Based on your financial goals, you can select between FD vs RD vs PPF vs SIP. FD and RD are best for short term goals of 6 months to 5 years, where as PPF is best for saving income tax and SIP is best to generate wealth over long term. Between PPF and SIP, the main distinction is – PPF is government backed scheme that provides you guaranteed returns based on interest rate which will be tax free, where as SIP in mutual funds can give you better returns over long term but the profits will be taxable as well.

Let us understand the differences between FD vs RD vs PPF vs SIP and which one is better for you.

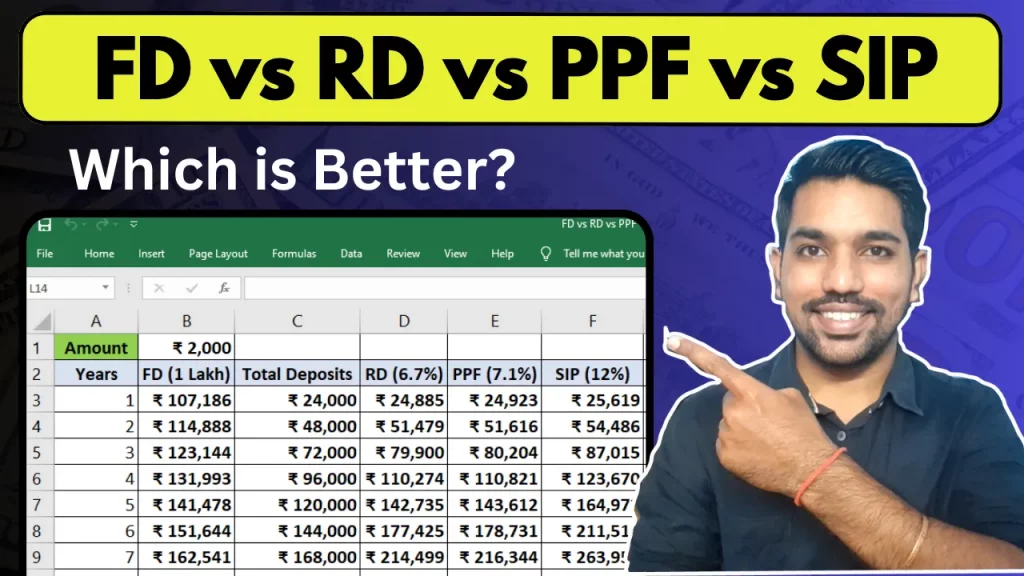

FD vs RD vs PPF vs SIP Returns Calculation Video

Watch more Videos on YouTube Channel

Watch above video to understand the returns or interest amount you can get in Fixed Deposits, Recurring Deposits, PPF (Public Provident Fund) and SIP (Systematic Investment Plan) in Mutual Fund.

What is FD (Fixed Deposit) and how it works?

- FD full form is Fixed Deposit, which is also known as term deposit

- It provides you guaranteed returns based on the interest rate and the principal amount you need to deposit

- You deposit lumpsum amount only once in FD and you get interest amount based on this lumpsum amount

- You can open any number of fixed deposits based on your goals you need to achieve

- FD provides you quarterly compounding which means, after every quarter (3 months), the interest amount is credited in your FD, which earns more interest in upcoming quarters. This is called cumulative FD

- On other hand, if you want to withdraw the interest amount, you can do so using non-cumulative FD. In this case, you’ll earn less interest amount overall due to withdrawal of the interest amount, that might earn you extra interest in upcoming quarters

- The interest you earn in fixed deposit is taxable based on your income tax slab rates, after adding the interest amount in your total financial income

- You can use FD calculator to know how much interest you can get based on interest rate and tenure

What is RD (Recurring Deposit) and how it works?

- RD full form is Recurring deposit, which provides guaranteed returns based on the interest rate set while opening recurring deposit

- In RD, you deposit specific amount every month, in a bank or post office for a period of 6 months or 1 year or more

- This gradual deposits in RD helps you to accumulate large amount over a period of time, rather than investing a lumpsum amount

- You get interest amount in every month in RD, based on the balance after your monthly deposits

- Also you get quarterly compounding in RD, like fixed deposits

- This RD can help you to accumulate Rs. 12,000 over a period of 6 months with just Rs. 2000 recurring deposit every month

- You don’t have to manually or physically go to the bank to deposit this amount, but you can ask the bank to set instruction to debit from your savings account and deposit in recurring deposit

- This can help you gradually move towards achieving your financial goal using recurring deposits

- You can use the RD Calculator to know the interest and maturity amount you can get

PPF Account Benefits and features

- PPF full form is Public Provident fund and is one of the popular saving schemes

- PPF is a government backed saving scheme with a lock-in period of 15 years that provides you tax free interest

- During the 15 years tenure of PPF account, you can deposit minimum amount of Rs. 500 and maximum of Rs. 1.5 lakh in a financial year

- Deposits can be made in any month throughout the financial year

- The interest rate in PPF is reviewed by government of India every quarter, hence the monthly interest can change depending upon your balance in PPF account and current interest rate

- The deposits you make in PPF helps you to save income tax under Section 80C

- Please note that the deduction to save income tax is only available with Old Tax regime.

- New tax regime does not allow this deduction to be claimed due to low tax slab rates

- You earn monthly interest in PPF account, which is credited to your PPF account after financial year end – March end

- In this way you get yearly compounding in PPF that helps you earn more interest amount over upcoming years

- The interest amount and maturity amount you receive after 15 years is tax free

- You can use PPF calculator to know how much interest amount you can get over 15 years based on your deposits and interest rates

SIP in Mutual Funds for Wealth Generation

- SIP or Systematic Investment Plan helps you to grow your wealth

- Similar to RD, you deposit a specific amount every month over long tenure of 5 to 10 years and see your money grow

- Unlike RD, SIP has associated risks based on the companies you are investing your money in

- When markets are volatile, you’ll see the stock prices of companies going up and down thus your investment profits also go up and down

- Over short term of 3 to 5 years, it might happen that your returns are 0% and in negative. You need to be patient and show consistency while investing the SIP amounts to see growth over long term of at least 7 to 10 years

- Historically, we have seen that market corrects itself periodically which is the best opportunity to increase you SIP amount

- We have seen almost 12% of returns from Indian indices such as Nifty and Sensex over long term of 15 to 20 years

- So if you are young and can take some risk, you should use SIP to grow your wealth over long term

- Remember that – it is not important to time that market, but you should give time to market. So be a long term investor while focusing on your active income growth

SIP Returns in Sensex Mutual Funds over 20 Years Video

Conclusion – Which is better for you?

So after going through the features of FD, RD, PPF and SIP, we can say that if your goal is for next 6 months to 3 years and you already have some lumpsum amount you might need in future or as emergency funds, you should go with FD (Fixed Deposit).

If you don’t have the lumpsum amount but can gradually accumulate by depositing every month to achieve your short term goals, than open RD (Recurring Deposit).

In case you only want to save income tax by depositing and get tax free interest with long tenure of 15 to 20 years, you can use PPF account, where as if wealth generation is your important financial goal, than you should definitely start SIP in mutual funds.

Some more Reading:

- Rs. 2000 in PPF Interest Calculation for 15 Years

- SIP vs Step up SIP Returns Calculation on Rs. 2000

- Benefits of SWP for Monthly Income

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.