Everyone has a dream to become a crorepati at some point of time in their life, but to become a crorepati we need to have proper plan to be executed consistently. Becoming a crorepati is possible even with Rs. 5000 SIP! In this post we will see 5 ways to become a crorepati and it is just a matter of time to reach this milestone.

Becoming a crorepati is just a matter of time when proper plan is executed. You can easily use SIP or Systematic Investment Plan in the right mutual fund or stock to become a crorepati and this is the plan you have to stick with. You have to be consistent to reach this important milestone. Let’s see 5 ways to become a crorepati using Excel calculations.

Also, I have provided the link to download excel calculator used in below video at the bottom of this article.

How to Become a Crorepati using SIP Video

5 ways to become a crorepati

1. Mutual Fund SIP – 15 / 15 / 15 rule

This is the first way to achieve the milestone of Rs. 1 crore and it works is this way:

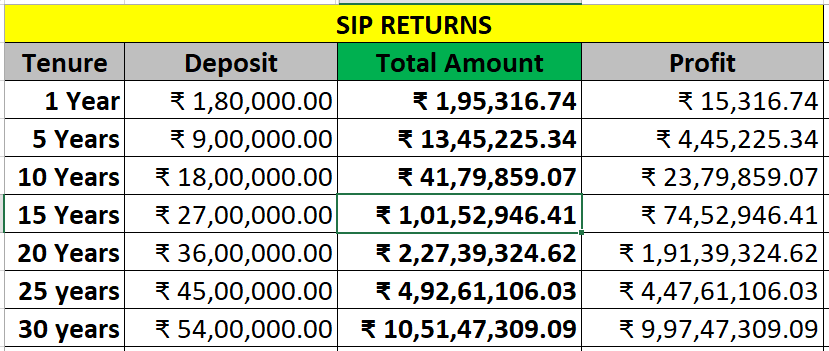

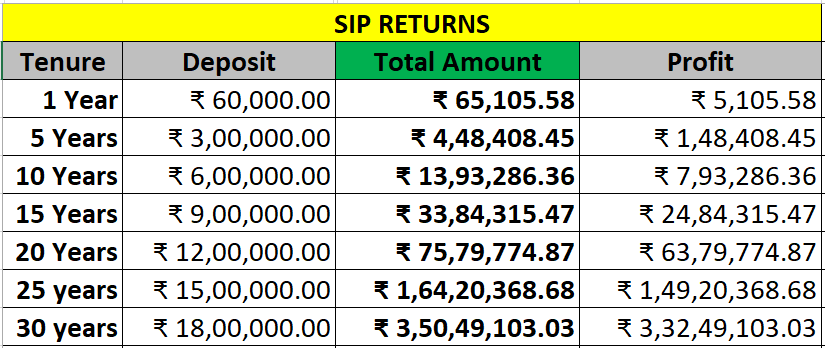

If you invest Rs. 15,000 per month as SIP with an expected returns of 15% per year in best mutual funds, you’ll become a crorepati in next 15 years.

Here is the excel screenshot of how this works:

I have already explained you how mutual fund returns are calculated in SIP & Lump sum here in this article.

If you cannot afford to start with Rs. 15,000 SIP per month, you can start with a small amount you can afford to save or invest in mutual funds. The important thing here is to give time to the market to see the compounding effect to grow your profits over time in mutual funds.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

2. Mutual Fund SIP – 10 / 18 / 15 rule

Here’s the second way to become a crorepati:

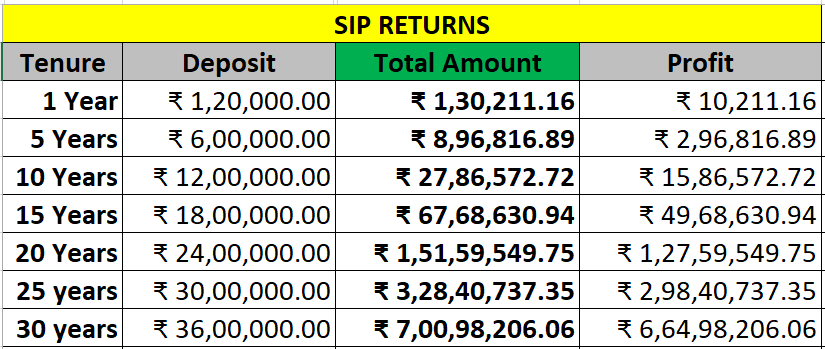

If you invest Rs. 10,000 per month as SIP with an expected returns of 15% per year in best mutual funds, you’ll become a crorepati in next 18 years.

Here we have slightly reduced the SIP amount to Rs. 10,000 if this is what is feasible to you to achieve the milestone.

Below screenshot shows you the calculations in excel:

You can read more about the Types of Mutual Funds here. Equity mutual funds can help you to invest in shares of companies, that can help you to grow your invested money exponentially. But you should be ready to take risk while investing in equity mutual funds to get good rewards over long term. The risk decreases with the increase in your investment time.

How to Start SIP Video:

Watch more Videos on YouTube Channel

3. Mutual Fund SIP – 5 / 22 / 15 rule

Here’s another way to become a crorepati:

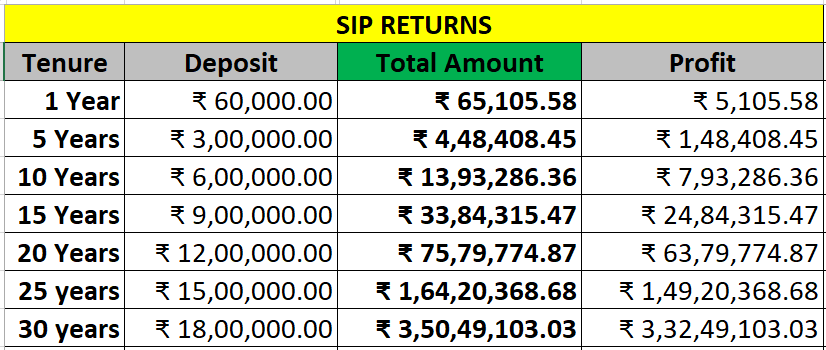

If you invest Rs. 5,000 per month as SIP with an expected returns of 15% per year in best mutual funds, you’ll become a crorepati in next 22 years.

Again we have slightly reduced the SIP amount to Rs. 5,000 so that anyone can afford to keep aside this amount to be saved to achieve the milestone.

Below screenshot shows you the calculations in excel with Rs. 5000 SIP:

4. Step up SIP – 5 / 18 / 15 rule

Now, in order to reduce the tenure with Rs. 5000 SIP, we can use Step up SIP which helps us to increase the SIP amount every year in order to reach the goal before time.

Since our income also increases every year with the help of salary increments and bonuses, it would be wise to increase our SIP amounts as well.

If you invest Rs. 5,000 per month as SIP with an expected returns of 15% per year in best mutual funds, and increase SIP every year by Rs. 1000 you’ll become a crorepati in next 18 years.

That’s the reduction of period by 4 years with same SIP as you started in method #3!

Here’s the excel screenshot:

Step up SIP Calculator Video

5. PPF – Public Provident Fund

Here’s another great way to become a crorepati – PPF or Public Provident Fund is a government backed saving scheme with a lock-in period of 15 years.

If you invest Rs. 12,500 monthly for next 25 years, you’ll accumulate Rs. 1 crore with expected interest rate of 7% annually.

Here are few features of PPF:

- PPF or Public Provident Fund is a savings scheme offered by the Government of India.

- PPF has a lock-in period of 15 years

- Minimum deposit amount in a FY to keep your PPF account active is Rs. 500

- Maximum deposit amount for which you can earn interest in PPF account is Rs. 1,50,000

- The interest on the account is paid by the government of India and is set every quarter, It is also tax-free.

- PPF interest is calculated every month and is compounded annually

- The applicable PPF interest rate for Oct 2021 to Dec 2021, has been fixed at 7.1% annually.

- PPF or Public Provident Fund falls under EEE category (Exempt, Exempt, Exempt), which means, the Deposits, Interest and Maturity Amounts are all exempted from Income Tax

- Partial withdrawals are allowed in PPF account

- Loan facility is also available in PPF account

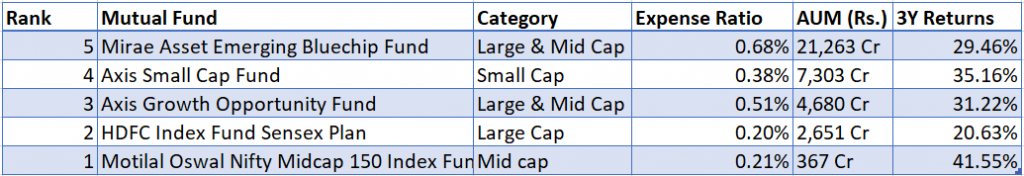

Best Mutual Funds for good returns

Conclusion

As seen, it’s possible to become a crorepati and accumulate Rs. 1 crore even after investing just Rs. 5000 per month in good mutual funds. It is just a matter of time and consistency to achieve this life changing milestone.

DOWNLOAD BECOME A CROREPATI EXCEL

Some more Reading:

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.