It is very easy to link PAN and Aadhaar using the official income tax website. In this article we are going to see step by step process on how to link PAN and Aadhaar online and also verify whether the PAN Card and Aadhaar number got successfully linked.

Note that if you don’t link these documents by 31st March 2023, your PAN might become inactive.

Also you can watch the below video to know all the steps to follow to link PAN and Aadhaar online.

How to link PAN and Aadhaar Video in Hindi

You can watch above video to see the steps on linking your PAN card with Aadhaar number. You can also see how to verify of both are successfully linked.

Let’s now go through the steps of linking PAN card with Aadhaar number.

Steps to link PAN Card with Aadhaar Number

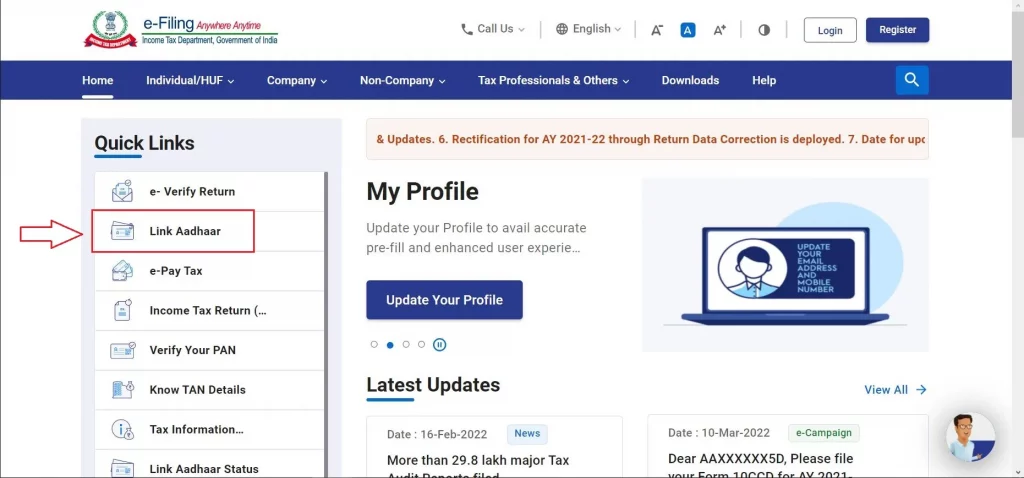

- Go to the official Income Tax Website: https://www.incometax.gov.in/iec/foportal

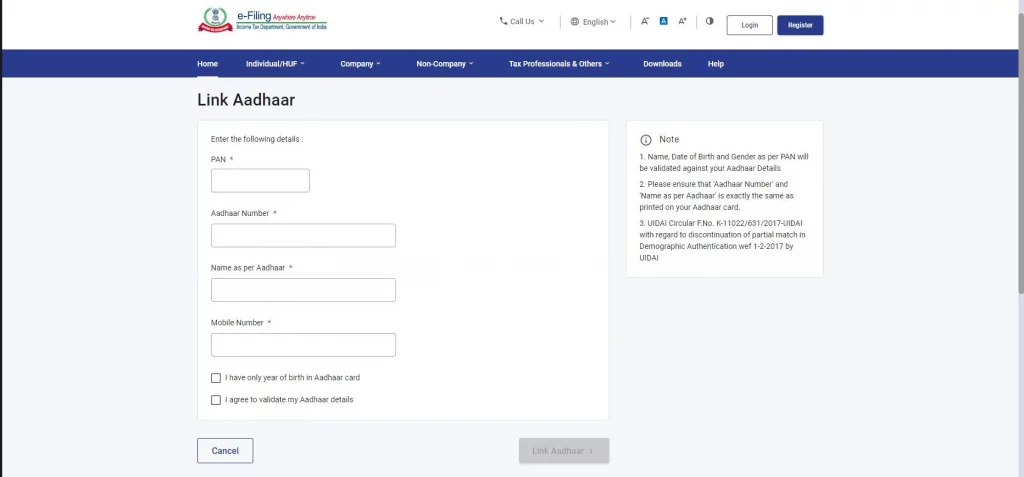

- On left – Click on Link Aadhaar

- Provide details of PAN, Aadhaar Number, Name as per Aadhaar, Mobile Number. Note that names on PAN and Aadhaar must match. If not matching then please get it rectified from Aadhaar center.

- Click on “Link Aadhaar“

- Provide OTP in case you are asked, and your PAN and Aadhaar will be linked

In case you have any queries or get stuck somewhere, you can watch above video to link your PAN card with Aadhaar number easily.

ALSO READ: No Income Tax on Income up to 7.5 Lakh

Verify whether PAN & Aadhaar are linked

Once you have raised the request to link PAN and Aadhaar to be linked, it might take some time to link both. You can check the status of linking these documents by following simple steps. Below is the video for same.

How to Check PAN and Aadhaar Link Status Video

Watch more Videos on YouTube Channel

You can also check whether both are actually linked or not using below steps with screenshots:

Steps to Verify PAN and Aadhaar are linked

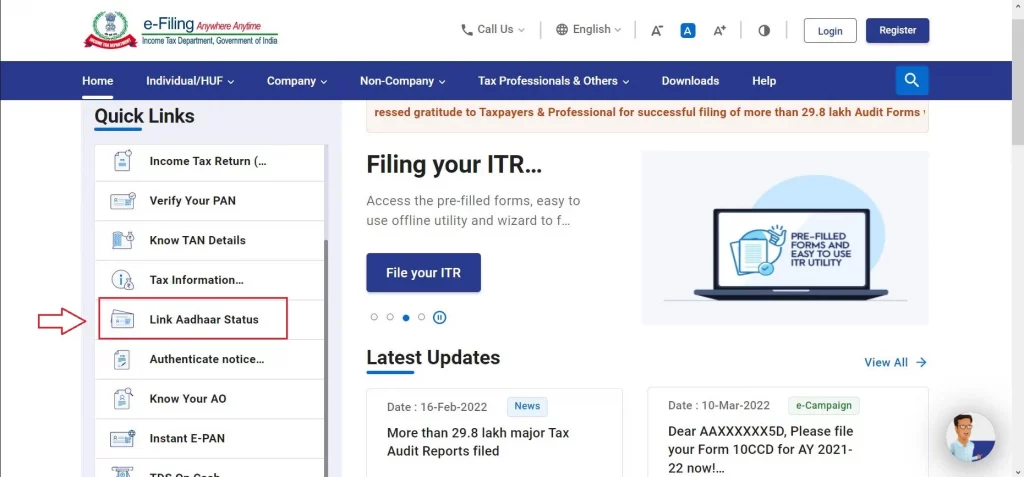

- Go to the official Income Tax Website: https://www.incometax.gov.in/iec/foportal

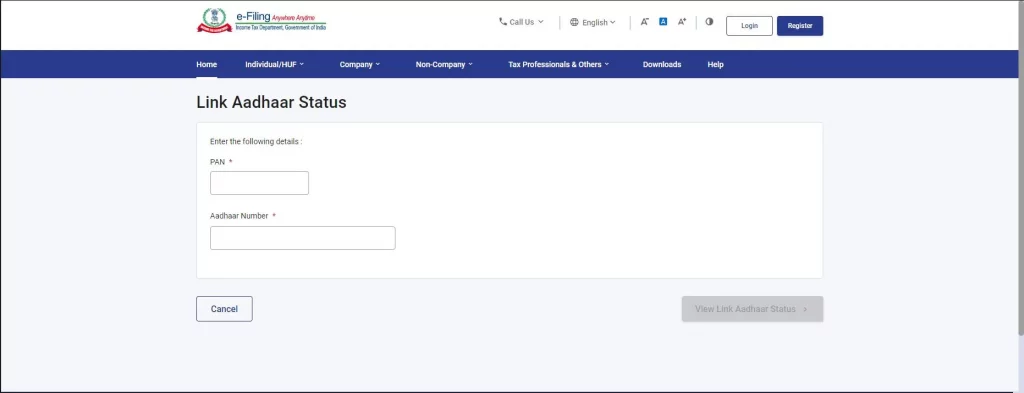

- On left – Click on Link Aadhaar Status

- Provide PAN and Aadhaar details and click on View Link Aadhaar Status

So in this way you can easily check your PAN and Aadhaar status. This is one of the easiest ways to link your PAN card with Aadhaar number or vice versa, apart from the offline modes of linking both.

It is important to link both these important documents so that you don’t get stuck in completing your important work. This step of linking PAN with Aadhaar is mandatory without which your PAN might become inactive or inoperative. It would be difficult to proceed with any important financial work if it involves both these documents.

The last date to link Aadhaar with PAN has been set as 31st March 2023, but you can always check on google if the date is extended if you have recently applied for both these documents.

Conclusion

Linking PAN and Aadhaar cards is mandatory step to avoid your PAN card becoming inoperative or inactive. Not able to withdraw money from your bank account will be the last thing you would want if your PAN becomes inactive.

So link your PAN and Aadhaar as soon as possible to avoid such things in future.

Some more Reading:

Frequently Asked Questions

Is Aadhaar-PAN linking free?

It was free until 31st March 2022. But from 1st April 2022, Rs. 500 had to be paid to link PAN and Aadhaar which was increased to Rs. 1000 from 1st July 2022. From 1st April 2023, your PAN might become inactive or inoperative if it is not linked with Aadhaar.

What is the Last Date to Link PAN with Aadhaar?

The last date to link Aadhaar with PAN has been set as 31st March 2023, but you can always check on google if the date is extended if you have recently applied for both these documents.

Can we link Aadhar to PAN in Mobile?

Yes it can be done on mobile browser by following the steps mentioned in above videos and screenshots. In fact many Indians have easy access to mobile and the income tax website is mobile friendly as well so PAN and Aadhaar can be linked via mobile.

Why is linking of PAN with Aadhar required?

PAN Aadhaar linking is required so that the IT (Income Tax Department) can identify the fraudulent transactions and frauds that are increasing day by day with digital payments in India.

What will happen if Aadhar and PAN not linked?

If Aadhaar and PAN are not linked on or before 31st March 2023, than your PAN card might become inactive. In such cases you won’t be able to carry out several banking transactions and the amount of charges you have to pay, such as TDS on your fixed deposits will increase due to no PAN card. So better to get both these documents linked as soon as possible.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.