Step up SIP is one of the best strategies to make the most out of the mutual fund market returns. Before you start your step up SIP in any mutual fund or stocks, you should know what is step up SIP, how it works, how you can calculate step up SIP returns and where you’ll find step up SIP excel sheet calculator to download which will have required formula, to check your returns so that you can plan your financial goals accordingly. All your queries will be solved in this article.

Step up SIP also known as Step up Systematic Investment Plan, is a method to invest in mutual funds or stocks by increasing the SIP amount by some fraction periodically every 6 months or 1 year.

Since your income increases every year, if you are working professional, it is best to increase your investment amounts as well in the form of Step up SIP. Systematic Investment Plan helps you to invest during various market conditions and gives you the benefit of Rupee cost averaging.

We have already seen how SIP returns are calculated in mutual funds, Step up SIP also works in same way. The only difference is we are increasing the SIP amount periodically to make the most of the market.

DOWNLOAD STEP UP SIP EXCEL CALCULATOR

Click below button to Download Step up SIP calculator in Excel and calculate your returns in Step up SIP:

- DOWNLOAD STEP UP SIP EXCEL CALCULATOR

- Step up SIP Calculator in Excel Video

- How Step up SIP Works:

- Difference between Step up SIP and conventional SIP:

- Benefits of Step up SIP:

- What is the formula for step up SIP calculator?

- Lump sum vs Step up SIP:

- Rs. 2000 SIP vs Step up SIP Returns Calculation Video

- Conclusion:

- Frequently Asked Questions (FAQs):

Step up SIP Calculator in Excel Video

How Step up SIP Works:

As mentioned above, Step up SIP helps you earn more returns compared to SIP since you are increasing your investment amounts periodically.

Let’s take below example to understand Step up SIP:

- Your income is Rs. 50,000 pm and you decided to start SIP with initial investment of Rs. 5000 in the month of April 2021

- You make SIP investments of Rs. 5000 pm from April 2021 to March 2022 (end of Financial Year)

- In March 2022, you get salary increment and now your monthly salary is Rs. 60,000

- Due to this increment, you decided to increase the SIP investment amount to Rs. 7000

- So you adjust your current SIP investment and set the monthly SIP amount to Rs. 7000 between April 2022 to March 2023. This is called Step up SIP.

Either you can do it manually every year and take benefits of Step up SIP (later in this post), or use the automatic feature of Step up SIP provided by many AMC (Asset Management Company). So you can select the percentage or amount of SIP increase and the period after which your SIP amounts will be increased automatically and periodically.

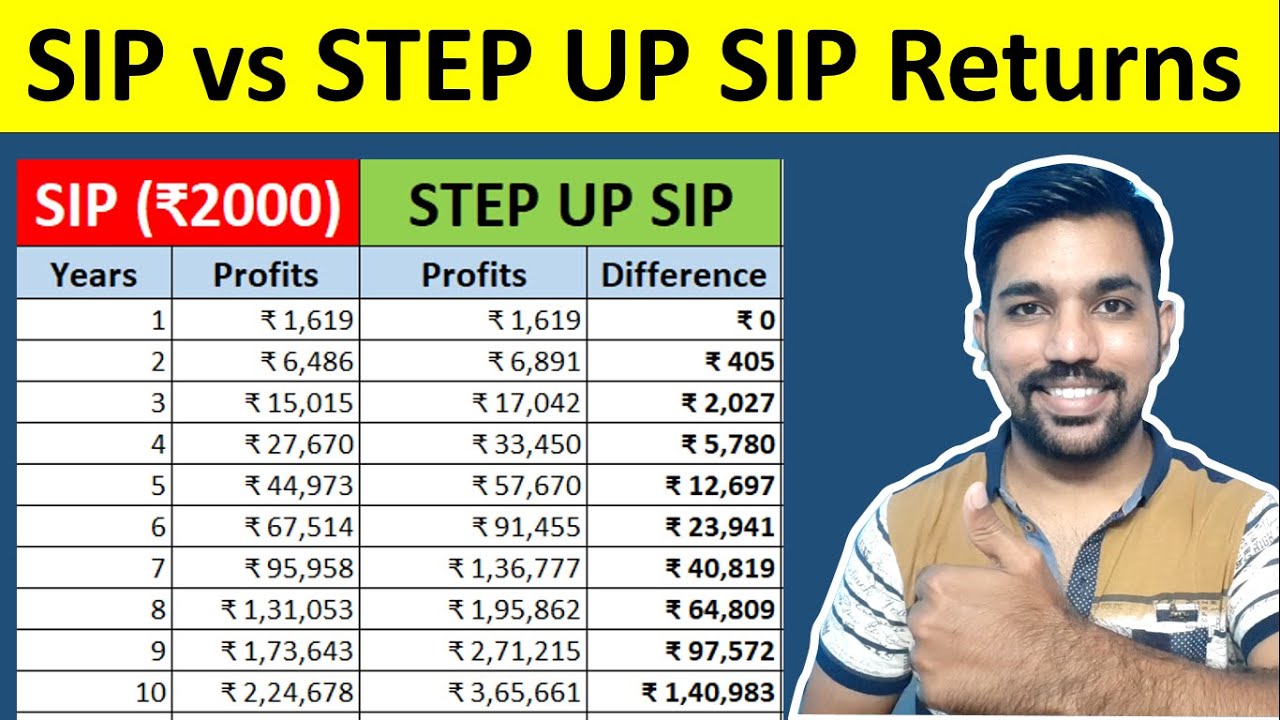

ALSO READ: Rs. 2000 SIP vs Step up SIP Returns Calculation

Difference between Step up SIP and conventional SIP:

When we talk about conventional SIP, you invest a fixed amount every month for specific period of time or throughout your lifetime (known as perpetual SIP). Conventional SIP helps you achieve your financial goals with specific period in your mind.

You can easily calculate SIP returns for next 20 years using Excel in which you’ll see that you deposit a fixed investment amount as your SIP amount throughout the period you invest for.

On other hand, Step up SIP helps you to increase your SIP investment amount with the increase in your income in the form of salary increment.

Watch below video on Difference between SIP and step up SIP with calculations:

Benefits of Step up SIP:

There are many benefits of Step up SIP.

- Helps in increasing your investment amount periodically with increase in your income

- Rupee Cost Averaging – You buy more mutual fund units when market goes down, less units when market goes up, thus averaging the cost of investment

- Helps you achieve your goals before time, by increasing the SIP investment amount

- Get more returns compared to returns from SIP investment

- Like SIP, you can automate the step up SIP which works great with your increasing income as well. Step up SIP indeed is a great strategy to become wealthy over time and to retire early

- It also helps you to be disciplined towards your investment journey while sticking to your budget

- Helps you in avoiding intuitive spending over things you don’t need, since you know about your SIP deductions in your mind!

So these are some of the great benefits of Step up SIP against conventional SIP. It really helps you build wealth over time and also in achieving your goals before time.

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

What is the formula for step up SIP calculator?

The Step up SIP calculation formula is similar to the formula we used while calculating SIP and lump sum returns.

The amount you invest via SIP helps you to buy calculated units based on below formula:

Number of Units = SIP Amount / NAV

where NAV is the Net Asset Value of the Mutual Fund (or share price in case of Stocks).

So, every month, the SIP deduction that happens, helps you to buy mutual fund units based on the formula mentioned above.

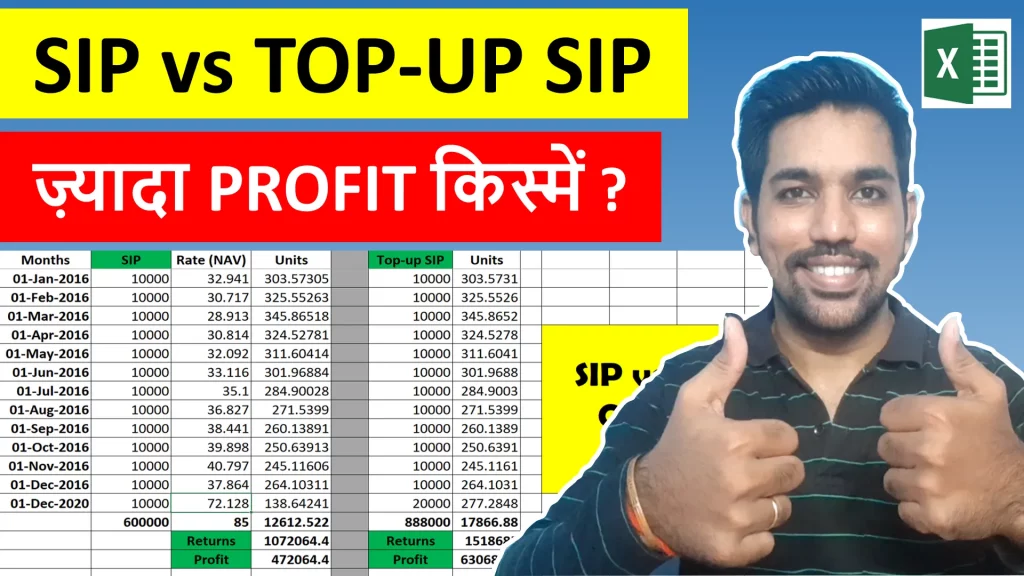

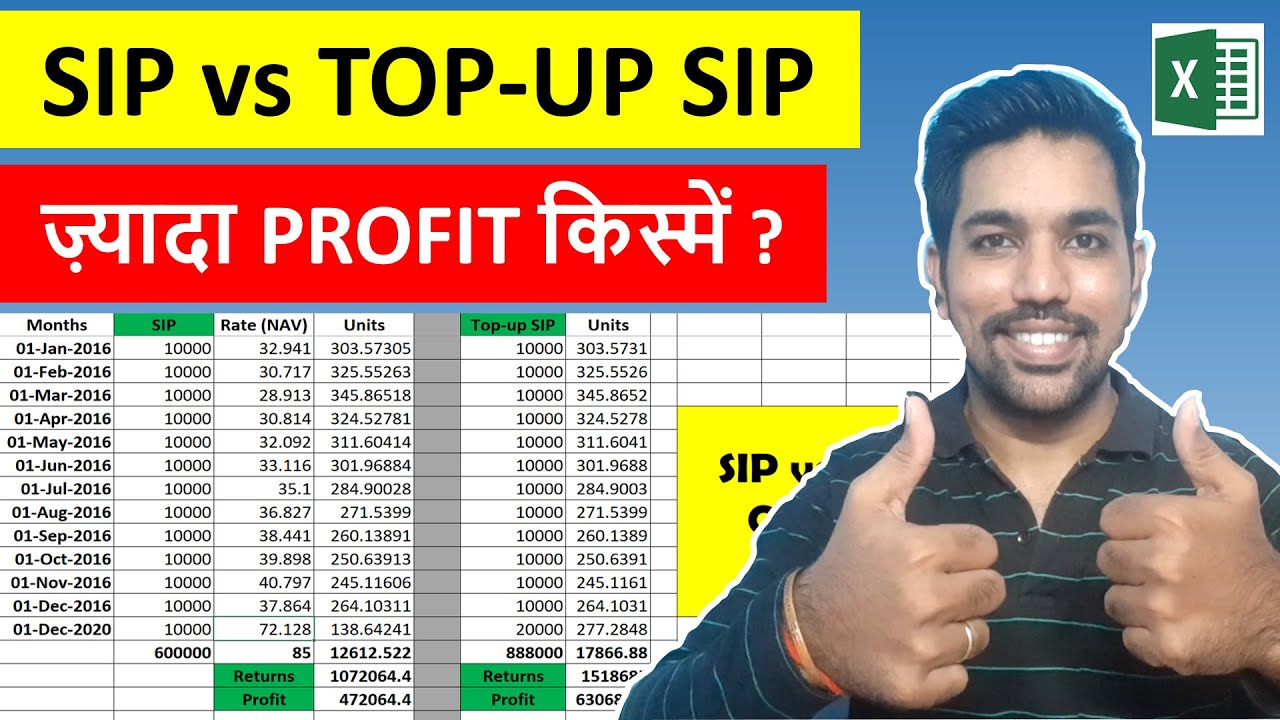

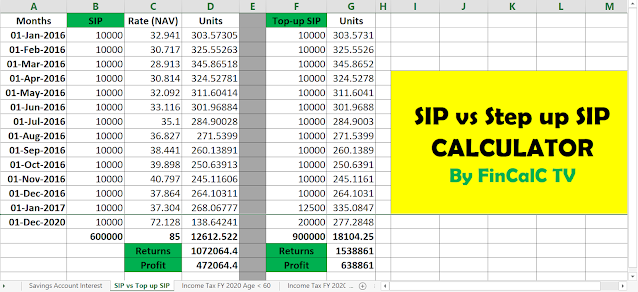

Below is the screenshot from the SIP vs Step up SIP excel calculator I have attached at the bottom of this article.

As seen, we have taken example of a mutual fund and listed it’s NAV value for last 5 years.

We have taken SIP amount of Rs. 10,000 for 5 years on left (2016 to 2020), and Step up SIP amount started with initial investment of Rs. 10,000 (same as conventional SIP, on right), and we increased Step up SIP by Rs. 2500 every year. Hence the SIP amount you pay in 5th year (2020) is Rs. 20,000.

The returns we saw were quite interesting.

For conventional SIP, the total amount you gather in 5 years was Rs. 10,72,064 thus making profit of Rs. 4,72,064. And on other hand, in Step up SIP, the total amount you gather in 5 years was Rs. 15,38,861 thus making profit of Rs. 6,38,861

This is the way Step up SIP increases your profits compared to conventional SIP. It’s always better to increase your SIP amount with the increase in your income every year

ALSO READ: Rs. 2000 SIP Returns Calculation for 15 years

Lump sum vs Step up SIP:

We saw how SIP differs from Step up SIP. What about Lump sum investing. How Lump sum investing returns are calculated?

Lump sum returns can be calculated more easily and is straight forward compared to SIP and Step up SIP returns.

The units calculation formula is same as mentioned above, that is:

Number of Units = Lump sum Amount / NAV

Now, the NAV value is taken on the day you invest via Lump sum investing. For example, let’s say NAV on the day you invest is Rs. 100, and you invest Rs. 10,000.

Number of units will be calculated as below:

Number of Units = 10,000 / 100 = 100 Units

This is how number of units are calculated in Lump sum or conventional SIP or Step up SIP investing.

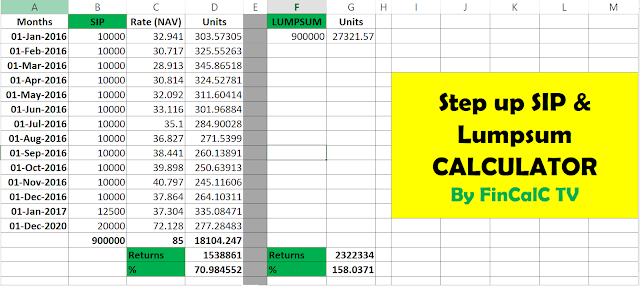

Let’s compare Lump sum and Step up SIP investing returns in our Excel Calculator. Below is the screenshot for lump sum and Step up SIP returns in Excel calculator:

As seen, we have taken example of a mutual fund and listed it’s NAV value for last 5 years.

Examples Explained:

We have taken Step up SIP amount with initial investment of Rs. 10,000 (on left from 2016-2020), and we increased Step up SIP amount by Rs. 2500 every year. Hence the SIP amount you pay in 5th year (2020) is Rs. 20,000. The lump sum amount is Rs. 9,00,000 (same as total of SIP amounts) invested in January 2016.

The returns we saw were quite interesting.

For conventional SIP, the total amount you gather in 5 years was Rs. 15,38,861 thus making profit of Rs. 6,38,861. And on other hand, in lump sum investing, the total amount you gather in 5 years was Rs. 23,22,334 thus making profit of Rs. 14,22,334

So, lump sum investing gives you more returns compared to Step up SIP returns over long term. Over short term, lump sum investing is very risky since you put entire amount in one go, and there is a risk whether you’ll get back your principal amount. But this is the case in short term.

Over long term, lump sum actually gives more returns (if invested in better mutual fund or stocks) since you are getting more units based on a particular day.

The only disadvantage in lump sum investing is that you put entire amount in one go, and you have this fact psychologically in your mind that a huge amount has been taken away from you! But it is an investment.

Also, it is not recommended to do lump sum investing in any single stock as it is very risky. You cannot time the market. And the one who says, he can time the market for you and give you better returns? Just run away from him!

ALSO READ: Best Index Mutual Funds for 2023

Rs. 2000 SIP vs Step up SIP Returns Calculation Video

Watch more Videos on YouTube Channel

Conclusion:

We saw that Step up SIP performs better compared to conventional SIP, since in Step up SIP you increase the SIP amount periodically which helps you buy more units compared to normal SIP.

Also, we saw that lump sum investing is more beneficial compared to Step up SIP since it gives you better returns. But we have to be careful that lump sum investing is single stock or a bad mutual fund can also lead you not to get your already invested principal amount back!

So, it is wise to start or continue with Step up SIP and increase the SIP amount periodically with the increase in your income.

Some more Reading

- Short Term Capital Gains Tax in Mutual Funds

- How to Invest in SIP Online [SBI Demo]

- Income Tax on SIP

- Rs. 5000 SIP in Sensex for 25 Years

Frequently Asked Questions (FAQs):

What is the Full Form of SIP?

SIP full form if Systematic Investment Plan. Usually SIP is a specific amount you invest every month to achieve specific goals with specific tenure (time period)

How SIP works?

SIP is the specific amount you invest every month for a specific goal with a specific period of time. You invest an amount of let’s say Rs. 5000 every month for 5 years and with expected returns of 10% per year. In this case, after 5 years your expected investment value would be Rs. 3,90,411 according to the SIP returns excel calculator provided above. This makes you a profit of Rs. 90,411 in 5 years and also helps you achieve your goal.

What is Step up SIP?

When you increase your SIP amount periodically, it is called Step up SIP. For example, when there is an increase in your income every year in the form of salary increment, you can increase your SIP investment amount as well, this helps in getting many advantages as stated above.

Is step up SIP better than SIP?

Yes step up SIP is better than normal SIP since it helps you to allocate investment amount with the increase in your income. This will eventually help you to achieve your goals faster and before time compared to normal SIP. Also, the profits you get in value will be more in step up SIP.

How much should be a step up SIP?

Step up SIP amount depends on your income and goals. If your income is increased by 10% than you can have the SIP also increased by 10% of your current amount. Similarly you can decide the increase in your SIP amount based on your income increase percentage and how early you want to achieve your goals.

Can we start Step up SIP online?

Yes. Most AMC (Asset Management Company) allows you to select step up SIP investment when you want to start SIP, with the percentage or amount your want to increase every year or 6 months. You can also select the frequency of increase in SIP amount.

What is lump sum investing?

Lump sum investing means you invest entire amount in one go. Let’s say you have Rs. 1,20,000 to be invested for a year. In SIP, you divide this Rs. 1,20,000 for 12 months (1 year) and invest Rs. 10,000 every year in a mutual fund. On other hand, in lump sum investing, you invest entire amount of Rs. 1,20,000 in first month in one go. This is called lump sum investing.

What is better SIP or Lump sum investing?

Combination of both SIP and Lump sum is better. You can continue with your SIP during normal days and invest lump sum amount if available when market goes down. This way you get more units when market is down and make more profits during market crash.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.