When you are looking to buy a new house, Fixed vs Floating Home Loan Interest rates are the two options you have to select from, while taking a home loan. Fixed Interest rate home loan simply means the interest rate on your home loan will be fixed throughout the tenure, but you pay penalty in case you want to make prepayments. On other hand, floating interest rate home loan helps your interest rate to change based on the benchmark rate that the bank is following, thus either increasing or decreasing the interest amount you pay back to bank.

Which is better between fixed vs floating home loan interest rate? Let us understand more in detail.

What is Fixed Interest Rate Home Loan

Below are some key points to remember about fixed interest rate home loan:

- The fixed interest rate home loan is the type of home loan in which case the interest rate of your home loan will be fixed throughout the tenure of loan

- So let’s say, if your rate of interest is 10%, this interest rate on home loan will be fixed for a tenure of let’s say 10 years while you are paying your Home Loan EMIs

- The tenure of loan to be set depends on you and accordingly you can calculate the Loan EMI based on the tenure and interest rate of home loan

- Higher the tenure or interest rate will make your home loam EMI costly, thus you have to set the tenure accordingly, as setting of interest rate is not controlled by you

- Fixed interest rate for home loans are 1-2.5% higher compared to floating interest rates, since this interest rate will not be changed in upcoming years for you

- This rate is higher since the banks want to assure that their income is not impacted due to change in interest rates of home loans

- It is important to note that you have to pay some penalty if you want to make home loan prepayments while you are on fixed interest rate home loan, to reduce the tenure and save some interest amount

Let us now understand floating interest rate home loan

What is Floating Interest Rate Home Loan

Below are some key points to understand floating interest rate home loan:

- Floating interest rate home loan is the type of home loan where your interest rate can change based on the repo rate of RBI

- If repo rate of RBI increases, you home loan interest rate also increases, thus increasing the tenure by default

- And if the repo rate decreases, you home loan interest rate also decreases in floating interest rate home loans

- Note that most of the times the interest rate only goes upwards and rarely it comes down, so don’t set any expectations for reduction in existing home loan interest rates frequently

- Home loan tenure is increased or decreased by default if there is any change in floating interest rate. This is obvious since banks cannot increase the EMI amount without customer’s consent when the interest rate increases.

- A reset date is set usually to update the interest rate, which is mostly done on quarterly basis from the start of your home loan EMIs

- Floating Interest Rate allows you to make home loan prepayments without any penalties

- This floating Interest rate home loans have low interest rate compared to fixed interest rate home loan, since banks expect this rate to move up (or down) based on external benchmark rate – usually linked to RBI repo rate

ALSO READ: 7 Home Loan Mistakes to avoid

Fixed vs Floating Home Loan Interest Rates Differences

Below are the differences between fixed and floating interest rates home loan:

| Fixed Interest Rate Home Loan | Floating Interest Rate Home Loan |

|---|---|

| Interest rate is fixed throughout home loan tenure | Interest rate varies based on the external benchmark rate |

| The interest rate is 1-2.5% higher compared to floating interest rate | Floating interest rates are lower compared to fixed interest rates, subjected to go up based on RBI repo rate |

| Home loan Prepayments will have some extra cost to be paid | There is no penalty on home loan prepayments in floating interest rates |

| Fixed interest rate helps you to know the total interest you will pay to bank | The total interest amount you have to pay to bank will vary based on the change in interest rate |

| Budgeting and savings for other financial goals is simple | Savings for other financial goals is difficult due to possible change in interest rates |

| Tenure remains fixed since interest rate is fixed | Tenure can increase with increase in interest rate of home loans |

Fixed vs Floating Interest Rate – Which is Better?

Based on above mentioned points, floating interest rate is better than fixed interest rate when you loan tenure is more than 5 years, below are some points why floating interest rate is better:

Why Floating Home Loan Interest Rate is Better?

- The floating interest rate is lower compared to fixed interest rate, almost 1-2.5% lower

- Even though floating interest rate increases with time, maximum of interest amount is taken from you during initial stages of home loan when the interest rate might be lower than fixed interest rate

- For long tenure of more than 5 years, it takes time for floating rate to go above the fixed rate home loans

- You can make home loan prepayments without any penalties

- Floating Home loan interest rate is better for people taking loans for longer tenure for more than 5 years

Why Fixed Home Loan Interest Rate is Better?

- Important factor about going for fixed interest rate is paying fixed interest amount for specific tenure

- The interest rate does not increase thus keeping the tenure fixed, even when RBI repo rate increases

- Fixed interest rate is better for people taking short term home loan with tenure of less than 5 years to keep the interest rate fixed

- Also, if you don’t bother about making home loan prepayments, than fixed interest rate home loan is better for you

Let us now understand home loan prepayments examples with below video

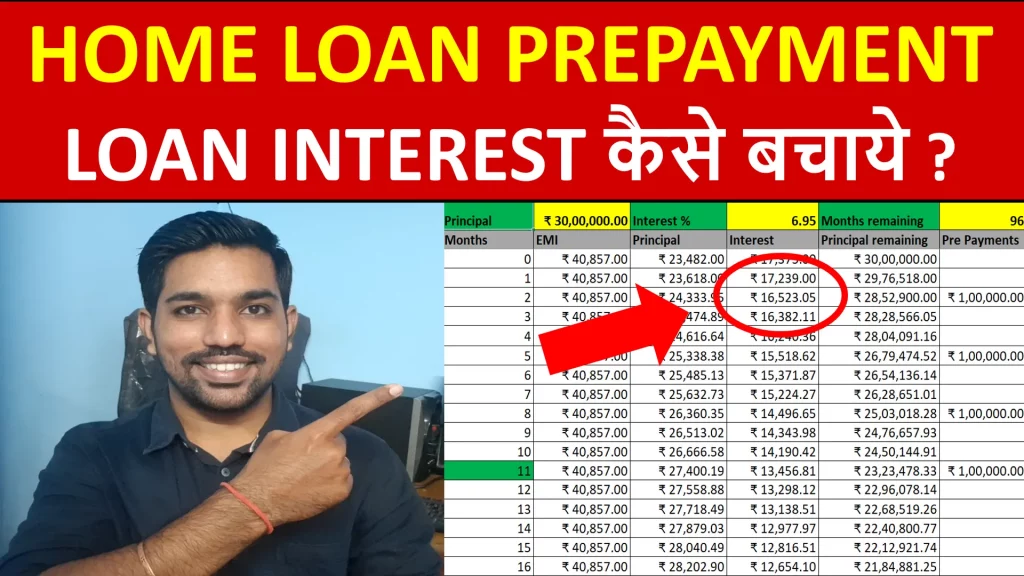

Video – Home Loan Prepayments to Save Interest Amount

Home loan prepayment is the process to reduce your principal remaining balance in home loan, so that you save your interest amount and reduce loan tenure. It helps you to close loan before time and save for other financial goals.

Watch below video to understand home loan prepayments:

Watch more Videos on YouTube Channel

As seen in above video, home loan prepayments can help you to save interest amount and reduce tenure.

It is important to note that you can make prepayments in floating interest rate home loan without any extra costs, where as you need to pay some penalty in foxed interest rate home loan while making prepayments, since banks do not expect prepayments from you in fixed interest rate home loan.

Some more Reading:

Frequently Asked Questions

Which is better fixed or floating interest rate for home loan?

Floating interest rate is better as it provides low interest rate compared to fixed interest rate home loan. Also, floating interest rate helps you to make home loan prepayments without any extra costs incurred.

Why is floating-rate better than fixed rate?

Floating rate home loans are better due to lower interest rates and the capability of making prepayments without any extra costs makes floating rate loan better than fixed rate. On other hand, Fixed rate home loans have higher interest rate and involves penalties while making prepayments.

Should I take floating-rate or fixed rate mortgage?

If you are first time home buyer and going for home loan, floating rate mortgage is better for you, since you can make prepayments and reduce the tenure as well based on your affordability. If you are not interested in making prepayments, and want to keep the loan tenure as it is with fixed interest amount to be paid, than go for fixed rate mortgage or home loan.

What are the disadvantages of a floating interest rate?

Floating interest rate can increase within a small span of time based on the increase in repo rate by RBI. We have seen between Dec 2021 to ay 2022 the increase of floating interest rates from 6.9% to 9.5%, which was done within a span of 6 months, and this is the major disadvantage to floating interest rates, which will increase the home loan tenure and also the interest amount you have to pay to bank.

Save Home Loan Interest Amount!

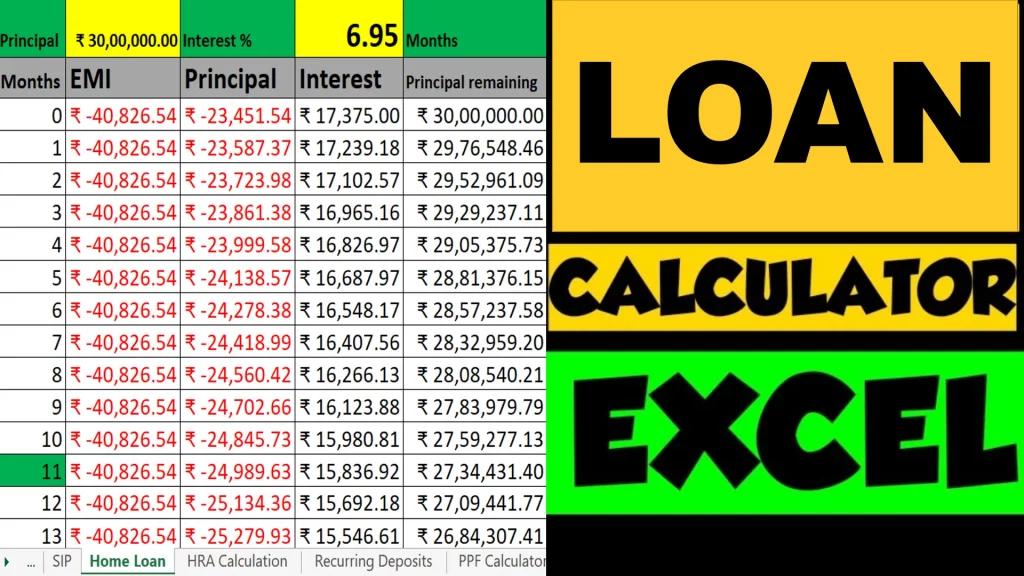

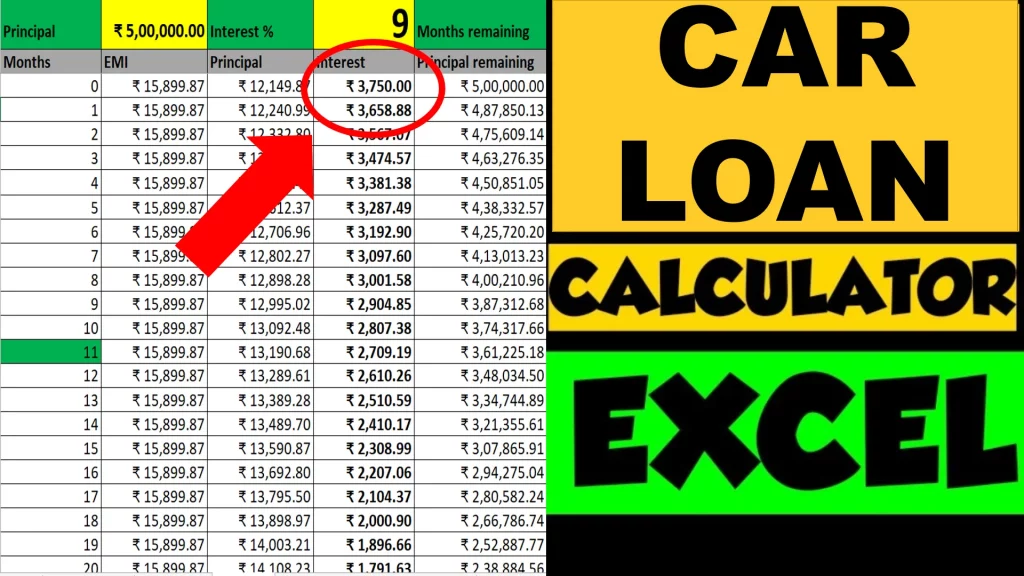

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.