Index Funds are passively managed mutual funds that aim to replicate the performance of a specific market index—like the Nifty 50 or Sensex—by investing in the same stocks in the same proportion. They offer broad market exposure, low operating expenses, and predictable returns. The expense ratio for these funds are low compared to actively managed funds since there is no frequent buying and selling to beat the benchmark returns, but to match the returns with benchmark by following them. It is best for beginners to start investing in Index Funds, as they are simple and do not need much research.

Let us understand Index Funds in India in more detail.

What are Index Funds in India?

- Index Funds in India are passively managed funds with less frequent buying and selling of stocks

- Total Assets in stocks are allocated based on the allocation in a specific index such as BSE Sensex and NSE Nifty 50

- So let’s say, in Nifty 50, the top 4 stocks include Reliance Industries Ltd. TCS, HDFC Bank and ICICI bank with 5%, 4%, 3% and 2% asset allocation respectively. The index fund in this case, that is representing Nifty 50 will also allocate assets in similar percentages to match the returns of Nifty 50 index

- Usually in indices, the companies are ranked based on market capitalization, and similarly in index mutual funds as well, the assets are allocated similarly, based on companies rankings with respect to market capitalization

- There can be multiple index funds you can invest in, like Sensex (top 30 companies on BSE), Nifty 50 (top 50 companies in NSE), Nifty next 50 index, Nifty midcap index, Nifty Small cap index, etc.

- The expense ratio for index mutual funds are low compared to actively managed mutual funds, due to less frequent buying and selling

- Index funds in India are believed to provide better returns compared to actively managed funds over long term, mainly due to low expense ratio and passive management

ALSO READ: Types of Mutual Funds in India

How Index Funds Work?

The working of Index funds in India is quite simple:

- The Index fund will allocate assets in stocks based on the asset allocation in specific Index

- For example, in Nifty 50, the top 4 stocks include Reliance Industries Ltd. TCS, HDFC Bank and ICICI bank with 5%, 4%, 3% and 2% asset allocation respectively. The index fund in this case, that is representing Nifty 50 will also allocate assets in similar percentages to match the returns of Nifty 50 index

- If any company in Nifty 50 is replaced by another company with increase in market capitalization and thus entering in top 50 companies, the fund manager in index fund also makes changes based on this ranking change and include that new company in the list of stocks in it’s portfolio

- And based on the assets allocated to all the stocks, the allocation in index funds are also imitated

- The returns in index funds is more or less similar to the benchmark returns provided by indices. In case if the returns are less, it may be due to tracking error

- The fund manager tries to have tracking error as low as possible to get returns matching with benchmark returns

Types of Index Funds in India

Below are some of the types of Index Funds you can invests in:

| Index Fund Type | Benchmark Index | Focus Area |

| Large Cap Index Funds | Nifty 50, Sensex | Top 50/30 companies by market cap |

| Mid Cap Index Funds | Nifty Midcap 150 | Mid-sized companies |

| Small Cap Index Funds | Nifty Smallcap 250 | Emerging small companies |

| Sectoral Index Funds | Nifty IT, Nifty Bank | Specific sectors |

| International Index Funds | Nasdaq 100, S&P 500 | Global exposure |

ALSO READ: SIP Retruns in Sensex Index Fund for Last 25 Years

Advantages of Index Funds in India

Some of the advantages of index mutual funds include:

Low Cost

The cost (expense ratio) of index mutual funds in India is very less compared to other actively managed funds. This is mainly due to less frequent buying and selling of stocks in index funds in India unlike actively managed funds, where the goal is to beat benchmark returns provided by index, with frequent buying and selling of stocks based on opportunities in market. Expense ratio includes the fees of fund manager, cost to handle your investments, transactions cost, etc.

Good Returns

Index mutual funds are believed to give good returns compared to many other actively managed funds since active funds tend to get out performed by benchmark returns. There are still some good actively managed funds that give better returns than index funds at the expense of high cost (expense ratio).

Better for New Investors

Index funds are best options for new investors who just starts with investing in equity mutual funds or stocks. They can simply start investing in index funds with the help of SIP (Systematic Investment Plan) and forget about it for the next 1 to 2 years before reviewing their portfolio. New investors don’t have to analyze or read about stocks quarterly results, since that is done by the fund manager and moreover, since they are investing in index funds related to sensex and Nifty 50 than they are investing in top Bluechip companies.

Diversification

Index funds provides the advantage of diversifying your investments by investing in top companies across various sectors. Diversification means not putting all eggs in one basket and that is what we do while we invest in index funds – covering top companies that belong to different industries and sectors

Examples of Index Funds in India

Below are some examples of Index Mutual Funds in India:

- HDFC Index Fund Sensex Plan: Invest in top 30 companies in BSE (Bombay Stock Exchange) with respect to market capitalization

- Motilal Oswal Nifty Midcap 150 Index Fund: Invest in companies ranked between 101 to 250 with respect to market capitalization in NSE

- Motilal Oswal Nifty Smallcap 250 Index Fund: Invest in companies ranked between 251 to 500 with respect to market capitalization in NSE

- HDFC Index Fund Nifty Plan: Invest in top 50 companies in NSE (National Stock Exchange) with respect to market capitalization

Below are the top 10 holdings of HDFC Index Fund Sensex Plan as of writing this article:

Things to Consider Before Investing

Below are few points you need to consider while investing in Index Funds:

| Factor | Why It Matters |

| Tracking Error | Lower error = better index replication |

| Expense Ratio | Impacts net returns |

| Investment Horizon | Best suited for long-term goals (5+ years) |

| Index Selection | Choose based on risk appetite (large cap vs mid/small cap) |

| Taxation | Same as equity mutual funds |

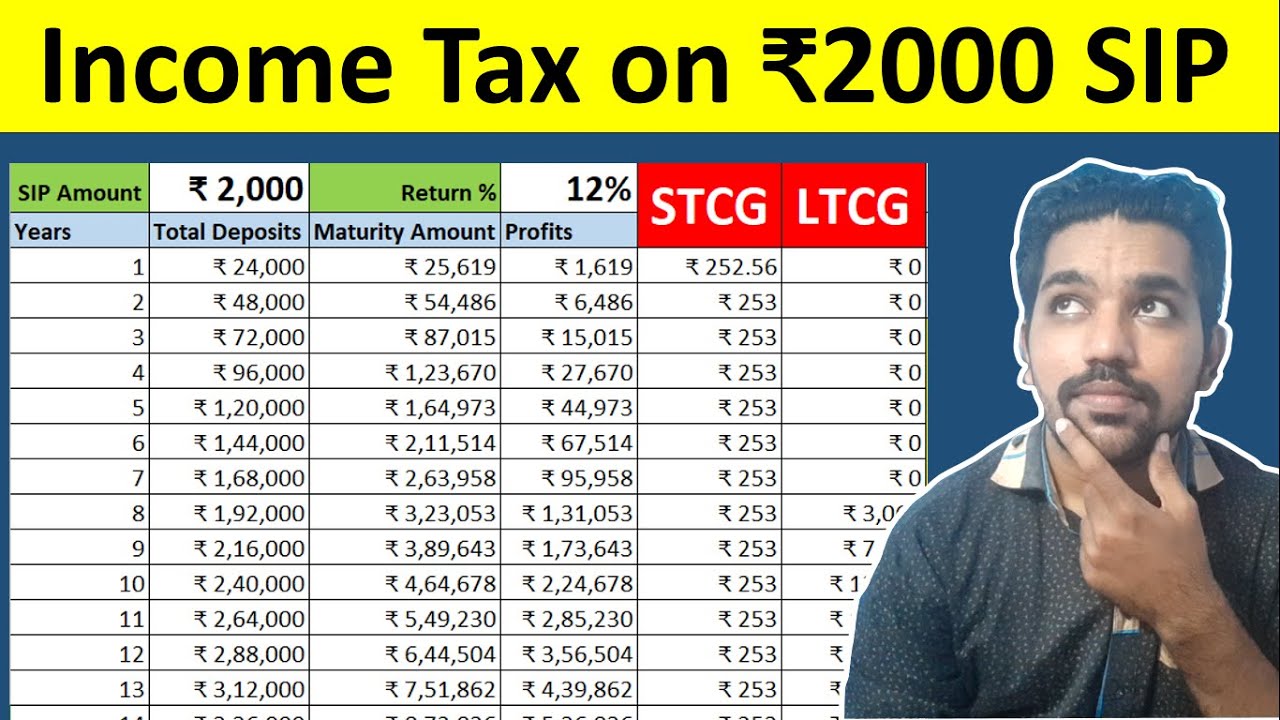

Taxation on Index Funds

Taxation on Index funds is similar to other equity mutual funds.

STCG (Short term Capital Gains) Taxation: When profits are made within 1 year of buying index funds, these are termed as short term capital gains or STCG. These profits will be taxed at 15% flat rate.

LTCG (Long term Capital Gains) Taxation: When profits are made after holding period of 1 year of index funds, these profits are termed as long term capital gains. Rs. 1 lakh in profits is exempted from tax in a financial year. Gains after Rs. 1 lakh will be taxed at 10% flat rate.

Watch below video to understand taxation with SIP.

Income Tax on SIP Video

Who Should Invest in Index Funds?

- Beginners looking for low-maintenance equity exposure

- Long-term investors seeking stable returns

- Passive investors avoiding active fund volatility

- Cost-conscious investors preferring low expense ratios

Conclusion

So Index funds in India can be a better option for those staring to invest in equity mutual funds. These funds are also called passively managed funds since they do not involve in frequent buying and selling of stocks in their portfolio. Index funds try to imitate the indices such as Sensex and Nifty to provide similar returns compared to benchmark returns.

Index mutual funds have low expense ratio compared to actively managed mutual funds and also outperform majority of the actively managed funds.

Some more Reading:

- How to Start SIP Online

- Taxation on Short Term Capital Gains

- Rs. 2000 SIP Returns Calculation for 1 to 15 Years

Frequently Asked Questions

What is an index fund?

An index fund is a mutual fund that replicates a market index like Nifty 50 or Sensex, offering passive exposure to top companies.

How do I buy index funds?

You can invest via AMC websites, mutual fund platforms (Groww, Zerodha), or through your bank’s investment portal.

Are index funds a good investment?

Yes Index funds can be a good investment for someone who is just getting started with investments in equity. Index funds try to imitate the indices such as Sensex or Nifty and provide similar benchmark returns. They also have low expense ratio (cost) compared to other actively managed mutual funds.

Which is best Nifty 50 index fund?

Some of the best Nifty 50 Index Funds are HDFC Index Fund Nifty 50 Plan, ICICI Prudential Nifty 50 Index Fund, UTI Nifty 50 Index Fund. Since these funds are investing in same stocks with almost similar asset allocation percentages, their returns are also similar. It is advised to invest only in one of the above index funds (and not in 2 or more of them in Nifty 50) since their returns will be similar over a period of time.

Are index funds better than actively managed funds?

Over the long term, many index funds outperform actively managed funds due to lower costs and consistent strategy.

Are index funds 100% safe?

No mutual fund investment is 100% safe and that is why we get to see “Mutual fund investments are subjected to market risks, Read all scheme related documents carefully” statement. So index funds are also not 100% safe but if we see historic returns, they have given better returns than fixed income assets such as Fixed Deposits, etc.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.