SWP for Monthly Income is a way to withdraw regular income from mutual funds in order to cover your expenses. The idea is to accumulate enough corpus in mutual fund of your choice, that will continue to perform better in future with good returns, and withdrawing from this mutual fund regularly (monthly frequency), to cover for the monthly expenses and thus replacing your source of income to cover those expenses. This is the best way to retire early and get regular income from mutual funds to enjoy post retirement life.

Let us understand more about SWP for Monthly Income in detail.

SWP for Monthly Income Calculation Video

Watch more Videos on YouTube Channel

So you get good returns as regular income with expected rate of 8% as seen in above video.

What is SWP for Monthly Income from Mutual Funds?

- SWP full form is Systematic Withdrawal Plan

- It helps you to get regular income from mutual fund, provided you have accumulated enough corpus in that mutual fund

- Similar to Post Office Monthly Income Scheme where you get fixed interest rate, the percentage of returns from mutual fund varies over time, but over long term you can get anywhere between 10% to 15% in good mutual funds

- You can also simply invest via SIP in Sensex to accumulate your target amount, and then systematically withdraw from this mutual fund

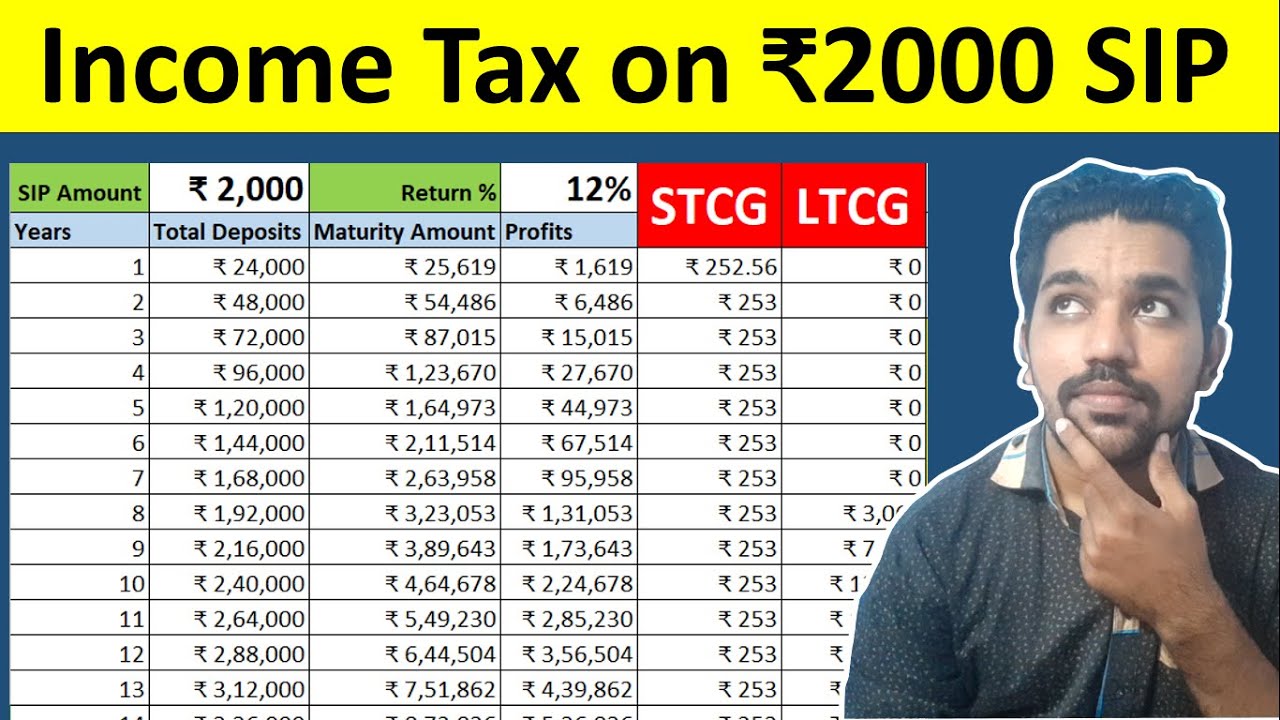

- The amount you withdraw is taxable as per short term or long term capital gains

- If you are holding the mutual fund units for long term (LTCG), the profits made above Rs. 1 Lakh will be taxed at 10%

- Moreover, the regular income you earn from SWP can be used to cover your monthly expenses and hence you can retire from your salaried job and work for yourself in your own Life Goals

- SWP helps to retire early, provided you plan early in your life and start accumulating amount in a good mutual fund

ALSO READ: Income Tax on SIP Redemption in Mutual Funds

How SWP works with Example?

The working of SWP is quite simple:

- Let’s say for example you have accumulated Rs. 1 crore in a mutual fund that is expected to grow at 12% annually in upcoming years

- Which means 1% in every month will help you to get Rs. 1 Lakh profit in a month from Rs. 1 crore principal amount

- You need to choose a withdrawal amount based on your expenses, so let’s say your expenses is Rs. 50,000, and you choose to withdraw Rs. 60,000 to cover for unexpected expenses as well

So below is the table covering the withdrawal for first 6 months based on 12% expected returns:

| Month | Withdrawal per month | Returns Expected | Remaining Balance |

|---|---|---|---|

| 0 | – | – | ₹ 1,00,00,000 |

| 1 | Rs. 60,000 | 12% | ₹ 1,00,40,000 |

| 2 | Rs. 60,000 | 12% | ₹ 1,00,80,400 |

| 3 | Rs. 60,000 | 12% | ₹ 1,01,21,204 |

| 4 | Rs. 60,000 | 12% | ₹ 1,01,62,416 |

| 5 | Rs. 60,000 | 12% | ₹ 1,02,04,040 |

| 6 | Rs. 60,000 | 12% | ₹ 1,02,46,081 |

- Note that in above table you are withdrawing at the end of month after getting profits from mutual fund

- And since your withdrawal amount is less the the expected returns from mutual fund, the remaining balance will increase over time which is a good sign

- Always try to keep your withdrawal amount below the expected returns, so the your balance does not decrease with time

- The amount you withdraw every month can also be done manually and changed as per your requirements

Using SWP Calculator for Regular Income

You can also use below SWP calculator to calculate your monthly income from mutual funds based on your principal amount:

Is monthly income from SWP taxable?

Yes, since the income from Mutual funds is considered as one of the sources of income, the amount will be taxable.

If the mutual fund units you sell is held from more than 1 year in case of equity mutual fund, you need to pay tax on profits made above Rs 1 Lakh in a financial year after removing the cost to buy those mutual fund units.

In case of short term capital gains, you need to pay 15% tax on the profits made.

Watch below video on Income Tax on SIP Redemption to understand more about taxation on Redemption:

How much return is expected from SWP?

A good rate of return from a mutual fund can be between 10% to 15% in a year. Note that you won’t get this return regularly, sometimes it will be in the range from negative to 0% and other time it will be between 20% to 30% in a year. On average you can consider 10% to 15% over long term of 7 to 10 years

While making withdrawals via SWP, you can consider this average return on monthly basis and calculate your remaining balance as per your withdrawal. If your withdrawal amount is less than the actual profits you make in every month, the balance will increase. But if withdrawal is more than actual profits, the balance will decrease.

You should try to keep the balance increasing so that it does not get over with time and inflation.

Is SWP better than SIP?

SWP is the reverse of SIP. In SWP, you withdraw a specific amount every month from mutual fund to cover your monthly expenses, where as in SIP you deposit a specific amount in mutual fund to achieve a financial goal like accumulating wealth, children education, buying a house, etc.

The best combination will be to use both SIP and SWP. You can start SIP (Systematic Investment Plan) and slowly accumulate good amount in mutual fund, and once the accumulated amount helps you to cover your monthly expenses with the help of monthly profits, you can start SWP (Systematic Withdrawal Plan) to get regular income.

While starting SWP, ensure that the withdrawal amount is less than the expected profits that you make to keep the remaining balance increasing over time.

Is SWP better than FD?

FD or fixed deposits is used to achieve your short term or mid term goals, where as SWP is used withdraw from mutual funds to cover for expenses and it is a long term goal.

FD provides you low guaranteed returns in the range between 5% to 7% in a year with quarterly compounding where as SWP in mutual fund can provide returns between 10% to 15% in a year over long term.

So it depends on your goal tenure, for short term – FD or Fixed Deposits are better where as for long term and if you can take some risk in mutual funds, SWP is better.

Conclusion

So SWP or Systematic Withdrawal Plan helps you to withdraw regularly from mutual funds which can help you to cover for monthly expenses. It is better to withdraw monthly amount that is less than the profits you make in mutual funds on monthly basis to keep your balance increasing with time.

If your withdrawal amount every month is higher than the profits you make on balance, at one point of time your balance will become zero in which case you won’t be making any profits from mutual funds. So try to keep your withdrawal amount low compared to actual profits you make or are going to make in future.

Some more Reading:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.