Some important Car Loan repayment tips are – go for low interest rate car loan, reduce the tenure of your car loan by paying extra EMI amount, make EMI payments on time and also try to make car loan prepayments that will save you the interest amount you pay every month in EMI. These tips will help you save a lot of car loan interest amount and also close your loan before time.

Watch below video to understand the Car loan repayment tips with car loan EMI and prepayment calculation examples:

Car Loan Repayment Tips Video

Watch more Videos on YouTube Channel

Let us understand all these car loan repayment tips in detail below:

1. Interest Rate should be Low

Car Loan Interest rate is one of the important factors, as it decides the total amount of interest you need to pay in your car loan.

For example, if your car loan is of Rs. 5 lakh for the tenure of 3 years, below are the total interest amount you’ll pay on various interest rates:

| Car Loan Amount | Tenure | Interest Rate | Total Interest |

|---|---|---|---|

| Rs. 5 Lakh | 3 Years | 11% | Rs. 89,297 |

| Rs. 5 Lakh | 3 Years | 10% | Rs. 80,809 |

| Rs. 5 Lakh | 3 Years | 9% | Rs. 72,395 |

| Rs. 5 Lakh | 3 Years | 8% | Rs. 64,055 |

As seen in above table, the total interest you to pay back to bank or financial institution is reducing with the reduction in the interest rates.

With 11% of interest rate you pay almost Rs. 25,000 extra interest during 3 years tenure, compared to the 8% interest rate of car loan.

Hence for this reason, you should be looking for car loans provided by banks or financial institutions at lowest interest rates.

You can use the Car Loan EMI calculator to check the EMI and total interest in car loan:

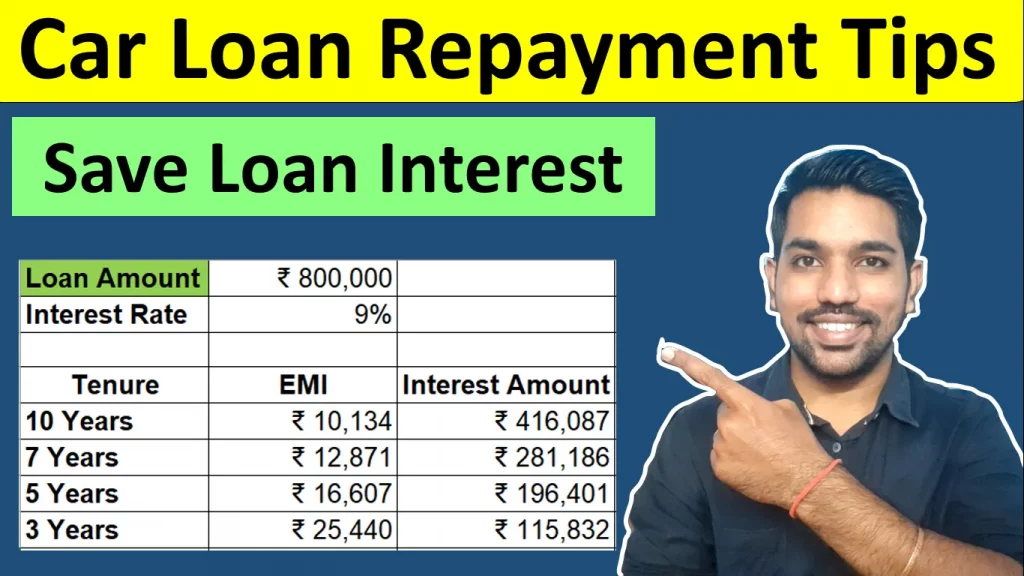

2. Tenure of Car Loan should be less

While interest rates are important, tenure is also equally important. Less tenure will help you to pay EMIs for less number of months thus decreasing the total interest amount you’ll pay. Higher the tenure, you’ll pay EMIs for longer duration thus increasing the interest amount you pay back.

Let us take same example as above, with 3 to 5 years of tenure at 8% interest rate of car loan:

| Car Loan Amount | Tenure | Interest Rate | Total Interest |

|---|---|---|---|

| Rs. 5 Lakh | 3 Years | 8% | Rs. 64,055 |

| Rs. 5 Lakh | 4 Years | 8% | Rs. 85,910 |

| Rs. 5 Lakh | 5 Years | 8% | Rs. 1,08,292 |

As seen above, the increase in tenure increases the total interest amount you have to pay back in car loan.

But while decreasing the car loan tenure, there will be increase in your EMI amount you have to pay every month. S make sure you can afford the monthly EMI you need to pay after covering other household expenses.

It is also important to keep emergency funds for uncertain conditions to be met.

3. Make EMI Payments on Time

While you take car loan to buy a new car, you must also pay back the loan EMI on time to avoid any impact in your credit rating which occurs on no payments or late payments.

Not paying the EMI on time can also increase the interest amount in your car loan which is not desirable, since our aim is to pay less interest amount over the tenure and close loan before time, so that we can invest the extra money in mutual funds via SIP.

SIP in mutual funds can give us better returns to cover for our retirement which should be one of your long term financial goals.

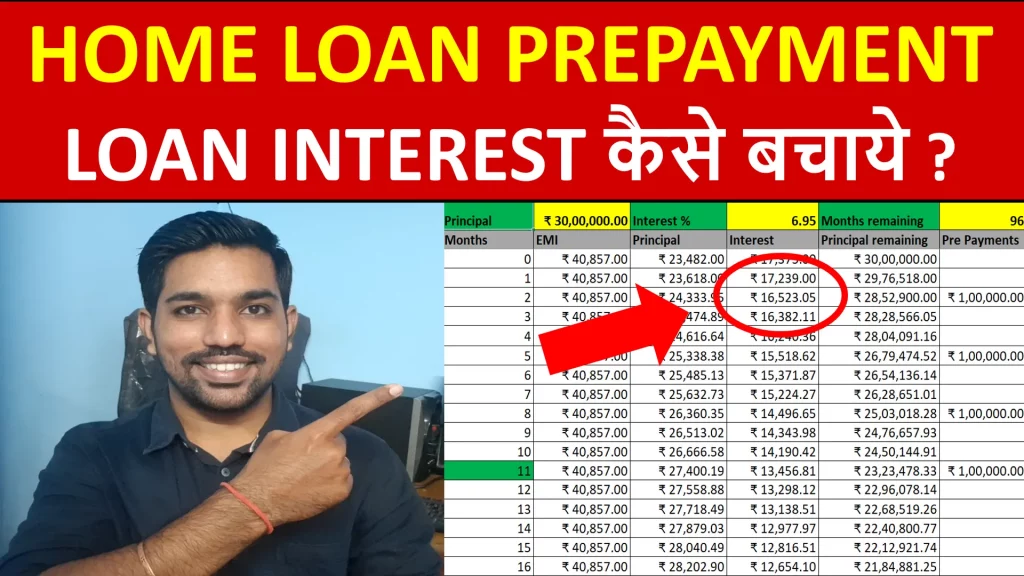

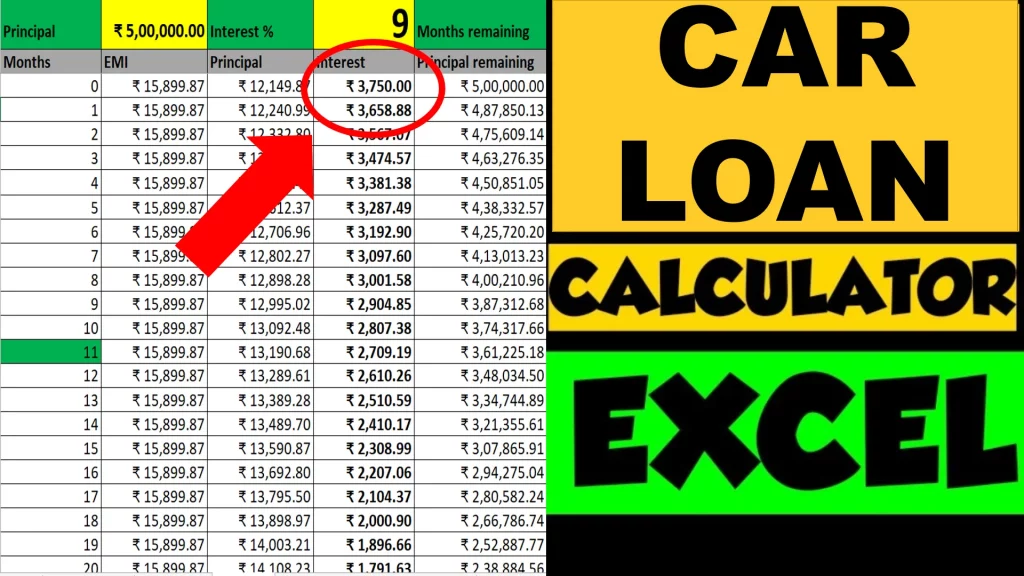

4. Make Car Loan Prepayments

This is another important factor for existing car buyers as well, to save the car loan interest amount by making prepayments.

Car Loan Prepayments is a way to reduce the principal remaining balance in your car loan, which eventually reduces the interest amount you pay every month. Since interest amount is calculated on remaining balance in your car loan, prepayments can help you to reduce the interest amount directly.

For prepayments, you need to save some fixed amount every month and after every 4 months to 6 months, you can make car loan prepayments to save interest amount you need to pay back. This also decreases the tenure of your car loan, thus providing you double advantage.

Watch below video on Car Loan Prepayment with calculations in excel:

Car Loan Prepayment Calculation Excel Video

Conclusion

So these are some of the important car loan repayment tips to help you save car loan interest amount and close the loan before time, so that you can focus on your other financial goals:

- Interest rate must be LOW

- Tenure of car loan should be LESS

- Make EMI payments on Time

- Make Car Loan Prepayments

Some more Reading:

- Car Loan in India – What you should know

- Car Loan EMI Calculation Method

- Floating Interest rate in Car Loan

Save Home Loan Interest Amount!

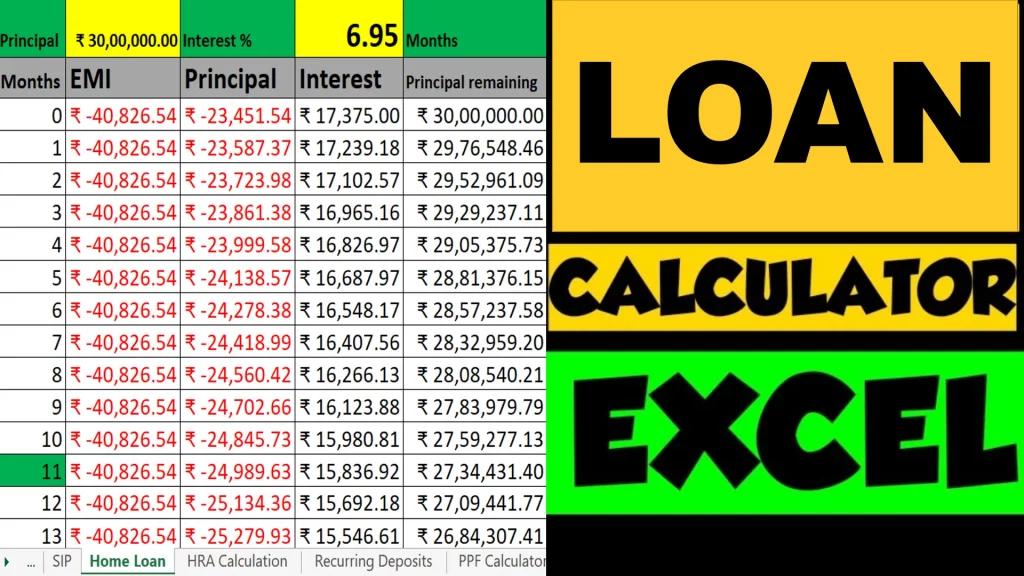

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.