What is the average Stock Market Returns in last 15 years as far as Nifty 500 is concerned? We will see the SIP Returns over last 15 years in Nifty Large cap, Nifty Midcap and Nifty Small cap stocks.

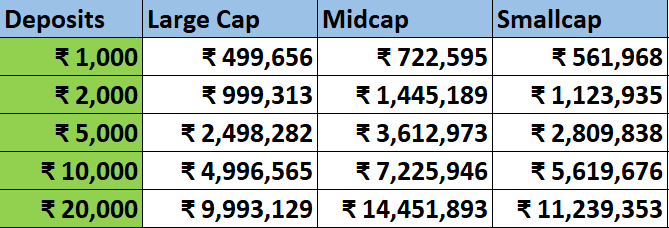

Over the last 15 years, Nifty large cap companies has given 12.24% CAGR, Nifty midcap companies has given 15.98% CAGR and Nifty small cap has given 12.71% CAGR. Rs. 1000 SIP in last 15 years would have become Rs. 4.99 Lakh in Nifty large cap stocks, Rs. 7.22 Lakh in Nifty midcap stocks and Rs. 5.61 Lakh in Nifty small cap stocks.

Above returns are based on the top 100 companies in each category of large cap, midcap and small cap stocks.

- Stock Market Returns in Last 15 Years Video

- What is Nifty Large cap, midcap and small cap categories?

- Average Stock Market Returns in last 15 years

- What is the return of Nifty 50 in last 15 years?

- CAGR vs XIRR

- Benefits of SIP in Stock Market

- ₹2000 Stock Market Returns in last 15 years

- Conclusion

- SHOW your Support!

- Income Tax Calculator App – FinCalC

Watch below video to understand the returns calculation:

Stock Market Returns in Last 15 Years Video

Watch more Videos on YouTube Channel

What is Nifty Large cap, midcap and small cap categories?

Stocks or companies in Stock market are categorized based on Market Capitalization (number of shares of company multiplied by share price), and based on this number, companies are ranked and categorized into large cap, midcap and small cap companies.

- Large cap – Companies that are ranked from 1-100 with respect to their market capitalization

- Midcap – Companies that are ranked from 101-250 with respect to their market capitalization

- Small cap – All other Companies that are ranked above 250 with respect to their market capitalization

So above are the categorization of the companies based on Market cap.

Check below screenshot to know the top 10 companies currently with their market cap:

Average Stock Market Returns in last 15 years

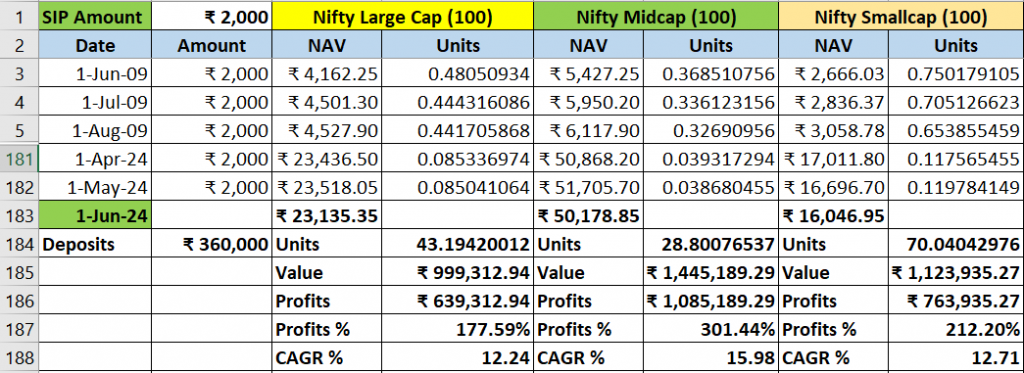

If we consider Nifty 500 companies, out of which if we only check the top 100 companies from large cap, midcap and small cap categories – Nifty large cap companies has given 12.24% CAGR, Nifty midcap companies has given 15.98% CAGR and Nifty small cap has given 12.71% CAGR.

As seen above, Nifty midcap companies has given better returns compared to top 100 companies of large cap and small cap categories.

Below are the returns based on the SIP investments every month for last 15 years in these stocks:

As seen above, you could have achieved Rs. 1 crore goal with large cap or small cap stocks, and Rs. 1.5 crore goal with midcap stocks in last 15 years with Rs. 20,000 SIP investments.

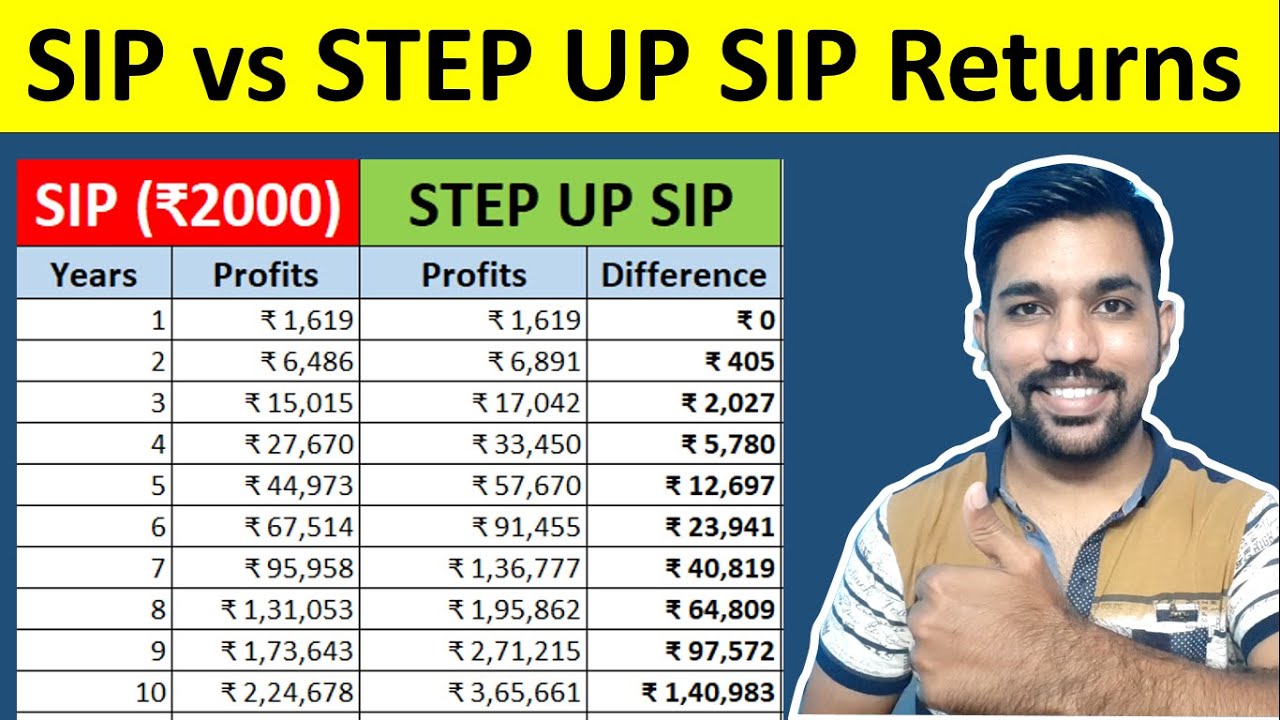

You can also make use of Step up SIP to gradually increase the SIP amount every year based on your annual increment and performance bonuses or job switches increments.

Watch below video to understand how Step up SIP works with examples

Step up SIP Returns Calculation Video

As seen in above video, Step up SIP helps you to increase your deposits or investments every year, thus increasing the profits from stock market. This helps you to achieve your financial goals before time.

What is the return of Nifty 50 in last 15 years?

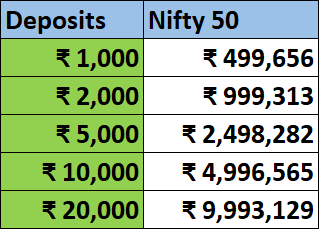

Nifty 50 has given approximately 12% CAGR over last 15 years.

Which means, if you would have done SIP of Rs. 1000 every month in Nifty 50 for last 15 years, than your current investment value would have been Rs. 4.99 Lakh out of which, the profits would have been Rs. 3.19 Lakh

Below is the Nifty 50 Returns over last 15 years for various SIP amounts:

CAGR vs XIRR

It is very important to understand the way returns are calculated in stock market.

CAGR or Compound Annual Growth rate is the way to calculate average returns of stocks or mutual funds over a period of time. This is great when it comes to lumpsum investing. But it cannot be used when you make SIP investments in any stocks or mutual funds.

XIRR or Extended Internal rate of return is the returns calculated when you make SIP investments over a period of time. It takes into consideration the dates of the SIP investments as well to give you more accuracy in terms of returns compared to CAGR.

Watch below video to know more about XIRR returns calculation

XIRR Returns Calculation on SIP Video

Benefits of SIP in Stock Market

Below are some of the Benefits of SIP Investments in Stock Market:

- Regular deposits in Mutual funds or stocks on monthly basis

- Rupee Cost averaging – buy more units when markets are down and less units when markets are high

- Reduces your risk while doing SIP for long term. Since your investments are spread across long term

- Best for new and young long term investors and experienced investors as well. Whether you are new to investments or someone already investing in stocks or mutual funds, it is never late to Start SIP online based on your research of stocks and mutual funds to achieve your financial goals.

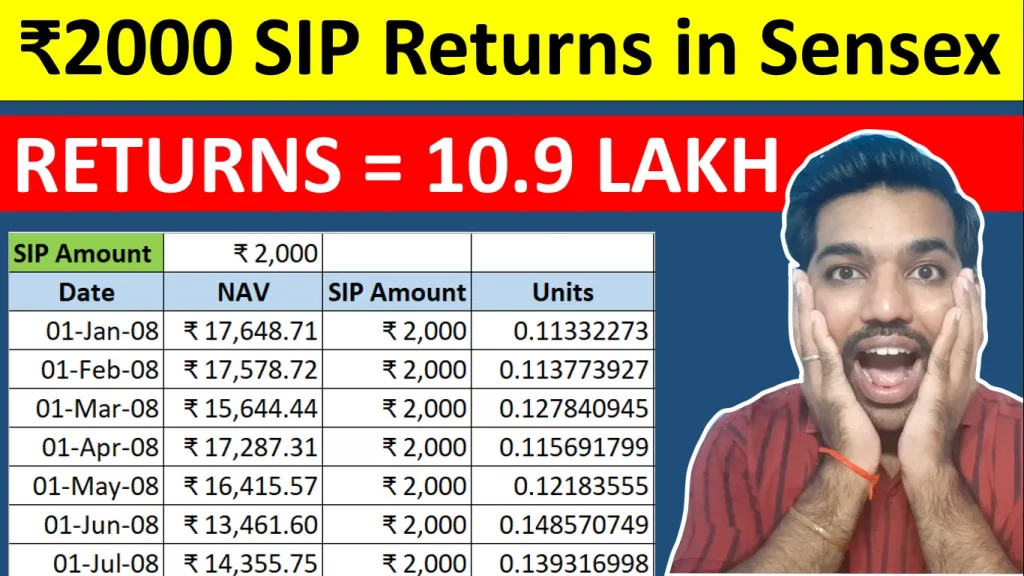

₹2000 Stock Market Returns in last 15 years

Below is the calculation of Rs. 2000 SIP in Stock market for last 15 years based on the video at the start of this article:

Midcap companies has given better returns compared to large cap and small cap companies. Please make note that past returns does not guarantee future returns in stock market, so it is better to do your research and diversify your investments over long term and achieve your financial goals with time.

Rs. 2000 SIP in stock market in last 15 years has provided Rs. 10 lakh to Rs. 15 Lakh in various indices of nifty 500 companies.

Conclusion

So we have seen the stock market returns in last 15 years for top 100 companies of different indices – Nifty Large cap, nifty midcap and nifty small cap companies.

It is very important to note that past returns does not guarantee future returns. These returns can be calculated for educational purpose and get the idea about how returns are calculated when you invest in stock market of mutual funds.

Some more Reading:

- PPF vs Mutual Funds Returns Calculation

- How to Calculate Income Tax in India

- Income Tax on SIP of Rs. 2000

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.