If you want to know senior citizen income tax calculation 2022-23 for age between 60 to 79 years than you are at the right place. Many queries will be solved in this article such as how to calculate income Tax in FY 2022-23 for senior citizens, what are the various Tax slabs and Rebate available, Old Tax regime vs New Tax regime, which one to choose between old slabs and new slab rates and how you can save income tax in FY 2022-23. Senior Citizen Income Tax Excel Calculator download link is provided at the bottom of this article.

Calculating Income tax for senior citizen is very simple with the help of Excel calculator. But before calculating income tax, you should know various factors like Income tax slab rates for FY 2022-23, Tax rebate limit, Investment options available, Section 80TTB limit, select between old or new Slab Rates, etc. Let’s see all of these one by one.

- Senior Citizen Income Tax Calculation 2022-23 Excel video

- Income Tax Slab Rates FY 2022-23

- How to Calculate Income Tax

- What is Standard Deduction

- Deductions available to Senior Citizens

- Other Investment Options for Senior Citizens

- Choose between Old and New Slab Rates

- Conclusion

- Some more Videos

- DOWNLOAD INCOME TAX EXCEL CALCULATOR

- Frequently Asked Questions (FAQ)

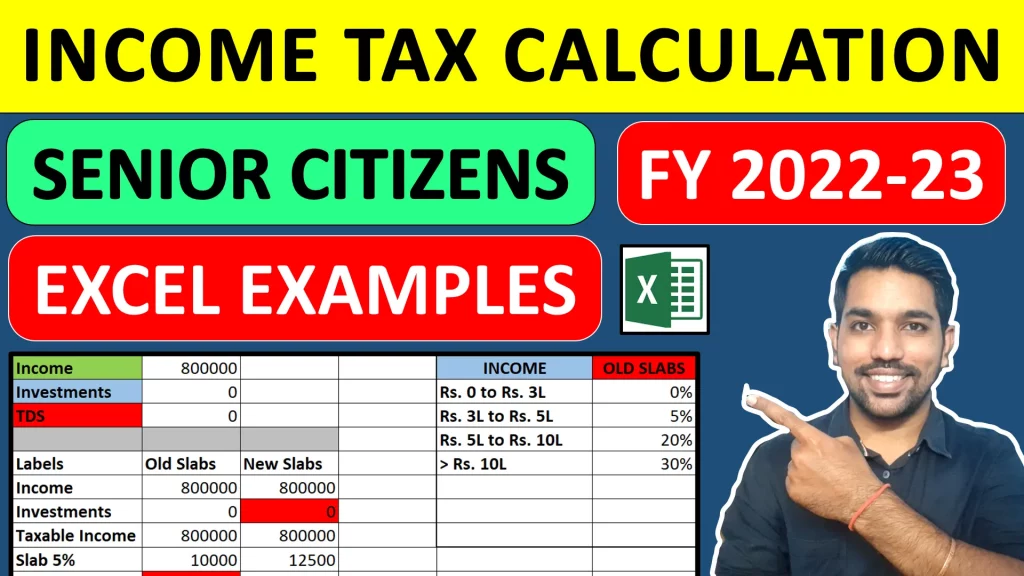

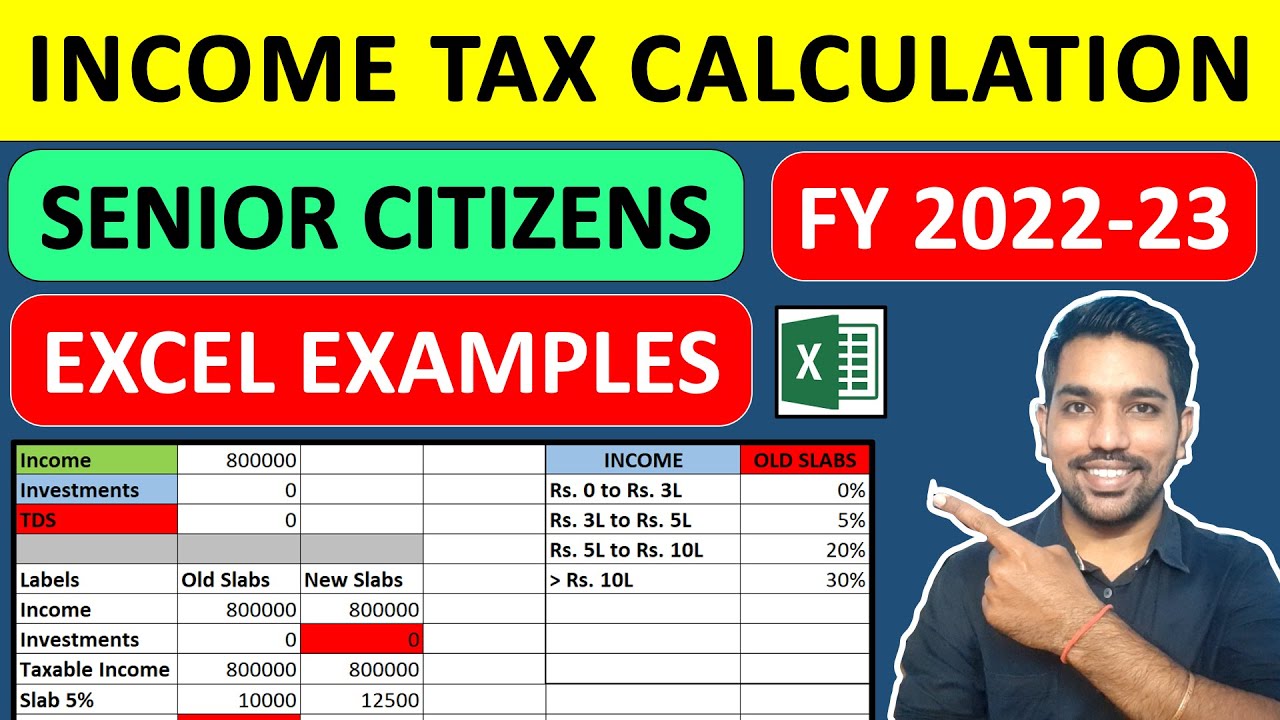

Senior Citizen Income Tax Calculation 2022-23 Excel video

In this video I have shown you examples of Income Tax calculation for Senior citizen for FY 2022-23 with the help of examples.

Income Tax Slab Rates FY 2022-23

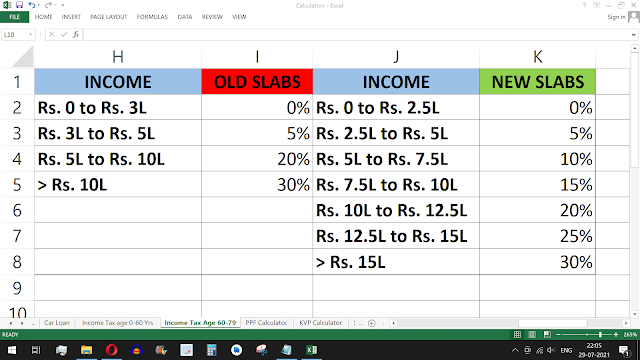

- In Budget 2020, new Income Tax Slab Rates were introduced which are reduced Tax Slab Rates compared to Old Income Tax Slab Rates

- You will have the option to choose between old tax regime (higher tax rates) or new tax regime (lower rates)

- But with lower rates in new tax regime, there is a condition. You will not be able to claim any deduction against your investments in any of the Tax saving schemes

- You will also NOT have the option of Standard Deduction to help reduce your Income Tax if you choose new tax regime

- All the deduction options are still applicable if you choose old tax regime to calculate your income tax, but with higher rates compared to new tax regime

As we can see above, Old tax regime have high tax rates (except for Income between Rs. 0 Lacs to Rs. 5 Lacs) compared to New tax regime.

The only thing you should remember while you select new tax regime is, you won’t be able to claim any deductions from your investments.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How to Calculate Income Tax

Now, how do we calculate Income Tax using above slab rates? It depends on your Income

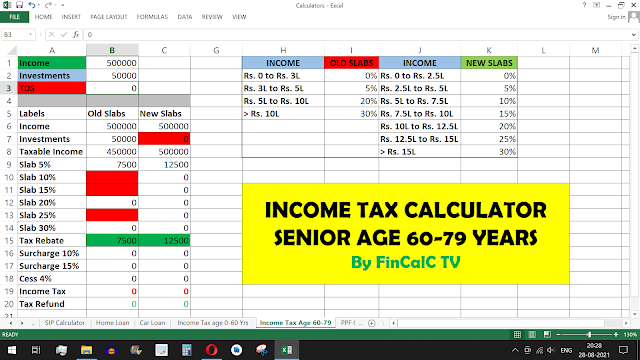

Using the Income Tax Excel Calculator, you can easily calculate your Income tax with the help of 3 inputs – Income, Investments & TDS

Based on the Income Tax Slab Rates, your Income Tax will be calculated and you can easily choose between Old and New Tax Regime to lower your Income Tax.

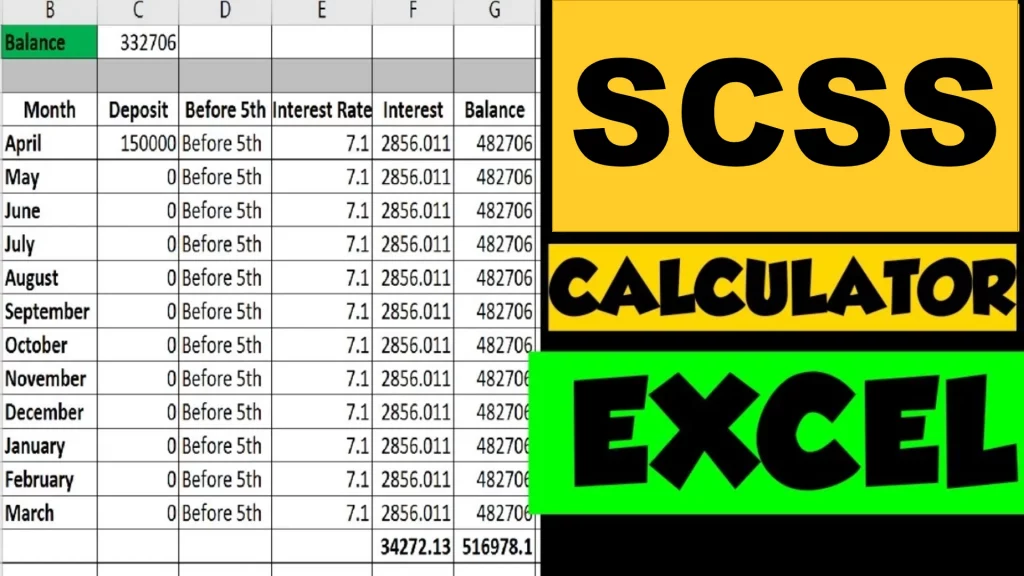

ALSO READ: Senior Citizen Saving Scheme Interest Calculation

What is Standard Deduction

Standard Deduction is a flat deduction of Rs. 50,000 that is applicable if you are a salaried employee or pensioner. Remember that you will be allowed to use this deduction only when you choose Old Tax Regime and not with New Tax Regime.

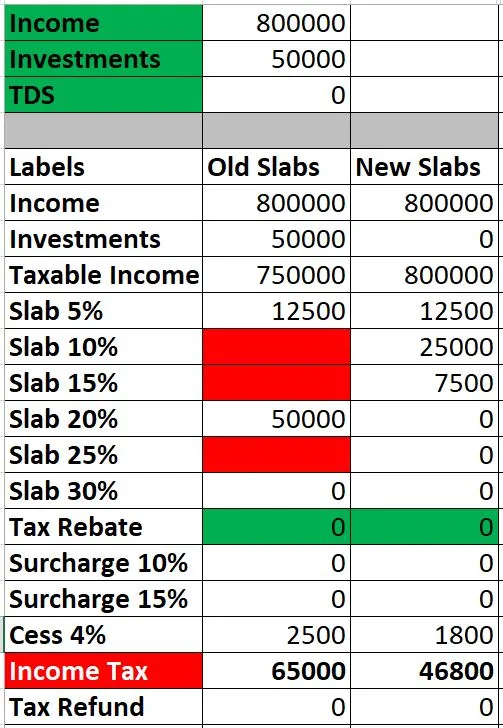

Example:

As seen above, standard deduction is only applied in old tax regime thus reducing the taxable income to Rs. 7.5 Lacs and accordingly income tax is reduced. This is one of the ways to save income tax when you opt for old tax regime and are eligible for standard deduction of Rs. 50,000 (only to salaried employees and pensioners)

Deductions available to Senior Citizens

- Important: You can claim Deductions only under Old Tax Regime. So you need to choose Old Tax Regime to calculate your Income Tax while claiming deductions. You can clearly identify this in our Income Tax Excel Calculator

- Section 80C: You can claim maximum of Rs. 1.5 Lacs in a FY to save your Income Tax under Old Tax Regime

- Section 80TTB: Savings Account interest that you get in a FY can be claimed under this section so you don’t pay income tax on savings account interest, maximum Rs. 50,000 can be claimed in FY 2022-23

Other Investment Options for Senior Citizens

- House Rent Allowance: If you are still working and receive HRA from employer, you can claim HRA in case you pay rent, to reduce your taxable income

- Home Loan Interest: Home Loan Interest paid by you can be claimed under Section 24 to save your Income Tax (maximum limit = Rs. 2 Lacs)

- Charity: You can also donate to identified charitable organizations to save your income tax

How to Save Income Tax Video

Choose between Old and New Slab Rates

When your income is below Rs. 5 Lacs, you need not have to pay any income tax due to the benefit of Tax Rebate u/s 87A. As your income increases above Rs. 5 Lacs in a FY, you need to make required investments and reduce your taxable income to below Rs. 5 Lacs to save your income tax.

When your income increases more and reaches at a point where investment options won’t help much, you need to analyze your financial data and choose between Old & New Tax regime to pay less income tax.

The ideal way is the specify Investments that you are eligible for and compare the Income Tax that you have to pay with Old or New Tax Regime and choose the one that makes you pay less Income Tax.

This can be easily done using the Income Tax Excel Calculator or our Free Android App Calculator.

Conclusion

It is very easy to calculate Income Tax using the excel calculator or our Free Android App Calculator.

It’s just a matter of providing 3 inputs – Income, Investments & TDS, that will help you calculate your Income Tax with Old and New Tax Regimes and help you decide between them.

Some more Videos

DOWNLOAD INCOME TAX EXCEL CALCULATOR

Download Senior Citizen Income Tax Calculator using above link.

Some more Reading:

SWP Calculation – Systematic Withdrawal Plan

SIP & Lump sum Returns Calculation for 30 Years

PPF Interest Calculation – Public Provident Fund

Frequently Asked Questions (FAQ)

1. How do I calculate my Income Tax in FY 2022-23?

Ans. You have the option of choosing between Old Slab Rates and New Slab Rates in order to calculate your Income Tax in FY 2022-23. You can choose based on your income and investments you make to accordingly calculate income tax in FY 2022-23

2. Where can I get Income Tax Calculator for FY 2022-23?

Ans. You can download the Income Tax Calculator Android App to calculate and compare your Income Tax

3. How to Save Income Tax in FY 2022-23?

Ans. You can save income tax in FY 2022-23 by opting for Old Income Tax Slab Rates and making required Tax saving investments. You can watch this video to know what are the Tax Saving instruments you can use to Save Income Tax – CLICK HERE

4. Can I save Income Tax using New Income Tax Slab Rates?

Ans. No, you cannot claim any deductions for your investments you make using New Income Tax Slab Rates for FY 2022-23. So your gross income becomes your Net Taxable Income to calculate your Income Tax.

5. Why Income Tax is Rs. 0 on Income up to Rs. 5 Lakhs?

Ans. In case your Net Taxable Income is up to Rs. 5 Lakhs, you get Tax Rebate of maximum Rs. 12,500 under Section 87a which cancels your income tax of Rs. 12,500 on income of Rs. 5 Lakhs, thus making your Total Income Tax = Rs. 0. This Tax Rebate u/s 87a is applicable to both Old and New Slab Rates.

6. Is Tax Rebate u/s 87a applicable to both old and new slab rates?

Ans. Yes.

7. What is the standard deduction amount for FY 2022-23?

Ans. Standard Deduction applicable for FY 2022-23 is Rs. 50,000. But this is applicable only when you choose Old Income Tax Slab Rates to calculate your Income Tax. Not on New Income Tax Slab Rates. Standard Deduction is available only to employees and pensioners.

8. Is interest earned in Savings Account Taxable?

Ans. Yes. But you can claim maximum of Rs. 50,000 in FY 2022-23 under Section 80TTB for interest earned in your savings account using old tax slab rates. Again, this is not applicable in New Tax Slab Rates. Any amount above Rs. 50,000 as interest in your savings account will be taxable even using old tax slab rates.

9. What are the new Tax Slab Rates in FY 2022-23?

Ans. There were no changes made in Budget 2022 regarding the Income Tax Slab Rates. So the old and new slab rates that were applicable in FY 2021-22 are still applicable in FY 2022-23 and you have the option of choosing between these slab rates to calculate and pay your Income Tax. To check your Income Tax download my Income Tax Calculator App. LINK GIVEN BELOW.

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.