Income Statement is one of the important financial statements of a business that helps you to get an overview of revenue and expenditure of business you are analyzing. Income Statement consist of various components like Revenue or Sales, cost of goods sold (COGS), Gross profit, expenses, gains, net income, etc. Some companies have global reach and hence they need to include several more components in this Statement which is frequently published by the company.

We will see the basic components in Income Statement for you to understand the important factors while analyzing business of a company. Let us understand Income Statement in detail.

What is Income Statement?

- Income Statement is a financial statement that is published by a company frequently, mostly on quarterly basis

- It contains various factors including the revenue generated by company, cost of goods sold, other gains, expenses, gross and net profits, income from operating and non operating activities, etc.

- These factors becomes very important for business owners and investors. Business owners use the Income Statement to take effective decisions in order to increase revenue or decrease cost or both in upcoming quarters, and investors use this Statement to decide whether to invest in stocks of this company

- The revenue is generated in two modes – operating and non operating revenue. Operating revenue is the revenue that is generated due to the main business of the company, like selling of products or services. Non operating revenue is mostly generated from other non operating activities, like selling of old equipment / machinery, selling land, etc.

- One of the important factors is gross profit which is the actual income the company makes after subtracting cost from revenue. Similar factor is net income which defines the amount of money, the company is left with after subtracting expenses, taxes, depreciation from revenue and gains

- Different companies have to follow different Income Statement structure based on regulatory information as well, so you won’t see same structure of income statement for all companies, like banks might have to include different components compared to oil companies

- Competitors also keep tabs on income statement of a company to see how the numbers are growing and what strategies are being implemented to increase the net income of company

ALSO READ: Top 6 Financial Ratios to Select Stocks

Components of Income Statement

Let us now understand the various components of Income Statement.

Revenue or Sales

Revenue also called as sales is the figure that is highlighted at the top of the Income Statement. It is the number or figure generated by company for a given period (mostly quarterly basis). Revenue or sales can be defined as the amount generated after selling products, services and income from non operating activities such as investing and financing activities as well. Business owners look to increase revenue on quarterly basis to help the company grow and investors look for this number if it is growing on quarterly basis before deciding to invest in this company.

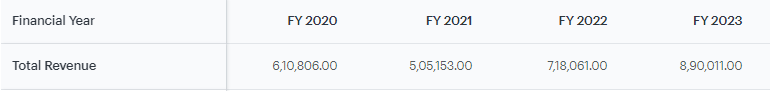

Below is the Yearly Revenue example taken for Reliance Industries as of Jan 2024 from Tickertape:

As seen above, the revenue decreased in FY 2021, but increased in FY 2022 and FY 2023. When looking for revenue figures, we must see at least past 5 years data as well as future forecasted numbers as well.

Cost of Goods Sold (COGS)

This is the cost incurred to sell the products or services by the company. Let’s say the company is a manufacturing company, so the cost to buy raw material and other related components are included in this Cost of goods sold or COGS. It does not include other costs such as overhead cost and other indirect costs.

Gross Profit

Gross profit can be found by subtracting Cost of Goods sold (COGS) from Revenue and below is the formula for gross profit of a company for a given quarter:

Gross Profit = Revenue - Cost of Goods Sold (COGS)Business owners tries to increase gross profit of the company by either increasing the revenue component or decreasing the cost incurred to run the company. Investors also find the company attractive when gross profits increases on quarterly and yearly basis, which means the company is either increasing the sales consistently or lowering the direct costs to sell goods or services.

Gains

Gains include other non operating revenue which is generated not due to the company’s selling of goods and services. This includes selling of old vehicle not required anymore by the company, selling of land or machinery, etc. Revenue is the income generated by selling products or services and belongs to operating revenue, where as gains belong to non operating revenue which is not consistent in every quarter because this is not the main business of the company.

Revenue = Income from Operating Activities

Gains = Income from Non Operating Activities

Total Revenue = Revenue + GainsSometimes the gains can also be categorized as Other Income.

Expenses

Expenses is the amount of money the company spends in order to sell the goods and services. Expenses can be further categorized as operating expenses which incurs while performing the core activities of the business like salary payments, supplies payments, sales commission, inventory expenses etc, and the other category is no operating expenses which is not eh result of the core activities of the company, like settlement of lawsuit, etc.

Depreciation

With time the new machinery and other components gets used and depreciation is the non cash transaction that is recorded as part of the lost value of such machinery and other related components. We cannot assign an accurate number for a machine to depreciate with time but it is an assumed figure. Depreciation is also included as part of expenses in income statement.

ALSO READ: What is Business Valuation and Types

Earnings before Tax (EBT)

Earnings before tax is the net income of the company before paying tax to the government. Below is the formula for Earnings before Tax (EBT):

Earning before Tax (EBT) = Revenue - expensesThis component does not include income tax to be paid by the company and is one of the important factors in income statement.

Net Income

Net income is defined by subtracting total expenses from Revenue. This is the actual figure, the company makes after removing all expenses (operating and non operating) and tax component as well.

Below is the formula for calculating net income:

Net Income = (Revenue + Gains or Other Income) - (Cost + Expenses + Income Tax)So all expenses, cost and income tax are subtracted from total revenue including gains as well for a given period to find net income of the company.

Similar to revenue, the net income of the company must increase with time for the business to be in a good financial condition.

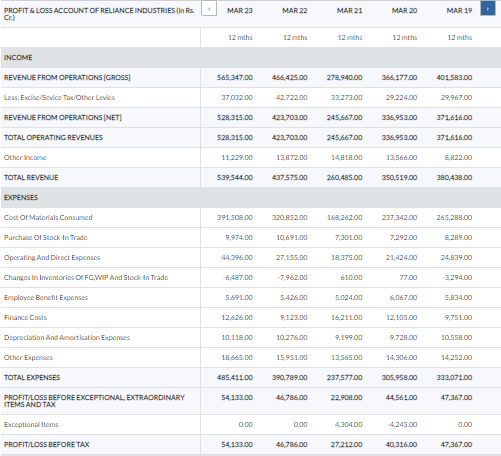

Income Statement Format with Example

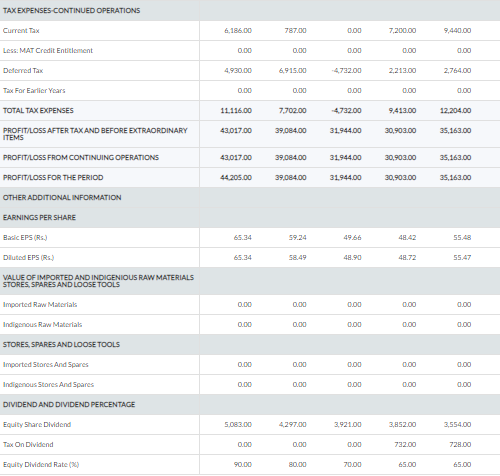

Below is the screenshot of the recent income statement of Reliance Industries to understand various components that include, Revenue, other income, costs, expenses, income tax, etc.

So above income statement example is divided in two parts to understand various components of the statement of Reliance Industries.

Income Statement vs Balance Sheet

Apart from Income Statement, we have another important financial statement which is balance sheet.

Balance sheet is also published on quarterly basis and mentions the total assets, equity and total liabilities of the company for a given period of time.

Assets are something that generates revenue for the company, like equipment, machines, etc, and liabilities are things that are expenses for the company like short term debt, long term debt, expenses, etc.

Total Assets should always be equal to Total Liabilities + Equity, that is why it is called balance Sheet:

Total Assets = Total Liabilities + Shareholder's EquityBelow is the difference between income statement and balance sheet:

| Income Statement | Balance Sheet |

|---|---|

| Mentions Revenue and Cost associated to operating and non operating activities | Mentions Assets, Liabilities and shareholder’s equity along with various components |

| It defines how a company performed during specific period | Balance Sheet reports what a company owns at specific date |

| Defines Operating and non operating revenue and expenses, along with income tax paid | Total Assets must balance the addition of total liabilities and equity |

| Total revenue is further divided into operating income and other income. Expenses are divided into cost of goods sold and other expenses | Assets are further divided as current and non current assets and same division is done for liabilities. Current Liabilities are the ones that needs to be paid within next 1 year |

Like Income Statement, Balance sheet is also an important financial statement that business owners and investors go through.

Assets must increase and liabilities must decrease with time for a company to be in a good financial condition.

Income Statement vs Cash flow Statement

Cash flow statement is the financial statement that actually records the inflows and outflows of cash from an organization for specific period. Since cash flow statement is more accurate to see the real cash coming inside the company, cash flow statement is the king of all financial statements.

You can easily make out whether the company’s net cash flow was positive or negative for a given quarter. It must be positive and increase with time for a company to be in a good financial condition.

Below is the difference between Income statement and cash flow statement:

| Income Statement | Cash Flow Statement |

|---|---|

| Records the revenue and expenses for carrying out business | Records the actual cash coming in and going out of the organization |

| Further division is done based on operating and non operating activities | Further division is done based on Cash from Operating activities, financial activities and investing activities |

| Revenue figures can contain payments that will be done in future, which is called accrual accounting | Cash figures only contains the ones received in cash on actual basis and does not include future payments to be received, so real cash cannot be manipulated |

| Revenue figures can be misleading since it follows accrual accounting, and we cannot reach to the actual number if company need to be liquidated or sold | Net cash flow can be easily obtained |

| Income Statement records depreciation | Cash flow statement does not record depreciation since it is not a cash transaction |

Conclusion

So to conclude, Income statement includes important factors such as revenue or sales, cost of goods sold (COGS), gross and net profits, gains and other expenses in a specific period of time. This statement is published on quarterly basis in India for all companies listed in exchanges, that helps business owners and investors to take decision based on the numbers.

Business owners always try to increase the revenue of the company while reducing the cost incurred in order to keep the financial health of the company stable.

Some more Reading:

- Equity Mutual Fund Taxation

- Benefits of Term Life Insurance

- Rs. 2000 SIP Returns in Sensex for 15 Years

Frequently Asked Questions

Is income statement same as P&L?

Yes Income statement and P&L or profit and loss statements are used interchangeably. Both these statements mention same set of parameters, where these parameters can be different based on their underlying business.

What are the two types of income statement?

Two types of income statement include – single step income statement and multi step income statement. Single step income statement are straight forward and does not contain many parameters, where as with the increase in reach of the company to global levels, some companies have to provide additional parameters in income statement as per regulatory information and hence they move to multi step income statement which includes additional parameters to be tracked.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.