Many viewers on this website and my YouTube Channel asks about how PPF Interest calculation is done, what will be maturity amount when Rs. 1000 is deposited every month in PPF, can you deposit different amounts every month and how to get maximum interest in PPF? All your answers will be solved in this article.

PPF Interest calculation is very simple – You get monthly interest in PPF on your balance and yearly compounding, which means the interest earned in all 12 months is added in your balance at the end of financial year on which you earn more interest. You will get ₹ 3,15,572 as maturity amount on Rs. 1000 deposits per month with 7.1% annual interest rate for 15 years. You can also deposit different amounts every month in PPF. Depositing Rs. 1.5 Lacs before 5th April will give maximum interest in PPF for that financial year.

- PPF Interest Calculation for 15 Years Video

- PPF Features and Benefits

- PPF Interest Rate 2026

- How is PPF Interest Calculated?

- Interest Calculation on PPF Interest rate change

- Can you deposit different amounts every month in PPF?

- How to get yearly compounding calculation in PPF?

- Actual Tenure of PPF is 16 Years

- How to get Maximum Interest in PPF

- PPF Maturity Amount after 15 Years on Rs. 1000

- Conclusion

- Frequently Asked Questions

Below is the video on PPF Interest Calculation for 15 Years on Rs. 1000 monthly deposit.

PPF Interest Calculation for 15 Years Video

Watch more Videos on YouTube Channel

PPF Features and Benefits

- PPF full form is Public Provident Fund. It is a government backed saving scheme with a lock in period of 15 years

- Which means once you open PPF account, you have to keep it active for next 15 years (16 years to be precise due to reasons mentioned below)

- Minimum amount to be deposited in PPF is Rs. 500 in FY to keep the account active

- Maximum amount that can be deposited in PPF is Rs. 1.5 Lacs in FY to get maximum interest

- You can open PPF account in any nationalized bank or post office

- PPF Interest Rate – Current interest rate in PPF is 7.1% per annum for January to March 2026 quarter

- Interest rates are reviewed every quarter by Government of India

- You get Tax Benefits in PPF under Section 80C

- Maximum Rs. 1.5 Lacs can be claimed as deduction in Section 80C after you deposit in PPF

- Also, the interest amounts and maturity amount earned in PPF are tax free

ALSO READ: More Tax Saving Options

PPF Interest Rate 2026

The current interest rate in PPF is 7.1% for January to March 2026 quarter, subjected to change in every quarter. You cab check latest Post Office Interest Rates here.

How is PPF Interest Calculated?

PPF Interest is calculated on monthly basis. Let’s understand this with formula and example.

PPF Formula for monthly Interest

Monthly Interest = Monthly Interest Rate * Balance / 100Based on above PPF formula for monthly interest, let us check the examples with calculations.

Example

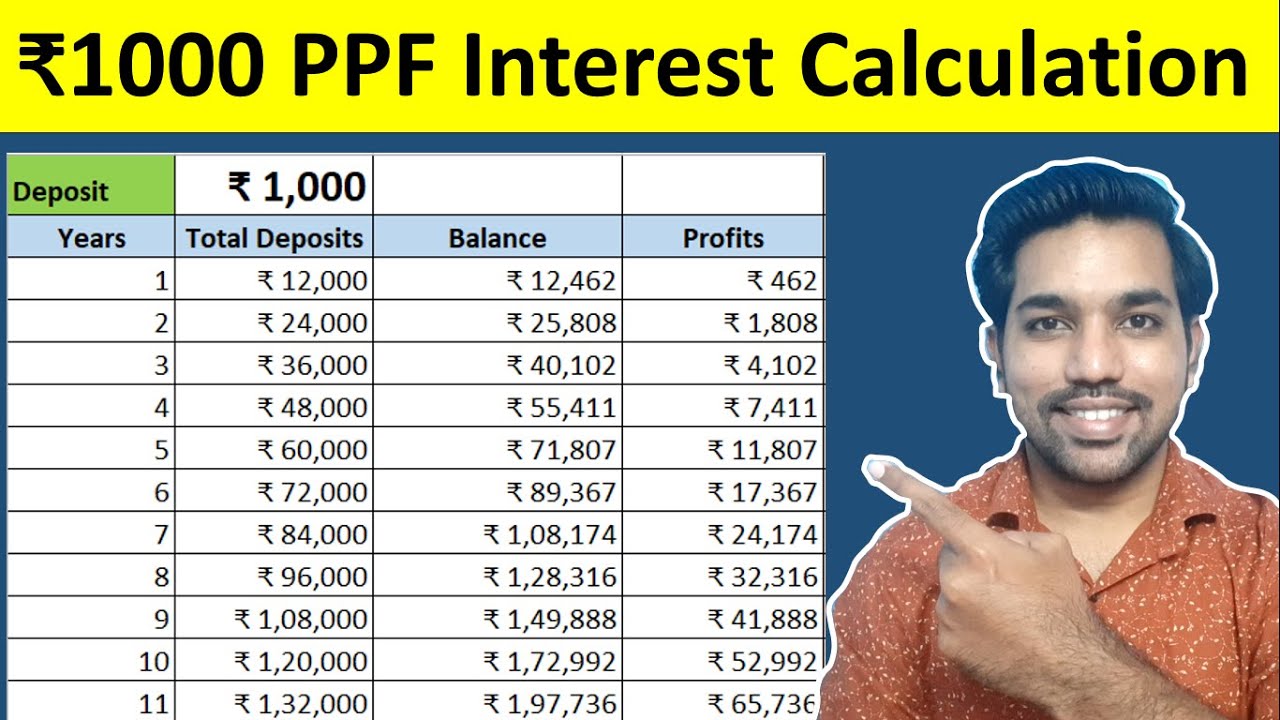

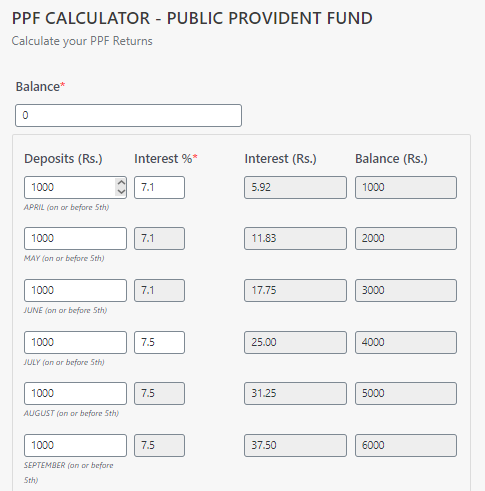

Let’s say you deposit Rs. 1000 in the month of April before 5th day in a new PPF account, interest rate for year is 7.1%, below is the calculation using our PPF Calculator:

So you get Rs. 5.92 as the interest amount on Balance of Rs. 1000. This is calculated using PPF Interest calculation formula:

- PPF Monthly Interest = Monthly Interest Rate * Balance / 100

- PPF Monthly Interest = 7.1% / 12 * 1000 / 100 = Rs. 5.92

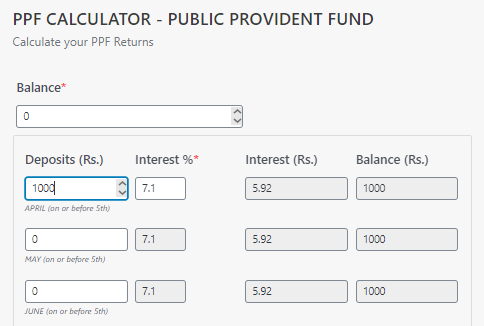

Now let’s say you deposit Rs. 1000 again in the month of May before 5th day. So your PPF balance will be updated as Rs. 2000:

As seen above, May month’s Interest is calculated based on the balance before the 5th day of May. So based on above PPF formula:

- PPF monthly Interest = 7.1% / 12 * 2000 / 100 = Rs. 11.83

Similarly Interest in every month is calculated in PPF based on the balance.

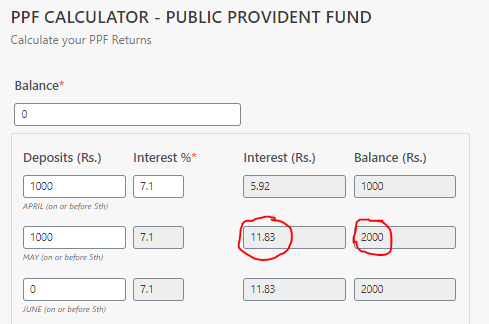

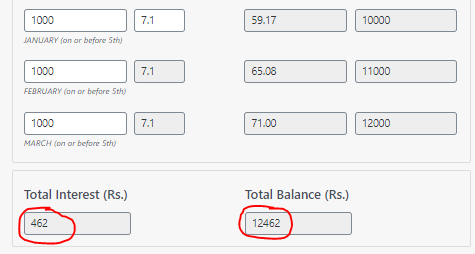

Now let’s say you deposit Rs. 1000 in all months up to march. The total interest will be found using the PPF calculator as mentioned below:

As seen, you total deposits is Rs. 12,000 in the year (Rs. 1000 * 12), and the total interest earned is Rs. 462. This total interest is added to the total deposits to each at the balance of Rs. 12,462, which will be treated as balance for next financial year.

And you’ll start earning more interest on this already earned interest amount. This is what we call yearly Compounding in PPF.

So make sure to check out the PPF calculator to check your interest.

Interest Calculation on PPF Interest rate change

The above PPF calculator is designed to make changes in the PPF interest rate as well. So let’s say the interest rate in PPF changes to 7.5% for July to September quarter, below are the monthly interest amounts calculated on balance:

As seen, for the month of July, interest will be calculated as mentioned below:

- PPF monthly interest for July = 7.5% / 12 * 4000 / 100 = Rs. 25

So whenever interest rate changes in PPF, it is applied on that quarter and interest is calculated considering this updated rate of interest and every month’s balance in PPF.

Can you deposit different amounts every month in PPF?

Yes, you can deposit different amounts in PPF every month. There are no strict rules to deposit specific amounts only every month.

How to get yearly compounding calculation in PPF?

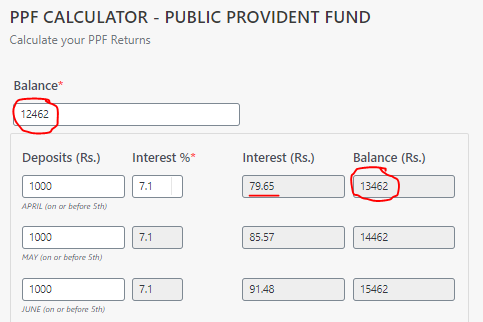

As calculated above, you get Rs. 12,462 as balance at the end of first financial year. This balance must be treated as balance at the start of next financial year as shown below:

So now with more deposits every month, your balance is increased and you earn more interest.

Notice that your balance after April month’s deposit is Rs. 13,462, that additional Rs. 462 is from the previous financial year on which you are earning more interest amounts. This is the power of compounding.

- PPF interest in April = 7.1% / 12 * 13462 / 100 = Rs. 79.65

We will also see the total maturity amount after 15 years with such deposits in PPF in below section.

ALSO READ: DOWNLOAD PPF Calculator in Excel

Actual Tenure of PPF is 16 Years

The actual tenure of PPF is 16 years, since you have to complete 15 financial years in PPF.

Let’s say you start PPF account in Dec 2022, so this FY will not be counted. From FY 2023-24, 15 financial years will be counted, so your maturity month will be March 2038, which will be the end date of your PPF account.

You can either close your PPF account after 15 years or extend it with a block of 5 years.

How to get Maximum Interest in PPF

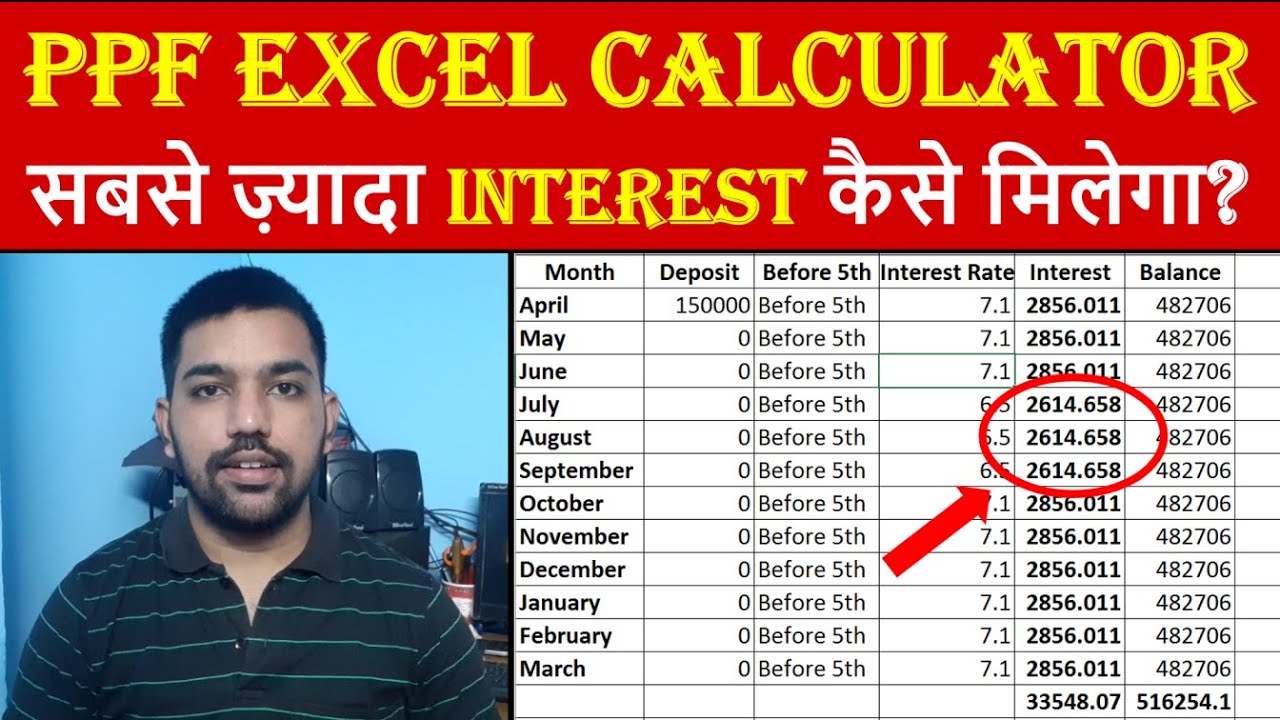

You can get maximum interest in PPF account every financial year when you deposit maximum amount of Rs. 1.5 Lacs at the start of financial year – between 1st to 5th day of April month.

Check this video on maximum interest in PPF:

Maximum Interest in PPF Video

PPF Maturity Amount after 15 Years on Rs. 1000

Finally, let us now see some numbers that you will actually get in your account!

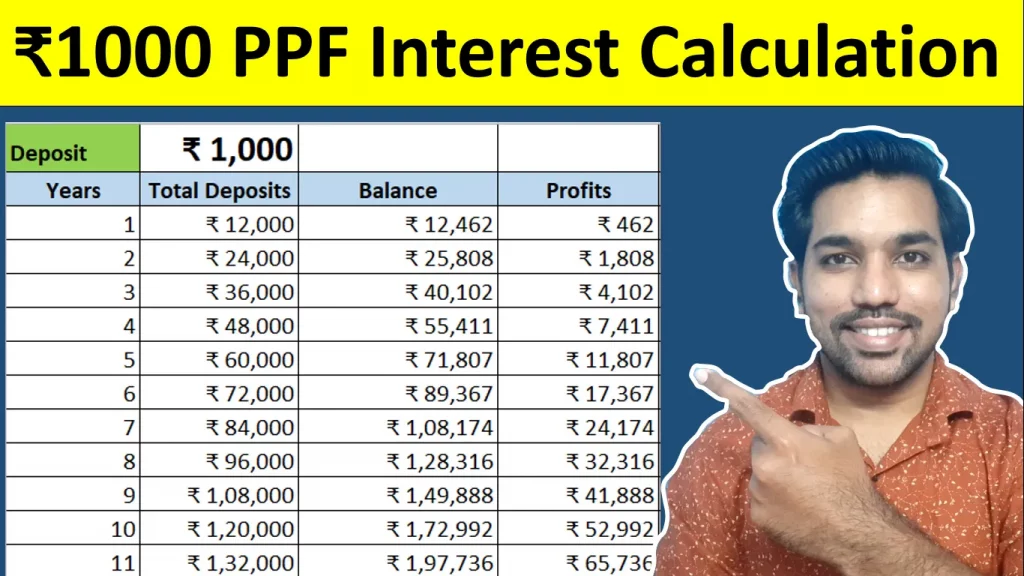

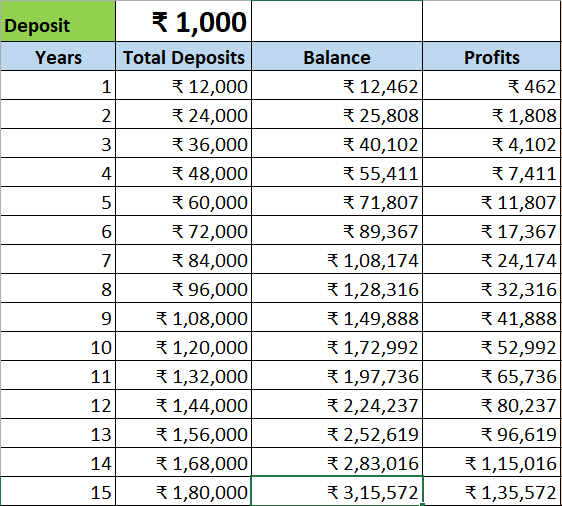

Please note that we have considered 7.1% interest rate of PPF throughout the tenure. It may so happen that the interest rate increase or decrease in future so accordingly the interest calculation will be done and maturity amounts will be deposited on your monthly deposits of Rs. 1000 in PPF:

As seen above, you get ₹ 3,15,572 as maturity amount considering 7.1% interest rate in PPF. You total deposits is ₹ 1,80,000 and total interest earned is ₹ 1,35,572. That’s a good amount. All this amount is Tax Free and also you save tax on your deposits as well under Section 80C.

If you want more returns and don’t car about taxation, you can also invest in mutual funds via SIP.

ALSO READ: Rs. 1000 SIP Returns Calculation in Mutual Funds for 15 Years

Conclusion

So PPF is one of the attractive scheme since it is a government backed scheme. The interest already earned in PPF is guaranteed and is subjected to change based on interest rates change.

You can get good interest amounts if you increase the deposits every year based on your income increase, and at the same time you’ll be saving income tax as well.

But if you are looking for good returns, you can also check out ELSS under mutual funds. ELSS also gives tax benefits with lock in period of 3 years. But the returns are subjected to market and your investment in at little risk in short term. Over long term, mutual funds have given good returns but nobody can predict the future.

Some more Reading

- Rs. 10000 FD Interest Calculation for 10 Years

- Savings Account Interest Calculation in Excel

- SWP for Monthly Income

- SIP vs Step up SIP Returns on Rs. 2000

Frequently Asked Questions

What is PPF Full form?

PPF full form is Public Provident Fund that is a Government Backed saving scheme with lock in period of 15 Years.

PPF Formula to calculate Monthly Interest?

Below is the PPF formula to calculate monthly interest:

Monthly Interest = Monthly Interest Rate * Balance / 100What is the PPF Interest Rate 2026-27?

Latest PPF Interest Rate 2026-27 is 7.1% for January to March 2026 quarter, subjected to be reviewed every quarter.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.