Many Senior Citizens are in need of SCSS Calculator Excel that provides them the calculator to calculate SCSS Interest for their deposits. This article provide you the required SCSS Calculator Excel with all other required information you should know about Senior Citizen Saving Scheme.

The Senior Citizens Savings Scheme (SCSS) is primarily for the senior citizens of India. The scheme offers a regular stream of income with the high safety and tax saving benefits. It is an excellent choice of investment for those over 60 years of age.

You can also Download SCSS Calculator Excel to calculate your interest in SCSS at the bottom of this article.

- SCSS Calculator Excel Video

- Why you should invest in SCSS

- Investment Amounts

- Eligibility Criteria

- Benefits of SCSS

- How to open SCSS Account

- Interest Rate on SCSS

- Income Tax saving using SCSS

- Banks applicable to open SCSS Account

- Tenure & Withdrawal

- Conclusion

- Some more Videos

- DOWNLOAD SCSS EXCEL CALCULATOR

- Frequently Asked Questions

- How can I open a senior citizen savings schemes account online?

- IS 80C applicable on senior citizen savings schemes?

- Can I open a senior citizen saving account with SBI Bank?

- What is the maximum age of senior citizen saving account opening?

- Can anyone open joint SCSS account with any family member?

- What is the eligibility criteria of joint senior citizen saving account?

SCSS Calculator Excel Video

Why you should invest in SCSS

Investing in SCSS is a good opportunity for senior citizens above 60 years to make money. This is an effective and long-term saving option which offers security and added features that are usually associated with any government-sponsored savings or investment scheme. These schemes are available through certified banks and post offices across India.

Investment Amounts

An individual can invest a maximum amount of Rs.30 lakh, individually or jointly in an SCSS account (in multiples of Rs.1,000). The amount invested in the scheme cannot exceed the money that has been received on retirement. Hence, the individual can invest either Rs.30 lakh or the amount received as a retirement benefit, whichever is lower. The account can be opened by cash for an amount below Rs.1 lakh and by cheque for an amount exceeding Rs.1 lakh.

Eligibility Criteria

Following people/groups are eligible to opt for SCSS

- Senior citizens of India aged 60 years or above.

- Retirees who have opted for the Voluntary Retirement Scheme (VRS) or Superannuation in the age bracket 55-60. Here the investment has to be done within a month of receiving the retirement benefits.

- Retired defense personnel with a minimum age of 50 years.

- HUFs and NRIs are not allowed to invest in this scheme.

Benefits of SCSS

- Safe and Reliable: This is an Indian government-sponsored investment scheme and hence is considered to be one the safest and most reliable investment options.

- Good returns: At 8.2% the return rate is very good as compared to a savings or FD account.

- Nomination: Nomination facility is available at the time of opening an SCSS account by means of submitting an application as part of Form C. This submission is also accompanied by the passbook to the Branch.

- Tax benefits: Tax deduction of up to Rs.1.5 lakh can be claimed under Section 80C of the Indian Tax Act, 1961.

- Flexible: The tenure of this investment scheme is flexible with an average tenure of 5 years which can be extended up to 3 additional years.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How to open SCSS Account

You can open a Senior Citizens Savings Scheme account at all India Post Offices. The interest earned from SCSS account is automatically credited to the investor’s linked savings account at the same post office. The wide reach of India Post ensures that the option of SCSS account is available to Indians across the country- even those located in the most remote parts.

Senior Citizen’s Application Form is available via the offline route at India Post Offices as well as via the online route. If you are planning to open your SCSS account at an India Post Office, you can download the SCSS application form from the official India Post website.

An SCSS account can be opened in any of the authorized banks or post office branch across India and following documents are required:

- Form A has to be filled for opening an SCSS Account.

- Identity proof like PAN card, Passport to be presented.

- Address proof such as Telephone bill, Aadhar card is mandatory.

- Document for proof of age is required. This could be in the form of a Passport, Senior Citizen Card, a Birth certificate issued by the Corporation or Registrar of Births and Deaths, Voter ID card, PAN card etc.

- 2 Passport size photographs.

All the above documents must be self-attested.

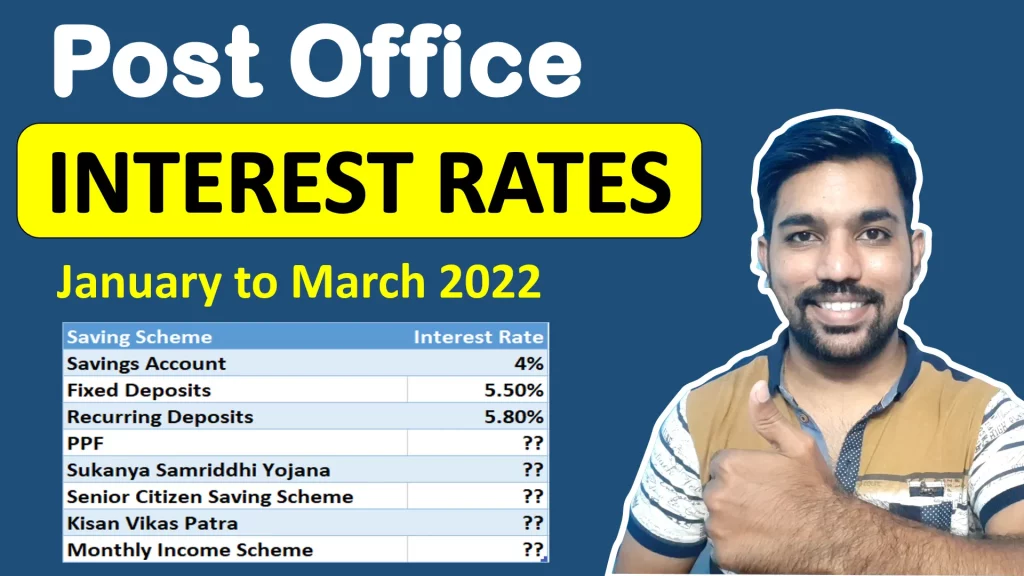

Interest Rate on SCSS

- Latest interest rate on SCSS for April to June 2025 is 8.2%

- Interest rates of SCSS is reviewed on quarterly basis by Government of India

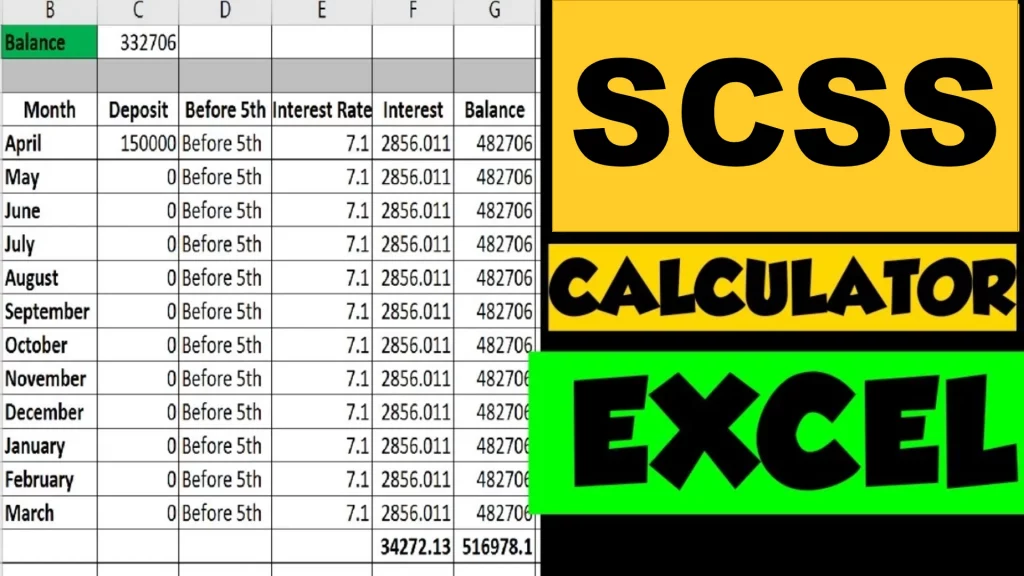

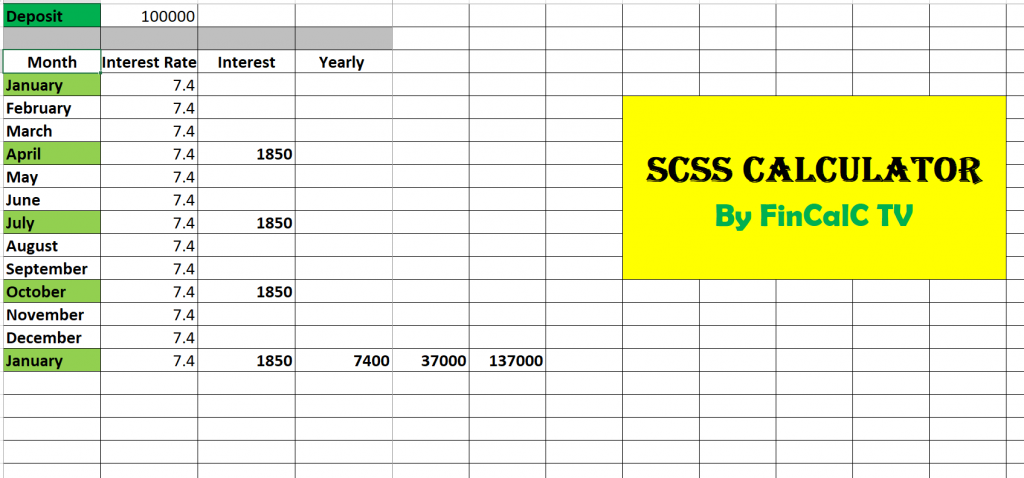

Below is the screenshot of the SCSS Calculator Excel with Interest calculation

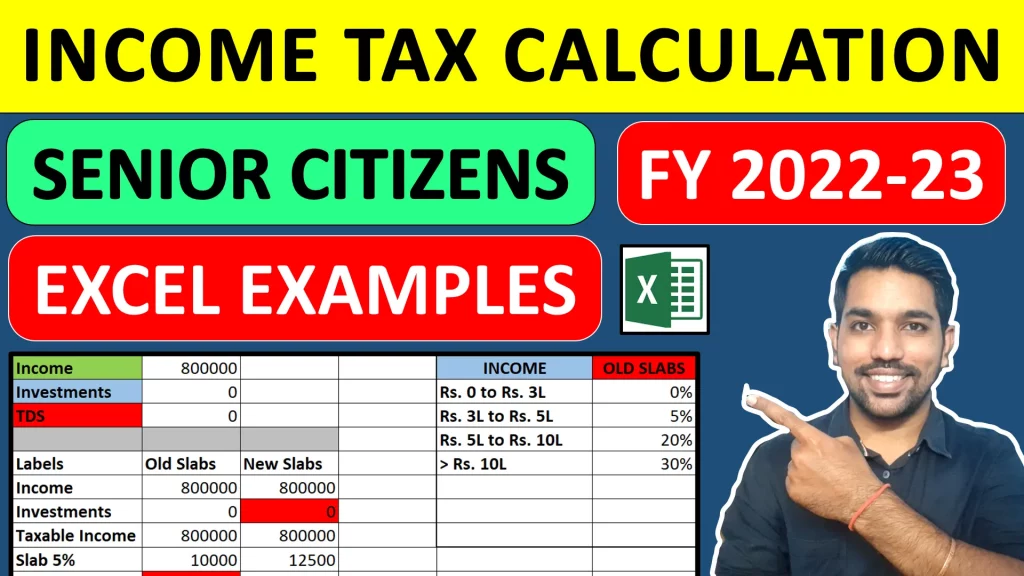

Income Tax saving using SCSS

You can claim a maximum of Rs. 1,50,000 in a FY under Section 80C, if you are investing in SCSS.

Senior Citizen Income Tax Calculation FY 2022-23 – Video

Banks applicable to open SCSS Account

Following are the banks where an SCSS account can be opened:

- Allahabad Bank

- Andhra bank

- Bank of Maharashtra

- Bank of Baroda

- Bank of India

- Corporation Bank

- Canara Bank

- Central Bank of India

- Dena Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Punjab National Bank

- State Bank of India

- Syndicate Bank

- UCO Bank

- Union Bank of India

- Vijaya Bank

- ICICI Bank

Tenure & Withdrawal

The tenure of this scheme is 5 years with the option to extend it for 3 more years. In order to extend the scheme for another 3 years after the completion of the 5-year tenure, the investor is required to submit the duly filled Form B for the extension of the scheme. Only one extension is allowed, and such extended accounts can be closed after one year of extension without any penalty.

Premature withdrawals are allowed but only after a year of opening an account. If the closure of the account takes place after one year but before the end of 2 years, 1.5% of the deposit is deducted in the form of pre-mature withdrawal charges. Upon closure of the account after 2 years an amount equal to 1% of the deposit shall be deducted as charges.

In the event of the death of the depositor, no charges or penalty is levied for the premature closure of the account.

Conclusion

SCSS is a very good scheme for senior citizens who want a decent risk free return on a corpus fund. At 8.2% interest rate and an investment amount of Rs. 30 lakhs, the monthly income is stated to be Rs 20,500 per month for each investor.

Some more Videos

DOWNLOAD SCSS EXCEL CALCULATOR

Download SCSS Calculator Excel using above link.

Frequently Asked Questions

How can I open a senior citizen savings schemes account online?

In order to open a SCSS account, the customer must visit the post office or bank branch and fill up the related form. The same form should be attached with KYC documents, age proof, ID proof, Address proof and cheque for deposit amount.

IS 80C applicable on senior citizen savings schemes?

Yes, investments made in SCSS are eligible for income tax deduction benefits under the Section 80C of Income Tax Act, 1961. Maximum of Rs. 1,50,000 can be claimed in a Financial Year.

Can I open a senior citizen saving account with SBI Bank?

Of course, any senior citizen can open a senior citizen savings account with banks such as the State Bank of India. However, according to SBI’s guidelines, a depositor can hold two or more SCSS accounts only if the deposits in all accounts taken together do not exceed Rs.30 lakh.

What is the maximum age of senior citizen saving account opening?

Any individual, above the age of 60, can open a Senior citizen savings account accompanied by all the required documents.

Can anyone open joint SCSS account with any family member?

A joint SCSS account can be opened by investing maximum Rs. 30 lakh (in the multiples of Rs.1000) only with the spouse.

What is the eligibility criteria of joint senior citizen saving account?

While opening a joint SCSS account, the age of first depositor is supposed to be above 60 years. However, there is no age limit for the second applicant. The joint account can be opened only with the spouse.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

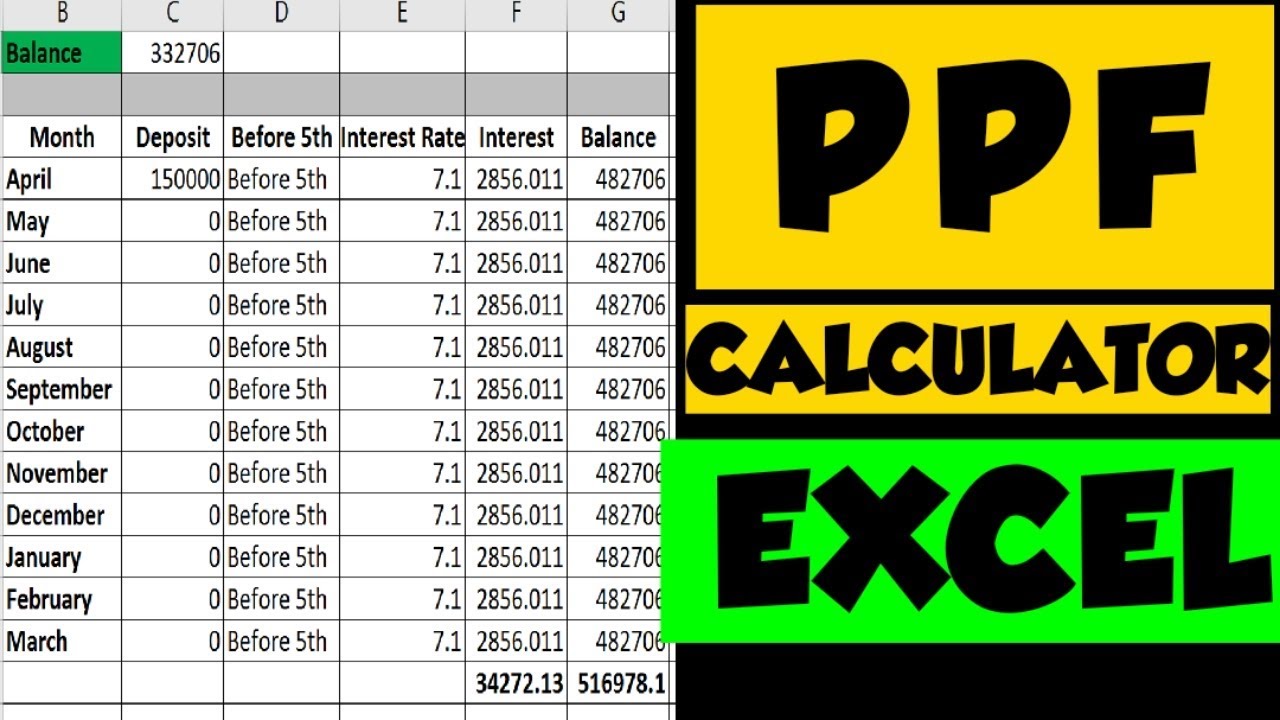

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

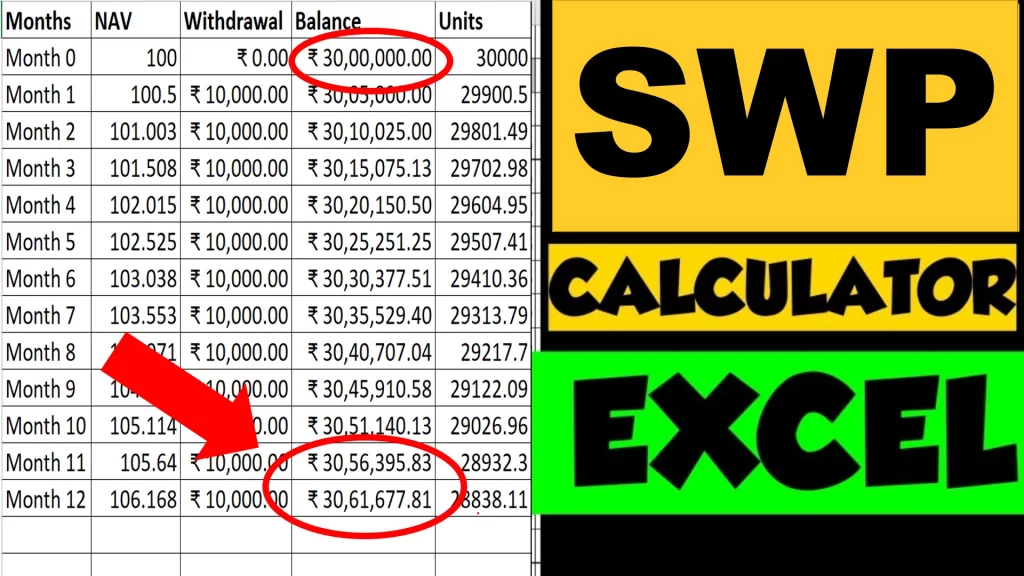

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.