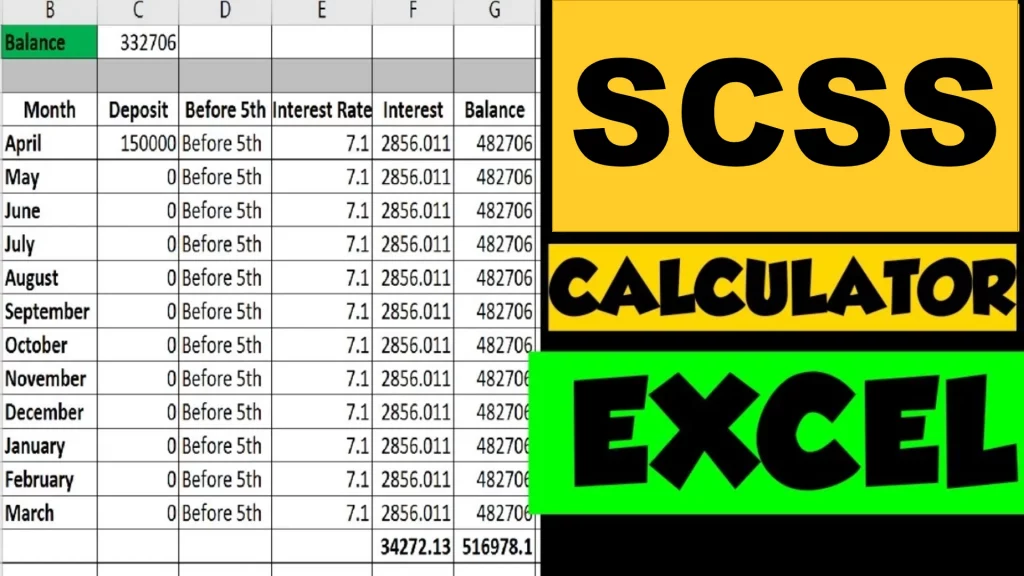

Click below button to download Senior Citizen Income Tax Calculator FY 2024-25 Excel (AY 2025-26). Once you provide details, you will be provided with link to download excel via Email. Also, read the instructions to use this Income Tax Excel Calculator. This excel calculator helps you to calculate income tax if you are salaried employee or business man.

Check out More online Calculators here including Income Tax, PPF, SIP, Home Loan Calculator and many more..

Note: This calculator is applicable for FY 2024-25 and AY 2025-26. There were some changes made in Budget 2024 in new tax regime mentioned below.

Instructions to use Senior Citizen Income Tax Calculator 2024-25 Excel:

- Download the Income Tax Calculator FY 2024-25 Excel on your device

- Provide Income as Gross Income for FY 2024-25

- Provide Investments including Standard Deduction, Section 80C investments, Section 80CCD(1B) investments and other tax saving options you are eligible for. Total amount of investments need to be entered. Standard Deduction of Rs. 50,000 is applicable for Employees.

- Enter TDS amount that is already deducted from your salary in financial year

- After providing all these parameters, income tax will be calculated based on Old and New Tax Regime

You can find more income tax calculation examples here

Now since you got the idea about how this excel calculator works, let’s see How to calculate Income Tax AY 2024-25 with the help of a video.

Senior Citizen Income Tax Calculation FY 2024-25 Video

Watch more Videos on YouTube Channel

Also in case you want to use Online income tax calculator use below link instead of using excel calculator:

New Tax Regime Changes in Budget 2024

Below are few changes made in Budget 2024applicable to new tax regime:

- Tax Rebate limit has been increased to Rs. 7 Lakh income with new tax regime. Which means if your income is up to 7 lakh and you choose new tax regime, you don’t have to pay any tax. This limit is still of Rs. 5 lakh with old tax regime for FY 2024-25

- Tax Slab Rates have been updated in new tax regime

- Standard Deduction will be now available in new tax regime as well, for FY 2024-25

So these were some of the important changes made for FY 2024-25.

Note that you will not get any other deductions except standard deduction in new tax regime. All other deductions are still available in old tax regime and new regime will be the default regime from FY 2024-25.

How this Senior Citizen Income Tax Calculator 2024-25 in Excel helps you?

- This Senior Citizen income tax calculator 2024-25 helps you to understand your income tax based on Old and New Tax Regime.

- Based on the calculations, you can choose which Tax regime you should choose. You should select tax regime based on which you’ll be paying less income tax.

- It is important to note that investment deductions are available only in Old Tax Regime.

- New Tax Regime does not allow you to claim any investment deductions to save income tax. This is because new tax regime are reduced tax slab rates.

- Only Standard Deduction is available in New Tax Regime for FY 2024-25

- In this way, the Tax calculator can help you to compare your tax outgo and by iteratively entering the investment amount, you can decide how much you can invest more to pay less income tax if selecting Old Tax Regime.

Income Tax Slab 2024-25

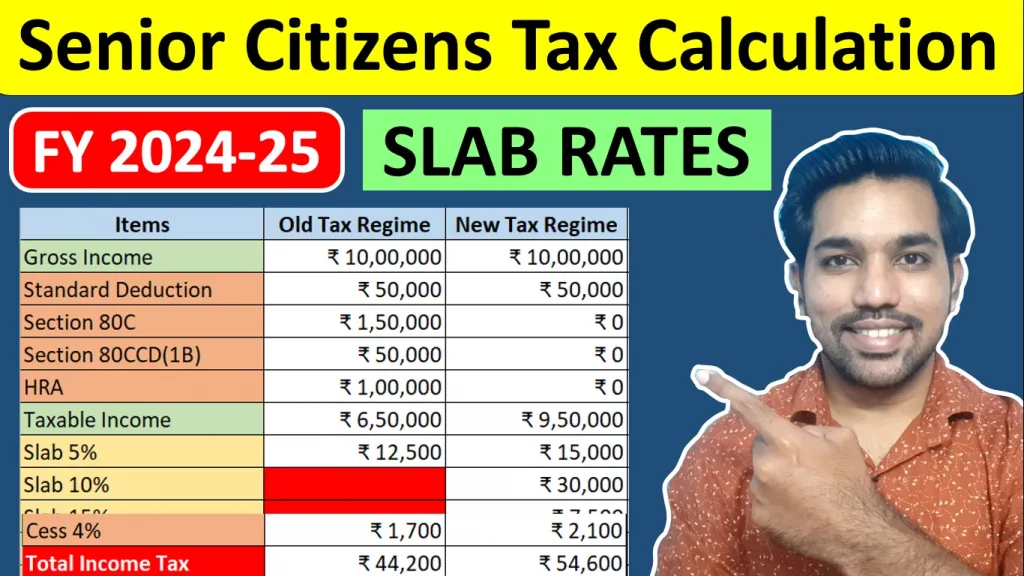

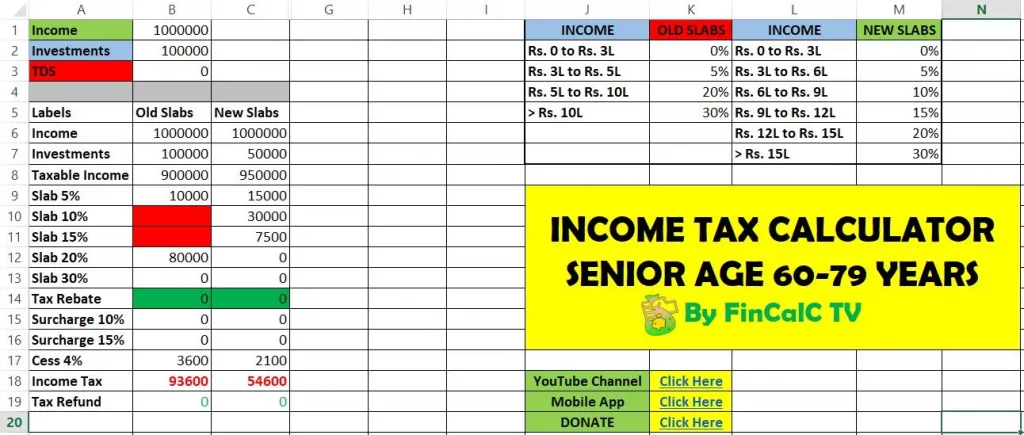

Below is the table showing Old Tax Regime and New Tax Regime 2024-25 Slab for Senior Citizens with age 60-79 years:

| Income | Old Tax Regime | Income | New Tax Regime |

|---|---|---|---|

| Rs. 0 to Rs. 3 Lacs | 0% | Rs. 0 to Rs. 3 Lacs | 0% |

| Rs. 3 Lacs to Rs. 5 Lacs | 5% | Rs. 3 to Rs. 6 Lacs | 5% |

| Rs. 5 Lacs to Rs. 10 Lacs | 20% | Rs. 6 to Rs. 9 Lacs | 10% |

| more than Rs. 10 Lacs | 30% | Rs. 9 to Rs. 12 Lacs | 15% |

| Rs. 12 to Rs. 15 Lacs | 20% | ||

| more than Rs. 15 Lacs | 30% |

As seen above, New Tax regime has reduced tax slab rates which means you will be paying less income tax, if you are not opting for any investment deductions.

In case you want to claim various deductions to save income tax, you might have to check how much income tax can be saved using Old Tax Regime.

ALSO READ: Income Tax Brackets in India

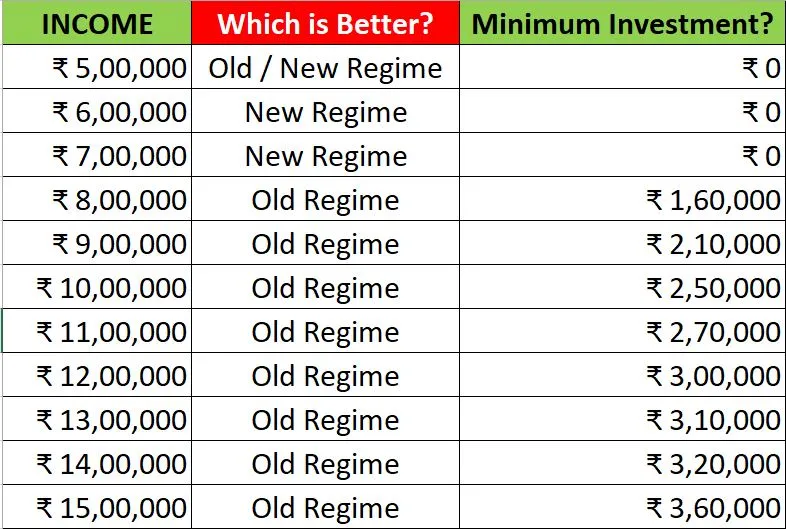

Which Tax Regime you should choose?

To answer this question, it depends on person to person. Every individual is having different incomes in a Financial Year.

And based on the investment options and deductions, you income tax can be calculated.

Below is the table of income tax regime you should select for income between Rs. 5 Lakh to Rs. 15 lakh in FY 2024-25 based on minimum investments. If you can make mentioned investments than go for old tax regime or else go for new tax regime:

So based on your income and investments, you can see which tax regime is better for you. If you can make deductions above Rs. 2 lakh by availing more deduction options, you can go for old tax regime.

If not than new tax regime would be better as it helps you pay less income tax with less or no deductions.

ALSO READ: How to Change Tax regime from new to old or vice versa

What is the new income tax calculation formula in Excel?

In Budget 2020, new tax regime was introduced with no deductions to be claimed. But Old tax regime is also applicable since than and you have the option to choose between these 2 options of old and new tax regime to pay income tax.

Using tax calculation formula in Excel (provided above), you can calculate tax liability based on below steps:

- 5% tax calculation on income between 2.5 to 5 lakh in old regimes. Formula will be 5% * 2.5 lakh / 100

- 10% tax calculation on income between 6 lakh to 9 lakh in new regime. Formula will be 10% * 3 lakh / 100

- Similarly for various slab rates and incomes, the tax calculation will be done based on such formula

- Finally cess of 4% will be applicable on the intermediate tax calculated

Are you eligible for Tax Rebate u/s 87A?

You will be eligible for Tax Rebate u/s 87A when your taxable income is below Rs. 5 lacs in FY 2024-25 with Old tax regime and below Rs. 7 Lacs with New Tax Regime.

Tax Rebate u/s 87A will be allowed in both Old and New Tax Regime.

According to new rule in Budget 2024, no income tax need to be paid on income up to Rs. 7 lakh in new tax regime. In old tax regime, the limit remains same of Rs. 5 lakh.

Example

Let’s say your Net Taxable Income equals Rs. 5 Lacs in FY 2024-25

Based on Old and New Tax Slab Rates, you are liable to pay Rs. 12,500 as Income Tax based on your Net Taxable Income.

But we also have Tax Rebate u/s 87A which provides us a maximum rebate of Rs. 12,500, thus making our Income Tax = Rs. 0.

Also if your income is Rs. 7 lakh and you choose new tax regime, your tax will be Rs. 25,000 according to new slab rates, but you also get tax rebate since income is within 7 lakh and you choose new tax regime, so no tax in this case for FY 2024-25.

How to pay ZERO Income Tax?

Using above trick of getting your Taxable income to below Rs. 5 lacs (old regime) and Rs. 7 lacs (new regime) in FY, you need not have to pay any income tax, and by making investments, you save for your future as well. So it’s a win-win situation.

This is possible only when your total income is up to 10-12 lacs in a financial year and you are able to use all available investment options present. If your income goes above this figure in FY, it becomes difficult to save maximum income tax. Again, you can check by yourself using the Income Tax Calculator in Excel I have provided above.

Note that you can reduce taxable income with old regime only and get it below 5 lakh, by using deductions. In new regime there are no deductions available except standard deduction so you cannot do much to get it below 7 lakh limit to get tax rebate.

Watch below video to know various tax saving options:

That’s it in this article about income tax calculator FY 2024-25 in excel. Comment your queries in case you have any. Make sure that you Subscribe to YouTube Channel for more Personal Finance Videos and Download Income Tax Calculator App “FinCalC” on your mobile.

Conclusion

You can easily download income tax calculator FY 2024-25 in excel using above form. Make sure that you watch the video at the start of this article to know how to use this tax calculator.

Some more Reading:

- How to File ITR on Salary

- How to Change Tax Regime from New to Old or Vice versa

- Section 80C Deduction List

- Rs. 2000 SIP Returns Calculation for 15 Years

Frequently Asked Questions

Standard Deduction available in New Tax Regime?

Yes standard deduction of Rs. 50,000 is made available in new tax regime from FY 2024-25. No other deductions are available in new tax regime

How much tax on 7 lakh with new tax regime?

Since we will get tax rebate on income up to Rs. 7 lakh with new tax regime, income tax will be Rs. 0 for FY 2024-25 on this income and new tax regime. Even with income = Rs. 7.5 lakh, you get standard deduction of Rs. 50,000 making taxable income = Rs. 7 lakh with new regime, making income tax as Rs. 0.

Use Income tax calculator for more details.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.