Multi Cap Fund is a type of mutual funds that invest in all market capitalizations – large cap, mid cap and small cap companies. They are required to invest at least 75% of assets in all these 3 market capitalizations and hence the name multi cap. These are riskier compared to pure large cap mutual funds and less risky compared to pure mid cap and small cap mutual funds. Major portion of this Fund is allocated to equities and hence you can get better returns over a long period of time.

Let us understand more about Multi Cap Fund in detail.

What is Multi Cap Fund?

- Multi Cap Fund is a type of Equity Mutual Fund that invest in companies with various market capitalization

- These funds invest in equities and equity oriented instruments

- They invest in large cap, mid cap and small cap companies to get better returns for investors

- These funds are good alternatives for those who want to get exposure to multiple companies in large, mid and small cap segments and are ready to take moderate risk

- At least 75% of the total assets need to be allocated in large, mid and small cap companies in Multi Cap mutual Fund

- So either it can be 25% in each – large, mid and small cap or based on fund manager’s decision to increase allocation in any specific segment based on market conditions to maximize the returns

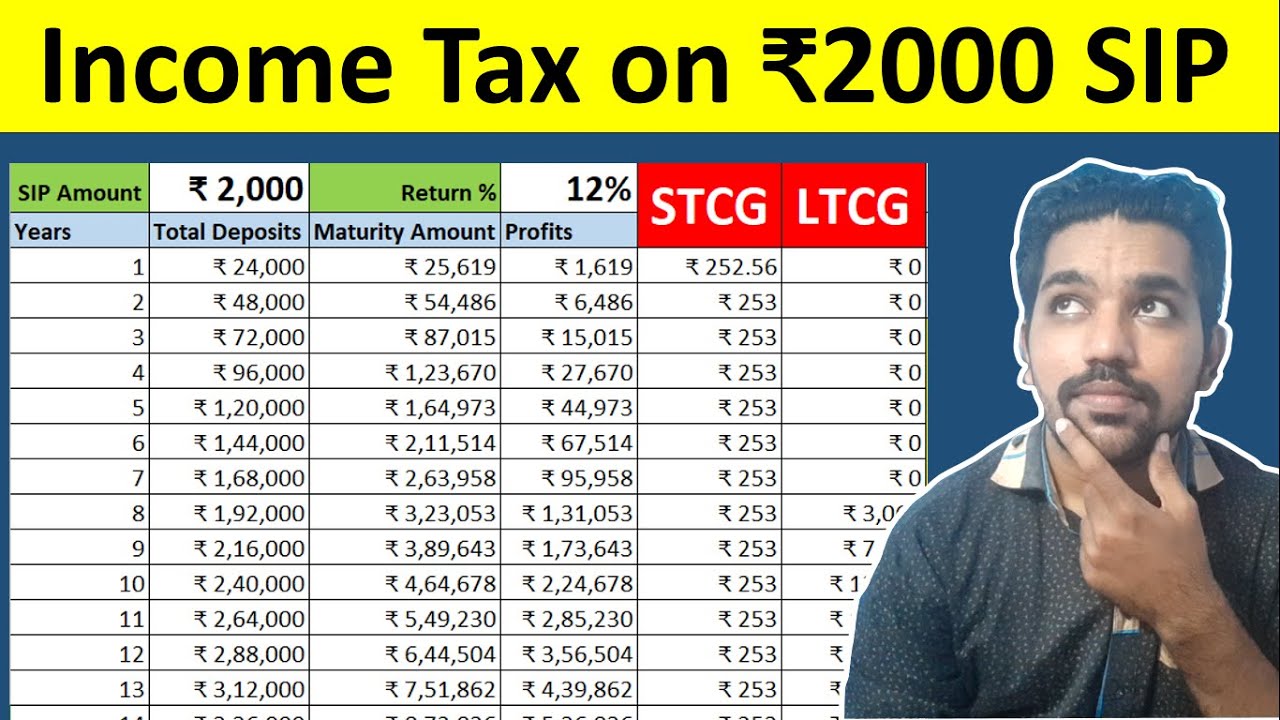

- Taxation in these Funds is similar to those in equity mutual fund. For STCG tax, 15% tax will be applied on profits and 10% tax on LTCG on profits above Rs. 1 lakh in a financial year

Key Features of Multi Cap Funds

- Diversification: Exposure to large cap, mid cap, and small-cap companies. Multi cap funds diversify your investments across multiple companies.

- Moderate Risk: Less risky than pure mid/small-cap funds, but riskier than large-cap funds.

- Fund Manager Flexibility: Allocation can be adjusted based on market conditions. So, when markets are down, the fund manager tries to increase allocation in small caps since they can give good returns when market comes up

- Equity-Oriented Returns: Potential for higher returns over the long term. You can get between 10% to 18% based on the multi cap fund selected

- Taxation: Same as equity mutual funds (STCG – 20%, LTCG – 12.5% above ₹1.25 lakh).

ALSO READ: STCG Tax Calculation with Examples

How Multi Cap Fund Works?

The working of Multi Cap Fund is quite simple:

- Every Multi Cap Fund is a assigned a fund manager who decides the list of stocks to invest in

- The fund manager will allocate at least 75% of total assets to large cap, mid cap and small cap companies, thus making it as equity oriented mutual fund

- Based on the market conditions, if fund manager thinks that small cap companies are going to grow more in near future, than allocation to small cap companies will be increased to get better returns

- And if a down turn in expected, the allocation from mid cap and small cap companies will be transferred to large cap companies for decrease the impact on returns

- In this way, it is important to know the experience of fund manager in this Fund as he or she plays a crucial role in maximizing your returns

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

Benefits of Multi Cap Fund

There are multiple benefits of Multi Cap Fund:

- Diversification:

You get the benefit of diversification while investing in this Fund since they invest in multiple companies across various market cap - Multiple Companies:

Due to the exposure of multi cap companies – large, mid and small cap, the risk is reduced and returns are also decent - Flexibility:

Fund manager has the flexibility to include stocks from multiple capitalizations which is not the case in case of pure large cap or mid cap mutual funds

So above are some of the benefits of Multi Cap Mutual Fund.

Comparison Table: Multi Cap vs Other Funds

| Fund Type | Investment Mandate | Risk Level | Return Potential | Best For |

| Large Cap | Top 100 companies | Low | Moderate | Conservative investors |

| Mid Cap | Rank 101–250 | Moderate | High | Growth seekers |

| Small Cap | Rank 251+ | High | Very High | Aggressive investors |

| Multi Cap | Mix of all three | Moderate | Balanced High | Diversification seekers |

| Flexi Cap | No fixed mandate | Varies | Depends on strategy | Investors wanting flexibility |

When you should invest in Multi Cap Fund?

Multi Cap Mutual Fund is best suited for those who can take some risk compared to large cap fund in order to maximize your returns.

So if you are a beginner, you can invest in Index Mutual Fund of Large cap companies. This will give you an idea about how mutual fund works and how you can continue SIP (Systematic Investment Plan) to achieve your goals.

Once you get the experience of mutual funds and the cycle of market, you can invest in this Fund to take some more risk while investing in mid cap and small cap companies to get more better returns with the experience of fund manager.

If your are in your retirement phase, than it is not recommended to invest in multi cap funds since they have equity risk associated with them over short term. Instead you can consider Debt mutual funds in case you are in retirement phase.

Risks associated to Multi Cap Fund

The only risk associated to these funds is allocation to mid cap and small cap companies, which means volatility. Most of the investors who are beginners or in retirement phase do not expect much volatility.

For them, emotions come into picture when they see sudden volatility and multi cap mutual funds are volatile in nature since they invest in multi cap companies including large cap, mid cap and small cap companies.

If you can take this risk of accepting volatility over long term of 5 to 7 years, you can invest in multi cap mutual funds.

Taxation on Multi Cap Fund

Taxation on Multi Cap Fund is similar to equity mutual funds:

- STCG or Short-Term Capital Gains Tax:

20% tax is applicable on STCG profits made when funds are sold within 1 year of holding period - LTCG or Long-Term Capital Gains Tax:

When holding period is more than 1 year, gains are termed as LTCG, for which 0% tax on less than Rs. 1.25 Lakh profits in financial year and 12.5% tax on profits of above Rs. 1.25 Lakh

Watch below video on Income tax on SIP to understand more:

Income Tax on Rs. 2000 SIP Video

Watch more Videos on YouTube Channel

Conclusion

So Multi Cap Fund provides you the option to invest in companies across various market capitalizations – large, mid and small cap, thus providing you diversification and decent returns for the risk that you take.

At least 75% of the total assets will be allocated to multiple capitalizations in this fund and hence the name multi cap fund. You can invest in these funds if you can take some risk for better returns compared to pure large cap companies.

Some more Reading:

- What is Hybrid Mutual Fund

- SWP for Monthly Income from Mutual Funds

- LTCG Tax Calculation with Examples

Frequently Asked Questions

Which is better mid-cap or multicap?

Mid cap companies are the companies that are ranked between 101 to 250 with respect to their market capitalization on NSE (National Stock exchange). These are the potential large cap companies of tomorrow and provide decent returns but are volatile as well. Where as multicap fund invests across various market cap companies thus providing you diversification but these are more volatile due to their exposure to small cap companies.

It is very close to choose between both these funds as they provide better returns over long term, but mid cap index fund might have low expense ratio compared to multi cap fund and this is the only winning point here.

What is the difference between multi cap and flexi cap mutual fund?

Multi cap fund have the mandate to invest in large cap, mid cap and small cap companies with at least 75% assets to be allocated in these market cap companies. Whereas flexi cap funds do not have such mandate and they can invest in any business to maximize your returns.

What are the disadvantages of multi cap funds?

One of the main disadvantages of this fund is they have high expense ratio, due to investments in various market cap companies. Also, the allocations of fund to various companies is switched over time based on market conditions, so the cost of these transactions also add up to reduce the overall returns. These funds are also volatile in nature due to exposure to small cap companies in their portfolio.

Is Multi Cap Fund good for beginners?

Yes, beginners can start with large-cap or index funds first, then move to multi-cap funds once they understand market cycles.

Are Multi Cap Funds safer than Small Cap Funds?

Yes, because they balance exposure across large, mid, and small companies, reducing extreme volatility.

Can I do SIP in Multi Cap Funds?

Absolutely. SIPs help average out market volatility and build wealth steadily.

Save Home Loan Interest Amount!

Use Home Loan Excel Calculator that will help you to Save Interest Amount on Home Loan EMI.

Click below button to download Home Loan EMI and Prepayment Calculator in Excel:

Watch how Home Loan Calculator in Excel Works

Income Tax Calculator App – FinCalC

For Income Tax Calculation on your mobile device, you can Download my Android App “FinCalC” which I have developed for you to make your income tax calculation easy.

What you can do with this mobile App?

- Calculate Income Tax for FY 2025-26 and previous FY 2024-25

- Enter estimated Investments to check income tax with Old and New Tax Regime

- Save income tax details and track regularly

- Know how much to invest more to save income tax

- More calculators including PPF, SIP returns, Savings account interest and lot more

Use Popular Calculators:

- Income Tax Calculator

- Home Loan EMI Calculator

- SIP Calculator

- PPF Calculator

- HRA Calculator

- Step up SIP Calculator

- Savings Account Interest Calculator

- Lump sum Calculator

- FD Calculator

- RD Calculator

- Car Loan EMI Calculator

- Bike Loan EMI Calculator

- Sukanya Samriddhi Calculator

- Provident Fund Calculator

- Senior Citizen Savings Calculator

- NSC Calculator

- Monthly Income Scheme Calculator

- Mahila Samman Savings Calculator

- Systematic Withdrawal Calculator

- CAGR Calculator

I’d love to hear from you if you have any queries about Personal Finance and Money Management.

JOIN Telegram Group and stay updated with latest Personal Finance News and Topics.

Download our Free Android App – FinCalC to Calculate Income Tax and Interest on various small Saving Schemes in India including PPF, NSC, SIP and lot more.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.