This Home Loan EMI Calculator helps you to calculate EMI (Equated monthly Installment) on your Home Loan, along with total interest amount you will pay throughout the loan tenure.

Keep in mind that higher the loan tenure, more interest you will pay while repaying your home loan.

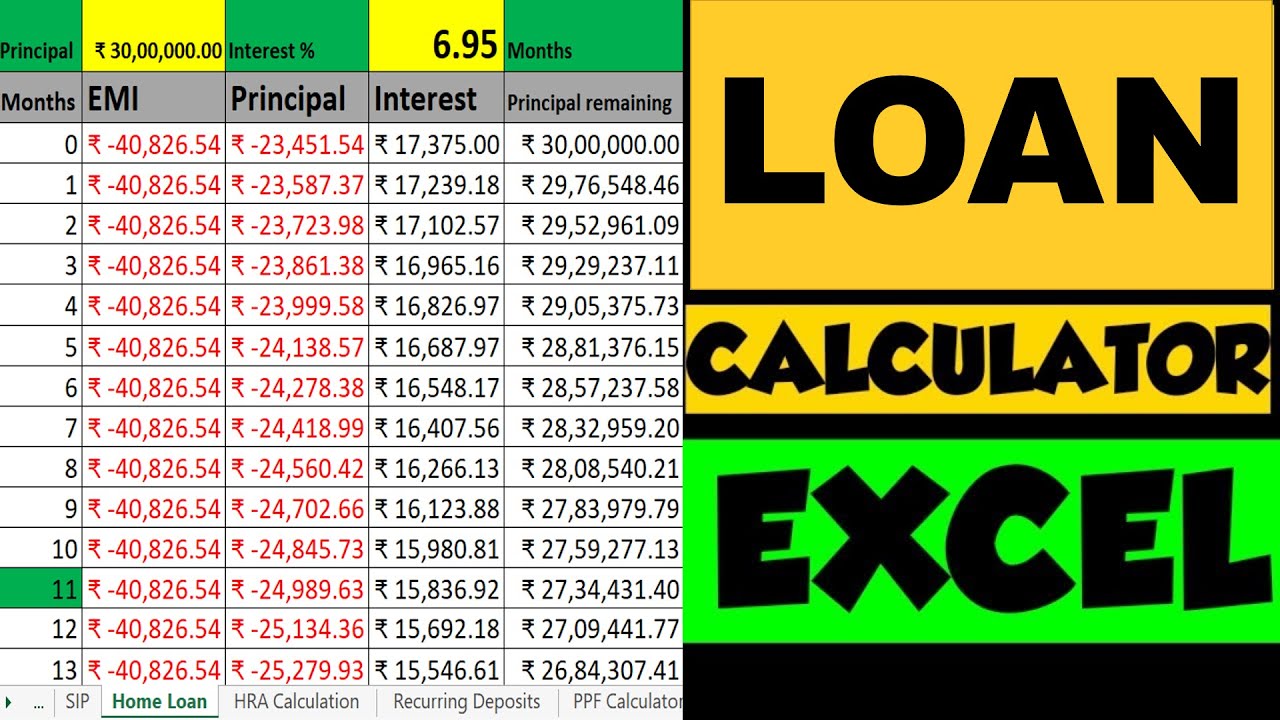

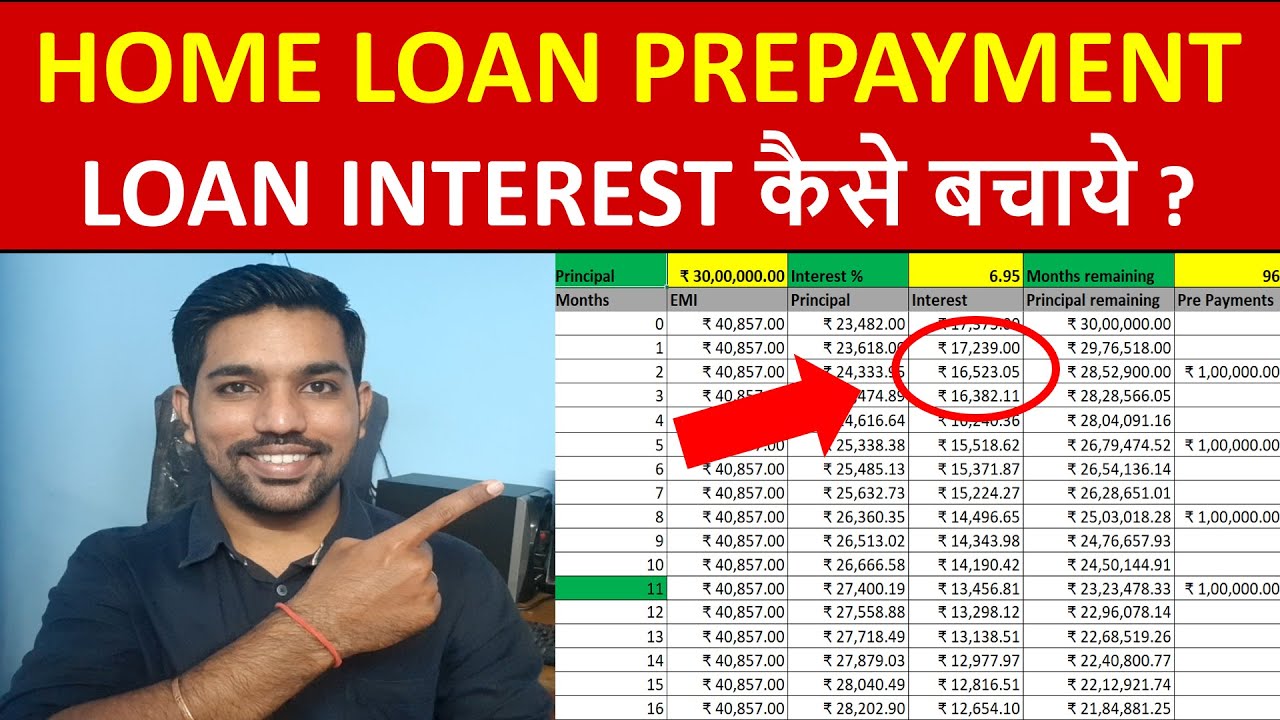

Get Monthly Principal & Interest Amount calculations and prepayment options with Excel Calculator:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Share this Free Home Loan EMI Calculator with your friends and family members and help them in Home Loan EMI Calculation!

What is Home Loan EMI Calculator

Home Loan EMI Calculator helps you to calculate home loan EMI (Equated Monthly Installment). This calculation helps you in planning for loan to buy or construct new house so that you get the idea of monthly loan EMI you will be paying.

Loan EMI Calculator also helps you to know the Total Interest you will be paying throughout your loan tenure. The Total Amount you pay to close your loan is Loan Amount + Total Interest

Home Loan EMI Calculator Video

Home Loan EMI Calculation Method

- I have already explained about home loan EMI calculation here

- Home loan EMI can be easily calculated in excel using PMT function, or you can also use the above calculator to quickly calculate home loan EMI

- PMT function takes 3 parameters: Interest Rate, Remaining months and Principal value remaining

- Interest rate provided should be the monthly home loan interest rate divided by 100

- Remaining months is the number of months remaining for which EMIs are yet to be paid

- Principal value is the outstanding principal amount remaining in your loan account

- Remember, your EMI consists of 2 things: Principal Amount and Interest Amount

- Interest Amount is high initially, and decreases with time

- Principal Amount is low initially, and increases with time

Components of Loan EMI

- Basically there are 2 components of loan EMI – Principal Amount and Interest Amount

- Principal amount is low initially and increases with time

- Interest amount is high initially and decreases with time

- Majority of Interest amount is paid by you during the first half of your loan tenure

- As you move towards your loan closure by paying all EMIs on time, very less interest if left to be made making it difficult to save loan interest using loan prepayment option

- Thus, it is recommended that if you are making loan prepayments to save interest, make the payments during initial half of the loan so that you can save maximum interest on your loan

- Car Loan EMI is also calculated in same way as above

Factors affecting Loan EMI

- 2 factors affect Loan EMI – Interest Rate and Tenure

- Higher the interest rate, more interest amount you will be paying

- Longer the tenure, more interest amount you will be paying

- You should try to take loan with minimum interest rate and tenure to save maximum interest amount

How to Save Loan Interest

- As mentioned above, loan interest can be saved by either choosing loans with low interest rate, choosing less tenure or by making loan prepayments on existing loans

- Remember to reduce tenure while making loan prepayments to save maximum interest on your home loan

- Reducing EMI will not save your loan interest to maximum extent compared to reducing tenure

- You can watch more excel videos to understand more about how home loan calculation method works and best practices

Home Loan Prepayment Examples – Video

Some more Reading

- Home Loan Tax Benefits

- Buy vs Rent a House [Excel]

- Home Loan Prepayment Reduce EMI or Tenure?

- Car Loan Calculator using Excel

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.