What is the Ideal Portfolio of Mutual Funds that you should invest in is the most common question. You should try to diversify the investments across various mutual fund category with respect to sector, industry or market capitalization. You can simply invest in Nifty 500 (Top 500 companies in NSE) if you are a beginner based on your long term goal, or simply choose midcap or small cap index mutual fund to take extra risk. For a conservative investor, it is better to allocate some assets to debt mutual fund. The ideal number of mutual funds in your portfolio must be between 3 to 5 mutual funds.

Let us understand more about building the ideal Portfolio of Mutual Funds.

- What is Portfolio of Mutual Funds?

- How to Build Portfolio of Mutual Funds?

- How many Mutual funds should I have in a portfolio?

- What is a good diversified mutual fund portfolio?

- How do I choose the funds for my portfolio?

- How much of my portfolio should be mutual funds?

- What is a 70 30 investment strategy?

- Conclusion

What is Portfolio of Mutual Funds?

- Portfolio of Mutual Funds means having a list of mutual funds that you invest in one time or regularly with the help of SIP (Systematic Investment Plan)

- You need to first decide in which mutual funds you will invest in based on your goals and risk appetite and accordingly allocate the assets in the next step, followed by monitoring of these funds every 6 months or 1 year

- List of mutual funds whether it is Equity Mutual Funds or Debt Mutual Funds, will make up your Portfolio of Mutual Funds

- One of the best rules to allocate the asset to equity mutual fund is to subtract your age from 100. So let’s say your age is 30 years and you want to invest in equity mutual funds, your investment allocation to equities must be : 100 – 30 = 70%

- With above formula for equity asset allocation, with increase in your age, the allocation to equity mutual funds will decrease and hence this is ideal for those investors who don’t want to lose money when they move towards their retirement phase

ALSO READ: Types of Mutual Funds in India

How to Build Portfolio of Mutual Funds?

It is very important to build the Portfolio of Mutual Funds based on your goals and risk appetite. Below are the steps to build Portfolio of Mutual Funds:

- Finalize your financial goals which can be buying a new car or house, planning for vacation after 3 years, children’s higher education after 15 years, etc.

- Diversification which means investing in various sectors of mutual funds and not putting all eggs in one basket is important to avoid losing your hard earned money in one investment

- Based on the tenure of goals, you need to select the mutual funds along with the risk associated with them

- Equity mutual funds have high risk compared to debt mutual funds, but also provide high returns due to high risks in long term

- So for your long term goals of at least 5 years, such as children’s higher education or buying a new house after 7 years, you can select equity mutual funds. If you are not aware about which equity fund you should invest in, simply invest in Index Mutual Funds that invest in top companies in India based on market capitalization

- For medium term goals between 3 to 5 years, you can opt for Hybrid Mutual Funds that invest in a mix of Equity and Debt mutual funds. These funds come if 2 types – aggressive hybrid funds that have more allocation to equity with good returns and conservative hybrid funds that have more allocation to debt and money market instruments with moderate returns

- For short term goals up to 3 years, you should consider Debt mutual funds due to their low risk, and may be invest in Liquid Mutual Funds that have very low risk and gives better returns than Bank’s savings Account

So above are few points to consider while building a Portfolio of Mutual Funds based on financial goals, tenure and risk appetite.

Also for very short term goals which need to be achieved within a year, it is better to invest via Recurring Deposits (RD), in which case your principal amount will be safe and you’ll gain interest on every month deposits. In such very short term goals, protecting the capital must be of utmost importance and mutual funds are not good investments for such short term goals.

How many Mutual funds should I have in a portfolio?

You should not exceed more than 5 mutual funds anytime during your investment journey in your mutual fund investment portfolio. While chasing for good returns and the next best mutual fund, many investors tend to increase the number of mutual funds in their portfolio, not realizing that over diversification is also not good.

Having more than 5 mutual funds will make your investments common in multiple mutual funds, which means when one mutual fund is going down, the other mutual fund is also going down due to market conditions and similar underlying stocks in those mutual funds.

It is also better to have mix of equity and debt mutual funds, since the downfall in equities is countered by increase in debt interest rates and vice versa, to have a balanced portfolio of mutual fund investment.

What is a good diversified mutual fund portfolio?

Good diversified mutual fund portfolio should include equity mutual funds based on your tenure of financial goals along with risk appetite, debt mutual funds for your medium term goals and fixed income assets such as Fixed Deposits or Recurring Deposits for your very short term goals.

It is important that you diversify your mutual fund portfolio, and not put all eggs in one basket to avoid losses from market trends during downfall.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How do I choose the funds for my portfolio?

One of the best rules while investing in mutual funds is using your age and subtracting it from 100 to know the equity allocation to in mutual funds. Equity mutual funds have high risk compared to debt mutual funds, and this risks can be taken when you are starting to invest and not during your retirement phase.

- So if you age is 25 years, 100 – 25 = 75% allocation in your total mutual fund amount can be in equity mutual funds

- Rest 25% can be either in Debt mutual Funds that include Liquid funds, Low duration funds, Bonds, Fixed Deposits, etc.

- While choosing 75% of the equity mutual funds, you can decide based on goals and risk appetite, whether to select large cap, mid cap or small cap mutual funds

- Small cap mutual funds have the highest risk followed by mid cap and large cap mutual funds

- Large cap mutual funds invest in giants and well known companies that have high market capitalization (amount invested by people) which reduces the risk to greater extent compared to small cap companies that have high potential to grow based on industry they belong to and the demand for their products and services

- It is important that you do not exceed more than 5 mutual funds while allocating assets

- So you can select 2 index funds from large cap and mid / small cap category, 2 active mutual funds of your choice – mid and small caps if you can take more risk or large and mid cap if you want to take less risk, and 1 debt mutual fund to be conservative

In this way you can choose the funds based on your portfolio.

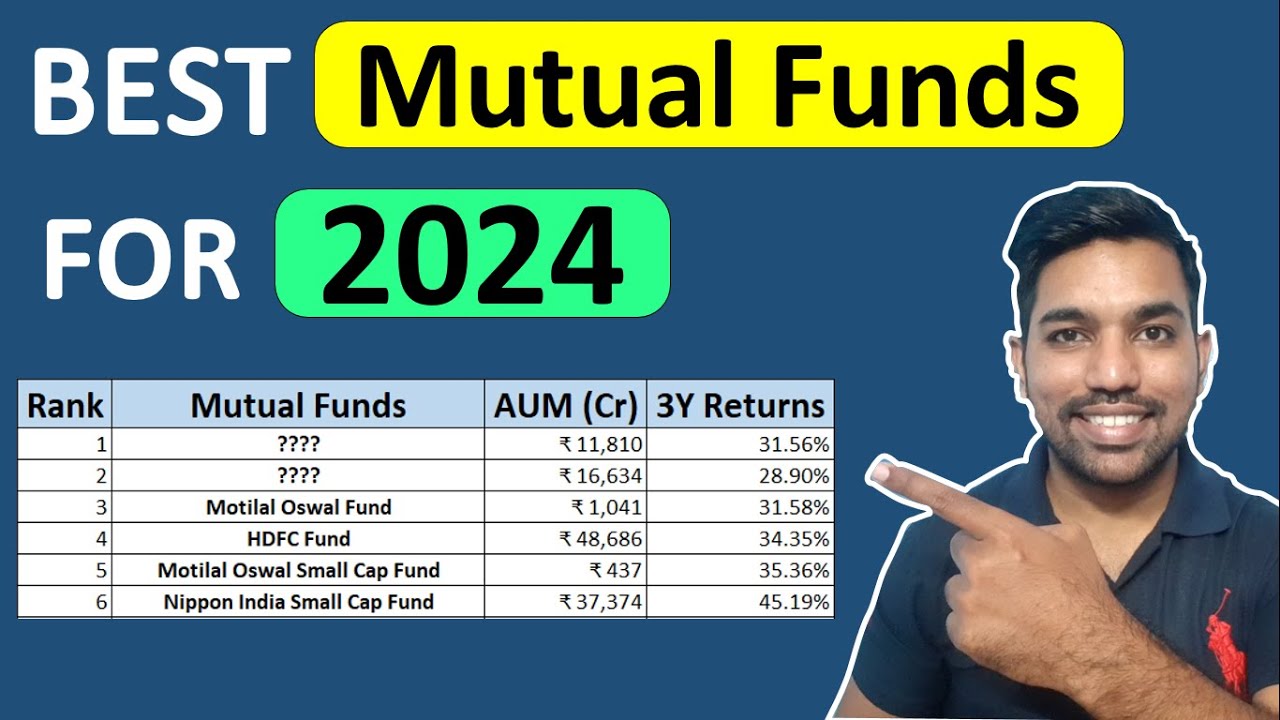

Watch below video to know some Best Mutual Funds

Best Mutual Funds for 2024 Video

Watch more Videos on YouTube Channel

How much of my portfolio should be mutual funds?

One of the best rules is using your age to decide the equity mutual funds allocation.

You can use below formula:

Allocation of Equity Mutual Funds = 100 - Your AgeUsing above formula, with the increase in your age, the allocation to equity mutual funds will decrease since it is required to be risk free when you reach retirement phase.

The remaining allocation can be either done if debt mutual funds or fixed income assets. Senior Citizens can also opt for SCSS (Senior Citizens Saving Scheme) which is a Post Office scheme for regular income.

ALSO READ: Post Office Latest Interest Rates for all Schemes

What is a 70 30 investment strategy?

70/30 Investment Strategy involves investing 70% of your assets in equities and rest 30% in Debt. This is one of the ideal allocation for age group between 20 to 50 years. But if you are planning for retirement after 50 years, you would want to decrease the equity allocation and increase the debt allocation to be more risk averse and conservative.

Conclusion

So building a Portfolio of Mutual Funds involves assessing your goals, tenure and risk appetite. Equity mutual funds are best suited for long term financial goals of at least 5 to 7 years as they tend to perform well for such durations with better returns.

If you are a conservative investor, you can opt for debt mutual funds for risk aversion for your short to medium term goals of up to 5 years. Also, your age plays important role here. Starting early is good with equity mutual funds over longer run to get better returns and during your retirement phase, you should decrease the allocation to equity mutual funds and have more funds allocated to debt or fixed income assets.

Some more Reading:

- How to Start SIP Online in Mutual Funds

- What is Sector and Thematic Mutual Funds

- What is Life Term Insurance & Benefits

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.