How to Get Out of Debt Quickly is one of the important question you should be asking yourself if you are struggling financially. Financial struggle starts with this debt trap and keeps on increasing with upcoming months and years if you don’t take required steps to come out of the debt or loan trap. You should be able to assess and accept the debt you have and gradually close those loans to live a peaceful life and follow other important financial goals.

Let us understand the steps to come out of Debt Quickly.

1. Acknowledge and Identify Your Debt

The very first step is to acknowledge that you need to review your finances and have a budget in place in order to get out of debt. While assessing your finances, below are some of the common debt categories you might have:

- Credit Card Bills: In case you don’t pay the credit card bills in full every month, you might find yourself paying interest amount on the money you have used via credit cards to buy items. So identify the amount of debt under this credit card bill category

- Loans: If you have bought a new house or a car on home loan or car loan, it is another type of debt for which you are paying EMI every month.

- Other Debt: Any other debt that include gold loan, personal loan, or money taken from someone else also need to be paid back. So identify these debts as well

Add all the numbers from above category and come to an estimate of how much monthly payments you have to make to repay above mentioned debt.

2. Understand Your Spending Habits

After categorizing the debt types, it is important to understand your spending habits and calculate the average monthly expenses.

You need to review below types of expenses and your spending habits:

- Subscription services: These subscription includes online entertainment such as Netflix, Hotstar, other platforms for which you need to pay for their services. Keep only those which are required. It also includes offline subscriptions such as gym memberships and other sports memberships

- Eating out: How often do you eat out. Eating out frequently has 2 disadvantages – increases your spending and affects your health. It is important to limit the number of times you eat out. Prepare healthy food at home and enjoy with family. It’s ok to go out once or twice in a month but not more than that

- Entertainment: You can also limit your spending on movie tickets, going to mall every week and doing other similar stuff, in order to prioritize debt repayment

- Shopping: Be careful about impulsive buying when you visit megastores. The items in stores are place beautifully in order to encourage impulsive buying – purchasing things that you didn’t plan for and don’t need. Such impulsive buying should be avoided

Above pointers related to spending habit are little strict but you have to follow them in order to get out of debt quickly, else it might takes ages to solve financial problems

ALSO READ: Investment Strategies for Different Risk Tolerance

3. Create a Budget and Stick to It

Next step is to create a budget and most importantly, stick to it for upcoming months and years. A financial budget is a rule book which have to follow while you are managing your money. It should be your friend and help you to properly manage your finances.

Here are some tips for creating a budget:

- Prioritize needs over wants: Needs are something which you require for yourself and family such as groceries, fruits, vegetables, etc. Wants are something that is not necessary for now such as online subscriptions, new smartphone model, big size TV, etc. You need to prioritize buying only needs and delaying the purchase of wants until you come out of debt

- Cut unnecessary expenses: Remove all the unnecessary expenses which includes impulsive buying, multiple online subscriptions for entertainment. These expenses will only avoid you to come out of debt trap

- Automate your savings: Automate the transfers of amount from savings account to fixed deposits or recurring deposits every month so that you are saving towards clearing your debt regularly.

4. Choose a Debt Repayment Strategy

Once you have the budget and spending habits corrected, it’s time repay the debt you have. There are multiple strategies to pay off debt:

- Avalanche Method: This method involves focusing on paying off the debt with the highest interest rate first, while making minimum payments on the rest. This strategy helps you to save huge amount of interest money that is going out of your pocket on big loans

- Snowball Method: This approach involves paying off the smallest debt first, irrespective of interest rate. The satisfaction of eliminating debts quickly can provide motivation to keep going and clearing other debts

- Debt Consolidation: This method combines multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest

You can choose the debt repayment strategy based on your preference mentioned above. Paying high interest rate debt first will be beneficial so that you can save the interest amount on such loans.

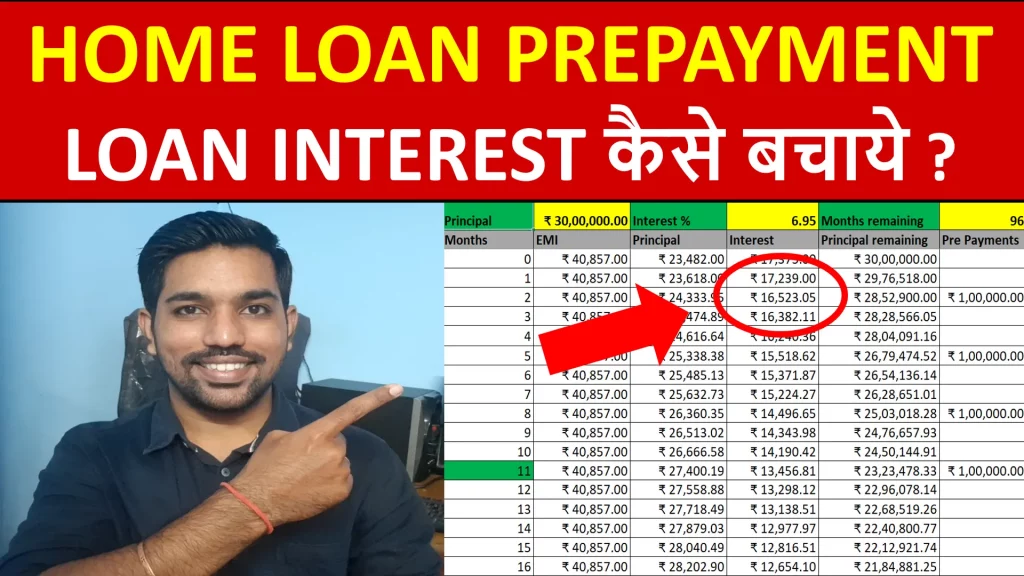

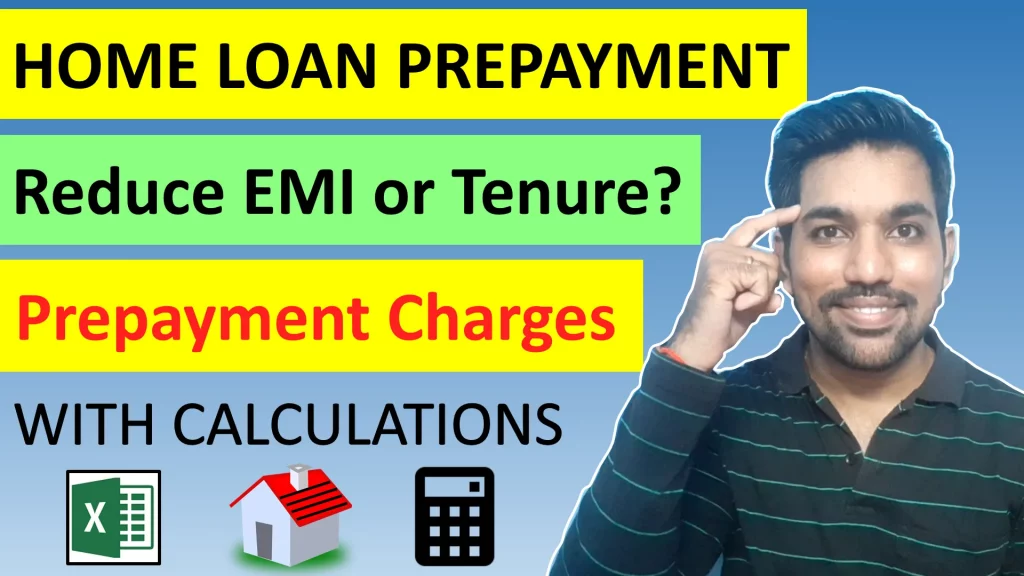

Watch below video to get out of home loan debt trap.

Home Loan Prepayment Calculation Video

5. Increase Your Income

Next you should also focus on increasing your monthly income. This can help you cover debt within less amount of time compared to same income in upcoming months.

You can start a side hustle that pays you money apart from your regular work. Also, you can rent the unused space at your home or sell unnecessary items that can clear the clutter at your place.

6. Stay Motivated and Consistent

While you paying back the loans and clearing debt, it takes time for your finances to improve. You should not get emotionally disheartened while you are not able to see the changes for good. Give time, have patience and stay motivated to clear your pending loans and debt.

Be consistent and do not miss the payment of home loan EMI or other debt every month, based on your budget you have prepared.

7. Seek Professional Help

After following above steps of assessing your loans and debt, creating a budget, increasing income and limiting your spending, if still you are not able to solve your debt trap problem, than you should seek professional help.

It is not bad to ask for help when things are not working for you. Financial advisors can help you to solve your debt problem with their experience and daily practice. They have the required knowledge to help you get out of debt quickly.

8. Avoid Future Debt

It is also important to avoid and stop all the habits that might lead to future debt trap again. After you have solved most of your debt problems, ensure that you align your habits to avoid future debt.

Debt or loans are the results of our own habits. Good habits will help you to grow your money, where as bad habits will lead to the same money going away from you for unnecessary things.

Below are some steps you can follow to avoid future debt:

- Live within your means: You should not spend your money on things you don’t need. Don’t get emotional factor while purchasing things out there is it might lead to increased expenses

- Create an emergency fund: It is important to create an emergency fund, so that you don’t have to dig your savings account in case of emergencies and get your bank balance close to zero, which you intended to use to repay the debt or loans.

- Be cautious with credit: You should be using your credit cards wisely. Not using the credit card wisely will lead to impulsive buying and again you will go into debt trap if you don’t pay the bills on time. Interest rates on credit card bills are highest compared to other loans

- Continue budgeting: Track your spending and expenses and wherever required, make changes as per your needs. Control the amount of money spent on your wants, which can be delayed after you have cleared your existing debt

Conclusion

Getting out of debt is a journey and not a destination. It requires discipline, commitment, and willingness to make changes. But with the right strategies and mindset, you can achieve financial freedom and live a life free from the burden of debt.

Remember, it’s never too late to start working towards a brighter financial future. Make a budget, control your expenses, increase your income and avoid future debt while you are clearing the existing loans.

Save Home Loan Interest Amount!

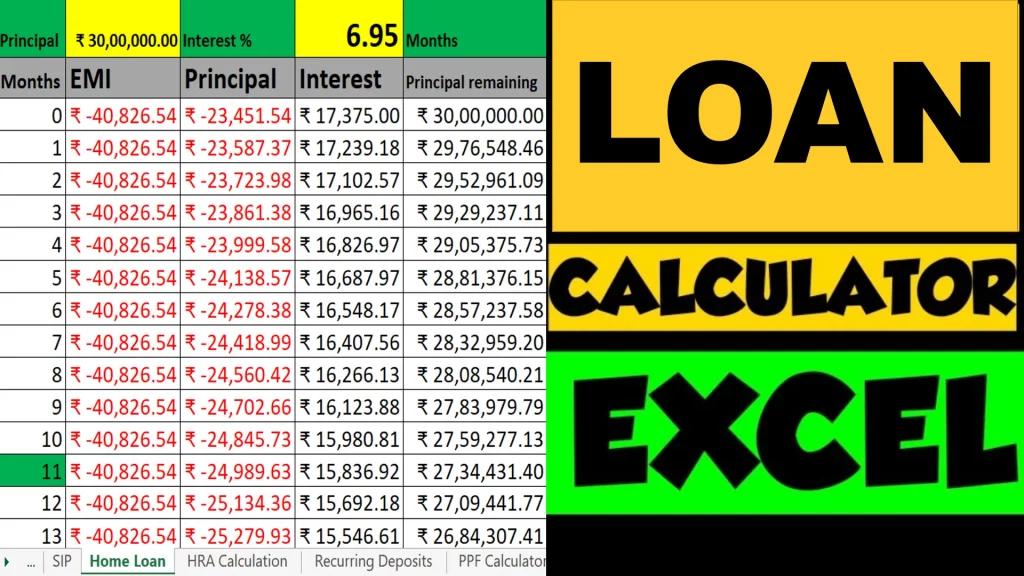

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

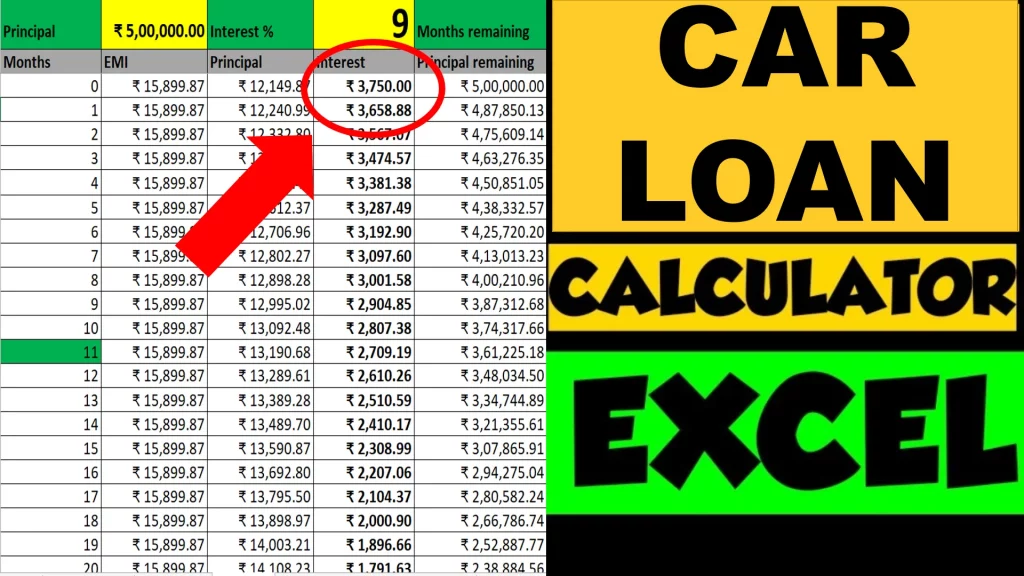

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.