You can easily withdraw from your PF (Provident Fund) account online by using the steps mentioned below. Also there are many queries covered in this article like whether TDS will be deducted, whether you will get the pension amount from EPS balance, how much time it will take for balance to be credited in your savings account and may other queries will be addressed.

You can withdraw PF and pension funds online using the EPFO portal. PF funds can be withdrawn using Form 19 and pension funds can be withdrawn using Form 10C. Usually it will take 13-20 days for PF and pension funds to be credited in your bank savings account. 100% of funds can be withdrawn if you are unemployed for last 2 months.

- PF Withdrawal Online Process Video

- PF Withdrawal Online All Steps

- Conditions to claim EPS fund (Pension) via Form 10C

- PF Withdrawal Online Track Claim Status

- How many days take for PF withdrawal?

- Do we need employer approval for PF withdrawal?

- Can PF pension be withdrawn?

- Can I withdraw 100% PF pension?

- Conclusion

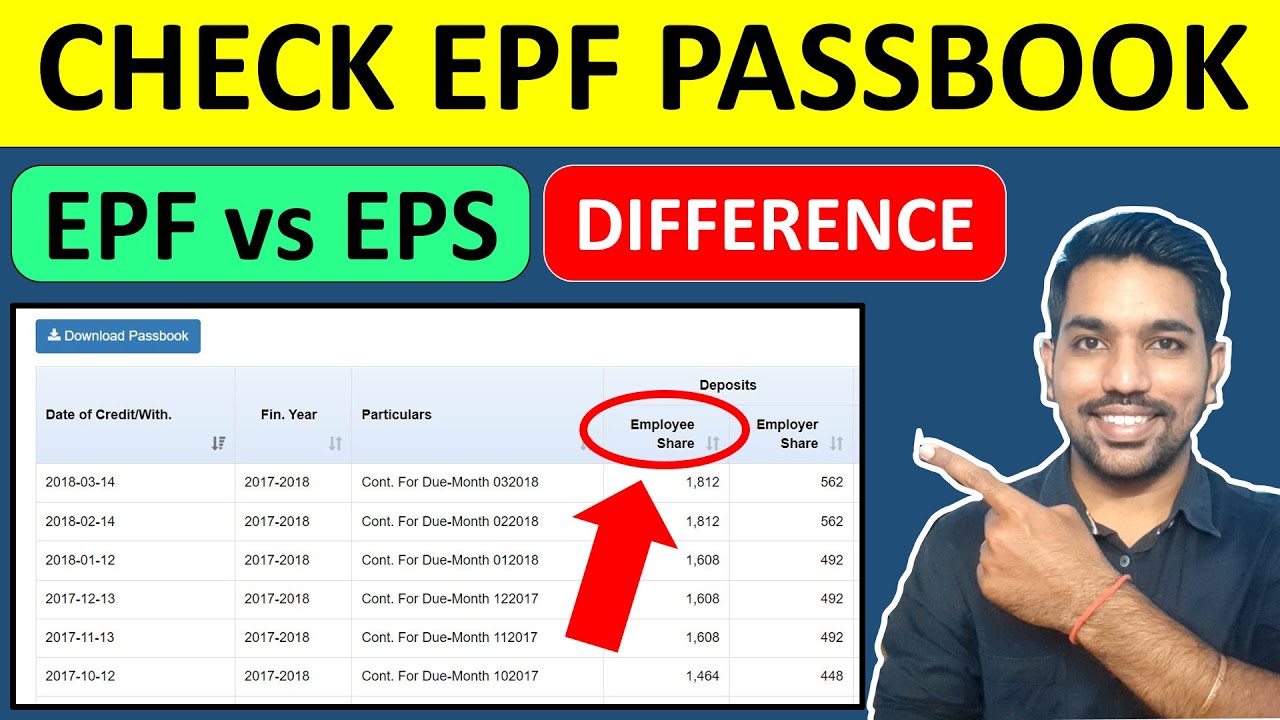

- EPF vs EPS Difference Video

- SHOW your Support!

- Income Tax Calculator App – FinCalC

PF Withdrawal Online Process Video

Credits: Tax Guru Ji YouTube Channel

As seen in above video, you can follow easy steps to withdraw from PF (Employee Provident Fund) online. Make sure to Subscribe to Tax Guru Ji YouTube Channel for more such valuable content!

PF Withdrawal Online All Steps

Let us discuss all these steps in detail.

Login to EPFO Official Website

This is the first step towards withdrawing from your PF account. You have to login on EPFO Official Website using the UAN (Universal Account Number) and password.

If you don’t have UAN number, please contact your employer and get the UAN activated from this same official website.

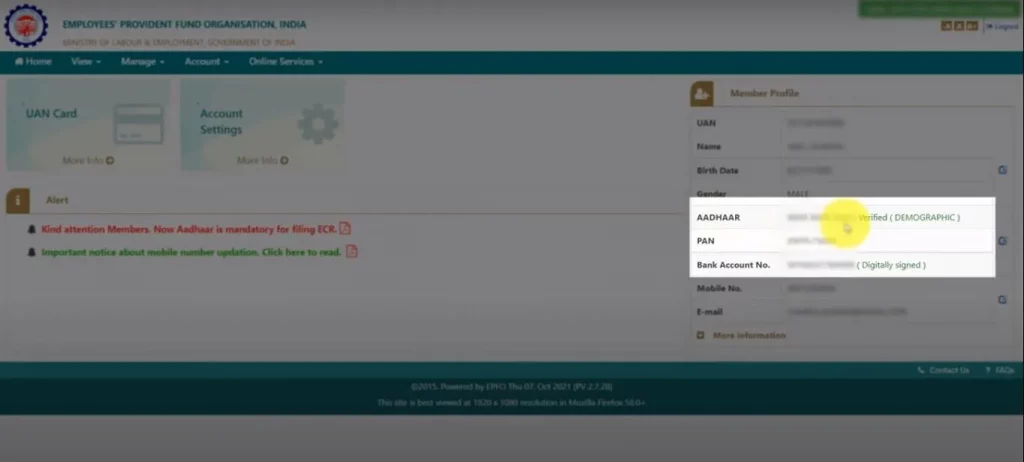

Verify your KYC Details

After successful login, next step is to verify your KYC (Know your Customer) details on right side. You will see Aadhaar card and other related details in this section.

Aadhar details must be Verified (Demographic), PAN card details must be displayed and Bank Account number must be Digitally Signed, as displayed below.

This is very important step. If KYC is not updated than please get it updated via your profile.

You can use EPF Calculator to calculate total funds in EPF:

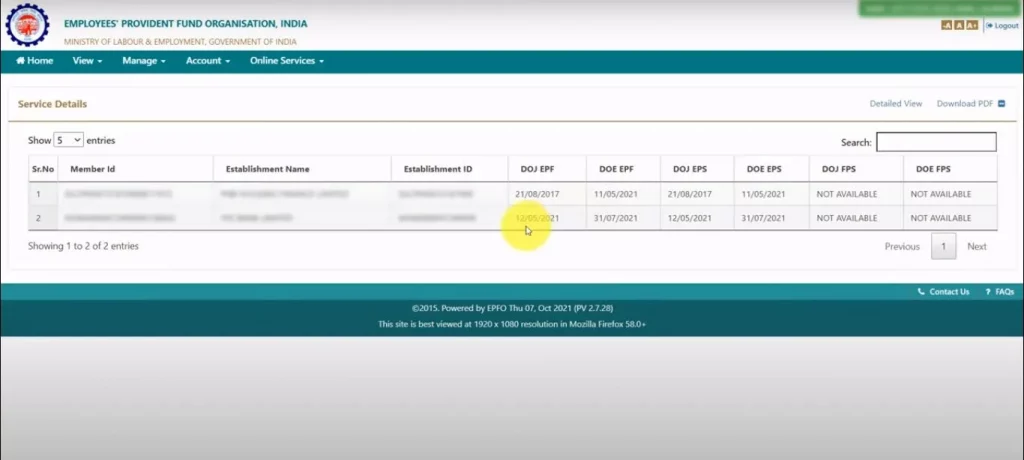

Verify DOE (Date of Exit)

This is the date on which you have exited from the services of your previous employer. You can navigate to View > Service History to check PF DOE (Date of Exit) details on this portal.

Below are the details you will see on this page:

- DOJ EPF (Date of Joining)

- DOE EPF (Date of Exit)

- DOJ EPS

- DOE EPS

The DOJ of EPF and EPS should match, and DOE should also match since these are the same dates of joining and exit from both funds.

When DOE (Date of Exit) is not mentioned than your job is still being continued with your previous employer and is not updated in portal. In this case, you cannot have full and final settlement of your PF Funds. Instead you will get the option for advance PF Withdrawal via Form 31.

You can request your employer to update DOE on this portal if you have left the job, or else you can also update the DOE here.

Another important point is – only after 60 days of DOE (Date of Exit), you can apply for Full and final settlement of your PF funds.

Check PF Transfer

If you have switched jobs previously and you had not transferred the PF amount from first employer to second employer, than you have to the the PF transfer done. This step of PF transfer is manual process and does not happen automatically.

Only after you have transferred funds from previous employer, you should raise request for PF withdrawal from your latest employer.

Without PF transfer from first employer, you will get PF funds from second employer only if request is raised for PF withdrawal. And to get the PF funds from first employer, you have to follow the offline process by contacting EPFO.

So make sure you get all the PF funds transferred from previous employers to latest employer before raising request for PF withdrawal.

ALSO READ: EPF Interest Calculation using Excel

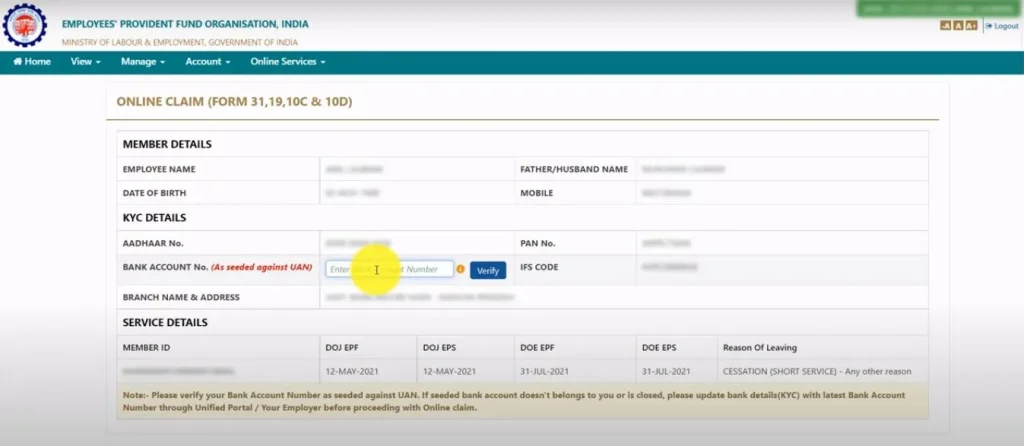

Apply for PF Withdrawal (Form 19)

This step is to apply for PF funds withdrawal via Online Services > Claim (Form 31, 19, 10C & 10D).

- Form 31 – For advance PF withdrawal request

- Form 19 – Full and Final PF withdrawal request

- Form 10C – Full and Final Pension withdrawal request

- Form 10D – Full and Final Pension withdrawal request after retirement

So based on above descriptions we will be using Form 19 and 10C for full and final PF and EPS withdrawal request.

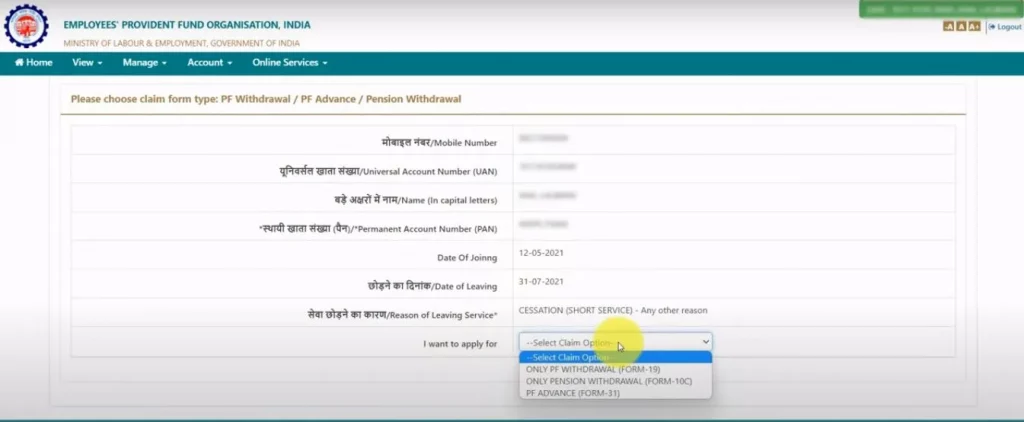

Below is the screenshot of the form that will open:

You need to verify the bank account number in which your funds should be credited. This should be the same bank account that is registered on your EPF account profile.

Next, you need to Agree to the terms and conditions screen displayed.

Your bank account number will be verified.

Other details such as DOJ EPF, DOJ EPS, DOE EPF and DOE EPS will be also displayed for the latest employer, if you have followed all the steps so far.

Also the reason to leave the job will be displayed as “CESSATION (SHORT SERVICE)” if there is proper leaving of the job with mutual understanding.

Next, you should click of Proceed for Online Claim.

On next screen your details will be displayed with the option to apply for 1 of the options:

- Only PF Withdrawal (Form 19)

- Only Pension Withdrawal (Form 10C)

- PF Advance (Form 31)

We will submit Form 19 and Form 10C one at a time for PF and Pension funds withdrawal.

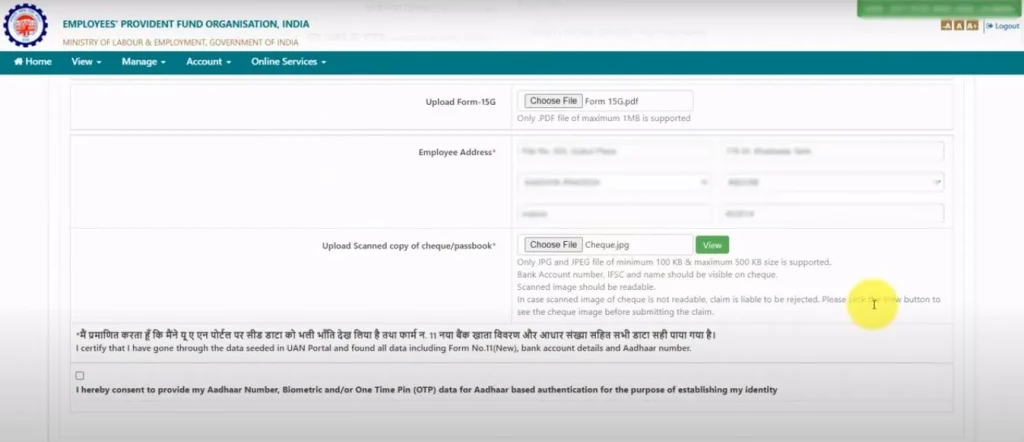

On selecting Only PF Withdrawal (Form 19) option, you will be asked to submit Form 15G (optional), employee address that must match with address on Aadhaar card and scanned copy of cheque or passbook.

What is Form 15G?

Form 15G is the declaration that your income is below Rs. 5 Lakh in a financial year and no TDS must be deducted while getting back your PF funds.

If you don’t provide this declaration, than 10% TDS will be deducted from your PF funds before it is credited to your savings account.

After providing form 15G, you can provide the address as per aadhaar card and preferably the clear picture of cheque. Make sure that you follow the formats and size of the files while uploading these documents.

IMPORTANT: Cheque must have your name printed on bottom right, or else your PF withdrawal request might get rejected even if other details are correct.

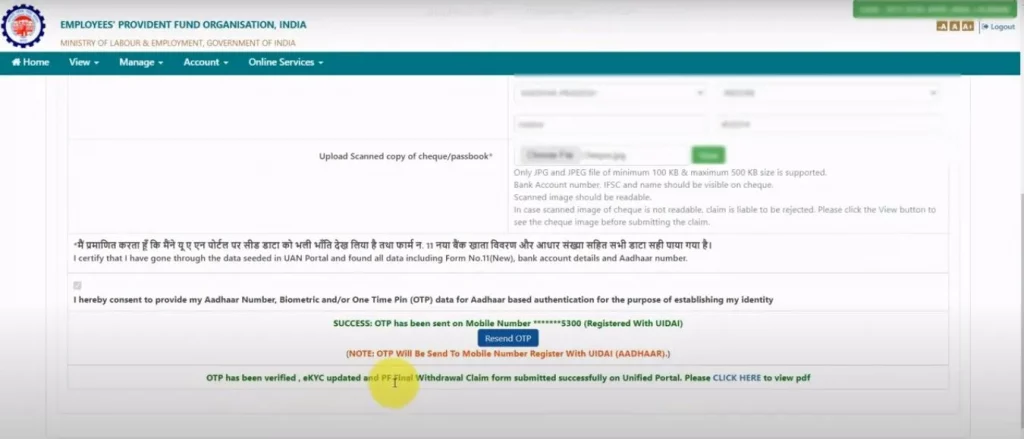

Next, check the consent checkbox provided and click on Get Aadhaar OTP.

You will receive the OTP on registered mobile number. Enter and OTP and click on Submit,

You will get the message – “OTP has been verified. eKYC updated and PF final withdrawal claim form submitted successfully on unified portal“

This same process you need to follow to claim EPS funds also by submitting Form 10C.

ALSO READ: Superannuation Fund Benefits and How it Works?

Conditions to claim EPS fund (Pension) via Form 10C

- You must work for at least 6 months with your current employer

- Your total years of service with all employers must be less than 10 years. If more than 10 years than you need to wait till your retirement age to claim EPS fund.

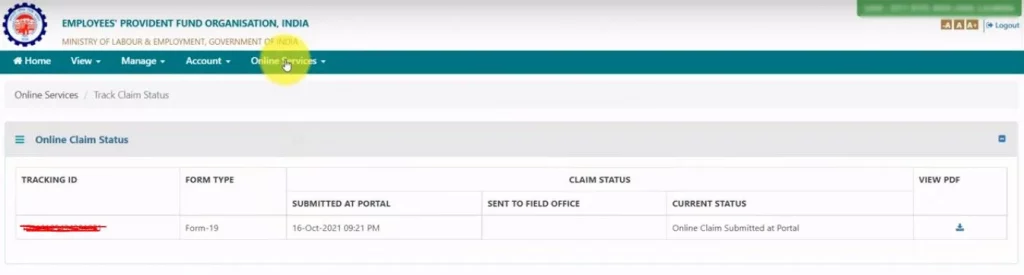

PF Withdrawal Online Track Claim Status

After submitting PF and EPS Withdrawal forms, you can track the claim status via Online Services > Track Claim Status.

How many days take for PF withdrawal?

Usually it will take 13-20 days for EPF and EPS funds to be transferred to your savings bank account. You can check the passbook via View > Passbook option from same website above.

Do we need employer approval for PF withdrawal?

No approval is required. You can withdraw both EPF and EPS funds after six months of date of exit from previous employer.

Can PF pension be withdrawn?

Yes you can withdraw EPS funds as well along with EPF fund by submitting Form 10C as mentioned in above video. The conditions to withdraw PF pension fund include: minimum 6 months service with last employer and not more than 10 years service overall with all employers.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

Can I withdraw 100% PF pension?

100% PF and pension fund withdrawal is allowed after 2 months of unemployment.

Conclusion

So to conclude, you can easily withdraw PF and pension funds by submitting Form 19 and Form 10C respectively. It will usually take 13-20 days for your funds to be transferred to your bank savings account.

If you are unemployed for more than 2 months, you can withdraw 100% of funds. Watch above video in full to know complete steps.

Some more Reading:

- How to Save Tax on Salary above 5 Lakh

- Rs. 10,000 FD Interest Calculation for 5 Years

- Deductions allowed for Tax Payers

- Rs. 1000 PPF Interest Calculation

EPF vs EPS Difference Video

Watch more Videos on YouTube Channel

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.