Long Term Capital Gains Tax is the income tax to be paid on the long term capital gains or profits made in equities or equity mutual funds. We will talk about Long Term Capital Gains Tax on shares and mutual funds in this article.

Long Term Capital Gains Tax or simply LTCG Tax is the income tax you pay when you hold the shares or equity mutual funds for more than 1 year and sell them after this holding period. 10% tax is applied on such LTCG or profits made above Rs. 1 Lakh in financial year. We will check LTCG Income Tax on SIP with the help of examples. While on other hand, STCG or Short term capital gains attracts 15% tax on the profits made. We can also save LTCG tax by dividing the profits across multiple financial years, known as Tax Harvesting.

Let us understand Income Tax on Long Term Capital Gains or LTCG in more detail.

Long Term Capital Gains Tax Video

Watch more Videos on YouTube Channel

Long Term Capital Gains Tax Rate

Long Term Capital Gains Tax rate is 10% on profits made above Rs. 1 lakh. Here we are talking about equity related assets that include shares and equity mutual funds.

So instead of adding the LTCG profits in your total income, the LTCG profits are taxed separately and 10% tax is applied on profits made above Rs. 1 lakh in financial year.

LTCG Tax Example:

So let’s say in a financial year, you made LTCG profits of Rs. 90,000. In this case, since the profits is below Rs. 1 lakh in financial year, there will be no tax liability.

But if you make LTCg profit of Rs. 1,10,000 in financial year, 10% tax will be applied on profits above Rs. 1 Lakh and will be calculated as below:

LTCG Tax = 10% * Profits above Rs. 1 lakh / 100

LTCG Tax = 10% * Rs. 10,000 / 100

LTCG Tax = 10% * Rs. 1000So R.s 1,000 + cess will be your tax liability on above mentioned profits made in financial year.

ALSO READ: SIP Returns using Excel Calculator

STCG and LTCG Differences

So basically, LTCg is the profits you make after holding assets for more than 1 year, where as STCG or (Short Term Capital Gains) is the profits you make after holding the assets for less than 1 year.

Below are the differences between STCG and LTCG:

| STCG (Short Term Capital Gains) | LTCG (Long Term Capital Gains) |

|---|---|

| Holding of assets for less than 1 year | Holding assets for more than 1 year |

| 15% tax on profits made | 10% tax on profits made above Rs. 1 Lakh in Financial year |

| No way to save tax since profits made in short term | Tax can be saved by redeeming units having value less than Rs. 1 lakh in consecutive financial years |

Long Term Capital Gains Tax on Mutual Fund

You can simply calculate the Long Term Capital Gains Tax on mutual funds by using mentioned tax rete.

Let’s understand this with example.

Let’s say you buy a mutual fund using lumpsum investment in Jan 2020 with Rs. 2 lakh, and sell these mutual funds in Jan 2024 (4 years holding period), for Rs. 3.5 Lakh. So below are the profits and tax to be paid based on Long Term Capital Gains in mutual fund:

LTCG Profits = Rs. 3.5 lakh - Rs. 2 Lakh

LTCG Profits = Rs. 1.5 lakh

LTCG Tax on Mutual Funds = 10% * Profits above Rs. 1 lakh / 100

LTCG Tax on Mutual Funds = 10% * Rs. 50,000 / 100

LTCG Tax on Mutual Funds = Rs. 5000As seen above, since the holding period is more than 1 year, you have to pay LTCG tax of 10% on profits made above 1 lakh in financial.

Hence you pay Rs. 5000 tax + cess on such profits.

In this way LTCG tax is calculated in mutual funds.

Let us understand LTCG tax on shares

Long Term Capital Gains Tax on Shares

Similar to the LTCG tax on mutual funds, the tax on selling shares after holding for more than 1 year is calculated.

Let us understand the Long Term Capital Gains Tax on Shares with example.

Let’s say you buy shares of ABC company in Jan 2022 for Rs. 1 lakh and sell them for Rs. 3 Lakh in Jan 2024 (after 2 years). So you make LTCG profits of Rs. 2 lakh. Below is the tax calculation:

LTCG Tax on Shares = 10% * Profits above Rs. 1 lakh in FY / 100

LTCG Tax on Shares = 10% * Rs. 2 Lakh / 100

LTCG Tax on Shares = Rs. 20,000So you pay tax of Rs. 20,000 on these LTCG profits made on shares after holding them for more than 1 year.

If the holding period of mutual fund or shares is less than 1 year, you need to pay Short term capital Gains (STCG) tax on such profits, with no exemption of Rs. 1 lakh

Watch below video to understand Short Term Capital Gains Tax Calculation:

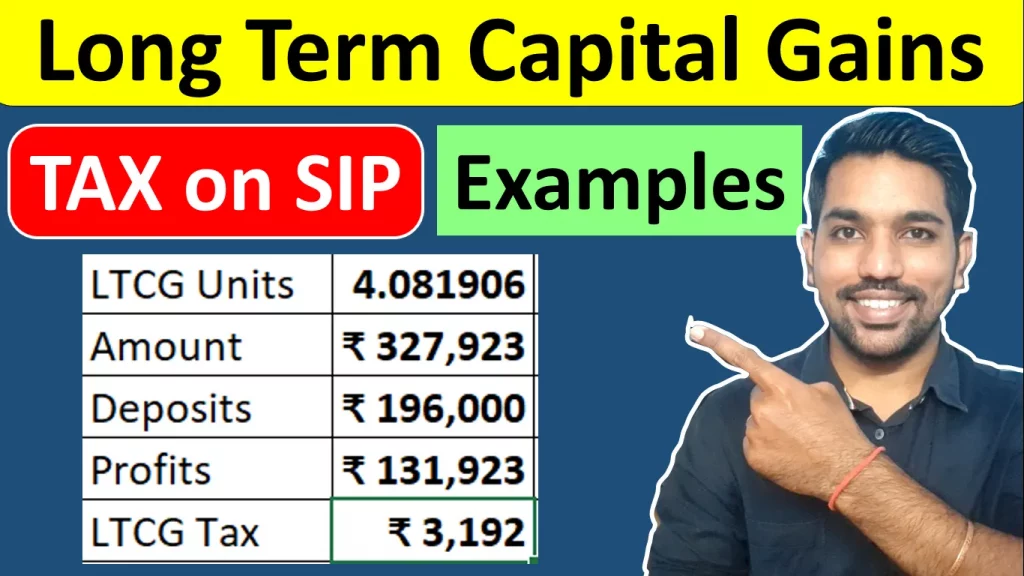

LTCG Tax on SIP

Now LTCG Tax on SIP can be easily calculated using the excel I have shown you in the video at the top of the article.

Every SIP amount invested will have it’s own purchase date to calculate the holding period, based on which the profits made will be classified as short term or long term.

Using this information, you can sell only those shares or mutual fund units that are having holding period for more than 1 year to classify them as long term capital gains.

So let’s say if you start SIP online on Jan 2022 and want to sell some of the shares or mutual fund units in July 2024. In this case, all the units you bought before July 2023 will earn you long term profits, where as those that are bought after July 2023 will have the holding period period of less than 1 year.

So you can calculate the sum of all the units bought from Jan 2022 to July 2023 and sell them to book long term profits for 10% tax applied on profits made that is above 1 lakh in that financial year.

Watch LTCG Tax on SIP Video to know more with calculation examples

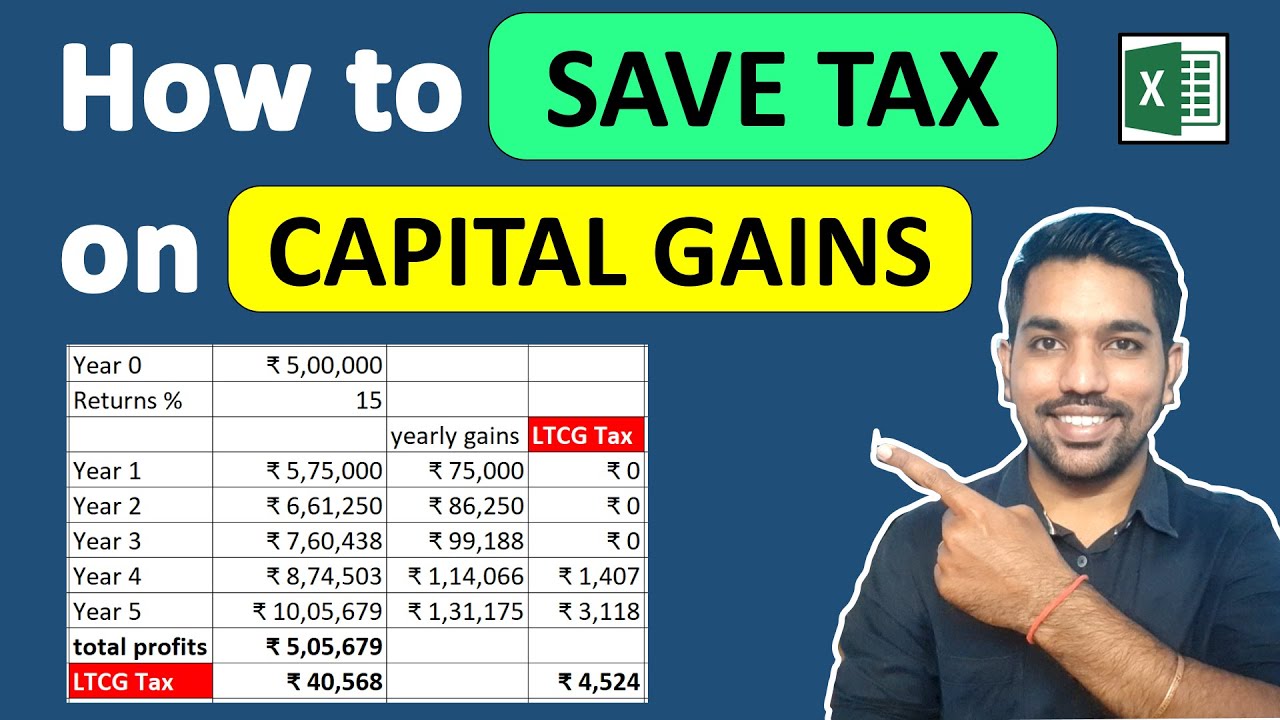

How to Save Long Term Capital Gains Tax

You can save LTCG tax by dividing your profits across multiple years. Here, you will be using the limit of Rs. 1 Lakh, that is allowed to pay no tax.

Since every year, you don’t have to pay tax on first 1 lakh profits made over long term holding of assets, you plan your selling of shares or mutual fund units accordingly and divide the profits across multiple years.

This will be better understood with the help of examples in below video

How to Save LTCG Tax on SIP Video

As seen in above video with examples, you can save LTCG tax by using the method of Tax Harvesting.

Conclusion

So LTCG or long term capital gains are taxed at 10% on profits made above Rs. 1 Lakh in financial year, if the holding period is more than 1 year. You can make use of the exemption limit of Rs. 1 Lakh to divide profits and save income tax on SIP in mutual funds or shares over long term.

On other hand, if the holding period is less than 1 year, you have to pay short term capital gains (STCG) tax of 15% on the profits made, which cannot be saved by any means, except if your total income in the financial year is below exemption limit of Rs. 2.5 lakh with old tax regime and below Rs. 3 lakh with new tax regime.

Some more Reading:

- Income Tax Calculation with Examples

- Rs. 2000 SIP Returns Calculation for 15 Years

- How to become Crorepati with SIP Investments

Frequently Asked Questions

How much amount is tax-free in long term capital gain?

Rs. 1 Lakh of long term capital gain is tax free in a financial year for equity oriented assets that you hold for more than 1 year. 10% of tax will be applicable on profits made above Rs. 1 Lakh in financial year.

How is LTCG tax calculated?

LTCG tax is calculated at 10% tax rate on profits made above Rs. 1 Lakh in financial year. Note that the holding period of shares or mutual fund units must be for more than 1 year in this case

How do I avoid long term capital gains tax?

You can save or avoid LTCG tax by dividing the profits made across multiple years. Which means, sell units of only those shares or mutual funds that have holding period of more than 1 year, and also the profits from these units is below Rs. 1 lakh in financial year. Continue this process every financial year to save long term gains tax.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.