If you are a working professional and receive HRA (House Rent Allowance) as one of the allowances in your salary payslip, you have to pay income tax on this HRA allowance. But if you stay in rented accommodation, you can claim this HRA allowance to save income tax. Even if you don’t stay on rent, still you can claim HRA! We will see how this is possible, along with how HRA exemption is calculated with examples. Not 100% HRA received is exempted from income tax, so we will see the calculations as well.

You can easily calculate the HRA exemption amount using the online calculator here. You basically need to do 3 calculations to reach your HRA exemption amount:

- Calculate Total HRA received in FY

- Total rent paid in FY minus 10% of Basic Salary + DA in FY

- 50% of Basic Salary + DA (metro city), else 40% in case staying in non metro city.

Minimum of above numbers will be considered as HRA exemption amount in the financial year to save income tax by reducing the taxable income. Of course other rules also applies that you should be staying in a rented accommodation, have rent agreement with landlord, provide rent receipts, etc. but not all rules or conditions need to be fulfilled to actually claim the HRA received. We will answer all these questions in this article.

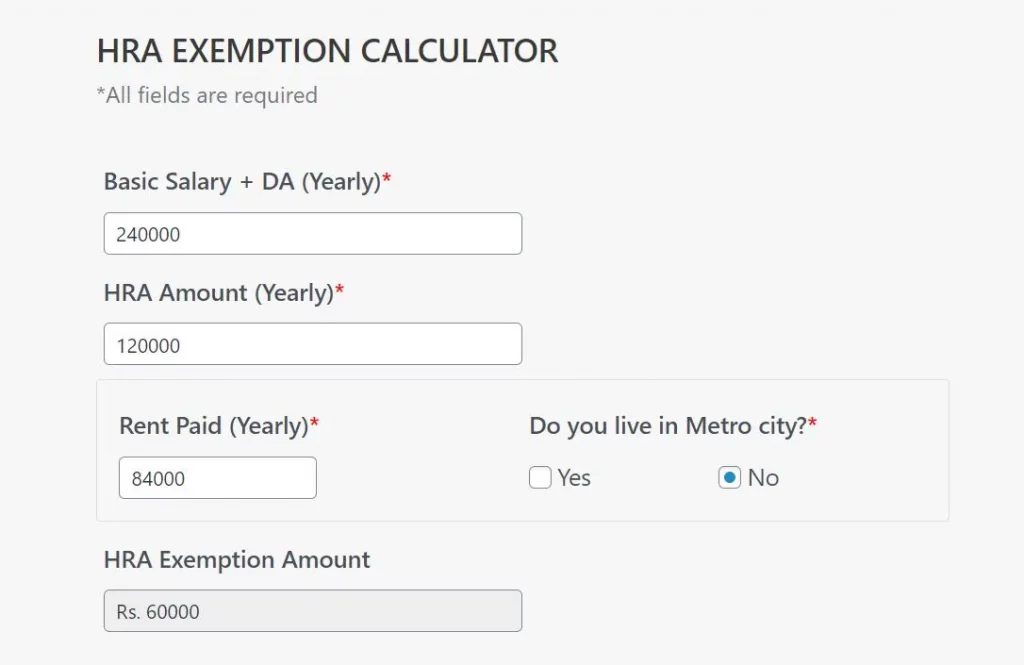

You can use below HRA calculator to quickly check the HRA exemption amount by providing some inputs. This calculator works only when your monthly income and rent is same throughout the financial year. In case your income or rent changes in FY de to job switch, increments or location change, we will have to calculate HRA on monthly basis since yearly calculation of HRA will not be accurate when income or rent amount changes.

Also, we will see monthly HRA calculation examples with the help of video as well!

- How HRA Tax Exemption is Calculated?

- Is HRA 100% Exempted?

- Rules for HRA Exemption

- Is HRA exemption part of Section 80C?

- Can you claim HRA without Rent Agreement

- How much HRA can you claim without receipts?

- Can wife pay rent to husband and claim HRA exemption?

- Who is not eligible for HRA exemption?

- Can you claim HRA without staying on rent?

- Rent amount paid to parent or Spouse taxable?

- Can you claim HRA and Home loan deductions?

- Download HRA Exemption Excel Calculator

How HRA Tax Exemption is Calculated?

As mentioned above, we have to find minimum of 3 calculations:

- Calculate Total HRA received in FY

- Total rent paid in FY minus 10% of Basic Salary + DA in FY

- 50% of Basic Salary + DA (metro city), else 40% in case staying in non metro city.

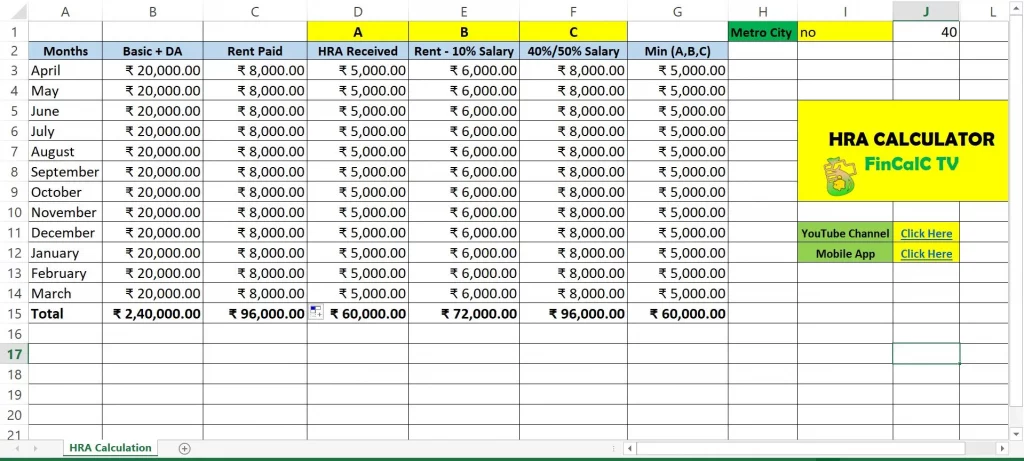

Let’s understand HRA exemption calculation with the help of an example. If Basic Salary + DA is Rs. 20,000 pm, HRA received is Rs. 10,000 pm and you pay rent of Rs. 7,000 pm, below is the HRA exemption calculation table from April to March months of complete financial year: we have considered example of non metro city and consider 40% salary in our calculations:

| Months | Basic+DA | Rent | HRA (a) | Rent-10% Salary (b) | 40% Salary (c) | min (a,b,c) |

|---|---|---|---|---|---|---|

| April | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| May | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| June | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| July | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| August | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| September | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| October | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| November | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| December | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| January | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| February | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| March | 20,000 | 7,000 | 10,000 | 5,000 | 8,000 | 5,000 |

| Total (Rs.) | 2,40,000 | 84,000 | 1,20,000 | 60,000 | 96,000 | 60,000 |

So based on above example, Rs. 60,000 is the HRA exemption amount you can claim out of Rs. 1,20,000 received as HRA amount in the financial year. Calculations are done in following way:

- Total HRA = Rs. 1,20,000

- Rent – 10% Basic = Rs. 7000 – 2000 = Rs. 5,000 (Rs. 60,000 for 12 months)

- 40% Basic + DA = Rs. 40% of Rs. 20,000 = Rs. 8,000 (Rs. 96,000 for 12 months)

This is the way HRA exemption is calculated. Below is the screenshot of calculation using the online HRA calculator:

If you noticed the income and rent amount is same throughout the financial year. What if the income or rent changes in a financial year? Do we calculate HRA exemption amount in similar way?

To make it clear, HRA exemption amounts are calculated on monthly basis. If you try calculating HRA amount on yearly basis, you may get incorrect results and calculate your taxable income wrongly, which would lead to incorrect income tax calculation.

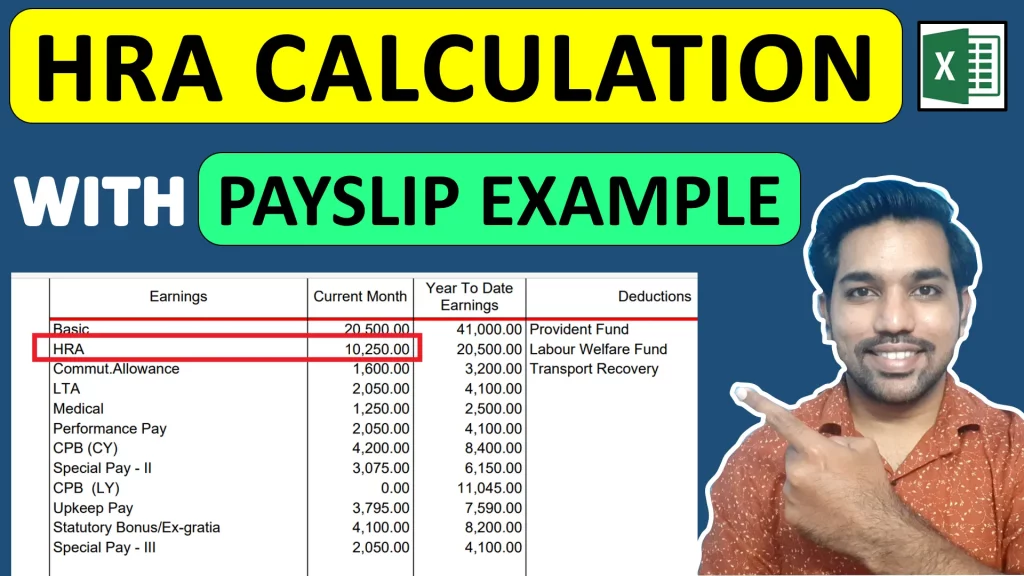

How HRA exemption is calculated on monthly basis? Watch this video with calculation examples using salary payslip:

Is HRA 100% Exempted?

Based on above calculations example, we saw that not entire HRA amount will be exempted. It depends on your income, rent amount and location you stay in rented accommodation – whether metro or non metro city.

Usually HRA amount received is 50% of your monthly basic salary, which makes it difficult to claim 100% HRA as exemption based on other calculation formulas as well.

Even if you cannot claim 100% HRA, still there is no limit as to how much HRA amount can be claimed. Since HRA exemption calculation depends on above mentioned 3calculations, there is no maximum limit up to which HRA amount is exempted.

But if let’s say, the HRA amount received is less than 50% of the Basic salary received, there may be a chance to claim full HRA amount received. For example, if basic salary is Rs. 20,000 pm, HRA received is Rs. 5,000 pm and rent paid is Rs. 8,000 pm, you can claim full HRA amount received in the financial year.

You can do the calculations by yourself using the HRA excel calculator here.

Rules for HRA Exemption

There are certain rules you must follow to claim HRA. Below are few of them:

- You should have receipts of all rent you have paid to landlord

- HRA exemption is part of Section 10(13A)

- If rent for a financial year (April to March) is greater than Rs. 1 Lac, you need to submit PAN of landlord

- Optionally, it is also better to keep a copy of rent declaration or rent agreement with you

- HRA exemption is applicable only for those staying in rented accommodation. This rule is not strict and we will see this why.

- If HRA component is not provided by your employer in salary slip, you can still claim HRA under Section 80GG. Maximum of Rs. 60,000 can be claimed in Section 80GG.

ALSO READ: Home Loan EMI Calculation using Excel

Is HRA exemption part of Section 80C?

HRA exemption amount is not part of Section 80C. HRA exemption belongs to another section which is Section 10(13A).

All other options to save income tax via Section 80C allows you to claim maximum Rs. 1,50,000 in FY 2022-23 if you choose Old Tax Regime.

Remember that you cannot claim any deductions, nor HRA as well under New Tax Regime. Since New Tax Regime are reduced tax slab rates, it does not allow you to claim any investment options as deductions to save more income tax. We have explained Old and New Tax Regime income tax calculation here which you may read with examples.

Can you claim HRA without Rent Agreement

Rental Agreement is not mandatory for claiming HRA tax exemption but rent receipts are required. It is better to have rent receipts as a proof that you are paying rent to landlord.

Still it is recommended to have a rental agreement or at least a declaration in case you are paying rent to your parents or spouse. This also tells us that paying rent to parents or spouse is possible provided you have proofs that the house you stay in is in the name of your parents or spouse (wife or husband), you do not have any share of the property you stay in and there must be online transactions of transferring rent amount to the property owner where you stay.

ALSO READ: Home Loan Tax Benefits with excel calculator

How much HRA can you claim without receipts?

As mentioned above, rent receipts are required to support your statement that you actually stay in rented accommodation. Paying rent to your parent or spouse is not the best reason to avoid having rent receipts.

In case you want to claim HRA when you don’t have HRA component in your salary slip, you can claim maximum Rs. 60,000 in a financial year under section 80GG.

And with rent receipts and valid transactions, there is no limit as to how much HRA you can claim with all valid documents you have. The only calculations you have to do is mentioned above in this article to reach your maximum HRA exemption amount.

Can wife pay rent to husband and claim HRA exemption?

Wife paying rent to husband or vice versa is possible as there is not such condition mentioned in Income Tax Act. As long as you do not own the property in which you are staying, and you have rent receipts by having valid online transactions or paying by cash, you should be able to claim HRA amount.

While having online transactions is recommended in case you pay rent more than Rs. 1 Lac in a financial year (which is Rs. 8,333 per month approximately), since the rent amount paid to your parents or spouse is taxable to them.

So in case you get happy by saving your income tax by claiming HRA after paying rent to parents your spouse, you also have to think about their taxable income and tax liability. The amount you pay to them as rent will be taxable to them on which they have to pay income tax.

In case your parents are retired or you pay rent to your housewife without any other income or less annual income, this could be the best scenario to pay rent to them if they fall in non taxable bracket, provided you follow required rules of having rent receipts, rental agreement and online transactions captured.

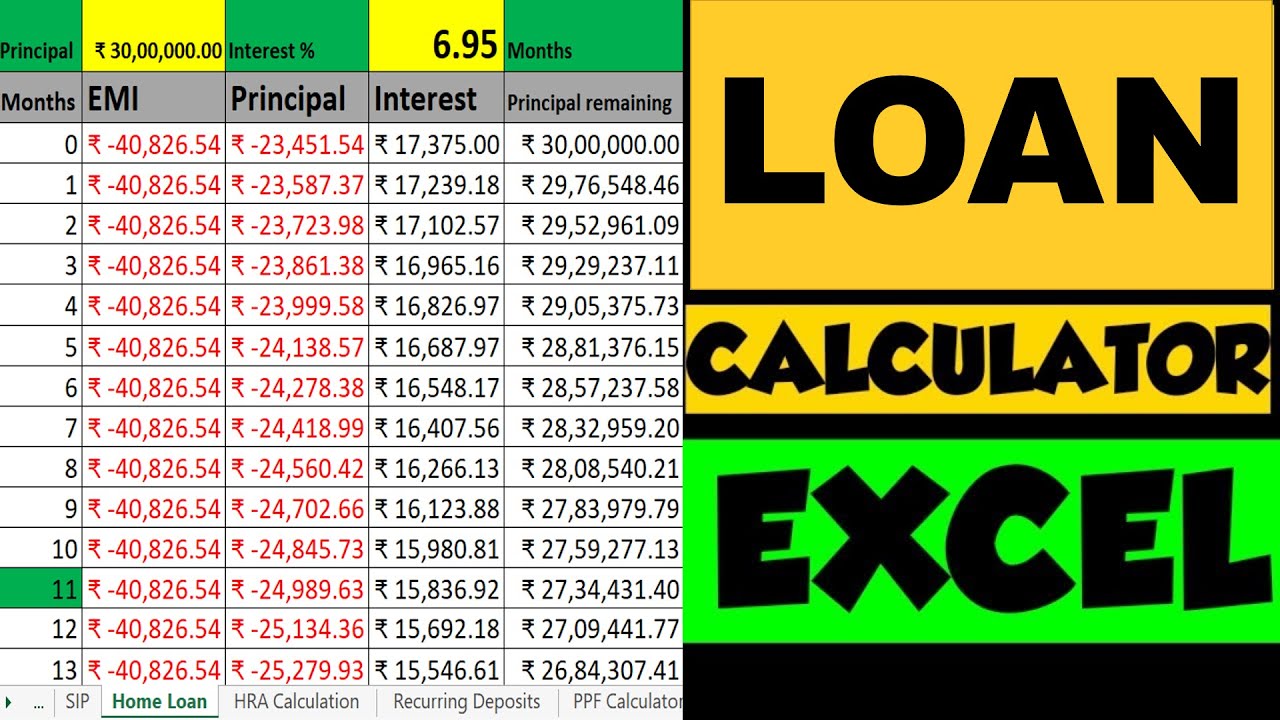

In case you plan to take home loan, below is the video on how home loan EMI is calculated using excel examples:

Who is not eligible for HRA exemption?

There are certain conditions when you cannot claim HRA exemption amount:

- When you stay in your own property

- When you don’t receive HRA, you cannot claim under section 10(13A), but can claim in section 80GG if you stay on rent

- If you don’t have rent agreement or rent receipts

- If you don’t have documents required to claim HRA

Above are certain scenarios when you cannot claim HRA amount.

Can you claim HRA without staying on rent?

This is one interesting scenario where it is possible to claim HRA amount even if you don’t stay on rent. Not staying on rent means you are not staying anywhere else but with your family. This doesn’t remove the condition that you don’t have to pay rent.

If you stay with your parents or spouse in which case, you do not own the property, you can pay them some amount every month as rent and claim that amount as HRA if you receive HRA in your salary payslip.

Again, you have to follow all the required conditions of making a rental agreement, having rent receipts of every month, having online transactions in this case is recommended to avoid false claims. Many claim to pay rent to their family members and arrange fake HRA receipts due to which it is important that you have the online transactions of transferring rent amount to your parents or spouse to whom this rental income will become their taxable income.

Rent amount paid to parent or Spouse taxable?

Yes the rental amount you pay to your parents or spouse is taxable to them. It is important to plan your income tax accordingly for a particular financial year.

You would save lot of income tax as a family if you pay rent amount to a family member who’s income is way below the taxable income, but also, the member must be the owner of the property where you are staying and you must not be the co owner of property.

It is also important to note that you have to follow all mentioned conditions to claim HRA to avoid the scenario of tax evasion!

Can you claim HRA and Home loan deductions?

Claiming HRA and home loan deductions is possible under Section 80C and Section 24, provided that the rental accommodation you stay in and the house property you bought with the help of home loan are located in different cities.

If this condition is met than you can claim both and save lot of income tax with various deduction limits in these sections. But in case your house property you bought on home loan is on rent and you enjoy rental income from this property, than you are liable to pay income tax on this rental income.

To avoid paying tax on rental income, you can take home loan with your wife as co owner (if she is house wife or have less taxable income) and the rental income can be credited in her account, in which case, she will be liable to pay income tax but can save a lot due to lower taxable income.

Also, when your taxable income is below Rs. 5 Lacs in a financial year, your income tax will be zero due to tax rebate under section 87A.

You can solve more home loan tax benefits queries here.

Download HRA Exemption Excel Calculator

Click below button to DOWNLOAD HRA Calculator in Excel:

Check out More online Calculators here including Income Tax, PPF, SIP, Home Loan Calculator and many more..

That is all on How HRA exemption is calculated when you receive HRA component in salary payslip. Comment below if you have any more queries. Also, download the income tax calculator app I have developed for you!

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Some more reading:

Income Tax Calculation FY 2022-23

SIP Returns Calculation using Excel

Home Loan Prepayment Calculation using Excel

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.