I have already explained magic of compounding in PPF account on my YouTube Channel videos but more questions I get from video comments are what if we extend PPF account after 15 years and continue with deposits for 20 years or 25 years? Is there any PPF Interest Calculator to help us calculate interest for such period? Yes, we have!

PPF or Public Provident Fund is a Government backed saving scheme, with the lock-in period of 15 years. You can extend the account with the block of 5 years. The more time you give to your money in PPF Account, more compounding benefits you’ll get over a period of let’s say 20 years or 25 years or 30 years. You can accumulate total of Rs. 1 crore in 25 years and Rs. 1.49 crore in 30 years if you consistently deposit maximum amount allowed in your PPF account every Financial year.

- PPF Interest Calculator Video using Excel

- What is PPF & What are the Benefits

- How compounding works in PPF

- What is the best date to deposit in PPF

- How to get Maximum returns in PPF

- What are PPF Tax saving Benefits

- How to open a PPF Account

- Standing Instructions on PPF Account

- Maturity options in PPF Interest Calculator

- Conclusion

- Some more Videos

- DOWNLOAD PPF EXCEL CALCULATOR

- Frequently Asked Questions (FAQs)

- Can I maintain more than 1 Public Provident Fund (PPF) account under my name?

- What happens if I fail to deposit any amount in one or more Financial Years in PPF account?

- Can I extend the tenure of a Public Provident Fund (PPF) investment beyond the Maturity Period?

- Can I withdraw funds from my Public Provident Fund (PPF) Account?

- When does a Public Provident Fund (PPF) account mature?

- Can I avail of Loan facility on my Public Provident Fund (PPF) investment?

PPF Interest Calculator Video using Excel

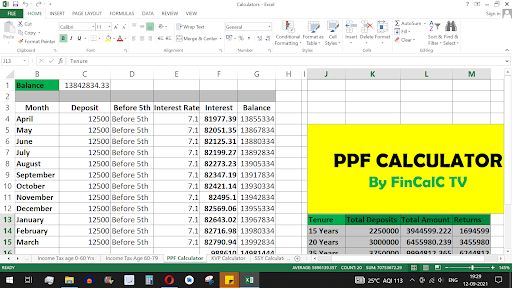

Below table shows total deposits, total amount and total returns in PPF account on consistent deposits of Rs. 12,500 per month

What makes PPF so valuable and how you can get such returns? What is compounding and how it works in PPF? Let’s address all these questions one at a time.

What is PPF & What are the Benefits

- PPF or Public Provident Fund is a government backed saving scheme with a lock-in period of 15 years

- PPF can be treated as a retirement fund due to it’s long term lock-in period

- The interest amount you get in PPF is guaranteed based on the interest rate of PPF

- Interest rate in PPF is reviewed every quarter and currently the interest rate is 7.1% for January to March 2026 quarter

- The deposits you make in PPF account can be claimed under section 80C to save your income tax in a financial year

- Maximum of Rs. 1.5 Lacs are allowed to be deposited in PPF account in a FY to get interest based on interest rate

- The interest amount you earn after maturity is also exempted from income tax

- PPF belongs to EEE category – Principal, interest and maturity are exempted from income tax

ALSO READ: Rs. 1000 PPF Interest Calculation for 15 Years

How compounding works in PPF

- Interest amount in PPF is calculated every month and is compounded annually

- Annual interest of let’s say 7.1% is divided by 12 to get monthly interest rate, which is then used to calculate monthly interest on PPF balance

- In this way, interest from April to March of next financial year are summed up and added to your balance on 31st March. This way you get annual compounding in PPF

- Compounding means getting interest on interest money

- The interest money you get on 31st March of every year will earn you more interest money in future years

- Important: While calculating interest on every month, if you deposit before or on 5th day of the month, you’ll get interest on this deposit from this month itself, else you will get interest on this deposit from next month onwards

Here is a screenshot of PPF Interest Calculator:

What is the best date to deposit in PPF

- As mentioned above, if you deposit before or on 5th day of the month, you’ll start getting interest from this month onwards

- If you deposit after 5th day of month, you’ll get interest on this deposit from next month onwards. So the best date to invest in PPF is on or before 5th day of the any month

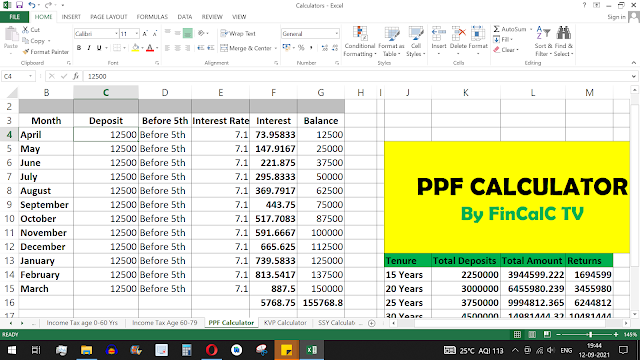

- The above screenshot shows interest of Rs. 81,977.39 when a deposit of Rs. 12,500 is made before 5th day of April

- And below is the screenshot for same deposit of Rs. 12,500 after 5th day of April, the interest you get is Rs. 81,903.44. There is no change in the interest for the month of May

- This proves that if we deposit before or on 5th day of the month, we’ll start getting interest from that month onwards for the deposit. Here’s another screenshot of PPF Interest Calculator:

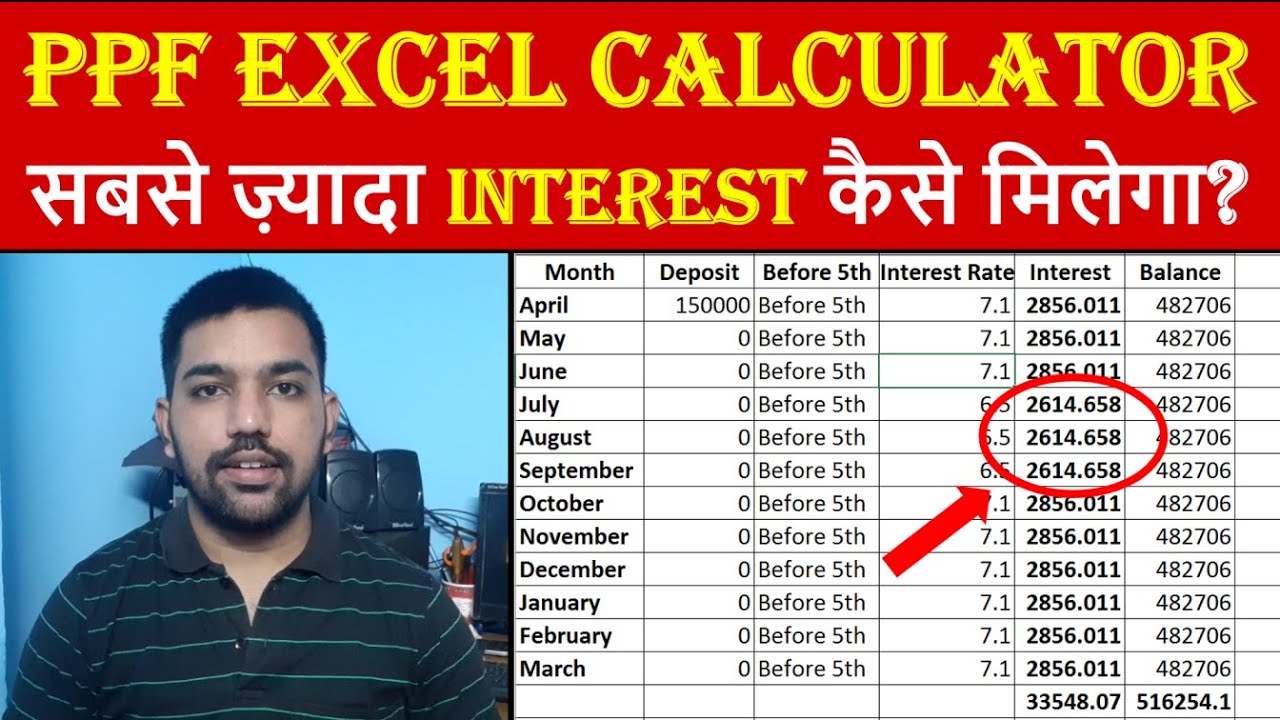

How to get Maximum returns in PPF

- One thing is clear about getting more interest – to deposit on or before 5th day of the month

- Another secret to maximize the interest in PPF is to deposit maximum amount of Rs. 1.5 Lacs in the month of April before or on 5th day

- In this way, you’ll start getting maximum allowed interest from April month to March month of next year

- Below are the screenshots for deposits of Rs. 1.5 Lacs in April and same amount being divided throughout 12 months (April to March)

As seen above, PPF Interest = Rs. 10,650 when we deposit maximum of Rs. 1.5 Lacs before 5th day of April in FY and PPF Interest = Rs. 5,768 when we deposit Rs. 12,500 every month before 5th day of the month.

So try to deposit maximum amount in PPF before or on 5th April to get maximum interest in your PPF account.

Maximum Interest in PPF Video:

What are PPF Tax saving Benefits

- PPF falls under EEE Category – Principal, Interest and maturity amounts are exempted from income tax

- The deposits you make in PPF can be used to claim deductions under section 80C (maximum Rs. 1.5 Lacs) in order to save income tax

- Income Tax can be saved only if you choose Old Tax Regime to calculate income tax

- Also, the interest amount you receive every year is also exempted from income tax. Which means, you need not have to pay any tax on the interest you receive every year on 31st March

- And the maturity amount you’ll receive after PPF maturity will be exempted from income tax.

- So you pay no income tax at all on the interest amounts, and on top of it, you save income tax by depositing in PPF account! Double benefits!

ALSO READ: How to Save Tax on Salary above 5 Lakh

How to open a PPF Account

- PPF accounts can be opened in post office, nationalized banks and major private banks such as ICICI, HDFC and Axis

- In several banks like ICICI and Axis, you can open a PPF account online through net banking as well.

- In case you are NRI (Non-resident of India), you cannot open a PPF account, but if you already had a PPF account before you became NRI, you can continue to hold PPF account until it’s maturity period

- Once the account is opened, a PPF passbook similar to the bank passbook is issued.

- All transactions such as subscription, interest, withdrawals, etc. are recorded in this passbook.

- Some banks simply allow PPF entries or PPF balance to be viewed online instead of issuing a passbook.

- You should remember that your amounts will be locked-in for 15 years in a PPF Account

- You can only have one PPF account at a time. Multiple PPF accounts for same holder are not allowed

Standing Instructions on PPF Account

- In order to deposit in PPF account on regular basis, you can set standing instruction for regular deposits in PPF

- This feature is available in almost all banks wherever you open a PPF account

- Setting standing instructions will help you to be disciplined towards saving, much like SIPs

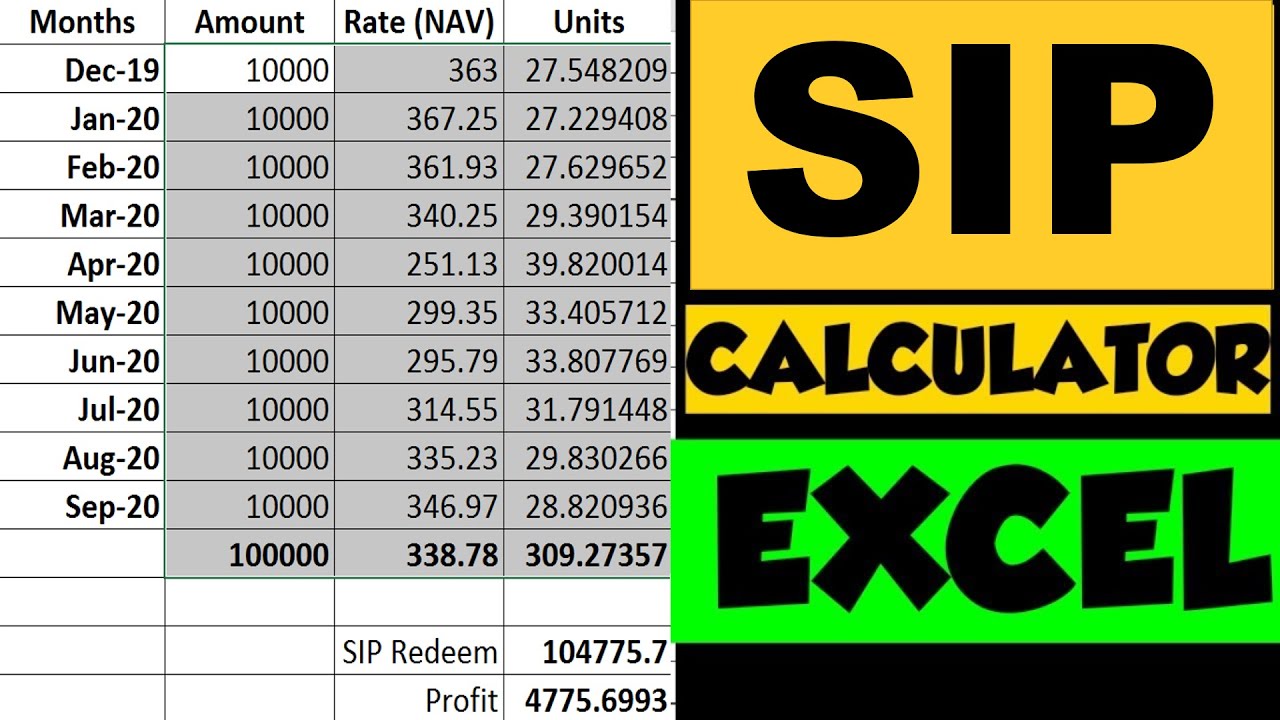

ALSO READ: SIP Returns Excel Calculator

Maturity options in PPF Interest Calculator

- At the end of the lock-in period of 15 Years, you have following three options:

- You can withdraw the PPF amount along with the interest earned. The entire maturity proceeds are exempt from tax.

- You can extend the life of the PPF account indefinitely in blocks of 5 years at a time with contribution. You have to submit a request to extend the account, with further contributions by submitting Form H. The choice of extension with contribution has to be made within one year from the date of maturity, otherwise the default choice of extension without further contribution applies.

- Extension of PPF without further contribution. You do not need to fill any form to choose this option.

Conclusion

So the option to extend PPF account after lock in period of 15 years becomes very important to earn compound interest over long term. This will help you to accumulate wealth.

As seen using above calculations in PPF, you can earn around Rs. 1 crore in 25 years and Rs. 1.5 crore in 30 years in PPF by investing Rs. 12,500 per month. You can go for lower deposits as well in which case the maturity amount will be adjusted.

Use the PPF Calculator to know how much interest you can get in PPF.

Some more Videos

DOWNLOAD PPF EXCEL CALCULATOR

Download PPF Interest Calculator using above link.

Some more Reading

- PF Withdrawal Online Process with All steps [Video]

- Power of Compounding in Stock Market

- What is Superannuation Fund and Benefits

- Rs. 10,000 FD Interest Calculation for 10 Years

Frequently Asked Questions (FAQs)

Can I maintain more than 1 Public Provident Fund (PPF) account under my name?

Only one PPF account can be maintained by an Individual, except an account that is opened on behalf of a minor.

What happens if I fail to deposit any amount in one or more Financial Years in PPF account?

A penalty of Rs. 50 will be levied per year of default, if the customer doesn’t deposit the minimum deposit amount of Rs. 500 on the completion of the financial year.

Can I extend the tenure of a Public Provident Fund (PPF) investment beyond the Maturity Period?

A customer can extend the tenure of a Public Provident Fund (PPF) investment for a block period of 5 years beyond the maturity period by submitting Form H within one year from the date of maturity.

Can I withdraw funds from my Public Provident Fund (PPF) Account?

Customer can make one withdrawal every year, from the 7th financial year, of an amount that does not exceed 50% of the balance of the customer credit at the end of the fourth year immediately preceding the year of withdrawal or the amount at the end of the preceding year, whichever is lower.

When does a Public Provident Fund (PPF) account mature?

A Public Provident Fund (PPF) account gets matured after the completion of 15 years from the end of the year in which the account was opened.

Can I avail of Loan facility on my Public Provident Fund (PPF) investment?

Customers can avail of the loan facility between third financial year to sixth financial year ie. from third financial year up to end of fifth financial year in a PPF Account.

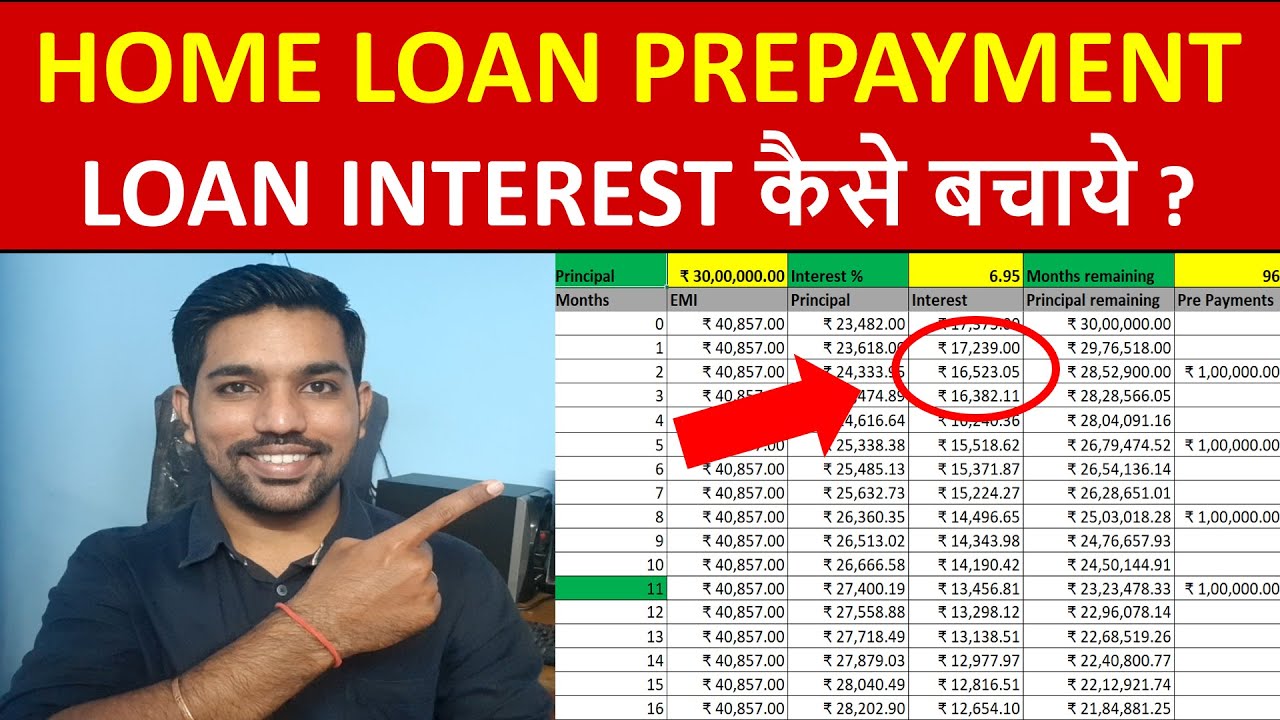

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.