and should be appreciated by investors.

Capital expenditures (CapEx) is recorded in this section. CapEx is something when business invest money in fixed assets such as buildings, land, vehicle or property to grow business in future. This may lead to negative cash flow for small businesses temporarily due to high investing activities.

Cash from Financing Activities

Financing activities include cash from sources such as investors or banks and also the dividends paid to the shareholders. It also includes repayment of debt that is taken as loan from banks.

When company wants to raise funds via investors, cash coming in is recorded in financing activities and dividend paid to shareholders are also recorded in this section. When company wants to raise funds via bonds than the cash coming in is also recorded in financing activities, but the interest payments in cash to bond holders are recorded in operating activities.

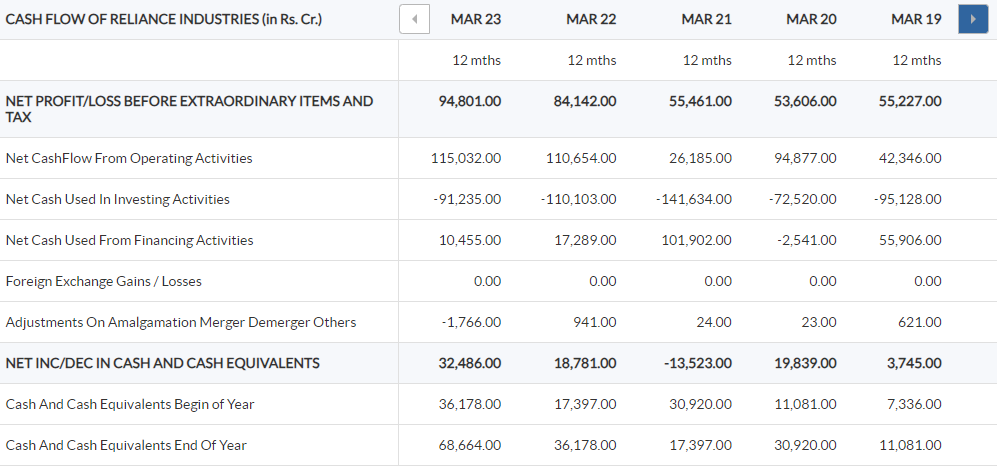

Sample Cash Flow Statement Format with Example

Below is the sample cash flow statement format with example of Reliance Industries taken from Moneycontrol:

What is Net Cash Flow?

Net cash flow or free cash flow is the addition of all numbers – cash from operating activities, investing activities and financing activities. A positive net cash flow is a good sign of financial health of a company.

Sometimes the net cash flow of company is negative, but it can be temporary due to high investing activities in new buildings, land or property to grow future operations of business. But consistent negative cash flow is not a good sign and cash flow statement must be used along with other statements such as income statement and balance sheet while analyzing the company.

Conclusion

So cash flow statement (CFS) is an important statement that summarizes the cash inflows and outflows. A positive net cash flow is a good sign of financial health of the company, but sometimes the net cash flow can be negative in a quarter due to high investing activities. Investors should be cautious when the net cash flow is negative on consistent basis for past 4 to 5 quarters.

CFS mainly consists of 3 sections – operating activities, investing activities and financing activities. This gives the clear picture about where the cash is coming in from and going out.

Some more Reading:

Frequently Asked Questions

What are the 3 types of cash flow statement?

Cash flow statement contains 3 sections if which cash inflows and outflows are summarized, these are – Cash from operating activities, cash from investing activities and cash from financing activities

What is the cash flow formula?

Cash flow formula is very simple which includes addition of all cash from various activities mentioned below:

Net Cash Flow = Cash From Operation Activities + Cash From Investing Activities + Cash From Financing ActivitiesWhy cash flow statement is prepared?

Cash flow statement is prepared in order to know the sources of cash inflow and outflow. it becomes important for business owners to take decisions in case the cash outflow needs to be controlled in specific areas. Also it helps us to know whether the revenue generated by company is in sync with CFS or not, since most businesses follow accrual accounting, in which case the revenue which is not received as cash is recorded in income statement but is not recorded in CFS since actual cash is not received and will be received in future.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.