PPF vs Mutual Funds – Which is better? This is one of the important questions you would come across either while saving income tax or growing your wealth. Selecting one of these instruments will decide how much returns you can get in future over long term and saving your income tax as well.

PPF (Public Provident Fund) helps you to save income tax under Section 80C with maximum limit of Rs. 1.5 lakh in Old Tax Regime. Also the PPF interest is compounded on annual basis. Mutual Funds can give you better returns based on the mutual funds selection over long term of 15 years and can help you to grow your wealth and achieve your financial goals before time.

Watch below video on PPF vs Mutual Funds to know more about calculations

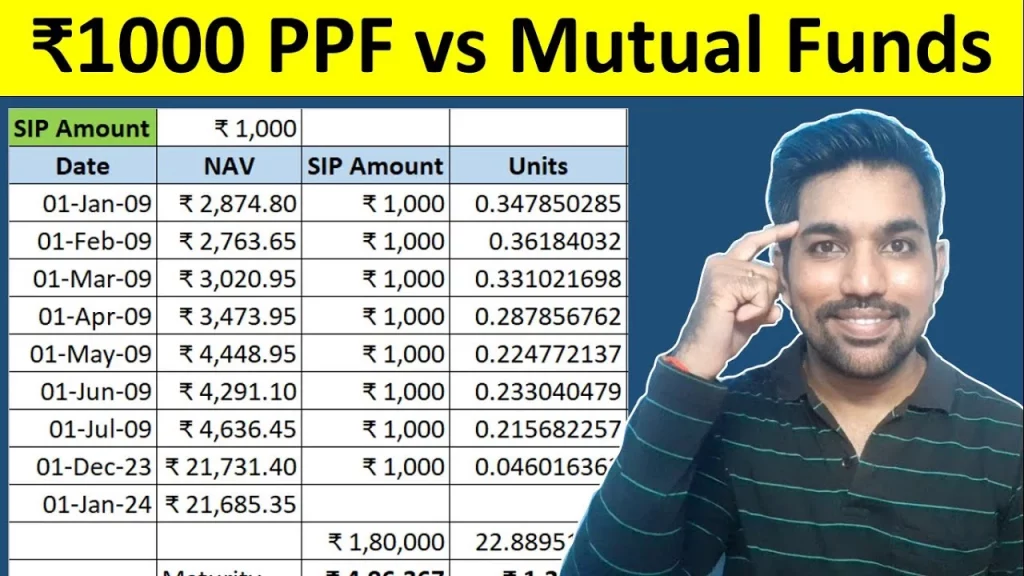

₹1000 PPF vs Mutual Funds Returns Calculation Video

Watch more Videos on YouTube Channel

PPF Features and Benefits

Below are some of the Features and Benefits of PPF:

- PPF or Public Provident Fund is a savings scheme offered by the Government of India

- PPF has a lock-in period of 15 years

- Minimum deposit amount in a financial year to keep your PPF account active is Rs. 500

- Maximum deposit amount for which you can earn interest in PPF account is Rs. 1,50,000

- The interest on the account is paid by the government of India and is set every quarter, It is also tax-free

- PPF interest is calculated every month and is compounded annually

- The latest PPF interest rate for January to March 2026, has been fixed at 7.1% annually

- PPF or Public Provident Fund falls under EEE category (Exempt, Exempt, Exempt), which means, the Deposits, Interest and Maturity Amounts are all exempted from Income Tax

- Partial withdrawals are allowed in PPF account

- Loan facility is also available in PPF account

- PPF helps to save income tax under Section 80C with Old Tax Regime

ALSO READ: Monthly vs Yearly Deposits in PPF

Mutual Funds Features and Benefits

Let us now see some of the features and benefits of Mutual Funds:

- Mutual fund contains list of stocks in which it invests it’s assets (money) collected from investors. In return, the mutual fund tries to maximize returns of investors

- Equity Mutual Fund is one of the types of mutual funds that invest in equities or stocks of the companies

- It is classified as Equity Mutual Funds, since at least 60% of the total assets must be invested in equities or stocks of the companies

- The remaining amount can be invested in debt or money market instruments to fulfill the need of redemptions made by investors

- Equity Mutual Funds are risky in nature since they invest in stocks of companies. this risk is directly proportional to the amount of money allocated to equities of companies

- Mutual Fund with 90% allocation to equities (stocks) will be more risky compared to the mutual fund with 65% of allocation to equities in their portfolio

- Mutual funds are allocated with fund manager to select equities or stocks of companies to maximize returns on your investments

- Every mutual fund has an associated cost called as expense ratio, which is capped at 2.5% by SEBI. This expense ratio is the cost of handling your invested amount by fund manager and team, to maximize your returns on invested amount

- Expense ratio of funds that buy and sell more frequently will have high expense ratio compared to other funds that buy and sell less frequently while holding the stocks for long period

ALSO READ: Rs. 1000 Mutual Fund Returns Calculation

What is SIP in Mutual Funds?

- SIP full form is Systematic Investment Plan. It is a way to invest in Mutual Funds.

- Similar to RD (Recurring Deposit), every month there will be an amount debited from your bank account and invested in mutual fund selected by you. The amount can be decided by you to be invested

- Hence SIP helps you to start with small amount every month, and achieve your financial goals with time

- It can also help you to retire early and enjoy your life.

- It is important to have financial goals before you start SIP over mid to long term. Giving time to the market is important which SIP helps you to achieve with small investments every month

ALSO READ: SIP vs Lumpsum Investment Which is Better?

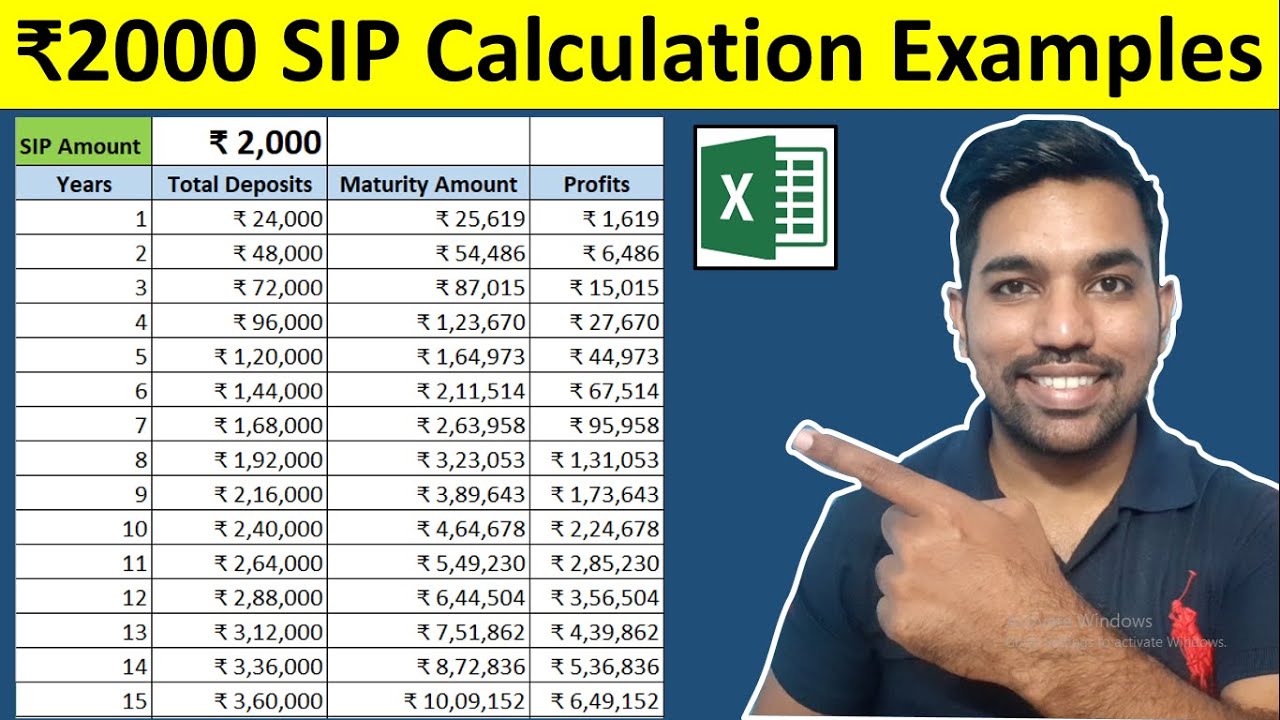

₹2000 SIP Returns Calculation Video

Watch more Videos on YouTube Channel

Conclusion – PPF vs Mutual Funds Which is Better?

So based on above video and calculations, it depends on your financial goals to select between PPF and Mutual Funds. PPF is a long term saving scheme with guaranteed returns that is tax free, but the returns are low compared to the same 15 years tenure in mutual funds. Historically we have seen mutual funds giving around 12% to 15% over long term.

Some small cap mutual funds can also give up to 20% average annual returns. ELSS (Equity Linked Saving Scheme) is a type of mutual fund that help you to save income tax under Section 80C.

The best strategy would be to invest in both and allocate funds in PPF considering a debt instrument and in mutual fund to grow your wealth exponentially.

Download PPF Excel Calculator

Click below button to Download PPF Calculator in Excel

Download Mutual Funds SIP Excel Calculator

Click below button to Download SIP Calculator in Excel:

Frequently Asked Questions

Which is better PPF or mutual fund?

Selecting between PPF and Mutual Fund depends on your financial goal. If you want to save income tax while preserving your capital amount, PPF is better for you with 15 years long term tenure and tax saving benefits with decent returns on your investments. Where as if you want to grow your wealth exponentially over long term of 10 to 20 years, than mutual funds will be a better choice.

What are the disadvantages of PPF?

PPF has a lock in period of 15 years, provides low interest compared to mutual funds and is less liquid compared to other saving schemes or mutual funds. Also you can only deposit maximum of Rs. 1.5 lakh in financial year in PPF

Can I invest more than 150000 in PPF in a year?

No, you cannot investment more that Rs. 1,50,000 in PPF in a financial year, since this is the maximum limit in PPF.

Can I open a 2 PPF account?

No, a person can only have one PPF account opened in post office or a bank.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.