As a new investor it is very important for you to understand the Difference between Large Cap, Mid Cap & Small Cap Stocks in India before you start investing. Large cap stocks or companies are the ones that are well established since many years, reputed companies that have seen the ups and downs in market. These companies are less risky to invest in.

Mid cap companies are the ones that have the potential for growth but they are little more volatile in nature and more risky compared to large cap stocks. Small cap stocks are the companies that are less known but have very high potential of growth with maximum volatility and very high risk compared to large cap and mid cap stocks.

Let us understand large cap, mid cap and small cap stocks in more detail.

What is Market Capitalization?

Before understanding the differences between Large Cap, Mid Cap & Small Cap Stocks, let us first understand the meaning of market capitalization.

Market capitalization or Market cap refers to the product of number of total shares in the company and current market price. Since current market price (share price) of the company changes everyday, the market cap also changes everyday for all companies.

Below is the formula for market cap of a company:

Market Cap = Number of Outstanding Shares * Share PriceSo for example, lets say the total number of shares of XYZ company is 1,00,000 and the current share price is Rs. 30 per share, so the market cap will be Rs. 30,00,000:

Market Cap = Number of Outstanding Shares * Share Price

Market Cap = 1,00,000 * Rs. 30

Market Cap = Rs. 30,00,000And this is how the market cap of the companies are calculated on everyday basis.

The difference between large cap, mid cap and small cap stocks depends on this market cap of the companies. All the companies are sorted in descending order or the market cap and are categorized as large cap, mid cap and small cap companies

- Large Cap: Top 100 Companies based on Market Cap

- Mid Cap: Companies with rank 101 – 250 based on Market Cap

- Small Cap: Companies with rank 251 and above based on Market Cap

Let us understand all these separately with examples.

What are Large Cap Stocks?

- Large cap stocks or companies are the ones that are ranked between 1 to 100 based on market cap

- These companies usually have the market cap of Rs. 20,000 crore or above

- Large cap companies have less risk in nature since these are stable, well established companies that have seen the market ups and downs based on recession, political effects, natural disasters, etc.

- These companies are reputed companies across the country and globe that have very less chance of getting bankrupted or liquidated hence these are less risky in nature

- New investors should consider investing in large cap stocks or mutual funds to get started for their long term goals with low risk

Below are some of the examples or large cap stocks taken from Tickertape Screener.

Large Cap Examples

Reliance Industries Ltd, Tata Consultancy Services Ltd, HDFC Bank Ltd, ICICI Bank Ltd, Infosys Ltd are some of the examples of top large cap companies as of writing of this article. The top companies might get changed in future based on the new mid cap companies that enter the large cap category.

ALSO READ: 8 Best Investment Options for Monthly Income

What are Mid Cap Stocks?

- Mid cap stocks or companies are the ones that are ranked between 101 to 250 based on the market cap

- Usually they have the market cap between Rs. 5000 crore to Rs. 20,000 crore

- But as the market cap of all companies increases with time, you will find many mid cap companies having market cap of above Rs. 20,000 crore as well

- Mid cap companies have moderate risk since they focus on their growth and have the potential to become large cap companies in future

- These companies are mid sized and get more impacted as far as market volatility is concerned compared to large cap companies

- New investors can give some exposure to mid cap companies if they can take some extra risks in return of good returns over long period

- It is important to assess the companies based on their financial results and choose the mid cap companies accordingly before investing

Below are some examples of mid cap stocks.

Mid Cap Examples

Torrent Pharmaceuticals Ltd, IDBI Bank Ltd, Max Healthcare Institute Ltd, Vodafone Idea Ltd, Info Edge (India) Ltd are some of the mid cap stocks or companies as of writing of this article. if they perform well, they have the potential to move in large cap category based on their revenue and earnings in future.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

What are Small Cap Stocks?

- Small cap stocks or companies are the ones that are ranked 251 and above based on the market cap

- These companies usually have market cap of below Rs. 5000 crore

- But since the companies grow with time, there are many small cap companies that have market cap of more than Rs. 5000 crore

- Small cap companies are highly volatile in nature and are risky compared to large cap and mid cap companies

- These companies take more risk to get potential growth to enter mid cap and large cap category eventually, but while taking risks, they can face losses as well if risks taken are not calculated

Below are some examples of small cap stocks.

Small Cap Examples

Narayana Hrudayalaya Ltd, Grindwell Norton Ltd, Ajanta Pharma Ltd, ICICI Securities Ltd are some of the small cap stocks or companies as of writing of this article.

Please note that above stocks can enter mid cap or large cap category based on future growth and you must always refer to the latest list of stocks based on market cap using Stock Screener.

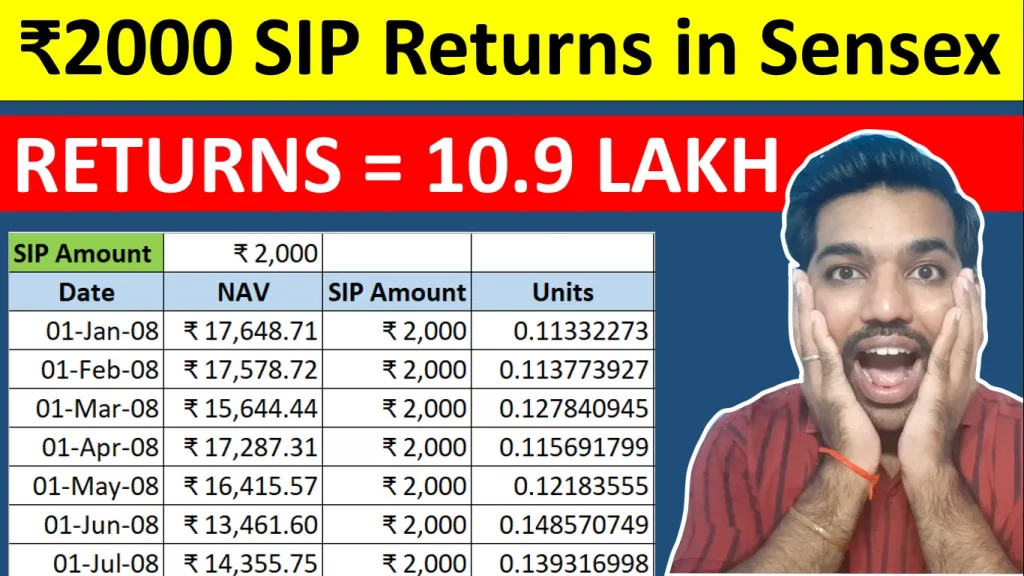

ALSO READ: Rs. 1000 Mutual Fund Returns Calculation

Difference between Large Cap, Mid Cap & Small Cap Stocks

Below is the table listing the differences between Large Cap, Mid Cap & Small Cap Stocks:

| Parameters | Large Cap | Mid Cap | Small Cap |

|---|---|---|---|

| Rankings | Top 100 Companies based on Market Cap | 101 to 250 ranked companies based on Market cap | 251 and above ranked companies based on Market cap |

| Companies Type | Well Established, stable companies | Compact mid sized companies with potential growth | Small companies with significant growth potential |

| Volatility | Less Volatile | Moderate Volatility | Highly Volatilie |

| Market Cap | Rs. 20,000 crore and above | Between Rs. 5000 crore to Rs. 20,000 crore | Less than Rs. 5000 crore of market cap |

| Growth Potential | Slow to moderate growth potential | Moderate growth potential | High Growth potential |

| Risk | Less risky due to well established companies | Medium risk due to mid sized companies | Highly risky due to small companies |

Conclusion

So to summarize, large cap companies are the ones that are well established and stable companies with less risk compared to mid cap companies that are of medium size as far as market cap is concerned.

Small cap companies have the highest risk but also provides better returns over long run based on company performance and economy.

If you are a new investor, opt for large cap or mid cap companies over long period to achieve your financial goals. after getting experience and markets, you can start analyzing small cap companies with their revenue, earnings or profits, financial statements to take some risk while you are well settled and already have emergency funds in place.

Some more Reading:

Frequently Asked Questions

What is a large-cap bank?

Large cap bank is a bank that belongs to large cap category, which means they are in top 100 companies based on market cap. Some of the examples of large cap banks are HDFC Bank Ltd, ICICI Bank Ltd, State Bank of India among others which are in top 100 companies of India currently.

Which cap is best for SIP?

For new investors, you should start SIP in large cap companies for couple of years and understand how mutual funds and stocks work. After getting some experience, you can start SIP in mid cap companies followed by small companies to take some extra risk for more rewards. Do not enter into stocks directly without prior knowledge of what you are doing and how to read financial statements of companies.

Is large-cap high risk?

Large cap companies are less risky in nature compared to mid cap and small cap companies. All companies have risk associated with them since they have to deliver good revenue and earnings in every quarter to move ahead in competitive markets while beating their competitors. The ones that posts good earnings and growth will tend to provide better returns financially.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.