Section 80DD allows you to claim deduction if there are medical expenses occurring to take care of a differently abled person in your family. Individuals and HUF (Hindu Undivided Family) can claim this deduction to save income tax with old tax regime. Maximum of Rs. 75,000 can be claimed if disability is between 40% to 79% and Rs. 1,25,000 can be claimed if disability is 80% or more. You cannot claim 80DD if the differently abled person has claimed the deduction under Section 80U.

Let us understand Section 80DD in more detail.

What is Section 80DD of Income Tax Act?

- Section 80DD of income tax act allows us to save income tax by claiming deduction for expenses occurred to take care of disabled person in your family

- Differently abled person can be your spouse, children , parents, brother or sister

- Only resident Indians can claim this deduction, who can be an Individual tax payer or HUF (Hindu Undivided family)

- If differently abled person is claiming the deduction for self than Section 80U is the correct section to claim such deductions

- And if the person has claimed Section 80U deduction for self, one cannot claim same deduction again under Section 80DD. Section 80U is for physical disability of self and Section 80DD is for physical disability of dependent family member

- It is important to note that while claiming 80DD, the differently abled person must be a dependent person for the tax payer

- You can only claim this deduction with Old Tax Regime. New Tax Regime does not allow this deduction to be claimed

ALSO READ: Old vs New Tax Regime Which is Better?

Section 80DD Conditions and Eligibility

Below are certain conditions and eligibility to claim Section 80DD:

- You are eligible to claim 80DD deduction only for dependent family member who is facing at least 40% physical disability, mentioned by appropriate medical authority

- To claim this deduction, you must be a resident Indian who can be individual or HUF

- Individual can claim 80DD for dependent family member and HUF can claim 80DD for any of the member of HUF, if they fulfill the conditions

- You cannot claim 80DD if the differently able person has already claimed Section 80U – Physical disability for self

- Individual’s dependent family member can be spouse, children, parents, brother or sister

- It is important to note that disability percentage must be at least 40%

- Section 80Dd can only be claimed with old tax regime, as new tax regime does not allow maximum deduction

ALSO READ: Deductions allowed with New Tax Regime

Disability Covered under Section 80DD

Let us now see the list of disabilities covered under Section 80DD:

- Blindness

- Low Vision

- Leprosy – cured

- Hearing Impairment

- Mental Retardation

- Locomotor Disability

- Mental Illness

- Cerebral Palsy

- Autism

If any of the above disability is mentioned by medical authority with at least 40% disability percentage, you care eligible to claim this deduction with old tax regime while bearing the medical expenses for your dependent family member.

ALSO READ: Section 80DDB Tax Deduction for Treatment of Specific Disease

Section 80DD Deduction Limits

Section 80DD limit is as follows:

- If disability percentage of dependent family member is between 40% to 79%, than maximum Rs. 75,000 can be claimed with 80DD

- If disability percentage of dependent family member is above 80%, than maximum Rs. 1,25,000 can be claimed with 80DD

- No deduction can be claimed if disability is less than 40% according to medical authority

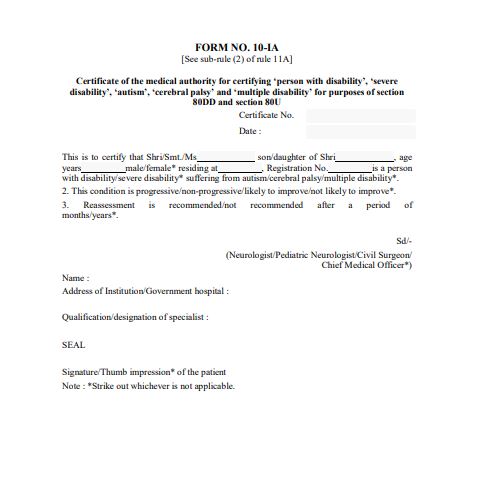

Documents Required to claim deduction under 80DD

Below are certain documents required to be submitted to claim 80DD:

- Medical Certificate: This certificate is required from appropriate medical authority stating the the dependent family member is having physical disability of 40% or more

- Form 10-IA: This form needs to be filled and submitted in case of some selected disabilities

- Self Declaration: The tax payer must provide self declaration in case the medical expenses are covered by him or her

Conclusion

So Section 80DD of income tax act allows you to cover medical expenses occurred to take care of differently abled dependent person in your family, who can be spouse, children, parents or siblings.

It allows deduction of Rs. 75,000 with 40% to 79% disability and Rs. 1,25,000 with 80% or above disability percentage.

Some more Reading:

- Section 80G Income Tax Deduction for Donations

- 5 Golden Rules of Finance you MUST Follow

- Section 80D Income Tax Deduction for Medical Insurance

Frequently Asked Questions

Who is eligible for Section 80DD?

The tax payer (individual or HUF) who is the resident Indian, who is paying for medical expenses to take care of differently abled person in family can claim Section 80DD, only if the person is dependent on the tax payer. The disability must be not less than 40% to claim 80DD deduction.

Can I claim 80DD without proof?

No, You need to have medical certificate from appropriate medical authority stating that the dependent family member is having at least 40% disability to claim 80DD. And based on the expenses, the amount can be claimed to cover for expenses while saving income tax with old tax regime.

Can I claim both 80DD and 80DDB?

80DD helps you to cover the medical expenses incase of disability whereas 80DDB is to cover the expenses for medical treatment of specific disease. If the conditions in both sections are satisfied than both 80DD and 80DDB can be claimed together.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.