It is possible that you can claim HRA when living with parents but there are certain steps you should follow to claim HRA without staying on rent or in rented accommodation.

If you stay with your parents or spouse in which case, you do not own the property, you can pay them some amount every month as rent and claim that amount as HRA if you receive HRA component in your salary payslip. This needs you to provide a rental agreement (or rent declaration) between you and parent, monthly rent receipts that act as proofs that you are paying rent where you stay, and having the online transactions of rent amount being transferred from your account to parent’s account. Also, it is important to note that the rent amount paid to your parent or spouse is taxable to them and they have to pay income tax on their income accordingly.

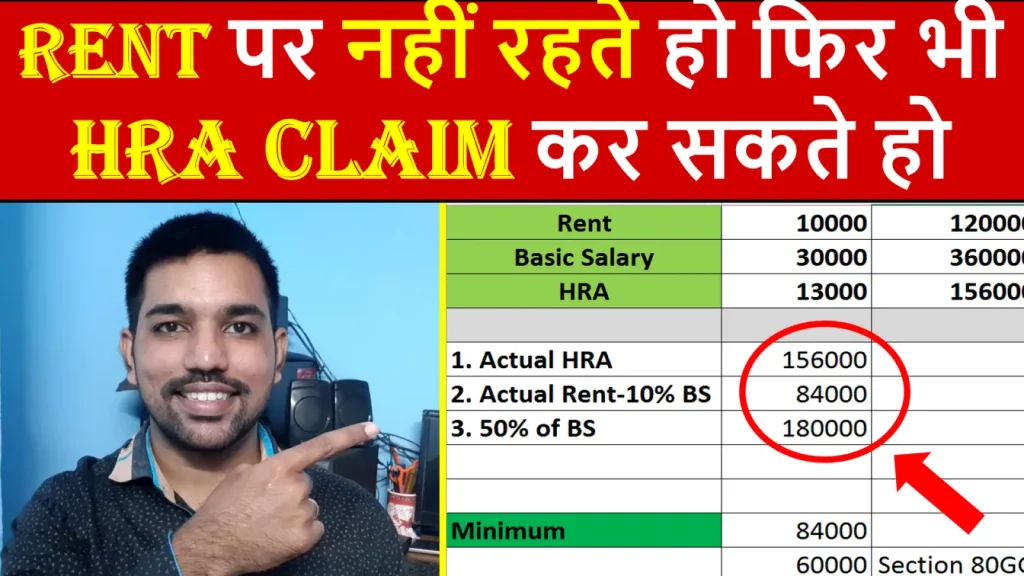

I have explained the HRA exemption calculation on my YouTube channel. Use below calculator to calculate your HRA exemption amount:

HRA Exemption Calculation Video

HRA exemption Rules when staying with Parents

So now you are aware that you can claim HRA when living with your parents. But what are the HRA exemption rules you must follow? Do you need any additional documents to claim HRA when living with parents or spouse?

There are no additional documents you need to claim HRA when staying with parents or spouse compared to the documents required when you actually stay on rent. Below are the documents you need, irrespective of whether you stay with parents, spouse or somewhere away from your family:

- Rent Agreement (or Rent Declaration) stating that you are staying on rent with rent amount and financial period mentioned. You can create a rent agreement with your parents as well.

- Rent Receipts of the rent amount for all required months.

- Online Transaction. This will be helpful to prove that you are actually paying rent to your parents or spouse and they are paying tax on required total income every financial year

- You must not be the owner of the property

In case you parent is senior citizen then this is how the income tax will be calculated for senior citizens.

Who is not eligible for HRA exemption?

There are certain conditions when you cannot claim HRA exemption amount:

- When you stay in your own property

- When you don’t receive HRA, you cannot claim under section 10(13A), but can claim in section 80GG if you stay on rent

- If you don’t have rent agreement or rent receipts

- If you don’t have documents required to claim HRA

Above are certain scenarios when you cannot claim HRA amount.

HRA exemption Rules when staying with Spouse

Yes it is possible to claim HRA when staying with spouse and all the above rules are applicable when you stay with spouse as well.

It is important to note that the rent amount paid to spouse will be taxable to him or her. So one must plan carefully if both are working professionals. Only one can claim HRA by paying rent to another, provided the person claiming HRA is not the owner or co-owner of the property.

Rent amount paid to parent or Spouse taxable?

Yes the rental amount you pay to your parents or spouse is taxable to them. It is important to plan your income tax accordingly for a particular financial year.

You would save lot of income tax as a family if you pay rent amount to a family member who’s income is way below the taxable income, but also, the member must be the owner of the property where you are staying and you must not be the co owner of property.

It is also important to note that you have to follow all mentioned conditions to claim HRA to avoid the scenario of tax evasion!

ALSO READ: 6 Tax Saving Options

Can you claim HRA and Home loan deductions?

Another important scenario is when you are staying with parents but purchased a flat on home loan in another city, so can you claim HRA while staying with parents and claim home loan deductions as well for the flat purchased in another city?

The answer is Yes.

Claiming HRA and home loan deductions is possible under Section 80C and Section 24, provided that the rental accommodation you stay in and the house property you bought with the help of home loan are located in different cities.

If this condition is met than you can claim both and save lot of income tax with various deduction limits in these sections. But in case your house property you bought on home loan is on rent and you enjoy rental income from this property, than you are liable to pay income tax on this rental income.

To avoid paying tax on rental income, you can take home loan with your wife as co owner (if she is house wife or have less taxable income) and the rental income can be credited in her account, in which case, she will be liable to pay income tax but can save a lot due to lower taxable income.

Also, when your taxable income is below Rs. 5 Lacs in a financial year, your income tax will be zero due to tax rebate under section 87A.

You can solve more home loan tax benefits queries here.

Download HRA Exemption Excel Calculator

You can use above link to download HRA exemption calculator in excel. Check out my YouTube Channel for more informative videos.

Read more about How HRA exemption is calculated in Excel here.

Watch below video on how to use this HRA exemption excel calculator:

That is all on How HRA exemption is calculated when you receive HRA component in salary payslip. Comment below if you have any more queries. Also, download the income tax calculator app I have developed for you!

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Some more Reading:

Home Loan Prepayment using Excel

Buy or Rent a House comparison in Excel

How to Calculate SIP Returns in Excel

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.