Balance Sheet is one of the 3 financial statements apart from income statement and cash flow statement that defines the company’s financial health at a specific point of time. It includes various components like Assets (what company owns), Liabilities (what company owes) and shareholder equity (the amount remaining from investors). When asset are greater than liabilities than the company is considered to be in a good financial situation. Balance Sheet is used by investors and business owners to take decision about whether to invest in stock of the company or to increase assets and decrease some liabilities respectively.

Let us understand Balance Sheet in more detail.

What is Balance Sheet?

- Balance Sheet is one of the 3 financial statements of a company, other two are income statement and cash flow statement

- It defines the Assets, Liabilities and Shareholder’s equity at a specific point of time

- Assets are things that the company owns such as Cash and short term investments, total receivables, inventory, machinery, property, buildings, long term assets and other assets

- Liabilities are things that the company owes such as accounts payable, short term debt , long term debt, Deferred tax liabilities and other liabilities

- Shareholder equity is the difference between the assets and liabilities, and below is the formula for shareholder equity:

Shareholder Equity = Total Assets - Total Liabilities- Balance Sheet term is used so that the total assets must be equal to the sum of total liabilities and shareholder equity. Assets are mentioned on lest hand side while liabilities and equity are mentioned on right hand side and both sides must be balanced ina Balance Sheet

- It is an important document used by financial institutions as well to check the credit worthiness and provide loans to the company

- When assets value are higher than liabilities, there are more chances that the company will get their loan approved to carry out the business they are taking loan for.

ALSO READ: Top 6 Financial Ratios to Select Stocks in India

Balance Sheet Components

Let us now understand the components of Balance Sheet:

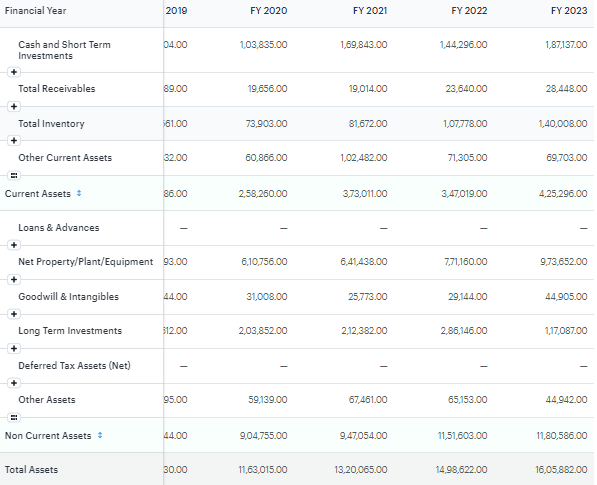

Assets

- Assets are things that company owns and can further be categorized as current assets and non current assets

- Current Assets are the assets that are cash or can be easily converted to cash and cash equivalents within next 12 months, like receivables, inventory, fixed deposits and other short term assets that can be liquidated

- Non current assets are the assets that cannot be liquidated within the next 12 months such as long term assets, property, buildings, equipment, patents, goodwills, etc.

- Assets are important part of Balance Sheet since it defines the amount the company owns currently, and must be higher than what company owes right now, that is liabilities

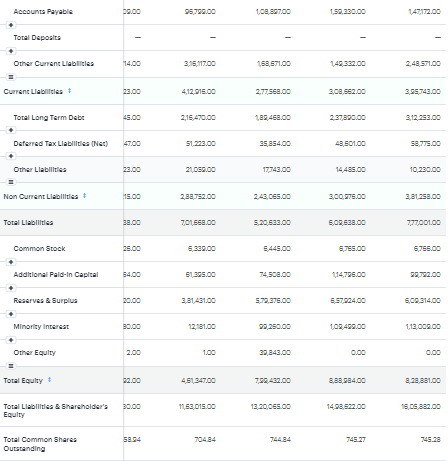

Liabilities

- Liabilities are things the company owes and can be further categorized as current liabilities and non current liabilities

- Current Liabilities are the liabilities that needs to be paid within the next 12 months such as accounts payable and other short term debt

- Non current liabilities are the liabilities for which due date is after 12 months which include long term debt, deferred taxes, etc.

- Current liabilities must be less than current assets which means that company will be able to at least cover the liabilities of next 12 months with the help of current assets that can be easily converted to cash

- Total liabilities less than total assets will be a good financial condition of a company

Shareholder’s Equity

- Shareholder equity is what is left after removing total liabilities from total assets

- A negative shareholder equity means that the liabilities are greater than assets which is not a good sign as far as financial health of the company is concerned

ALSO READ: What is Business Valuation

Format of Balance Sheet with Example

Below is the format of Balance Sheet with the example taken from Tickertape, mentioning various components of Balance Sheet:

Please note that not all companies will follow the same structure and format of balance sheet. Based on their areas of business, the format and components of balance sheet might differ.

Balance Sheet Formula

Below is the formula of Balance sheet including total assets, liabilities and shareholder equity:

Total Assets = Total Liabilities + Shareholder EquityNote that total assets must be equal to the sum of total liabilities and shareholder equity, that is why it is called balance sheet.

When the equity portion is negative, it means total liabilities are greater than total assets which is not a good sign for the company’s financial health.

Balance Sheet vs Income Statement

Balance sheet mainly focuses on mentioning parameters that the company owns and income statement mentions how the company performed during specific period of time.

Below are the differences between Balance Sheet and Income Statement:

| Balance Sheet | Income Statement |

|---|---|

| Mentions Assets, Liabilities and shareholder’s equity along with various components | Mentions Revenue and Cost associated to operating and non operating activities |

| Balance Sheet reports what a company owns at specific date | It defines how a company performed during specific period |

| Total Assets must balance the addition of total liabilities and equity | Defines Operating and non operating revenue and expenses, along with income tax paid |

| Assets are further divided as current and non current assets and same division is done for liabilities. Current Liabilities are the ones that needs to be paid within next 1 year | Total revenue is further divided into operating income and other income. Expenses are divided into cost of goods sold and other expenses |

Conclusion

So balance sheet is an important financial statement apart from income statement and cash flow statement that helps the investors to decide whether to invest in stocks of the company or not. It also helps the financial institutions to analyze the assets and liabilities of the company and decide whether to grant them loan for further business needs.

Multiple ratios can be obtained using balance sheet such as current ratio, quick ratio, Asset Turnover ratio, Debt-to-equity ratio, etc. while analyzing the balance sheet of a company.

Some more Reading:

- Zero Income Tax with Tax Rebate under Section 87A

- Top 9 Benefits of Term Life Insurance

- 6 Tax Saving Tips using Old Tax Regime

Frequently Asked Questions

What do you mean by balance sheet?

Balance Sheet is one of the financial statements that mentions what company owns and owes in the form of assets, liabilities and shareholder equity of the company at a given point of time. Assets must be higher than the liabilities for a company to be in a good financial condition.

What is the formula of balance sheet?

Balance Sheet formula is very simple, total assets must be equal to sum of total liabilities and shareholder equity:

Total Assets = Total Liabilities + Shareholder EquityIf shareholder equity is negative than total liabilities will be higher than total assets which is not a good sign for company’s financial health.

What is total liabilities?

Liabilities are things that the company owes which can be divided as current liabilities and non current liabilities. Current Liabilities are the liabilities that needs to be paid within the next 12 months such as accounts payable and other short term debt. Non current liabilities are the liabilities for which due date is after 12 months which include long term debt, deferred taxes, etc.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.