People say there is no compounding in mutual funds and I also used to believe same until I made an excel calculator while making one of my YouTube Videos for calculating mutual fund returns. Using the same excel calculator we will see how compounding works in mutual funds and is compounding in SIP a real thing?

Compounding works in Mutual Fund similar to how it works in PPF (Public Provident Fund) and this is exactly what we are going to see in this article with the help of Excel Examples. While buying Mutual funds via SIP, we know that we buy units of mutual funds based on volatile prices of NAV of Mutual Funds. These units that get accumulated in our mutual fund account helps us to get compound interest over time. We will compare the returns of PPF which compounds every year, with the returns of Mutual funds via the price of accumulated units which will show us power of compounding in Mutual Funds.

Note: You’ll find the excel calculator for calculating mutual fund returns at the bottom of this article.

How Compounding Works in Mutual Fund Video

Watch more Videos on YouTube Channel

Compounding Benefits

According to Albert Einstein, compounding is the 8th wonder of this world.

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

– Albert Einstein

We get compounding benefits in most of the Indian Saving Schemes including Fixed Deposits, PPF (Public Provident Fund), NSC (National Savings Certificate), etc.

What Compounding Means?

In simple terms, compounding means getting more interest on already earned interest.

For example, let’s say you deposit Rs. 1000 in a scheme that provides you compounding benefit on monthly basis. So assume you deposit Rs. 1000 on 1st January and assume the monthly interest rate you get is 1% per month.

So after one month, your deposit of Rs. 1000 gets an interest of Rs. 10 based on 1% interest per month. And due to this, your total balance on 1st February including your deposit and interest will be Rs. 1000 + Rs. 10 = Rs. 1010

In second month you will earn interest on this Rs. 1010 since you are getting compounding benefit on monthly basis – which means, Rs. 10 as interest was added in your deposit to help you earn more interest in coming months.

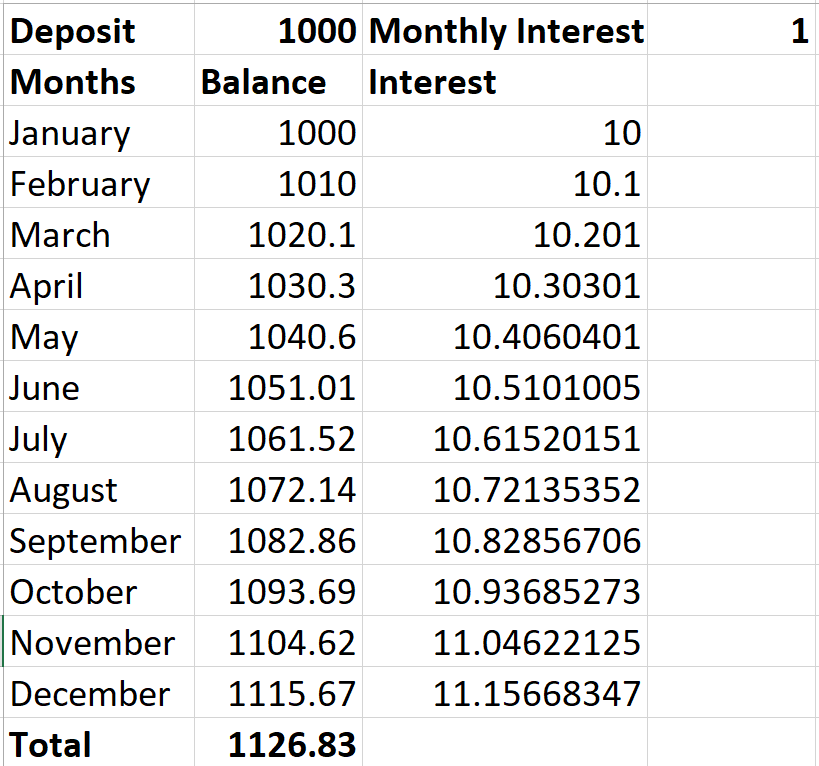

Below is the screenshot for above example with one time deposit of Rs. 1000 and 1% monthly interest rate and monthly compounding:

The total amount after 12 months is Rs. 1126.83 which is after we see monthly compounding.

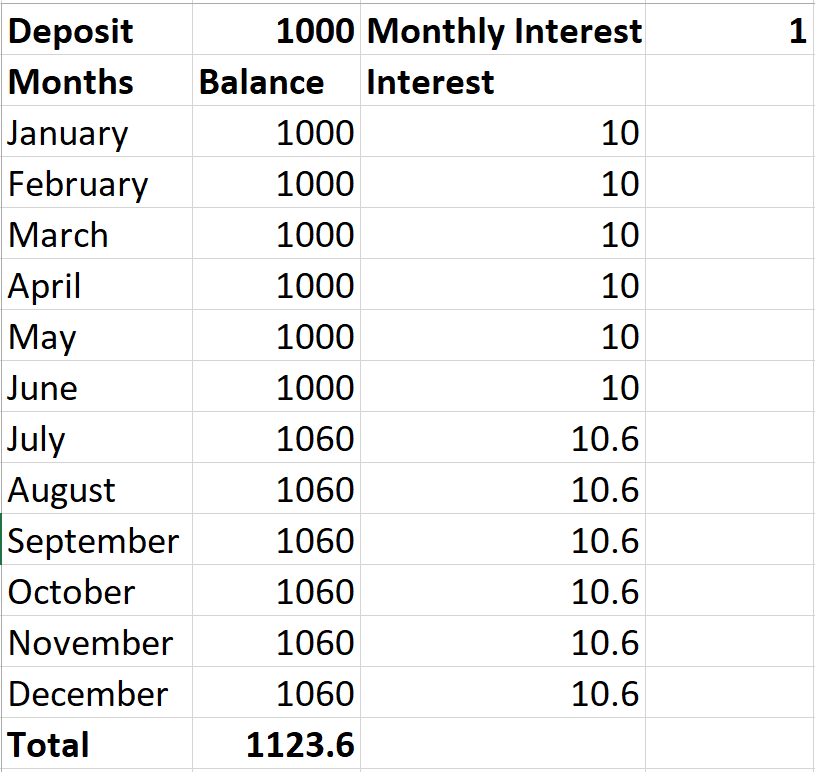

If we change compounding frequency to half-yearly (after every 6 months), we get below results:

As seen, we get a total of Rs. 1123.6 in half yearly compounding compared to Rs. 1126.83 that we received in monthly compounding.

This means, more frequent compounding gives us more returns on our investments. The investment amounts considered here are small and it makes a huge difference when we invest large amount of money in schemes that provide us compounding. One such scheme is PPF or Public Provident Fund which gives us yearly compounding and here’s how you can get maximum returns in PPF.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How Compounding Works in PPF

As explained above, compounding is getting interest on already earned interest

Below are some points about compounding in PPF:

- Monthly interest is calculated in PPF

- Compounding in PPF is done on yearly basis. Which means the monthly interest you earn in a financial year between April to March, is added to your balance to earn more interest.

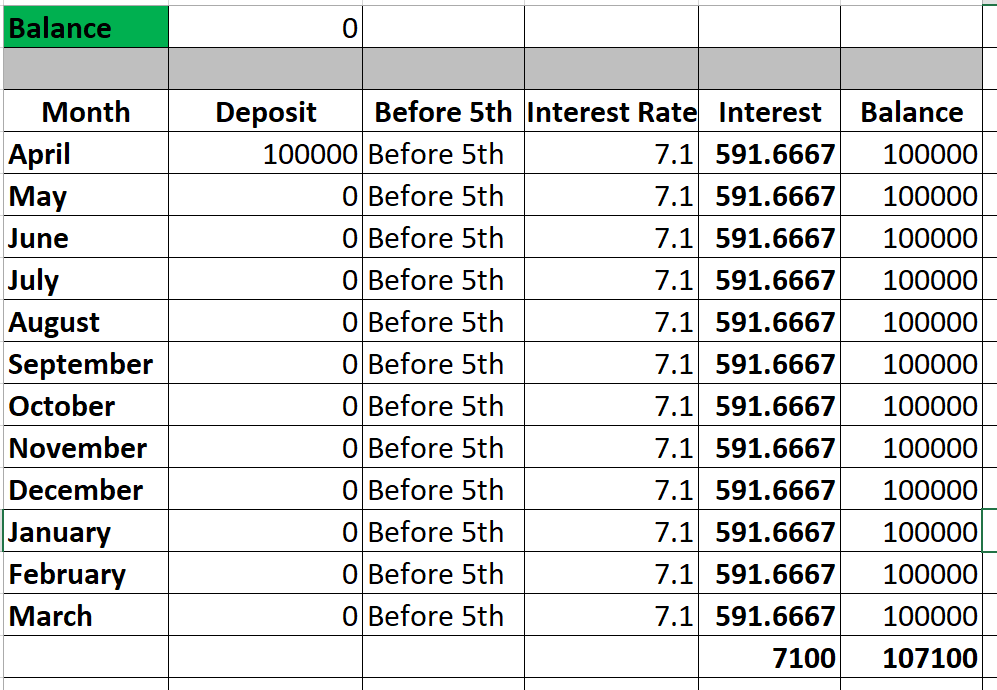

Below is the screenshot of Interest in PPF on deposit of Rs. 1,00,000 in the month of April:

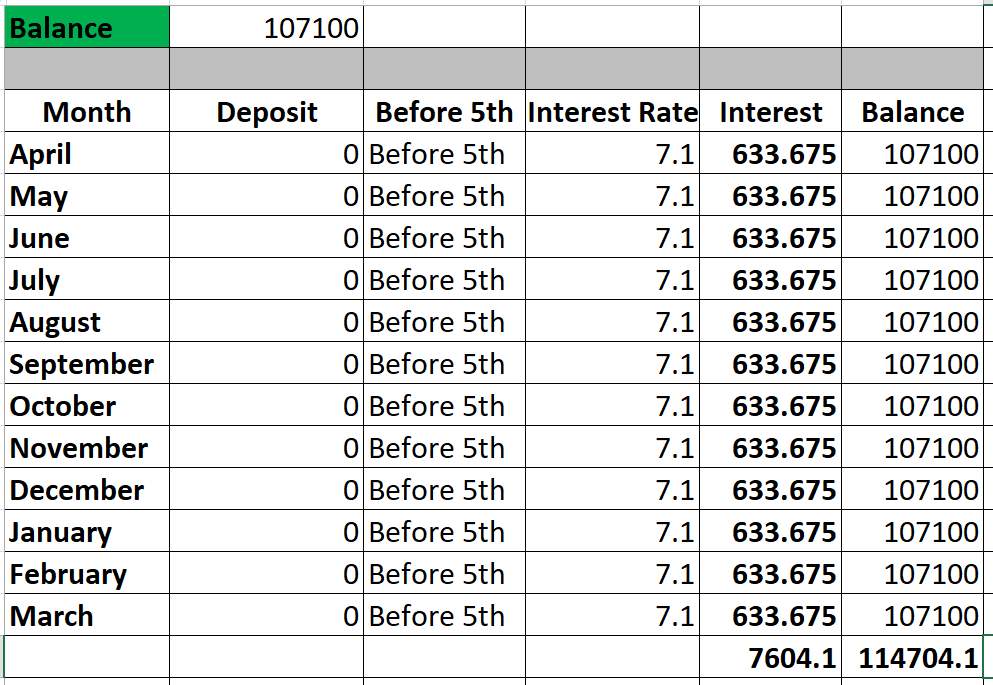

The balance after first year is Rs. 1,07,100 out of which Rs. 7,100 is the interest you earn in the first year based on 7.1% yearly interest rate. This total balance is considered in second year and without deposit you can see you earn interest as shown below:

As seen above you get interest of Rs. 7,604 in second year without any deposit, compared to Rs. 7,100 interest in first year. This increase in interest is due to compounding, where the interest from first year was added to the balance which earned us more interest money! This is how compounding works.

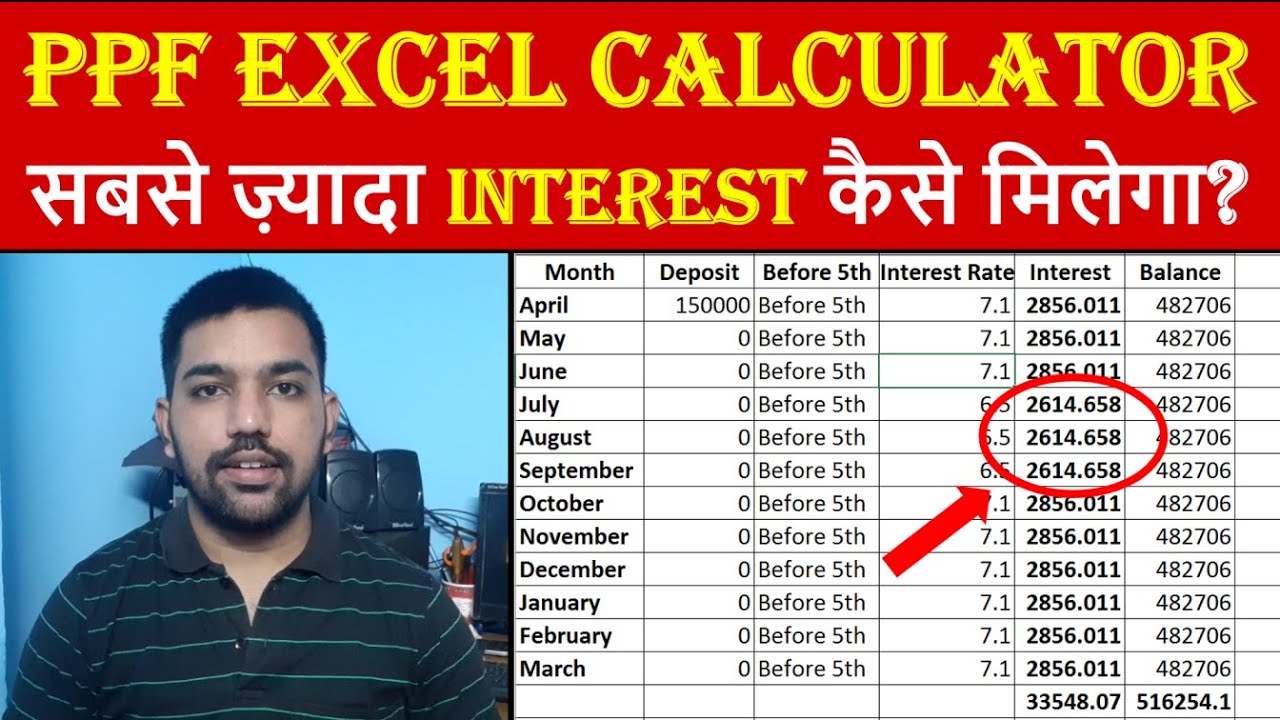

Maximum interest in PPF Video

How Compounding Works in Mutual Fund SIP

Let’s now see how compounding works in Mutual Fund.

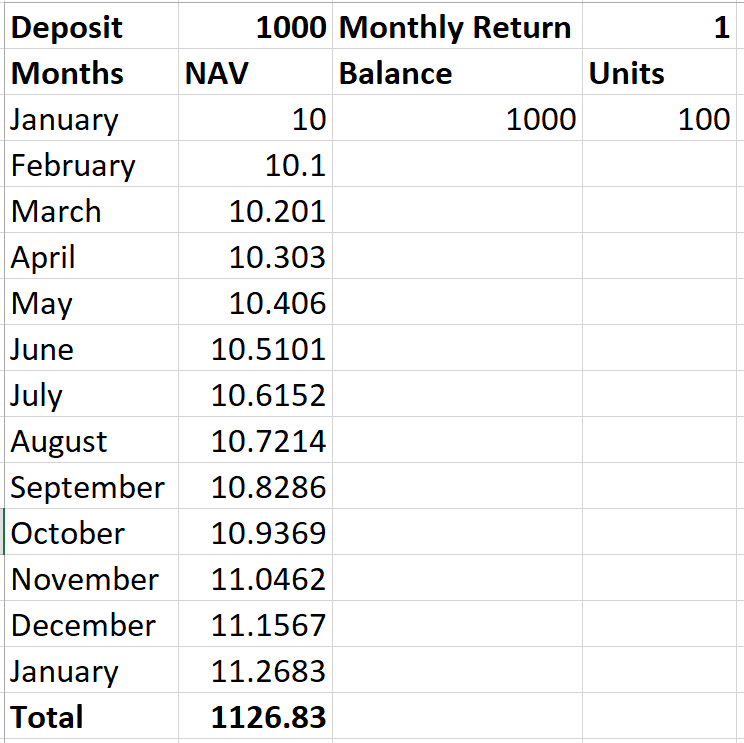

For example, let’s say the NAV (Net Asset Value) of a mutual fund is Rs. 10 in the month of January and the return we get per month is 1%. Let’s assume we deposit Rs. 1000 in the month of January and below is the screenshot of the value of investment after 12 months:

As seen above, total amount is Rs. 1126.83 which is same as the monthly compounding example we saw above. This proves that compounding happens in mutual funds as well.

We increased the NAV amount with 1% increase every month starting from January at Rs. 10, to Rs. 11.2683 in the month of January next year. And we bought 100 units of mutual fund by investing Rs. 1000 at the rate of Rs. 10 is January.

The total amount we get if we sell these mutual fund units after one year at NAV = Rs. 11.2683 is 100 units multiplied by Rs. 11.2683 (current NAV) which is Rs. 1126.83. And this same amount we received on our compounding example above.

ALSO READ: Mutual Fund Returns Calculator using Excel

Comparing returns in Mutual Funds & PPF

As we saw above, compounding happens in both PPF and mutual funds. Let’s take another long term example comparing PPF and Mutual Fund returns for next 15 years considering 7% annual returns.

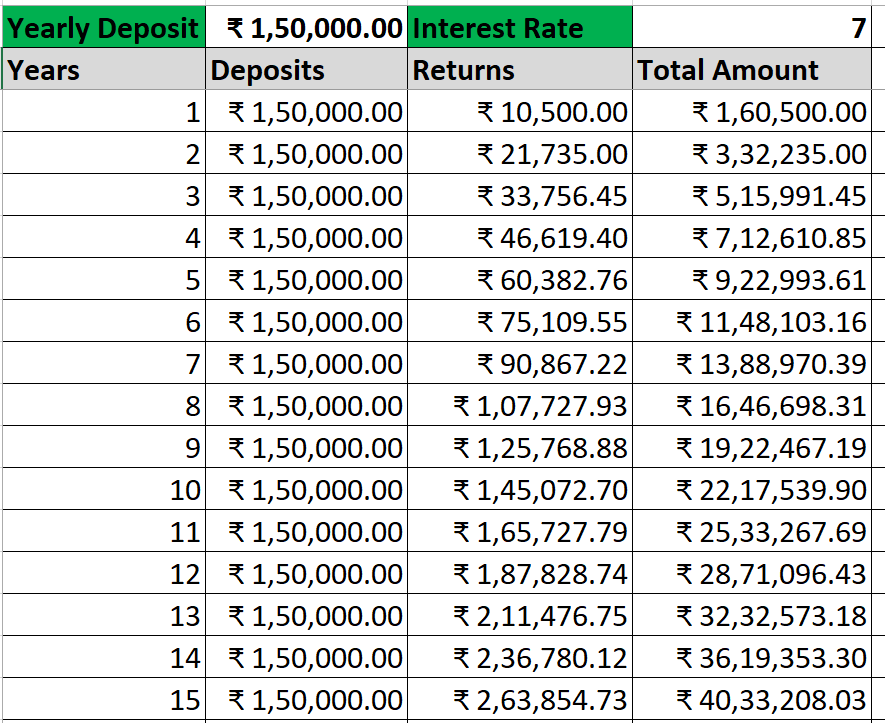

PPF Compounding Example

As seen above, we get Rs. 40,33,208.03 after compounding in PPF with yearly deposit of Rs. 1,50,000. Let’s see calculations in mutual fund with same investment amounts and returns:

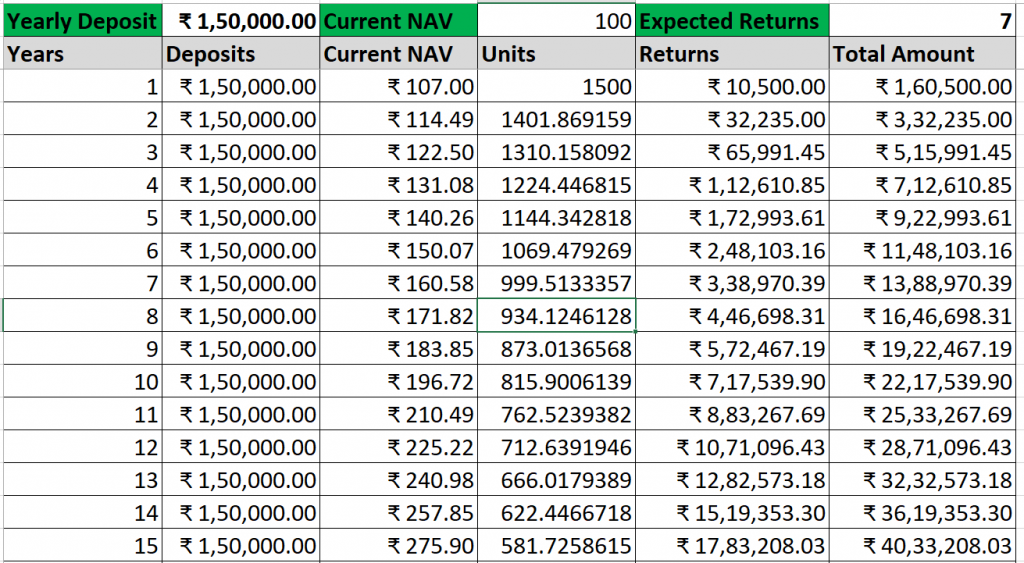

Here as well, we get Rs. 40,33,208.03 based on the total units we have been accumulating and 7% annual returns in mutual fund.

This again proves that compounding happens in mutual funds.

Though, we do not see how compounding happens in mutual funds or in SIP, if we actually calculate the numbers using excel, we’ll realize that compounding does happen in mutual fund as we continue buying mutual fund units in volatile markets.

WATCH: Rs. 1000 PPF vs Mutual Fund Returns Calculation for 15 Years

Conclusion

To answer the question that how compounding works in mutual fund, we need to work with excel examples as we saw above and make ourselves realize by comparing the returns with the scheme that does provide compounding, like PPF (Public Provident Fund).

Compounding in SIP happens on monthly basis when SIP frequency is monthly, or yearly basis when SIP is done yearly. Whether compounding happens daily in mutual fund, is the question I leave on to you to answer by using the excel calculator.

Download SIP Excel Calculator

Download excel calculator using above link.

Some more Reading:

- Rs. 2000 SIP Returns in Sensex for 15 Years

- SWP for Monthly Income in Mutual Funds

- SIP vs Lumpsum Which is Better?

Frequently Asked Questions (FAQs)

Does compounding apply to mutual funds?

Yes, compounding happens in mutual fund even when you invest via lump sum or via SIP (Systematic Investment Plan)

How does compounding work in mutual funds SIP?

The mutual fund units you accumulate every month via SIP increase in value when the NAV of Mutual Fund increases with time. The accumulated units which were bought at lower price compounds over time and give us returns similar to a scheme that provides us compounding, like PPF (Public Provident Fund)

Does mutual fund compound daily?

It depends on the frequency of SIP. We saw in above examples that when frequency of SIP is yearly than compounding happens on yearly basis or it happens on monthly basis when SIP is done monthly. Probably if SIP investments are done on daily basis than we might see daily compounding in mutual fund.

How is compounding done?

Compounding means getting interest on already earned interest. The interest money you get in first year will be added to your balance which will help you earn more interest in second year in case compounding is done yearly.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.