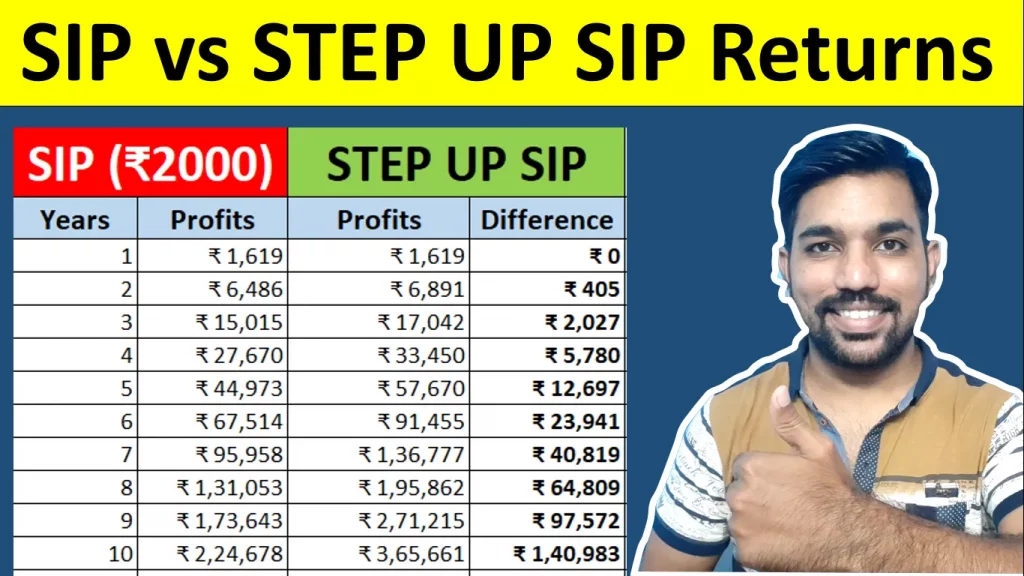

SIP vs Step up SIP Returns calculation is one of the comparisons we can do to check how much returns we can increase with step up. Step up SIP is a way to increase SIP amount based on the frequency set by us – quarterly, half yearly or yearly. But how much more returns we will get?

SIP of Rs. 2000 per month for next 15 years gives us approx. 6.5 Lacs of profits at 12% expected returns, whereas if we step up this SIP by Rs. 500 every year, we get returns of Rs. 12.5 Lacs after 15 years at 12% expected returns. That’s Rs. 6 Lacs more profits compared to SIP without stepping up the amount.

Watch below video to know the calculations.

SIP vs Step up SIP Returns Calculation Video

Watch more Videos on YouTube Channel

Let us now check some benefits of SIP and Step up SIP.

Benefits of SIP

There are many benefits of investing via SIP (Systematic Investment Plan)

- Rupee Cost Averaging – You get the benefit of Rupee cost averaging when you invest in markets going high and low with time

- Disciplined Investing – Giving time to the market is important and that is what happens in SIP when every month a pre defined amount is invested in mutual fund from our side

- No Fear of Loss – While making lump sum investments, there is a fear of loss if markets go down after lump sum investment. Doin SIP helps you to give time to the market with small amounts every month against timing the market

- SIP in Mutual Funds – While you invest via SIP in mutual funds, you eliminate the risks of investing in single company, as mutual funds help us to invest in multiple companies

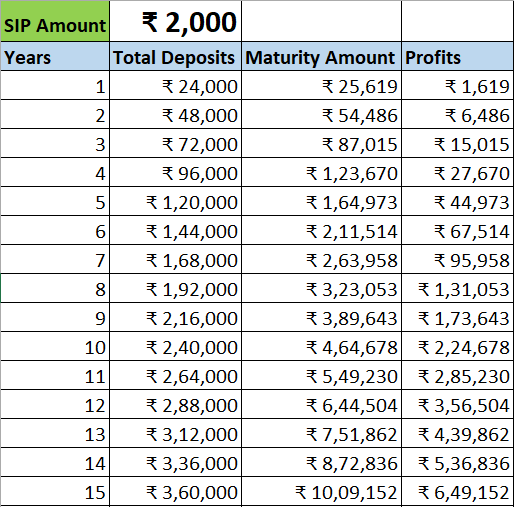

Below is the table for SIP Returns Calculation on Rs. 2000 monthly SIP, over next 15 years at 12% expected Returns.

In case you are new to Mutual Funds, you can watch this Mutual Funds for Beginners Playlist to understand the basics about mutual funds, different terms and how to invest in mutual funds.

Benefits of Step up SIP

So we have seen most of the Benefits of SIP in mutual funds above. But what are the advantages of step up SIP and how it is different from normal SIP?

Step up SIP is a way to increase SIP amount based on the frequency you want to select. The amount can be increased every quarter, half year or yearly as well.

While doing SIP online you get the option to increase SIP amount based on the frequency you want to select. And this is what we call Step up SIP.

Step up SIP can be done based on some events such as if you get a promotion or your salary increased with a job switch or when you get yearly bonuses or any other such occasion when your income increases.

With the increase in income, we should also increase our investment amounts.

Step up SIP has all the benefits of SIP as mentioned above. But it also has some additional benefits as mentioned below:

- Increase in returns on your investments

- Reduction in expenses since you allocate the additional income into investments

- More disciplined with your personal finance

- Goals achieved before time

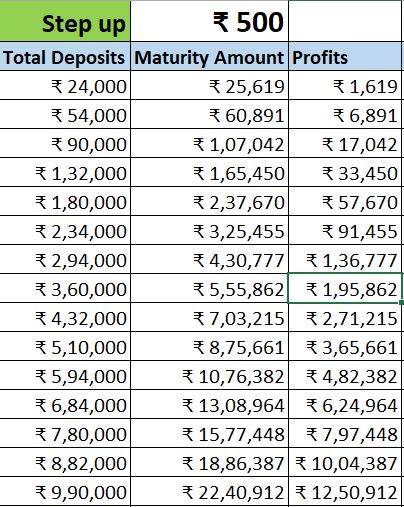

Below is the table for Step up SIP Returns Calculation on Rs. 2000 monthly SIP, step up of Rs. 500 every year, over next 15 years at 12% expected Returns:

As seen above, after 15 years of step up SIP, your total deposits = ₹ 9,90,000, total maturity amount = ₹ 22,40,912 and profits you make = ₹ 12,50,912.

Now this should be the perfect reason for you to start step up SIP!

ALSO READ: How to Start SIP Online [Video]

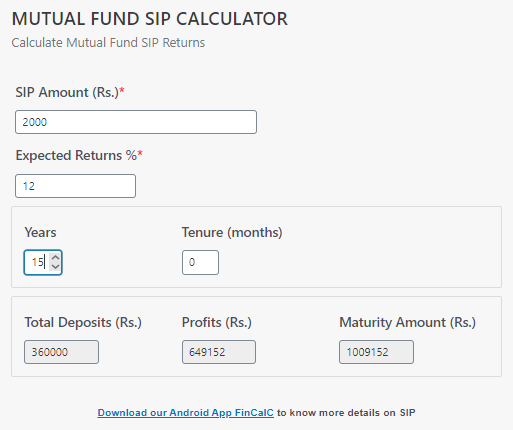

Using SIP Calculator

You can also verify the calculations mentioned above by using the online SIP Calculator.

By using above example of Rs. 2000 monthly SIP and expected returns of 12%, we get maturity amount as can be seen below:

As seen, we get profits of approx. Rs. 6.5 Lacs in 15 years, just by investing Rs. 2000 per month. Use this SIP calculator to know returns on your SIP.

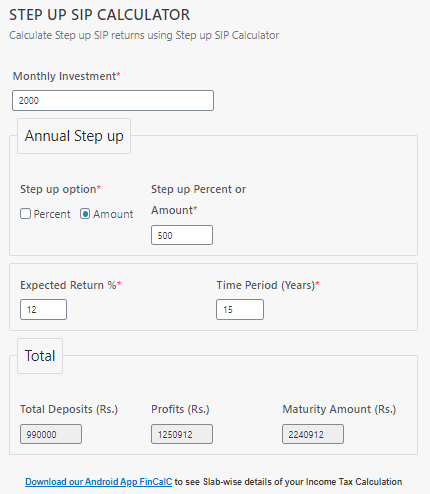

Let us now use the Step up SIP calculator.

Using Step up SIP Calculator

I have also created this Step up SIP Calculator which you can use for free to calculate your SIP returns while doing step up.

Below are the returns on monthly SIP = Rs. 2000, step up of Rs. 500 every year for 15 years at 12% expected rate of returns:

As seen above, we get profits of Rs. 12.5 Lacs with this step up SIP, which is Rs. 6 Lacs more compared to if step up is not done every year.

And all these profits just by increasing SIP amount by Rs. 500 every year!

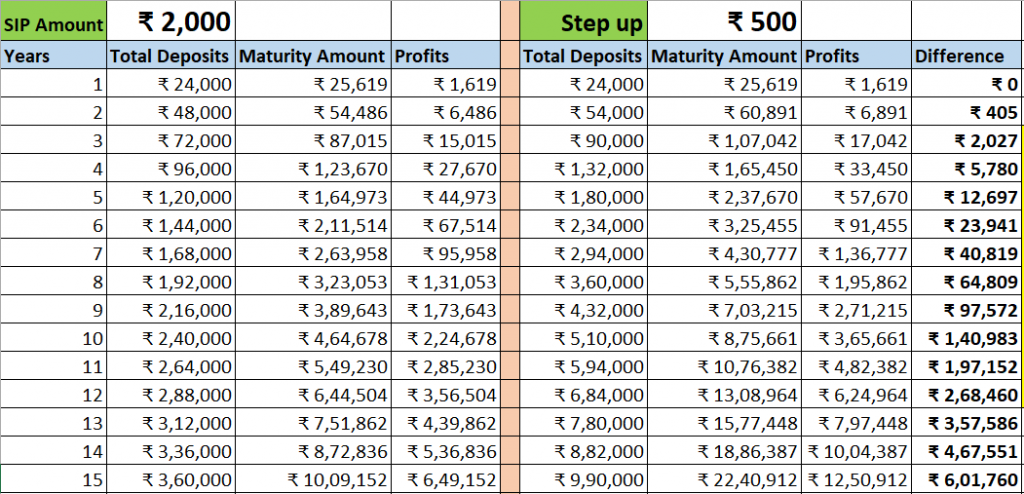

Let us now take a look on side by side comparison of SIP vs step up SIP calculations for next 15 years.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

SIP vs Step up SIP Calculation Comparison in Excel

If you have watched above video at the start of this article, you will see the side by side comparison of returns in SIP and Step up SIP from 1to 15 years.

Below is the image showing the same comparison along with the additional profits that you will be making with Step up SIP:

Above mentioned example is for Rs. 2000 monthly SIP and Rs. 500 step up with 12% expected rate of return, you can also create your own excel based on your investments amounts.

Also, you can download the individual Excel calculators of SIP and Step up SIP from below links:

Download SIP Excel Calculator

Click below button to get SIP calculator in Excel:

Download Step up SIP Calculator in Excel

Click below button to download step up SIP excel calculator:

Conclusion

So we saw SIP vs Step up SIP in this article, step up SIP has many benefits in which extra returns is one of the best advantages you can get with increased deposits.

As seen, you get additional Rs. 6 Lacs of returns over 15 years, just be increasing Rs. 500 every year in your Rs. 2000 monthly SIP. So start investing now.

Frequently Asked Questions

Which is best, SIP or step up SIP?

Step up SIP is best compared to SIP since every year you will be increasing the amount of investment you do every month with the help of step up SIP. This stepping up eventually helps you to get more returns due to more deposits and hence helps you to achieve your goals faster.

What is the meaning of step up SIP?

Step up SIP means increasing the SIP amount every year with the help of increase in income due to job change, promotion, bonus, etc. The meaning of step up is “increasing” and hence we must increase the SIP investment every year with the help of increase in income

Can I convert my SIP to step up SIP?

Yes SIP can be converted to step up SIP. Many Mutual Fund AMC (Asset Management Companies) helps you to do that.

What are the advantages of step up SIP?

Step up SIP helps us in achieving the financial goals faster compared to normal SIP, also we get more returns due to increase in the investment amount every year for a long period of time.

Some more Reading

- Income Tax on SIP

- Rs. 10,000 FD Interest Calculation for 10 years

- How to Calculate Income Tax on Salary

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.