Liquid Mutual Funds are the type of debt funds that provide decent returns, high liquidity, and safety of your capital invested. These funds invest in debt instruments like commercial papers, treasury bills, etc. with maturity period of within 91 days for short duration. That is why these funds are called short term fixed income generating mutual funds that tries to provide fixed income with the help of returns from debt instruments.

Let us now understand more about Liquid Mutual Funds in detail.

What is Liquid Mutual Funds?

- Liquid Mutual Funds are the type of Debt Mutual Funds that invest in safe instruments with maturity of within 91 days

- The debt instruments can be commercial papers, treasury bills (T-bills) and other money market instruments

- These funds usually invest in high quality, high credit rating instruments that can provide fixed income in the form of interests

- The maturity of these instruments are within 91 days so that the underlying products are not impacted by interest rates movement which might impact the returns from liquid funds

- Liquid Mutual Funds usually provide returns between 5% to 7% annually, and are considered to be better option than keeping the money idle in savings account which gives 3% to 4% interest

- Also, liquid funds can be the best alternative to Fixed Deposits to earn decent returns with high liquidity

- You can withdraw from Liquid Mutual Funds anytime you want based on your requirements

Let us now understand how Liquid funds work

How Liquid Mutual Funds Work?

- Since Liquid Mutual funds invests in debt instruments having within 91 days of maturity, they are less risky in nature

- The type of instruments in which these funds invest in are high credit rating instruments which rarely makes any default on interest payment on borrowoed capital

- The money invested by you as an investor is provided to these debt instruments of companies who promise returns at predefined rate of interest

- The fund manager allocates the total assets to similar debt instruments, with the aim of safety of your capital and get fixed income with the help of interest earned

- Once the maturity of the debt instrument is complete, the interest is earned on the invested capital and the fund manager moves on to other products to keep you invested for better returns than savings account interest

- That is why Liquid Mutual funds are low risk in nature compared to Equity mutual funds

Benefits of Liquid Mutual Funds

There are multiple Benefits of Liquid Funds:

- Low Risk: Since Liquid Mutual Funds invests in debt instruments that have maturity period of within 91 days, these are low risk in nature. The debt instruments are not impacted by the interest rate movement cycles due to their low duration term, and hence are less risky compared to equity funds

- Better Returns: Liquid funds provide better returns compared to interest earned in your savings account. You get anywhere between 5% to 7% annually, which is good compared to 3% returns in savings account. Also these funds are better alternatives for fixed deposits in terms of liquidity and returns earned

- Systematic Transfer: One of the best strategy is to invest lump sum investment in liquid mutual funds and start STP (Systematic Transfer Plan) to equity mutual fund. In this way you’ll earn better interest from liquid funds and at the same time invest in equity funds systematically every month to get Rupee cost averaging

ALSO READ: Rs. 1000 SIP Returns Calculation for 15 Years

Types of Money Market Instruments

While you are investing in liquid mutual funds, you should know the various types of money market instruments as well. These are mentioned below:

- Certificate of Deposits (CD): These are similar to fixed deposits that are provided by some commercial banks. The only difference between fixed deposits and certificate of deposits is that in CD you cannot redeem units before maturity period, where as in FD you can break it to remove funds in case you need emergency funds.

- Treasury Bills (T-bills): T-bills are issued by Government of India to raise money for short term of up to 365 days. T bills are one of the safest debt instruments as they are backed by Government. But it also provides less returns compared to other instruments

- Commercial Paper (CPs): CPs are issued by companies and financial institutions which have high credit rating. High credit rating meaning the company is capable to pay back the principal and interest amounts as promised, so the chances of defaulting is less.

So these are some of the money market instruments. Liquid funds might invest in some of them provided their maturity period is within 91 days. You can read more about money market mutual funds here.

Best Liquid Mutual Funds

Let us now see some of the best liquid mutual funds:

- Axis Liquid Fund

- Aditya Birla Sun Life Liquid Fund

- Quant Liquid Fund

- Mahindra Manulife Liquid Fund

- PGIM India Liquid Fund

Please note that these are some best liquid mutual funds that provided decent returns in past compared to savings account. It does not guarantee same returns in future. But these are not recommendations. It is important to seek financial advisor for better consulting while taking important financial decisions.

You can analyze these mutual funds from your side to see their portfolio and other factors.

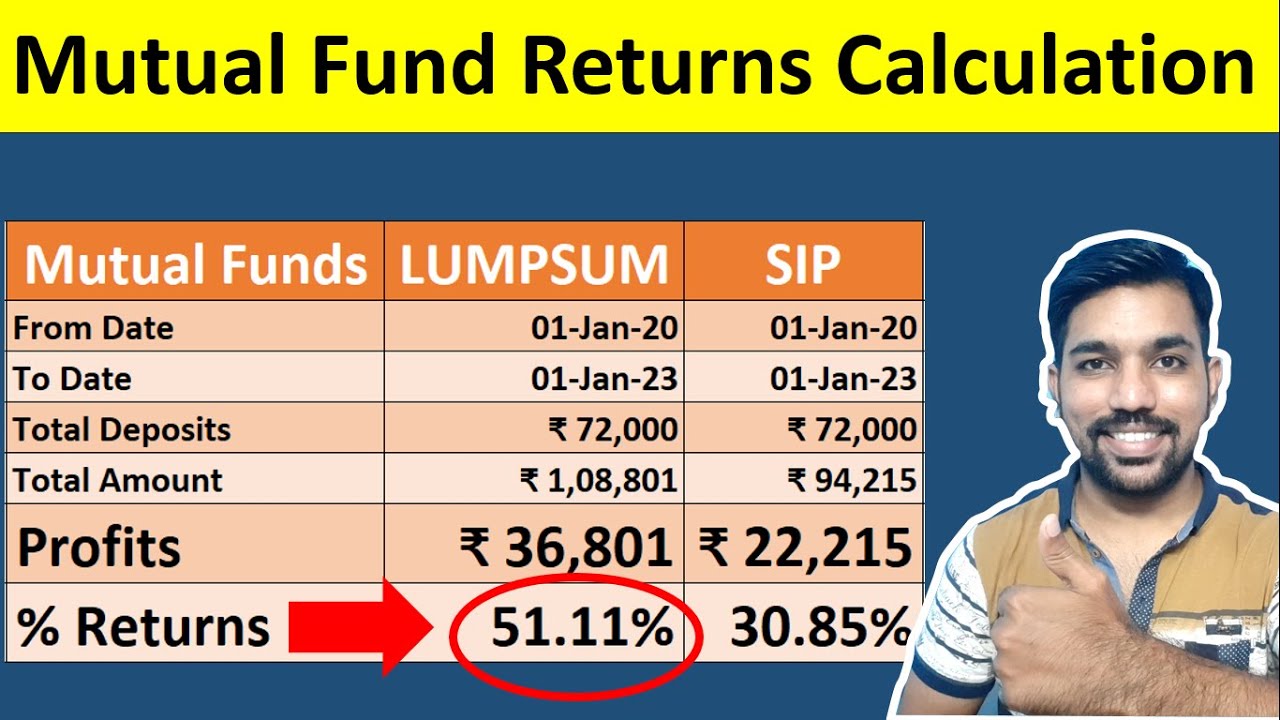

Lump sum Investment Mutual Fund Returns Calculation Video

Below is the video on mutual fund returns for lump sum investments:

Watch more Videos on YouTube Channel

Taxation on Liquid Mutual Funds

Capital gains from Liquid Mutual Funds are taxed similar to debt mutual funds.

After 1st April 2023, both STCG and LTCG will be taxed as per your slab rates after adding profits from Debt Mutual Funds or Liquid Funds in your income. This taxation is purely for Debt Funds, which have less than 35% allocation in equity.

Since liquid funds have less than 35% allocation in equity, the profits you make will be added in your income and taxed as per your income tax slab rates, irrespective of the holding period.

Conclusion

So Liquid Mutual funds are best mutual funds if you are looking to park your idle money from savings account to get decent returns and safety of your capital as well. These mutual funds invest in low risk, high credit rating debt instruments that provide fixed income with short maturity periods within 91 days.

Liquid funds can also be considered better alternative for fixed deposits in terms of liquidity and returns.

Some more Reading

Frequently Asked Questions

Is liquid fund better than FD?

Liquid fund can be considered as an alternative for FD or fixed deposits, since these funds provide decent returns and liquidity similar to fixed deposits. The only difference is in fixed deposits you know how much interest amount you can get on principal amount after the end of tenure, but in liquid fund transparency is not available, and the interest rate might slightly differ based on debt instrument the liquid fund invests in.

Is it safe to invest in liquid funds?

Liquid funds are low risk in nature and they invest in debt instruments with less than 91 days maturity period. These cannot be considered as 100% safe but are the safest mutual funds in all types of mutual funds.

Are liquid funds 100% safe?

No, liquid funds cannot be considered 100% safe but has low risk compared to other mutual funds.

Is liquid fund tax free?

No, you need to pay tax on capital gains from liquid funds . The profits you make will be be added to your income and taxed as per your income tax slab rates

Is SIP allowed in liquid funds?

You you can start SIP (Systematic Investment Plan) in liquid funds. The best strategy would be to invest lump sum amount in liquid fund and start STP (Systematic Transfer Plan) in equity funds to achieve your long term financial goals.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for new FY 2024-25 and previous FY 2023-24

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.