Multi Cap vs Flexi Cap Fund – The main difference between Multi Cap and Flexi Cap fund is that in Multi cap – fund manager can choose the funds from market capitalizations such as large cap, mid cap and small cap with minimum asset allocation of 75% in all three capitalizations. Where as in Flexi cap fund, the fund manager has the flexibility of choose any stocks irrespective of market capitalization, with minimum asset allocation of 65% in equities and equity related instruments.

Let us understand Multi Cap vs Flexi Cap Fund in detail.

Multi Cap Fund Meaning

- Multi Cap Fund is a type of Equity Mutual Fund that invest in companies with various market capitalization

- These funds invest in equities and equity oriented instruments

- They invest in large cap, mid cap and small cap companies to get better returns for investors

- These funds are good alternatives for those who want to get exposure to multiple companies in large, mid and small cap segments and are ready to take moderate risk

- At least 75% of the total assets need to be allocated in large, mid and small cap companies in Multi Cap mutual Fund

- So either it can be 25% in each – large, mid and small cap or based on fund manager’s decision to increase allocation in any specific segment based on market conditions to maximize the returns

- Taxation in these Funds is similar to those in equity mutual fund. For STCG tax, 20% tax will be applied on profits and 12.5% tax on LTCG on profits above Rs. 1.25 lakh in a financial year

Flexi Cap Fund Meaning

- Flexi Cap Fund is a type of equity mutual fund that invest in stocks of different companies irrespective of their market capitalization

- Most of the mutual funds invests based on the market cap such as large cap, mid cap or small cap companies in order to balance the risk and returns from these companies

- But Flexi Cap Fund is different. They can invest in any company irrespective of market cap

- These funds are risky in nature but also give high returns compared to other mutual funds based on the stocks in portfolio

Multi Cap vs Flexi Cap Fund Differences

Below are the Differences between Multi Cap vs Flexi Cap Fund:

| Items | Multi Cap Fund | Flexi Cap Fund |

|---|---|---|

| Meaning | Multi cap fund is a type of equity mutual fund that invest in different market categories – large cap, mid cap and small cap, hence the name multi cap mutual fund | Flexi cap fund is a type of equity mutual fund that invest in various companies irrespective of their market cap |

| Equity Allocation | The equity allocation in multi cap fund is at least 75% of total allocation, which can be divided as 25% each in large, mid and small cap companies | Flexi cap fund need to invest at least 65% in equity instruments irrespective of the market cap of the companies selected, to be in the equity category |

| Market Cap | Companies from various market cap like large, mid and small cap are covered in multi cap fund | The market cap of the companies is not the constraint her and any companies can be selected based on their expected future returns |

| Fund Manager Flexibility | Fund manager is constrained to select the stocks from large, mid and small cap categories in order to be in the multi cap category | Fund manager of Flexi cap fund has the flexibility to select any companies irrespective of market caps. They can increase or decrease exposure to large cap companies to take low or high risk and vice versa returns |

| Risk | Multi cap funds are more risky in nature compared to large cap funds since they have exposure to mid cap and small cap companies as well | Flexi cap fund’s risk will be defined based on the asset allocation of mid cap and small cap companies since they can invest in any percentage irrespective of market cap. More allocation to large cap companies means low risk |

| Taxation | Multi cap fund is taxed similar to equity mutual funds. STCG or Short term capital gains is taxed at 15% rate when units are held for less than 1 year. LTCG or Long term capital gains is taxed at 10% rate on profits made above Rs. 1 Lakh in Financial year | Flexi cap fund is taxed similar to other equity mutual funds. STCG or Short term capital gains is taxed at 15% rate when units are held for less than 1 year. LTCG or Long term capital gains is taxed at 10% rate on profits made above Rs. 1 Lakh in Financial year |

| Who Should Invest? | Investors who want to diversify their portfolio by investing in large cap, mid cap and small cap companies with the help of just one mutual fund can invest in multi cap mutual fund with at least 5 years time horizon | Investors who can take some risk by allowing fund manager to maximize their returns by selecting stocks irrespective of any market cap criteria can invest in Flexi cap fund with at least 5 years time horizon |

| Benefits | Diversification: You get the benefit of diversification while investing in this Fund since they invest in multiple companies across various market cap Multiple Companies: Due to the exposure of multi cap companies – large, mid and small cap, the risk is reduced and returns are also decent Flexibility: Fund manager has the flexibility to include stocks from multiple capitalizations which is not the case in case of pure large cap or mid cap mutual funds | Diversification: The stocks selected under Flexi Cap Fund are diversified in nature and does not belong to any specific market cap unlike other mutual funds Better Returns: These funds provides better returns compared to other mutual funds since they invest in the future growth of the companies Flexibility: The fund manager has the flexibility to select stocks irrespective of the market cap conditions that are applied in other mutual funds |

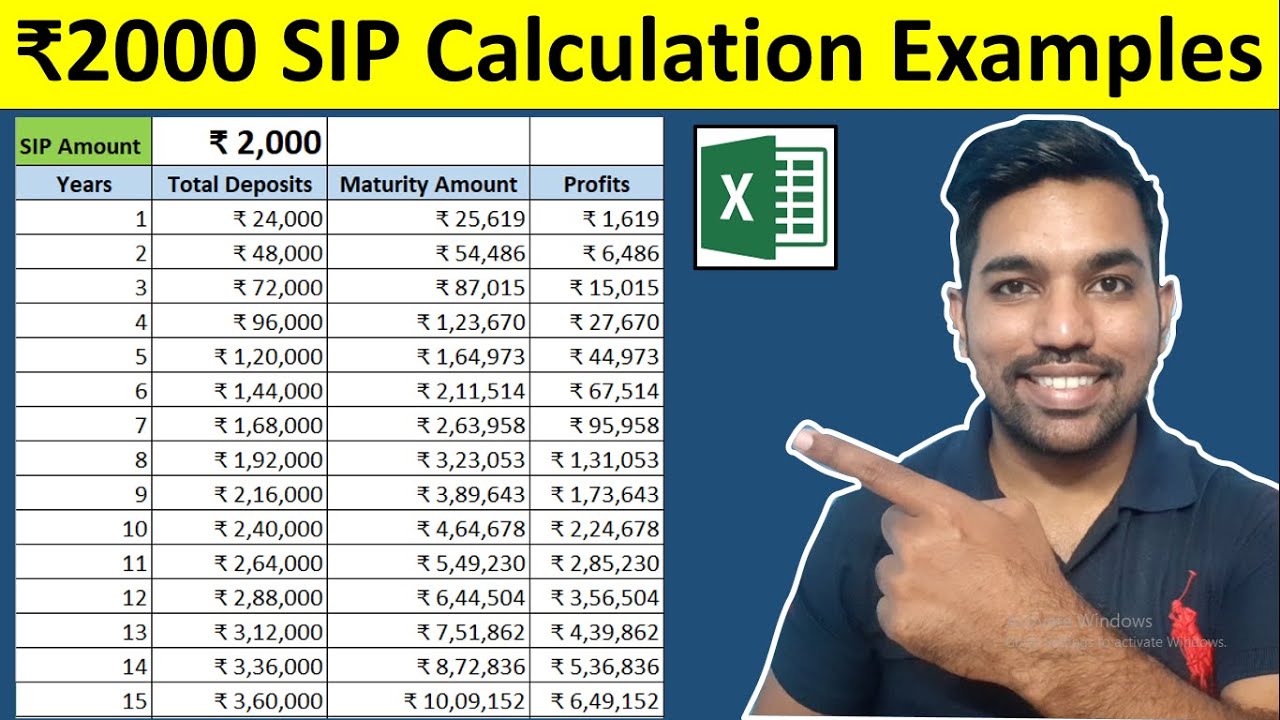

Rs. 2000 SIP Returns Calculation for 15 Years

Watch more Videos on YouTube Channel

Conclusion

So Multi cap vs Flexi Cap Differences are very clear by considering the differences in above mentioned table. Multi cap fund allows you to invest across various market cap where as flexi cap fund allows the fund manager to maximize your returns irrespective of the market cap conditions.

Both these funds are suitable for long term young investors looking to maximize their returns with slightly different approaches mentioned above.

Flexi cap fund might give you better returns compared to multi cap fund but also has high risk than multi cap fund.

Some more Reading:

- SWP for Monthly Income from Mutual Funds

- What is Asset Allocation Fund

- What is Life Term Insurance Plan and Benefits

Frequently Asked Questions

Which is better Flexi cap or multicap?

In terms of returns, flexi cap fund is better but also has more risk since fund manager has the flexibility to select companies irrespective of market cap. If the fund manager thinks that small companies will perform better, they increase allocation in those companies with high risks. In terms of safe investments, multi cap funds would be better since they diversify the assets across various market cap companies. In long term, both funds can give better returns to help achieve your financial goals

Is investing in Flexi Cap fund good?

Yes you can invest in flexi cap fund via SIP (Systematic Investment Plan) if you are a young investor with long term financial goals. Flexi cap fund take risk by investing in small companies to maximize your returns over long term.

Is Flexi Cap better than index fund?

Flexi cap and index funds use different approaches. Flexi cap might provide you better returns but index fund belonging to large cap category can provide you safety with less risk during market down turns. So it depends on your goals and risk appetite, if you can take risk over long term, you can go for flexi cap fund or if you are looking for less risk and decent returns, you can go for large cap index funds.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.