It is very important to manage your finances effectively for achieving your financial goals and maintaining peace of mind. Budgeting serves you as the foundation of financial management, yet many people find it difficult, especially when they are just starting. This article will provide you with 10 essential budgeting tips for beginners that can help you to take control of your finances and build a solid financial future.

- 1. Understanding Your Income and Expenses

- 2. Set Clear Financial Goals

- 3. Create a Budget Plan

- 4. Monitor and Adjust Your Budget Regularly

- 5. Build an Emergency Fund

- 6. Minimize Unnecessary Expenses

- 7. Use Cash for Certain Expenses

- 8. Prioritize Debt Repayment

- 9. Automate Your Savings and Payments

- 10. Educate Yourself Continuously

- Conclusion

1. Understanding Your Income and Expenses

First, understand the your income with total number of income streams:

- Total Income: Begin by calculating your total income. This includes your salary, side hustles, freelance work, and any other sources of income. Knowing your total income is essential as it forms the basis of your budget

- Net Income: Focus on your net income (the amount you take home after taxes and deductions) as this is what you will actually use for budgeting

Next, you need to calculate your expenses:

- Fixed Expenses: Identify your fixed expenses such as rent, utilities, insurance, and loan payments, which remain constant each month

- Variable Expenses: Keep track of variable expenses like groceries, entertainment, and dining out, which can fluctuate monthly

- Use Expense Tracking Tools: Consider using excel or mobile app to track your expenses over a month. This will provide insight about your spending habits and help you identify areas for improvement

2. Set Clear Financial Goals

Short-Term Goals

- Examples: These could include saving for a vacation, paying off a small debt, or building an emergency fund.

- Time Frame: Short-term goals typically lasts from a few months to a couple of years.

Long-Term Goals

- Examples: Long-term goals may include saving for retirement, buying a house, or funding your children’s education.

- Time Frame: These usually extend over several years or decades.

- Use SIP (Systematic Investment Plan) to achieve your long term goals

Ensure your goals are SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. This will help you stay focused and motivated

3. Create a Budget Plan

- Zero-Based Budget: This method allocates every rupee of your income to expenses, savings, or debt repayment, ensuring that your income minus expenses equals zero

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This is a simple and effective method for beginners

It is important to save some amount of money every month from your income for emergency funds or early retirement.

You should be honest about your spending habits and lifestyle. Your budget should reflect your real-world expenses and goals, ensuring that it is achievable.

4. Monitor and Adjust Your Budget Regularly

- Set aside time each month to review your budget and compare it against your actual spending. Look for discrepancies and analyze why they occurred

- If you find that your spending in certain categories is consistently over or under budget, adjust your budget accordingly. Flexibility is the key to successful budgeting.

- Utilize budgeting apps or personal finance excel sheet to help you monitor your budget effectively

5. Build an Emergency Fund

- An emergency fund is essential for financial security. It protects you from unexpected expenses, such as medical bills, car repairs or job loss

- Aim to save at least 3 to 6 months worth of living expenses in your emergency fund. Start small if necessary and gradually build up the emergency fund

- Consider keeping your emergency fund in a high-yield savings account or Liquid mutual fund that is easily accessible but still earns some interest

6. Minimize Unnecessary Expenses

- Distinguish between your essential needs (housing, food, transportation) and your wants (luxury items, subscriptions). Prioritize your spending on needs first

- Review your variable expenses and identify areas to cut back. For example:

- Dining Out: Limit eating out to once a week

- Subscriptions: Cancel unused or unnecessary subscriptions

- Impulse Purchases: Implement a waiting period (e.g., 24 hours) before making non-essential purchases

- Look for free or low-cost alternatives for entertainment and activities. For instance, explore community events, parks, and libraries instead of costly outings

7. Use Cash for Certain Expenses

- The use of UPI and credit cards in India have led to lot of impulsive buying

- You should be avoiding such impulse buying and stick to your budget

- Instead, using cash can be more effective to only buy what you actually need

- In case you don’t have cash, and you are planning to buy a non-essential want, you won’t be taking help of your credit card to buy that non-essential item without cash, thus helping you to be consistent on your saving habit

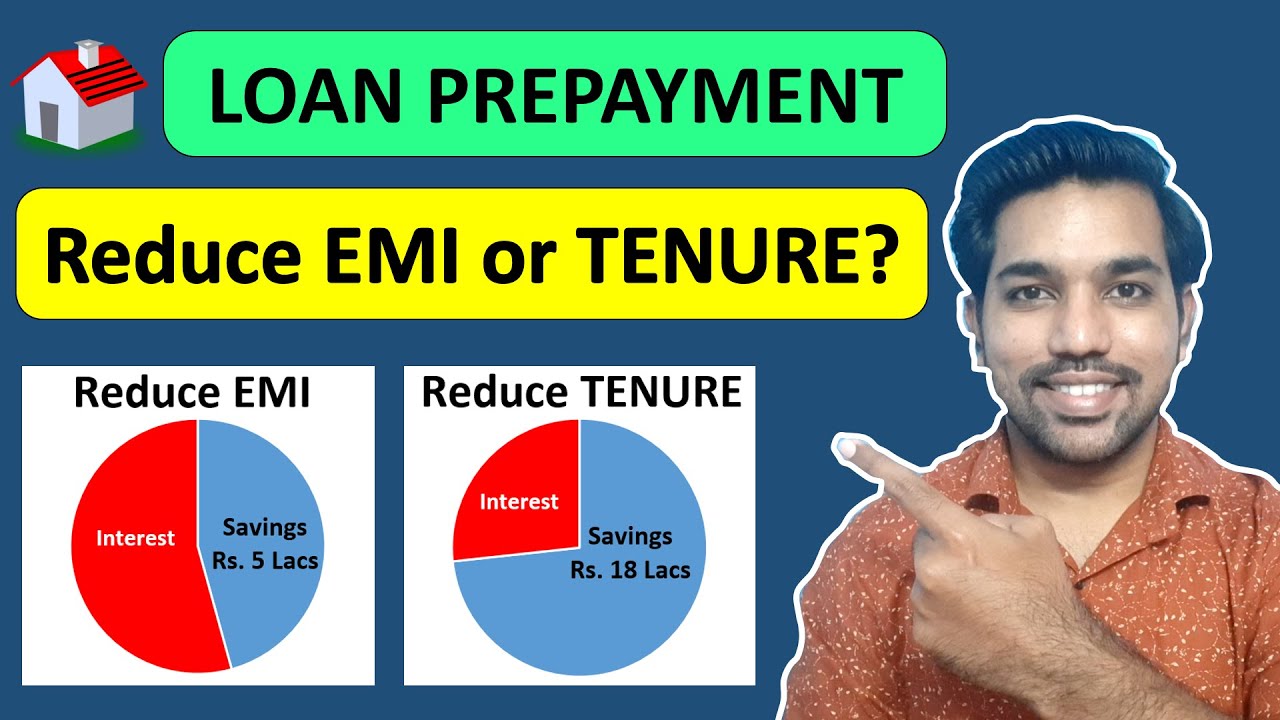

8. Prioritize Debt Repayment

- Loans including home loan, car loan, student loan are all taking huge interest amount with high interest rates and tenure

- Home loans can go as long as for 20 to 25 years which will simply make you work for money and sucking money out of your bank account every month

- If already taken a loan or are in debt, it is important to pay back the loan as soon as possible to avoid or save the interest amount you have to pay back to banks and financial institutions

- This will help you to be debt free and also work towards your future financial goals and achieve them before time

Home Loan Prepayment Video:

Watch more Videos on YouTube Channel

9. Automate Your Savings and Payments

- As a beginner, you can simply open RD (Recurring deposit) in your bank account to start with a saving habit

- This RD will help you to automatically debit your bank account and save in RD which will get mature after 6 months or 1 year, depending on your tenure selected, which can help you to save a lumpsum amount

- After creating a saving habit, you can start SIP online, save in PPF account or also, contribute in NPS (National Pension System)

- All these saving schemes help you to automatically save for your future financial goals

- Automating your savings is important so that you don’t have to provide any manual instructions every month, which you might forget about due to your other primary work

- Let automation help you save and invest money for you that will earn you extra money

10. Educate Yourself Continuously

- Budgeting and knowing personal finance is a not a one day task. You have to continuously learn and gain knowledge about personal finance

- Read books on personal finance to know about different perspectives that author wants to share with you

- Listen to personal finance podcasts that can help you to understand the experience of various speakers of podcasts

- Join finance communities on quora or reddit to understand

- Also, you can join my YouTube Channel where I share knowledge and experience on various topics related to personal finance and investing

Conclusion

Budgeting is a powerful tool that will help you take control of your finances and achieve your financial goals. By following these 10 essential budgeting tips for beginners, you can create a solid financial foundation, build good spending habits, and ultimately lead a more financially secure life.

Remember that budgeting is an ongoing process, and regular reviews and adjustments will help you stay on track and adapt to your changing financial situation

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.